Arrive and Cajabra: Announce Their Agreement to Deliver the First Operations + Growth Platform Designed for Modern Accounting Firms

Big news: Arrive and Cajabra are proud to announce their agreement to bring the accounting industry’s first Firm Operating and Growth Platform.

Arrive has solved the industry wide issue for accounting firms. Recently awarded the “Best Accounting Firm Platform of 2025” they have successfully done what no one in the accounting industry thought was possible..

Cajabra isn’t just a CRM — it’s the growth engine behind the firms redefining what’s possible in accounting. And now, it’s being embedded into the future of firm infrastructure.

Together, we’re about to eliminate one of the biggest pain points holding firms back from sustainable growth. The same platform that’s solving capacity and productivity bottlenecks will now help firms capture, nurture, and close more of the right clients — all without adding more chaos to their tech stack.

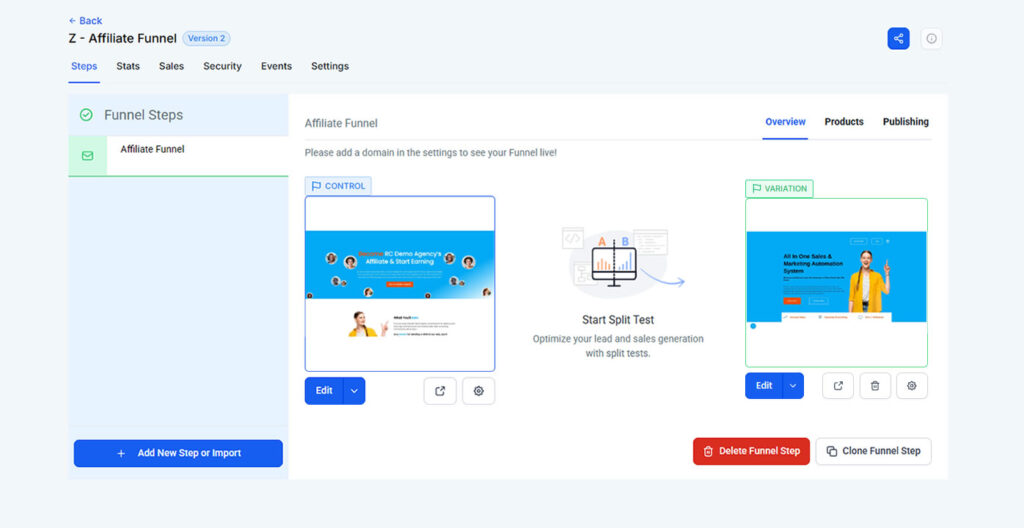

With this agreement, Arrive will be the first firm OS in the accounting profession to feature a fully integrated, full-featured marketing engine.

Arrive will leverage the Cajabra CRM as a core foundation of its roadmap and deploy their development resources to provide specific feature enhancement into their award winning software. This agreement will expedite their marketing and growth initiatives while effectively removing another fragmented piece of the accounting infrastructure.

This is the beginning of something big.

The Root of the Problem: You Have a Capacity Issue.

We talk to firms every week that are eager to grow — but overwhelmed.

“We have more business than we know what to do with, but it’s not necessarily the business we want. We want more higher paying advisory clients, but we don’t have the time to market let alone bring them on board.”

“We have so many leads we are not following up with, because we don’t have the bandwidth to put processes in place to follow up with them.”

“We know we need marketing... but who’s got the time?”

We get it. Because we’ve seen it firsthand.

Growth doesn’t stall because you lack leads, it stalls because you lack bandwidth.

That’s where Arrive changes the game.

Arrive Solves Capacity. Cajabra Fuels Growth.

Arrive is a next-generation accounting firm operating system that replaces over 50 disconnected tools, automates manual work, and gives your team back their time.

Accounting firms using Arrive are already:

- 10Xing their productivity

- Running at profit margins as high as 80%

- Creating new capacity to grow — without burning out their teams

And that’s exactly where marketing comes in.

As capacity opens up, Cajabra becomes the marketing engine that fuels strategic growth — helping firms:

- Differentiate their brand in a crowded market

- Capture and nurture high-value leads

- Convert interest into engagements — especially for higher-ticket advisory services

This is more than CRM. It’s firm growth, on purpose.

Coming Soon: Full Integration Inside the Arrive Platform

Our agreement with Arrive sets the stage for something the profession has never seen before: A unified platform that connects your operations, your people, and your growth.

Once fully integrated, firms will:

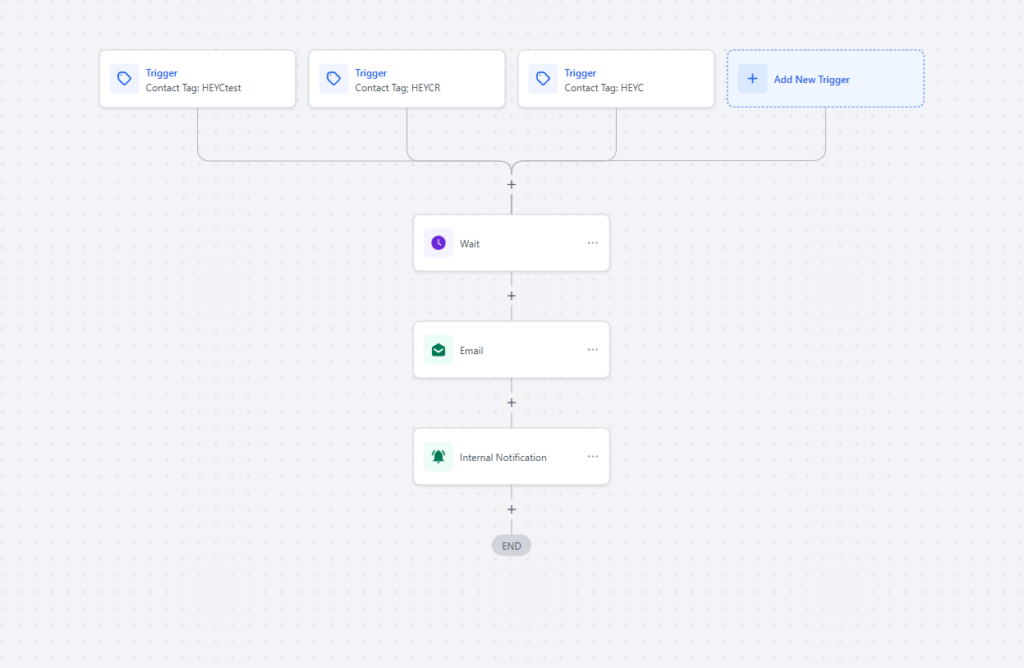

- Trigger marketing and nurture flows from within their operating system

- Automate follow-up, proposals, onboarding, and check-ins

- Track the entire client journey from lead to loyal fan — all from one login.

One system. One login. No chaos.

That’s not just efficiency — that’s how you scale profitably with confidence.

What This Means for the Profession

The firms that will win in the next era are the ones that get this right:

- They solve capacity before it breaks their people.

- They implement marketing systems before they desperately need leads.

- They connect operations and growth instead of managing them in silos.

With this agreement, firms will finally have both the room to grow and the engine to make it happen.

Want to Be One of the First to See It?

This is your invitation to see what the future looks like:

Visit us in Booth #34 at Scaling New Heights June 22-25 - or- 👇

We’re building something the profession has never had:

A fully connected operating and growth system — built by people who’ve lived your pain and are ready to change it.

The future isn’t about working harder. It’s about working smarter — and growing sustainably.

Arrive gives you the space. Cajabra fuels your growth.

Together, we’re helping firms finally scale — and thrive.

Are you still relying on those old-school lead magnets like checklists, ebooks, and whitepapers to generate leads? Or are you still offering that same dusty “Ultimate Tax Prep Checklist” you made back in 2018? Look, if your lead magnet strategy has cobwebs on it, it’s time for an upgrade. These days, traditional lead magnets aren’t just ineffective… I’m sorry to say: they’re practically vintage. But don’t panic! We’re not here to shame your PDFs. We’re here to help you evolve your strategy and embrace the future… a future powered by AI. (Cue dramatic music.)

If you’re looking to grow your accounting firm, you need more than a passive download and a sad little “subscribe for updates” button. You need something interactive, something snazzy, and most importantly, something that makes your prospects say, “Wow, that was actually helpful!”

Why Traditional Lead Magnets Just Don’t Cut It Anymore

Remember when a simple checklist was enough to get your ideal client’s attention? Those days are long gone. The internet is flooded with basic, free resources that offer little more than a few bullet points. Your clients are smarter than that and are no longer just looking for general information. They want solutions. They want something that actually helps them solve their problems, right now.

Traditional lead magnets like ebooks and downloadable guides are great for getting a name on a list, but they don’t do much for building relationships or nurturing leads. They’re passive. Your prospects consume the information and move on. The problem with that? You're left with a bunch of names that aren’t all that qualified, and they’re not invested in your business. It’s like throwing a bunch of spaghetti at the wall and hoping something sticks.

Introducing AI-Powered Lead Magnets

Now, let's talk about AI-powered lead magnets. These aren’t your grandma’s downloadables. AI-powered tools are dynamic, interactive, and, best of all, they deliver personalized results that actually solve problems for your prospects in real-time. Imagine creating something like a “Tax Deduction Finder” or a “Financial Health Check” tool that customizes its recommendations based on the user’s inputs. This is exactly what AI-powered lead magnets can do.

And, unlike old-school lead magnets that provide static content, AI lead magnets engage users with tailored solutions that are immediately actionable. You input data, and BAM! Immediate value. This creates a personalized experience that keeps your leads engaged and more likely to convert. Plus, it makes them feel like you truly understand their unique challenges.

What Makes AI Lead Magnets Different?

AI lead magnets are interactive. They engage users right off the bat with quizzes, calculators, or diagnostic tools that ask for input, analyze responses, and provide real-time solutions. This isn’t just information being handed out; this is problem-solving in action. These tools also allow you to collect much more data from your leads, giving you deeper insights into their pain points and allowing you to segment them for more personalized follow-up.

For example, imagine an AI-powered tax tool that lets users input their income, expenses, and deductions. Instantly, they get personalized recommendations on maximizing their tax savings. This tool not only adds value immediately but also collects data on the user’s financial situation. Data that can be used to nurture that lead into a paying client down the line.

AI Lead Magnets and the Power of Personalization

Personalization is where AI really shines. Traditional lead magnets are often one-size-fits-all, but AI-powered tools can tailor their output based on the individual’s input. This creates a much richer, more engaging experience for your leads, making them feel seen and heard. And when someone feels understood, they’re far more likely to trust you - and trust is everything in the accounting world.

The cool part? You don’t have to lift a finger. Once set up, AI tools run on autopilot, collecting leads, engaging with them, and delivering personalized results. All without you having to manually send out resources or follow up.

The Power of Automation: Nurturing Leads the Smart Way

So, you’ve captured a lead with a shiny new AI-powered tool. Now what? Well, the magic happens when you nurture those leads. Capturing leads is only half the battle. You need to be consistent and intentional about staying in front of them, or they’ll forget about you faster than you can say “tax season.”

This is where you leverage automation. Once you capture a lead, it’s time to set up an automated nurture sequence that delivers high-value content to keep them engaged. Automated emails, newsletters, and follow-ups can help you build a relationship with your leads and gradually move them down the funnel. Set it up, let it run, and you’ll be amazed at how it can build trust and convert leads without you needing to lift a finger.

The Importance of Having Lead Magnets on Your Website

Now, let’s talk about where these lead magnets should go. If you’re not using a lead magnet on your homepage, it’s like having a store with no window display. It’s just not going to grab attention. You need to make it easy for visitors to convert into leads, and your website is the perfect place to do that.

The key is to have at least one interactive AI-powered lead magnet prominently placed on your homepage. Whether it’s a “Tax Savings Calculator” or a “Financial Health Assessment,” make sure that it’s visible and accessible to your visitors. If you don’t, you’re missing out on valuable opportunities to capture those leads while they’re already engaged with your site.

The Time to Upgrade Your Lead Magnets was Yesterday

The lead magnets of yesterday are officially aged out of the marketing game like floppy disks and fax machines. It’s time to take a leap into the future with AI-powered tools that provide real-time value, engage your audience, and automate your lead-nurturing process. Not only will this help you capture more qualified leads, but it’ll also enable you to build stronger, more meaningful relationships with them, making your job easier in the long run.

Ready to make the switch? It’s time to ditch the static downloads and embrace the future of lead generation. After all, in the fast-paced world of accounting, staying ahead of the competition means constantly evolving. And trust me, this is one evolution you won’t want to miss.

Tax season is officially in the rearview mirror, and chances are, you're doing the victory lap. But now that the dust has settled, there’s a sneaky thought creeping into your mind, and it sounds a little like this: “I survived, but did I thrive?”

Surviving tax season isn’t enough anymore. If you really want your firm to grow (without giving yourself a permanent stress-induced eye twitch) you’ve got to make some changes. And trust me, those changes don’t have to be as hard as convincing your clients that you’re still open for business after April 15th.

The truth is, growing your firm the right way means doing it smart, sustainable, and dare I say it, systematic. Without the chaos. That’s why I created a 7-step blueprint to help you nurture leads, automate follow-ups, and actually grow your firm in a sustainable manner that won’t leave you burnt out and overwhelmed.

Step 1: Get Your Messaging Dialed In

Marketing within the accounting industry has evolved, and here’s a little secret: your messaging is EVERYTHING. If your website is still saying “we do taxes and stuff,” we need to talk. What does that even mean? Taxes are just the starting point for the incredible work you’re doing! The messaging on your website is what helps potential clients find you and decide whether they trust you to manage their business's finances. It’s also what convinces them that you’re the only firm that truly “gets” their struggles.

Get clear on your ideal client - who they are, what keeps them up at night, and how your services solve their problems. And here’s a pro tip: Write like you’re explaining it to a 5th grader. Buzzwords are so last season. Keep it simple, relatable, and human. Remember, when you make your client the hero of the story, you become the trusted guide who helps them win.

Step 2: Optimize Your Online Presence

I’m not asking you to become the next Instagram influencer - just the next person your ideal client can find online. That starts with a clear and professional website, an up-to-date Google Business Profile, and making sure you’re showing up on the social media channels where your target audience hangs out. (You know, Facebook, LinkedIn, or even your local Chamber of Commerce page).

And please, for the love of tax season sanity, get reviews. Google reviews are your new referrals. It's basically like getting a personal recommendation from a friend, but with more credibility. If you're not actively collecting reviews, you're missing out on that imperative "social proof" your future clients are looking for.

Step 3: Make It Ridiculously Easy to Book You

How many times have you played the dreaded "email tag" game to book a meeting? You send an email asking for a time, they reply with a time that doesn’t work, then you send another email with an alternative time... and so on, until you’re so frustrated that you almost book a meeting just to get any meeting scheduled. Here’s the solution: set up a scheduling tool. It’s the equivalent of saying, “Hey, I’m available at these times. Pick one. Or pick a few. Let’s go!”

Bonus points for automating appointment confirmations. You’re not going to forget, and neither are your clients. And here's a spicy little stat - 60% of prospects hang up if their call isn’t answered. So, when they call, answer, or better yet, let automation send them a quick text to let them know you’ll get back to them shortly. That’s a lot better than them wondering if they reached the right firm, or worse, they hang up and call your competitor.

Step 4: Automate the Follow-Up

Here’s a scenario I know you’ve experienced: you missed a call. Suddenly, you spiral into a guilt trip that’s way worse than missing your 9 a.m. coffee. But hold up - don’t go writing that apology email just yet. The beauty of automation is that you can follow up without the guilt.

Let’s talk about AI and automation for a minute. Your AI receptionist and a simple auto-text response will save you time and effort while ensuring that even missed calls turn into opportunities. And get this, 95% of text messages are read within 5 minutes. That’s way better than email open rates, and it’s an awesome way to stay top of mind.

Step 5: Show Up Like the Pro You Are (Because You Are One)

Want to grow with the right clients? They need to know you exist. Simple as that. Get out there and show up - whether it’s sharing nuggets of wisdom in industry Facebook groups, getting interviewed on a podcast, or simply telling your story on social media.

You don’t have to do everything, but you do need to be somewhere. Future clients are lurking, waiting for you to give them a reason to follow. So, do a little bit of everything, but make sure it feels authentic to you and your brand.

Step 6: Turn Clicks into Clients

If your website is more “online brochure” than “digital salesperson,” we need to talk. Your site should be working hard for you - even when you’re not. That means clear calls to action (no vague “Learn More” buttons) and giving visitors something they can’t resist. Maybe a free guide or checklist.

And don’t be afraid to send physical mail every now and then. In a world full of inbox overload, showing up with a handwritten note or a postcard is like a breath of fresh air. Trust me, your prospects will remember it.

Step 7: Automate Your Sales Journey (Because Who Needs More Work?)

The real game-changer here? Automation. Setting up automated workflows for every part of your sales process, from lead capture to client onboarding, lets you scale without cloning yourself. Imagine having an AI copywriter that writes your emails, your CRM handling follow-ups, and workflows keeping everything humming along. Meanwhile, you get to kick back, relax. Or better yet, pouring that additional time into what you do best - helping your clients.

Ready to Grow Without the Growing Pains?

Tax season is over, and the hangover is real. But now is the perfect time to reset, refine your approach, and implement a smarter, more effective way to grow your firm. If you’re ready to stop winging it, Cajabra is here to help. Our CRM system is built specifically for accountants and bookkeepers, and it’s got everything you need to automate your sales journey and nurture your leads effortlessly. So, let’s kick those growing pains to the curb and make scaling your firm feel more like a smooth ride and less like a rollercoaster!

Listen up, accountants and bookkeepers, let’s get one thing straight: you’ve got leads. You know this because you’ve either collected their email addresses from a lead generator or had a nice chat at a networking event. You’ve got leads just sitting there… waiting to be nurtured, turned into clients, and providing you with some sweet ongoing revenue. And yet, it feels like that "lead nurturing" thing you keep hearing about is a mystery.

It's not that you don’t want to nurture leads. No, no. It's just that you're missing a system. A repeatable, automated, high-value marketing campaign that gets the job done without you having to remember it every five minutes.

Let’s walk you through how nurturing leads with the right strategy, tools, and content can transform your firm into a lead-generating machine. Spoiler alert: You can actually do this without sacrificing your entire weekend!

Why Building Trust is So Important When Nurturing Leads

Let’s talk about trust. In accounting, trust is everything. Your clients are trusting you with their money, their business, and their future. And trust doesn’t happen overnight. It builds slowly, step by step. Hence the need to “nurture”.

Think of lead nurturing like a good relationship. At first, you're just getting to know each other. But with the right steps, you'll go from “nice to meet you” to “I’ll happily sign up for your services!”

The catch is, It’s not enough to just send out a few generic emails or random follow-up messages. If you really want to turn leads into clients, you need a strategic approach that shows value at every step. Lucky for you, I've got the blueprint.

Set Up High-Value Content Campaigns

So, you’ve got a lead - great! Now, what’s next? Instead of bombarding them with sales pitches or generic offers, give them something that’s actually useful. Share high-value content that speaks to their pain points and positions your firm as a problem solver.

Think about this: A lead has just connected with you. They’re curious but not yet committed. This is where email campaigns, newsletters, and educational content will help build that trust. Share tax tips, industry insights, or case studies of how you’ve helped other clients. Your goal is to show that you understand their struggles and have the knowledge to help them.

For example, if you're a bookkeeping firm, you might share a checklist for staying tax-ready all year long or a simple cash flow management tip that can save business owners thousands.

A little nugget of advice can go a long way, and remember - 80% of business success is just showing up and being helpful! That’s huge!

Use Automation to Stay Front and Center

You're busy, and I get it. The thought of manually following up with every lead you get can seem daunting. But don’t worry - automation to the rescue!

By setting up an automated nurturing campaign, you can be consistent without lifting a finger. Automated emails, text reminders, and even direct messages can be scheduled to reach leads at just the right time. This is your opportunity to consistently stay front of mind without burning yourself out.

Let’s say you’ve got a lead who filled out a form on your website requesting more information. Instead of manually following up days later (and potentially missing out on the opportunity), an automated sequence can send them a personalized welcome email, a useful resource, and then a follow-up message asking if they’d like to schedule a free consultation. It’s seamless, and it’s effective.

Create Separate Funnels for Different Leads

Not all leads are created equal - and that's okay! In fact, it's important to differentiate between the type of lead you're dealing with. For example, if you’re trying to network with CPAs to build strategic partnerships, you need a separate funnel for them.

Bookkeepers looking to collaborate with CPAs need to have content that speaks directly to their pain points, such as helping their clients be more organized and tax-ready. Having a specialized nurture sequence for this group ensures you’re building the right relationships and not wasting time on irrelevant leads.

Stay Consistent and Show Up

You know how some people need to be reminded to call their mom on her birthday? Well, guess what? Leads need to be reminded about your firm, too. Consistency is key.

However, that being said - you can’t just show up randomly. You need to show up with value. That means being there when they need you, whether it’s answering a question they’ve posted in a Facebook group or offering insight in a LinkedIn comment thread. Your goal is to make sure you’re always offering something useful.

Think of it like this: If your lead is stranded on the side of the road, they don’t need a "call me when you’re ready to sign a contract" pitch. They need a tow truck. Be the tow truck.

Leverage Social Media and Networking to Nurture Leads

Networking is still one of the most powerful tools for accountants. Whether it’s online groups like LinkedIn or Facebook, or even old-school Chamber of Commerce events, there’s value in consistently showing up in places where your ideal clients hang out.

And while you’re at it, don’t forget about podcasts or webinars. Sharing your expertise in these formats helps position you as a thought leader, which builds trust and creates a natural path for leads to move down your funnel.

The Big Secret?

All this can feel like a lot to juggle. But here’s the secret - you can automate your entire lead nurturing campaign. With the right CRM system, you can set up everything from lead capture to follow-up emails and appointment scheduling - all while you focus on doing the work you love.

With automated workflows, you can ensure no lead slips through the cracks, and more importantly, that you're delivering high-value content every step of the way.

Ready to Take the Leap?

If you’re thinking, “I need something that can do all of this for me,” I’ve got you. Cajabra’s CRM for accountants helps you streamline and automate the entire lead nurturing process, converting more leads into clients. Sounds exactly like what your firm needs? Be sure to catch the demo here. And if you’d like more information on how to nurture these leads, join our "How to Amplify Growth and Implement Effective Marketing in Your Accounting Firm" webinar on May 21, 2025. Not only will you get expert insights, but you’ll also earn CPE credits. Register now and start transforming your accounting firm!

Being a human calculator is hard enough. The last thing you want to add to your plate is figuring out how to nurture your leads as well. After all, if someone shows interest in your services, shouldn’t they just become a client automatically, right? Well, not exactly.

You see, many accountants and bookkeepers miss the mark not because they don’t want to nurture leads, but because they don’t have a clear process to do it. Whether the lead comes through a network meeting, an email list, or a lead-generating funnel, there are plenty of opportunities… And it’s easy to get overwhelmed and forget to follow up (or, even worse, forget to do anything at all).

Why Nurturing Leads is Non-Negotiable

First, let’s understand what nurturing is for a minute. Nurturing your leads is more than just sending a “thank you for reaching out” email. It’s about building a relationship and positioning your firm as the trusted resource your leads can’t live without. If you’re not doing this, well, your leads are probably out there in the wild...looking for the next firm that shows them some love.

Think of it this way, you’re running a marathon, but if you’re not engaging your leads, you're just walking in place. Nurturing keeps you moving forward. And don’t worry - you don’t have to break a sweat! There are simple ways to nurture leads with zero additional effort.

Ready to learn how?

1. Create High-Value Content (That Actually Helps)

The first thing you need is content. But not just any content. You need high-value, educational content that speaks directly to your clients’ pain points and provides solutions. If you’re wondering, “What does that look like?” don’t panic. You don’t have to be the next Shakespeare to craft something useful. Share quick tips, valuable insights, a newsletter or a funny video that speaks to your leads' pain points. The point is: your content should solve problems, not just advertise your services.

Take it a step further and create content specific to the niche industries you work with. For example, if you're working with restaurant owners, create an engaging blog post about tax deductions for the food industry specifically. When your content speaks to their business specifically, it shows that you understand their world. And trust me, they’ll begin to trust you even more when you speak their language.

2. Automate, Don’t Imitate

I can already hear the groans: “But, I don’t have time to do all this follow-up!” Trust me, I get it. You’re already balancing spreadsheets and answering 37 emails about the same thing. Well, that’s the beauty of automation. Automation isn’t about being lazy, it’s about being efficient. You don’t have time to manually follow up with every single lead that comes through the door, right? Automating follow-up emails and lead nurturing tasks can help keep the momentum going without you having to think about it all the time.

For example, once someone downloads a free resource from your website (like a tax checklist), you can set up an automated email series to follow up with more helpful content over the next few weeks. The goal? To keep your firm top of mind. No more letting hot leads cool off.

3. Build Trust with Personalized Content

When it comes to nurturing, one size does NOT fit all. A big mistake I see is firms sending generic messages to their leads. Nobody likes a generic email. When you can send your leads content that’s specifically relevant to them, you build trust.

So, let’s say you’re working with small business owners in the construction industry - send them tax tips on equipment depreciation or how to structure their civil engineering business for tax savings. You can automate the content distribution based on the lead’s interests, making it feel personal.

4. Position Your Firm as the Expert with Podcasts and Interviews

You’re sitting on a treasure trove of knowledge, right? So, why not share it? Create a podcast or a series of interviews with industry leaders. This not only establishes you as an expert, but it also provides your leads with real, actionable insights.

For example, if you’re working with real estate developers, imagine interviewing a tax expert about the latest deductions for property owners. Not only does it provide valuable information, but it also positions your firm as the go-to resource for that niche. When your leads listen to your podcast or read your expert blog posts, they see you as a trusted advisor, not just someone trying to sell them a service.

5. Don’t Forget About Your CPA Network (Yes, You Can Nurture Them Too)

If you're a bookkeeper, CPAs can be your best friends - but only if you nurture that relationship! CPAs are a great source of referrals, but just like any relationship, you have to put in the work. So why not have a nurture funnel specifically for CPAs? Whether you’re sharing tax tips, offering insights into common tax problems, or just keeping them updated on what your firm is up to, a dedicated nurture campaign for your CPA contacts will keep your name in front of them and make you their go-to referral partner.

Think about it like this: CPAs are like the bouncers at clients' VIP club. They’ll be much more likely to invite you in if you’re reliable, knowledgeable, and visible.

Build Stronger Client Relationships, One Lead at a Time

When it comes down to it, nurturing your leads is one of the most important things you can do to grow your firm. It’s about building relationships, sharing value, and positioning yourself as the expert they need. It’s not about being pushy or sales-y, it’s about showing your leads that you’re the firm they can trust by keeping them engaged, showing them value, and positioning yourself as the firm that can help to solve their problems. So, are you ready to stop letting your leads slip through the cracks? Start building that nurturing process today. And, if you’re thinking, “Oh, we need a system that can do that,” well, you’re in luck. Cajabra’s CRM is designed to automate lead nurturing, follow-ups, and client engagement with ease. Now, that’s how you take your marketing and client relationships from “meh” to “wow!”

So, you’ve heard the term “brand messaging playbook,” and you know it’s important, but maybe it sounds a little… intimidating? It doesn’t have to be. Think of it like a guidebook that helps you communicate your firm’s personality, expertise, and value consistently. And we all know consistency is key, especially in marketing.

Clients want to work with a firm that speaks to their needs and makes them feel understood. And to do that, you need a solid brand messaging strategy that hits home every time. Creating a brand messaging playbook will keep your messaging sharp, focused, and on-point, no matter where or how you’re communicating.

Why Brand Messaging Matters

Before we get into the “how” of creating your playbook, let’s quickly cover why brand messaging is even worth your time. When you get your messaging right, you position yourself as the guide in your client’s journey, helping them overcome their challenges. As Donald Miller puts it:

“When we position our customer as the hero and ourselves as the guide, we will be recognized as a trusted resource to help them overcome their challenges. Positioning the customer as the hero in the story is more than just good manners; it’s also good business.”

Exactly! When you focus on your client’s needs and position yourself as the guide, you’re creating a story they want to be part of.

How to Create Your Brand Messaging Playbook

Now that you understand the fundamentals of it, let’s talk about how to actually create your playbook. You can’t create messaging that resonates unless you know your ideal clients inside and out. Here are some things to think about when mapping them out:

Establishing who they are is the first step. You need to clearly define who your ideal clients are. Are they small business owners in real estate? Freelancers in creative industries? The more specific you can get, the more you’ll be able to speak directly to their needs and wants.

Next you need to ascertain the bad habits that your clients commonly have. Maybe they procrastinate on tax filing, or fail to keep up with bookkeeping? Identifying these habits allows you to position your firm as the solution - helping them avoid consequences like missed deductions or tax penalties.

The next step would be to figure out what your clients dream about. Do they want to grow their business? Maximize their profits? Position your services as the key to making these dreams a reality. Speak to their aspirations, and show how you’ll help them get there.

When creating your brand messaging playbook, it's important to know what your clients think about taxes, bookkeeping, or finances that’s just… wrong? Maybe they think that filing taxes is only a once-a-year thing, or they believe that bookkeeping is just an “expense” with no real return. Your messaging needs to address these misconceptions and provide clarity on how your services add value.

People have all kinds of ideas about what success looks like, especially in the accounting world. Your clients may think success is simply filing taxes on time, but real success goes much deeper than that. Understand the myths and truths about what your clients believe, and use that to shape your messaging.

Now that you’ve gathered all the intel, you need to figure out how to position your firm in relation to your clients’ needs. Are you the company saving them money? The one that helps them plan for future growth? Whatever it is, make sure your messaging speaks to the value you bring, and highlights your firm as the trusted guide to help them achieve their goals.

How to Use Your Brand Messaging Playbook in Your Firm

Alright, so you’ve created your playbook. Now comes the fun part: using it! A playbook is only useful if it’s actually applied, so let’s break down how to use it effectively within your firm.

1. Consistent Client Communication

Imagine showing up to a meeting with mismatched shoes - not ideal, right? That’s what happens when your firm communicates with clients across different channels without a unified voice. One minute you’re formal on email, then all casual on social media. It’s confusing! Your playbook is like your firm’s uniform. It gives you email templates, proposal language, and social media tips to make sure you’re always on-brand and sounding like yourself - trustworthy, approachable, and professional.

2. Attracting Ideal Clients

If you’re not clear about your messaging, your firm risks blending into the sea of other accountants. So, how do you stand out? Your playbook helps you define exactly who your ideal clients are and how you help them. With your messaging dialed in, you’re not just another firm offering the same old services. You’re speaking directly to clients who need exactly what you offer.

3. Employee Alignment and Onboarding

Consistency isn’t just for your clients, it’s important for your team, too! You don’t want new hires giving clients the wrong impression about your firm. Your playbook helps onboard new employees and keeps everyone on the same page when it comes to tone and communication. Whether they’re answering client calls, drafting emails, or updating your website, your team will know how to communicate your brand message, ensuring a seamless experience for your clients.

4.Thought Leadership and Content Marketing

It’s difficult to create content that stands out when you’re unsure about your voice. Your playbook makes it easy to know exactly what to say and how to say it. It helps you generate topics that’ll engage your audience and showcase your expertise, so your firm gets recognized as the go-to thought leader in your niche.

So, what’s the takeaway here?

A brand messaging playbook is central to maintaining consistency, building trust, and positioning your firm as the hero’s guide in your clients’ financial journey. It gives you the tools to communicate effectively with your clients, attract your ideal audience, and align your team around one cohesive message.

If you’re ready to create a brand messaging playbook that actually works for your firm, let’s talk about how we can help create one that’s custom made to fit your company.

Remember, your brand is more than just a logo or a website - it’s the way you show up in every conversation, every email, and every post. So, why not make it count?

As an accountant or bookkeeper, you’re busy. Like, so busy you can barely remember where you put your coffee mug half the time. The last thing you want to think about is marketing. Yet, you know you should be doing it.

You know you need more Google reviews, more follow-ups on proposals, more consistent communication with your clients, and heck, you probably even know you’re missing out on leads just sitting in your inbox. But the problem is: it’s just not getting done.

Why? Because there’s just no time to figure out how to do all that stuff manually. You’re already juggling 100 things - getting your clients’ tax returns in order, staying on top of bookkeeping, making sure you’re not missing a deadline.

The solution to this conundrum? You need a process to automate all this. Without automation, all those good intentions like “I’ll follow up on that proposal later” or “I’ll ask for a review when I’m done with this project” never really happen. It’s like telling yourself you’re going to work out after work, but the couch is way too comfy to get up.

So let’s talk about why automating your marketing processes isn’t just a nice-to-have - it’s a must-have for any accounting or bookkeeping firm serious about growth.

Here are the five marketing mistakes we see most often - and how automation can fix them for you:

1. No Automated Process for Getting Google Reviews

If I had a dollar for every time I’ve heard an accountant say, “Yeah, we know we need to get more Google reviews, but we just forget,” I could probably retire.

Listen, Google reviews are EVERYTHING. They’re the first thing potential clients check when they’re searching for an accountant or bookkeeper. According to a recent survey, 81% of consumers check Google reviews before engaging with a business. So, if you’re not asking for them, you’re missing a huge opportunity to build trust and show your expertise.

The problem is, if you don’t have a system in place to ask for reviews, it just doesn’t happen. It’s not that you don’t want to ask - you just get busy. If you set up a simple automated workflow that sends a review request to clients right after you’ve delivered a great service (tax return, financial report, bookkeeping update, etc.), you can make sure they get a link straight to your Google reviews page. All they have to do is click and type a few words. No more forgetting or hoping your clients remember to do it for you.

2. No Automated Communication to Stay in Front of Existing Clients

Your clients don’t need you just once a year for taxes or quarterly for bookkeeping - they need your assurance constantly. They need your expertise in real-time to help them make decisions, optimize their tax strategy, and plan for the future.

You can do this by setting up automated communication to stay top of mind with your clients. Whether it’s reminders about tax deadlines, business planning tips, or an annual check-in, automated emails or SMS messages that provide valuable insights. This keeps you in front of your clients without having to manually send messages every time.

Pro Tip: Content like tax tips or important financial reminders makes for perfect automated communication. You’re staying valuable without extra effort on your part. Win-win!

3. Lack of Messaging that Resonates with Your Ideal Clients

Alright, let’s talk about messaging - because it’s super important that you get this right. If your messaging doesn’t speak directly to the needs of your ideal clients, guess what? You’re wasting your marketing budget.

Most accounting firms focus on what they do: tax returns, bookkeeping, etc. But your clients don’t care about “tax returns.” They care about how your services will make their lives easier. They care about how you can save them time, reduce their tax burden, and provide valuable financial insights that set them up for success.

The problem? Many companies don’t have the right messaging in place, leading to a lack of engagement. Automation to the rescue! Once you’ve figured out your ideal client’s pain points and the messaging that resonates with them, you can automate campaigns that speak directly to their needs. A properly set-up CRM system can help deliver the right message at the right time without you having to send emails manually.

4. No Follow-Up on Proposals

Okay, we all know that feeling - you send a proposal, and then… crickets. Maybe you followed up once or twice, but nothing. So, what happens next? You probably just move on to the next lead. But guess what? That client didn’t go anywhere - they just needed a little nudge.

If you don’t automate your proposal follow-ups, you’ll forget or procrastinate. By setting up an automated follow-up system, you can send reminder emails or texts a few days after sending a proposal. It doesn’t feel pushy; it feels like you’re just keeping the conversation going. And trust me - it works.

5. Not Doing Anything with the Leads You Capture

You’ve got an email list, right? But how often do you actually use it? Capturing leads is one thing, but following up with them is a whole different ball game. If you’re not nurturing those leads, you’re missing out on potential clients who could be a perfect fit for your services.

You don’t have to wait for clients to come to you. With automated email sequences and CRM tools, you can engage with prospects regularly - whether they’re downloading a guide, signing up for your newsletter, or just expressing interest in your services. Automation ensures that leads aren’t forgotten, and it helps turn cold prospects into warm clients.

Let’s Get Your Processes on Autopilot

The bottom line is if you want to grow your firm and stop missing opportunities, you’ve got to automate your marketing processes. It’s about setting up systems that work for you - so you’re not chasing down proposals, constantly reminding yourself to ask for reviews, or forgetting to follow up on leads.

If you’re sitting there thinking, “Oh, we need something that can do that” - reach out to us. Cajabra’s CRM is designed to automate your marketing workflows, streamline your follow-ups, and ensure you stay top of mind with your clients, all without lifting a finger.

Let’s get your marketing working for you. You know the saying - better late than never!

Hey accountants and bookkeepers, do you have that nagging thought looming in the back of your mind that sounds like, “I know I need to get more Google reviews… but…”

Yeah, we’ve all been there. You know you need them, but it just keeps slipping through the cracks. Maybe it’s tax season, or maybe your to-do list is a mile long, and adding “ask for Google reviews” just doesn’t seem like it’s at the top of your priority list.

Here’s the plot twist: tax season is actually the PERFECT time to ask for those reviews. You’re busy, yes, but you’re also doing incredible work for your clients. You deserve some online love.

Did you know that 81% of consumers check Google reviews before engaging with a business? So, yeah - those reviews matter. Here’s how you can actually start getting them (without the stress and awkwardness) and build your online reputation while you’re rocking tax season.

The 3 Things Preventing Accountants from Getting More Google Reviews (And How to Fix Them)

1. “I don’t really have a ‘system’ in place to get them regularly.”

So, you just completed a tax return, the client seems happy, and you think, “Oh, I should ask for a review.” But then… life happens. You forget. The next thing you know, it’s two weeks later, and you’re wondering why your Google reviews haven’t budged.

Relying on your memory won’t work. Especially when you have 50 other things to juggle. So, forget the sticky notes on your desk or hoping you’ll remember when the client’s in front of you. It’s just too many steps: You ask, they Google you, then they click through to leave a review. That’s a lot of work for both of you!

Instead, automate it. Setting up an automated workflow that sends a review request to your clients as soon as they’ve received their tax return (or completed a major milestone) takes the pressure off. This is where efficiency meets reliability.

Here’s the trick - send them a text, not an email. Why? Well, 95% of text messages are read within 5 minutes. That means the emotional high they’re on (after getting their taxes filed or business bookkeeping in order) is fresh, and they’re way more likely to click that link and leave a review. No need to wait for them to check their email later when they’ve already moved on to the next thing in their busy life.

2. “I just forget to ask when I should.”

Ah, the classic - great intentions, but too much on my plate. You know you should ask, but it’s just not at the top of your to-do list when you’re delivering tax returns or handling client calls.

The solution here? Set up a system where the review request happens automatically. Here’s the beauty of automation: it just works. You don’t have to remember to ask. The minute a tax return is complete, or a certain milestone is hit (like 90 days of working with a client), the review request goes out. No more forgotten follow-ups. Your system does it for you.

And look, if you’re still feeling a little weird about asking for a review, just remember this: it’s not about you, it’s about your client’s experience. If you’re delivering good service (and you are), there’s no reason not to make it easy for them to share that experience online.

3. “I don’t want to automate it. What if we get a negative review?”

I get it, the fear of getting a negative review would make any business owner anxious. Nobody likes to see that dreaded 1-star pop up. But, getting a negative review is not the end of the world. In fact, sometimes it can be a good thing.

We all know that mistakes happen. You’re human. And guess what? Your clients know that too. When they see a negative review, what they’re really looking for is how you respond. Are you defensive? Or are you taking accountability and showing that you’re committed to fixing the issue? How you handle a negative review says a lot about you as a business.

When you automate your review process, you’ll have the opportunity to respond to every single review - whether it be positive or negative. That’s the key. Replying to reviews is just as important as getting them. It shows potential clients that you care, that you’re engaged, and that you’re willing to go the extra mile to make things right.

And if you’re worried about your online reputation - let me tell you a secret: SEO loves reviews. Google takes reviews into account when ranking your business, so consistently asking for them not only helps build trust but boosts your visibility. It’s a win-win.

Tax Season Is the Perfect Time to Prioritize Your Reviews

Now that we’ve covered the why and the how, here’s your call to action: make reputation management a priority this tax season. You’re already busy, and I know adding another thing to your plate can seem overwhelming. But if you can automate your review process, you’ll be building an online reputation that works for you long after tax season ends. And if you need help setting up your system to get more reviews and automate the process? Reach out. We at Cajabra can help streamline your review process and get more 5-star feedback without taking any more time out of your busy schedule. After all, it’s not about how much time you spend - it’s about working smarter, not harder.

If you’re a bookkeeper looking to grow your firm, getting new clients and scaling your operations can feel like a never-ending puzzle. You’re juggling client work, chasing down emails, trying to keep up with marketing (hello, social media fatigue!), and before you know it, another month has flown by without making any real progress on growth.

But here’s the thing, growing your firm doesn’t have to mean working harder. In fact, with the right systems, strategy, and automation, you can scale your business without adding more hours to your day.

That’s where this 7-step blueprint comes in. It’s designed to help bookkeepers like you attract high-quality leads, streamline operations, and ultimately convert more prospects into long-term clients - without the overwhelm.

Ready to make growth feel easier? Let’s break it down.

Step 1: Craft a Messaging Strategy That Actually Works

Let’s start with the foundation: your messaging. If you can’t clearly communicate who you help, how you help, and why it matters, your marketing efforts will feel scattered.

Key steps to refine your messaging:

- Define Your Ideal Client: Who do you actually want to work with? Construction contractors? Online coaches? Local small businesses?

- Identify Their Pain Points: What keeps them up at night? What’s frustrating about their finances?

- Position Yourself as the Guide: They don’t need another “accounting expert” - they need a problem-solver. Show them you understand their struggles and have the solution.

A brand messaging playbook ties it all together. It becomes your go-to for website copy, social media content, and even sales calls - so you’re always speaking the right language to attract the right clients.

Step 2: Optimize Your Online Presence (So Clients Can Actually Find You!)

If potential clients can’t find you online, they won’t hire you. Visibility matters, and it starts with these:

- Website: Ensure your website clearly explains what you do, who you help, and why you’re the best fit. Include a lead capture form.

- Google Business Profile: Keep it updated and actively collect Google reviews, as most people check reviews before making a decision.

- Social Media: You don’t have to be everywhere, just where your clients are. LinkedIn, Facebook groups for small business owners, and Alignable can be great places to start.

Step 3: Streamline Your Booking Process

A disorganized booking process can slow your sales cycle and frustrate potential clients. Simplify the process by:

- Using scheduling tools to let clients book directly into your calendar.

- Automating confirmations and reminders to reduce no-shows and last-minute reschedules.

- Making booking easy by adding a "Book a Call" button everywhere (your website, emails, and even your email signature).

A small change in how you schedule meetings can have a major impact on efficiency.

Step 4: Stop Missing Opportunities (AKA Answer Every Call, Every Time)

If a prospect reaches your voicemail, there’s a good chance they will move on to another bookkeeper. Studies show:

- 60% of potential clients hang up if they reach voicemail instead of a live person.

- The average bookkeeping client is worth $5,400 per year ($450 per month).

- Just 10 missed calls could mean a potential loss of $16,200 in revenue.

To avoid losing business, implement call automation:

- Set up automated text replies for missed calls, since most texts are read within minutes.

- Use an AI receptionist to answer FAQs and direct calls.

- Invite prospects into a text conversation instead of playing phone tag.

Step 5: Build Authority & Trust (So Clients Choose You)

People want to hire experts. To position yourself as the go-to bookkeeper in your niche, focus on:

- Guest appearances on podcasts and webinars to share your expertise.

- Regular LinkedIn posts featuring tips, insights, and behind-the-scenes wins.

- Networking with CPAs, tax pros, and business owners in your target market.

By consistently showing up, adding value, and engaging with your audience, you will build trust and credibility over time.

Step 6: Generate High-Quality Leads (Without Cold Outreach)

Lead generation doesn’t have to be overwhelming. The key is automation and smart positioning.

Strategies that work:

- Optimize your website for lead capture by using gated content, lead magnets, and an AI chat widget.

- Set up email and SMS follow-ups so warm leads don’t go cold.

- Leverage niche networking by getting referrals from CPAs or joining industry-specific groups.

- Test paid ads to bring in new leads. Social media video ads often perform well.

When done right, lead generation becomes a steady, automated system rather than a constant struggle.

Step 7: Automate Follow-Ups & Sales (So No Leads Slip Through the Cracks)

Following up is the key to closing more deals. Most leads don’t convert after just one interaction - they need reminders, education, and encouragement to take action.

To stay top-of-mind without constantly checking in manually:

- Set up automated email and SMS sequences to nurture prospects over time.

- Automate proposal follow-ups to keep deals moving forward.

- Use a CRM to track opportunities so you never lose track of where a lead is in your pipeline.

With the right automations, you can follow up consistently without adding more work to your plate.

Work Smarter, Not Harder

Growing a bookkeeping business doesn’t mean working more—it means working smarter.

- Automate what you can.

- Streamline your sales process.

- Focus on building trust and relationships.

By following this 7-step blueprint, you can scale your firm, win more clients, and make a bigger impact - without adding stress to your plate.

So, what’s your next move? Start with Step 1: Clarifying Your Brand Messaging - because everything else builds from there. Want to put this strategy into action without spending months figuring it out?

That’s exactly why we created The Bookkeeper Business Accelerator - to help bookkeepers implement these steps effortlessly. Click here to get all the details and start growing your firm today!

You’re an accountant. You’ve got numbers coming out of your ears, your clients are waiting for their tax returns, and marketing feels like the last thing on your mind, right? I get it. The hard truth is marketing your firm is not optional anymore. It’s imperative if you want to grow your monthly services client base and keep your pipeline full of ideal clients.

But how much should you really spend? I mean, there’s no “one-size-fits-all” answer here, right? Well, let’s break it down.

The Small Business Association (SBA) suggests that small businesses should spend 8 -10% of their revenue on marketing. Sounds simple enough, right? But, if you’re aiming for hyper-growth or trying to scale your firm to the next level, you might need to increase that. Think more like 15-20%.

Why Marketing Matters for Accounting Firms

If you’re just relying on word-of-mouth or clients who come to you because they have to file taxes, you're leaving opportunities on the table. Clients don’t see you as an investment, they see you as a necessary expense. You’re that thing they pay for once a year and then forget about. But here’s the deal: if you want to build a firm that scales (and I mean, scales with clients who see your value) you need to market yourself.

Think about it - how are you different from every other accountant out there? You’re not if you’re just offering the same services everyone else does. But you are if you position yourself as a trusted advisor, offer monthly or quarterly services, and really focus on helping clients increase the value of their businesses and their own wealth. The more proactive you are in marketing your value, the more clients will see you as an investment, not just a bill they have to pay.

How Much Should You Really Spend?

Okay, let’s talk percentages. Since the SBA recommends around 8-10% of your revenue to be spent on marketing if you want to grow steadily, let’s break that down:

- If you’re at the stage where you’re just maintaining a consistent flow of clients and not looking for major growth, 8-10% is probably just right.

- But if you’re looking to scale rapidly, targeting 15-20% of your revenue will give you the extra marketing muscle you need to go from “steady” to “hyper-growth.”

Where to Spend Your Marketing Dollars

So, you’re ready to invest in marketing - awesome! But how do you spend it wisely? Here are a few ways that adding in a CRM to your business will give you the most bang for your buck:

- Crafting a Powerful Messaging Playbook

Look, you can't just throw spaghetti at the wall and hope it sticks. You need clear, consistent messaging that hits your ideal clients right where it counts. Invest in a messaging playbook, something that defines your unique value and speaks directly to your audience's pain points. To keep that messaging consistent across every channel, you need a central hub - a CRM. It's where you store and deploy your brand's voice, ensuring you're always on message.

- Integrated Content & Social Media Automation

You know content is king, right? But churning out blog posts and social media updates shouldn't feel like a full-time job. Create killer content (blog posts, videos, social media gold) that positions you as the expert and builds trust. To make this sustainable, you need to automate. A CRM like Cajabra lets you schedule, publish, and track everything. Automate those social media posts, measure engagement, and free up your time for what really matters.

- Lead Generation & Instant Engagement

Let's be real, website visitors are gold. But if you're not capturing them, you're leaving money on the table. Implement systems to grab those leads like AI-powered chat widgets, booking links, lead capture forms that work while you sleep. A CRM automates the whole shebang. Lead capture, qualification, scheduling - it's all done for you. No more missed opportunities, just a steady stream of qualified leads.

- Automated Email Marketing & Lead Nurturing

Most people aren't ready to buy right away. That's where email marketing comes in. Nurture those leads, build relationships, and guide them down the sales funnel with automated email sequences that deliver real value. To make this work efficiently, you need automation. A CRM automates email segmentation, personalization, and follow-up. Consistent communication means higher conversion rates. It's that simple.

- Reputation Management & Client Communication

Your online reputation is your lifeline. Proactively manage it - ask for reviews, respond to feedback, and build a stellar reputation. And don't forget your existing clients! Implement a system for regular communication to keep them happy and coming back for more. To stay on top of this, you need a centralized system. A CRM lets you track reviews, automate review requests, and schedule those client check-ins. It's about building loyalty and creating raving fans.

- SEO & Paid Advertising

You want people to find you, right? Optimize your website for search engines and run targeted paid ads. But don't just throw money at it - track your ROI and see what's working. To understand your marketing performance, you need a system that tracks it. A CRM lets you track the performance of your SEO and paid ad campaigns. You'll know exactly where your leads are coming from and what's driving results.

Invest in Your Growth

The bottom line? Your marketing is an investment, not an expense. And if you’re serious about growing your accounting firm, you need to treat it that way. Whether you're sticking with the 8-10% recommendation for steady growth or going all-in at 15-20% for hyper-growth, the tactic is to be intentional with your spending. It should be invested in a technology system, a CRM, that allows you to automate and streamline your sales and marketing processes.

Marketing is your ticket to getting clients who value you - not just as an accountant, but as a trusted financial partner. At Cajabra, we know that juggling marketing while managing client work can feel like balancing the books with one hand tied behind your back. That’s why we’re here to help. Remember, you can't make money if you don’t make a move.