The accounting industry is experiencing rapid transformation as technology reshapes traditional practices. We at Cajabra, LLC see these trends in accounting accelerating faster than ever before.

From AI-powered automation to cloud-based solutions, firms must adapt quickly to stay competitive. The shift toward advisory services is creating new revenue opportunities while changing client relationships fundamentally.

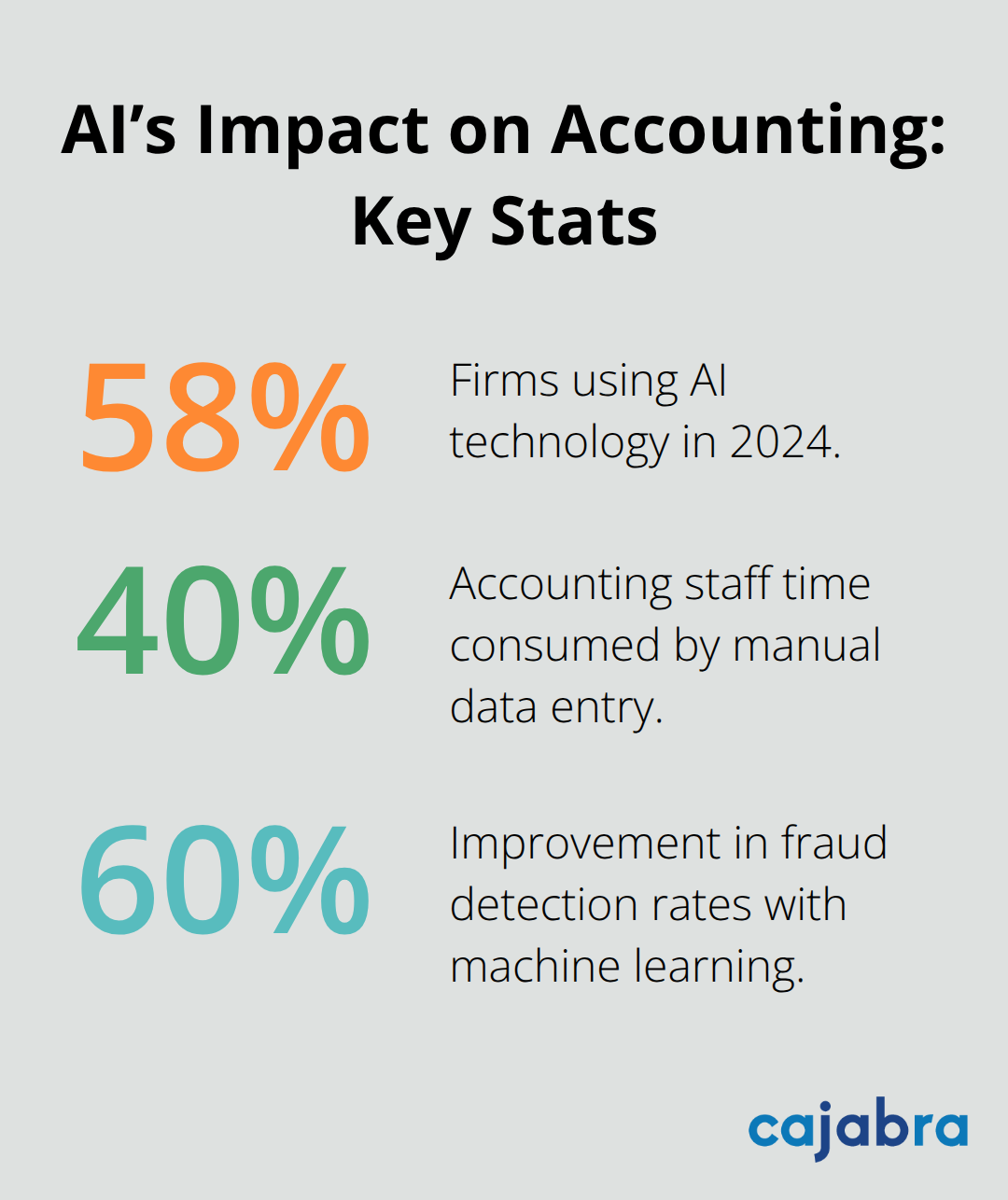

Artificial intelligence reshapes accounting operations at unprecedented speed, with 58% using the technology in 2024. Manual data entry consumes 40% of accounting staff time, but AI automation eliminates this burden completely. Intelligent systems now process invoices, bank statements, and receipts automatically while they flag discrepancies that humans miss.

Companies that implement comprehensive automation achieve 20 to 40 percent reductions in operating costs. These systems handle routine tasks with perfect accuracy, which frees accountants to focus on analysis and strategic advice.

Modern bookkeeping software connects directly to bank accounts, credit cards, and payment processors to capture transactions in real-time. These platforms categorize expenses automatically and match receipts to transactions without human intervention. The software learns from corrections and improves accuracy over time.

Firms that adopt automated bookkeeping complete monthly closes in days rather than weeks. Staff members redirect their time toward client consultation and business analysis instead of data entry tasks.

Predictive analytics revolutionizes financial forecasting through the analysis of historical patterns and market trends simultaneously. Machine learning algorithms process thousands of data points to generate accurate budget projections and cash flow predictions. Modern accounting software integrates these capabilities directly, which allows firms to provide clients with real-time insights instead of backward-looking reports.

Financial analysis that once required hours of manual calculation now happens instantly. Accountants can model multiple scenarios and present strategic recommendations based on data-driven insights.

AI-powered fraud detection systems analyze transaction patterns continuously and identify anomalies that escape human attention. These systems learn from each case and become more accurate over time while they reduce false positives. Financial institutions report 60% improvement in fraud detection rates after they implement machine learning solutions.

The technology examines spending patterns, vendor relationships, and approval workflows to spot irregularities. Accounting firms that use these tools position themselves as security partners rather than mere number processors, which creates additional revenue streams through specialized audit services.

This technological revolution sets the stage for another major shift that complements AI automation perfectly.

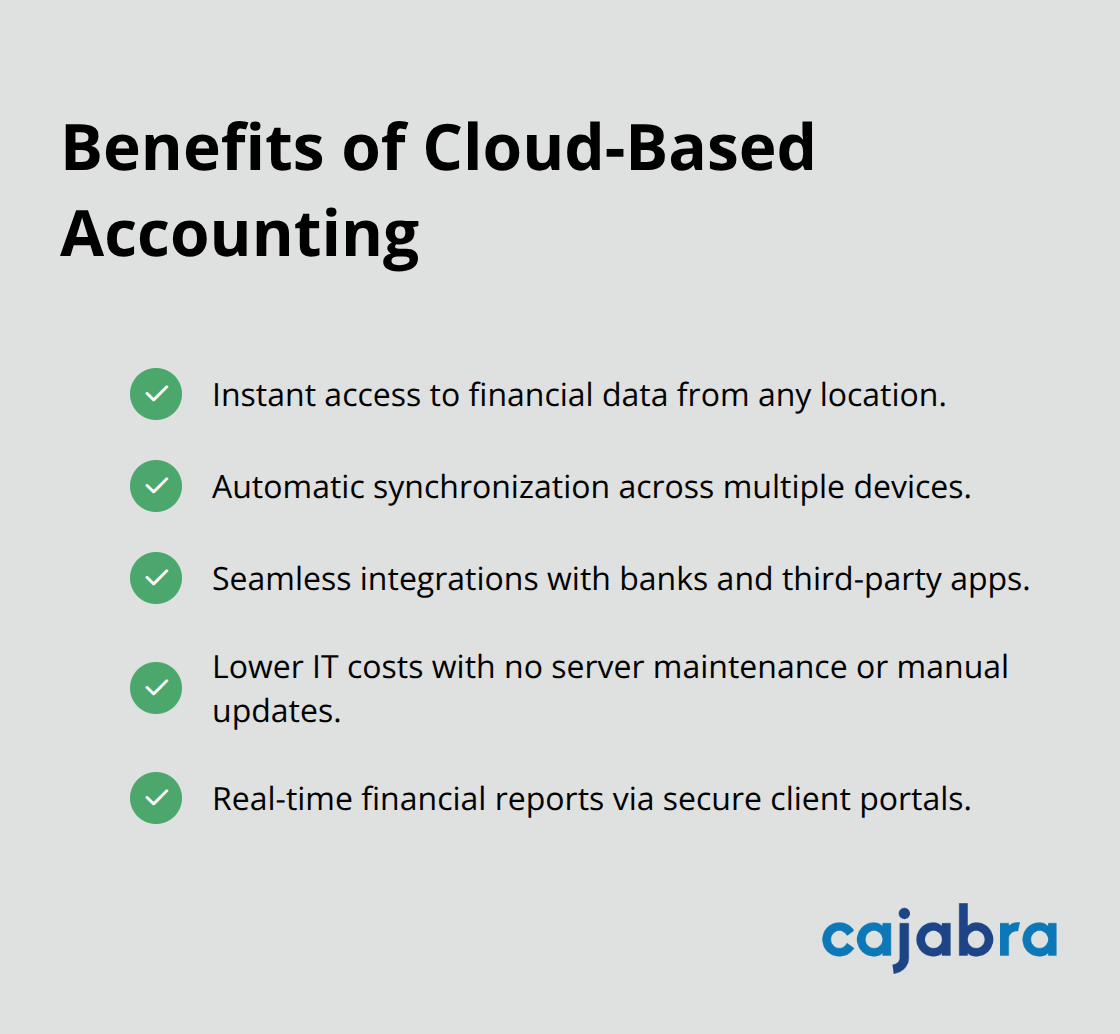

Cloud accounting platforms have become the industry standard, with firms increasingly adopting these solutions for enhanced flexibility. These systems provide instant access to financial data from any location and synchronize information across multiple devices automatically. QuickBooks Online, Xero, and NetSuite lead the market because they integrate seamlessly with bank systems and third-party applications.

Firms that switch to cloud platforms reduce their IT costs significantly and eliminate server maintenance and software updates completely. The technology enables real-time financial reports that clients can access through secure portals at any time.

Modern accounting firms abandon traditional desktop software in favor of cloud-based solutions that offer superior flexibility and scalability. These platforms handle everything from basic bookkeeping to complex financial analysis without requiring expensive hardware investments. Companies can access their financial data instantly from tablets, smartphones, or laptops regardless of location.

The migration process typically takes 2-4 weeks for most firms, and the return on investment becomes apparent within the first quarter. Cloud platforms automatically update tax tables and regulatory changes, which saves firms from manual software maintenance tasks.

Modern accounting software connects clients and accountants through integrated communication tools that streamline document sharing and approval processes. These platforms allow multiple users to work on the same file simultaneously and track changes while maintaining audit trails automatically.

Client portal integration means customers can upload receipts, review reports, and approve transactions without email exchanges or phone calls. Firms that use collaborative platforms complete client projects faster than traditional methods. The software sends automatic notifications when clients need to take action, which reduces delays and improves cash flow for both parties.

Cloud accounting platforms implement bank-level encryption and multi-factor authentication to protect sensitive information from cyber threats. These systems backup data automatically every few minutes and store copies in multiple geographic locations to prevent data loss.

Cloud-based systems provide enhanced security compared to traditional solutions because they receive constant security updates and monitoring. The platforms also provide detailed access logs and user permissions that help firms maintain compliance with privacy regulations (including GDPR and SOX requirements).

Professional accounting software includes built-in fraud detection that monitors unusual activity patterns and alerts administrators immediately when suspicious transactions occur. This enhanced security framework creates the foundation for accountants to expand beyond traditional compliance work into strategic advisory roles.

Accounting firms that embrace advisory services generate higher net client fees compared to traditional compliance-focused practices. The transformation from number-crunching to strategic consultation requires firms to position themselves as business partners rather than transaction processors. Modern clients demand forward-looking insights and actionable recommendations that drive growth, not just historical financial reports.

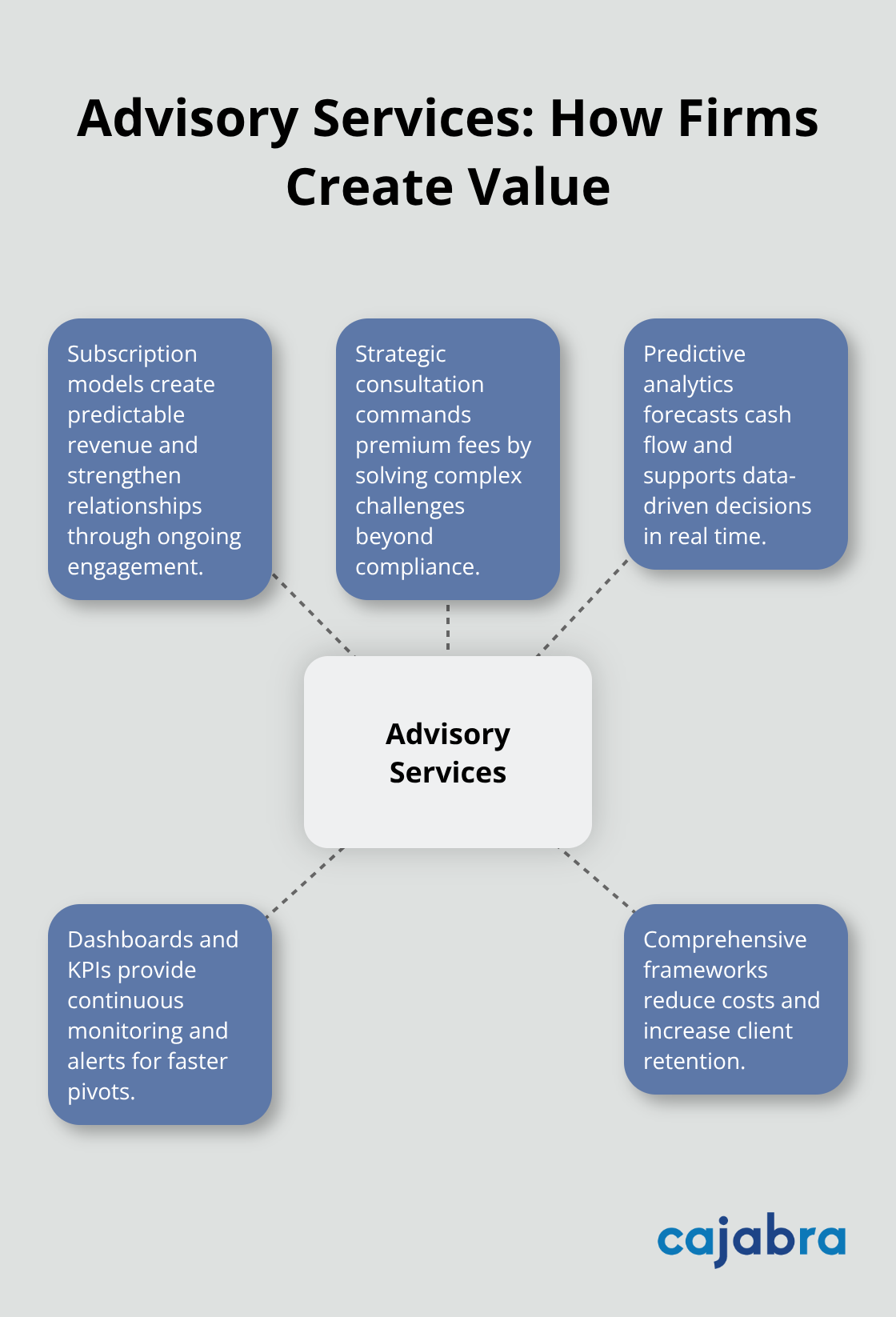

Firms that master predictive analytics can forecast cash flow patterns, identify profit optimization opportunities, and guide clients through complex business decisions with real-time data analysis. Companies that implement comprehensive advisory frameworks can achieve significant cost reductions while they increase client retention rates significantly.

Monthly retainer agreements create predictable revenue streams while they strengthen client relationships through continuous engagement. Firms charge fixed monthly fees for advisory services, financial analysis, and strategic planning rather than bill by the hour for reactive work. This approach encourages deeper client partnerships because accountants focus on value delivery rather than billable hour tracking.

Subscription-based firms report higher profit margins and better cash flow predictability than traditional hourly structures. Clients appreciate the transparency of fixed costs and the proactive support they receive throughout the year.

Accounting professionals who provide strategic guidance command premium fees when they solve complex business challenges beyond basic compliance work. These services include market analysis, growth strategy development, and operational efficiency improvements that directly impact client profitability. Firms position themselves as trusted advisors who understand industry trends and competitive landscapes while they deliver actionable recommendations.

The advisory approach transforms accountants from cost centers into revenue generators for their clients. This shift allows firms to charge based on value delivered rather than time spent on tasks.

Advanced analytics platforms enable accountants to provide clients with scenario modeling and performance benchmarks that support critical business decisions. These tools analyze industry comparisons, identify trends, and predict outcomes based on current financial data and market conditions (including competitor analysis and economic indicators).

Clients receive comprehensive dashboards that track key performance indicators and alert them to potential issues before they become problems. The real-time nature of these insights allows businesses to pivot quickly when market conditions change or opportunities arise.

The trends in accounting for 2025 represent a fundamental shift from traditional practices to technology-driven solutions. AI automation eliminates manual data entry while cloud platforms enable real-time collaboration and enhanced security. Advisory services transform firms from compliance processors into strategic business partners who command premium fees.

Firms that embrace these changes experience significant growth through improved efficiency and stronger client relationships. Automated systems reduce costs by up to 40% while subscription-based advisory models create predictable revenue streams. Cloud platforms provide instant access to financial data and strengthen security protocols against cyber threats (including advanced fraud detection capabilities).

Success requires immediate action on automation tools, cloud platform migration, and advisory service development. We at Cajabra, LLC help accounting firms navigate this transformation through our JAB System™ that moves accountants from overlooked to overbooked in 90 days. The accounting profession rewards firms that adapt quickly to technological advances and client expectations.