Most accounting firms struggle to maintain consistent client communication while attracting new prospects. Email marketing for accountants offers a proven solution that delivers measurable results.

We at Cajabra, LLC have seen accounting practices increase client retention by 40% through strategic email campaigns. The right approach transforms routine communications into powerful business development tools.

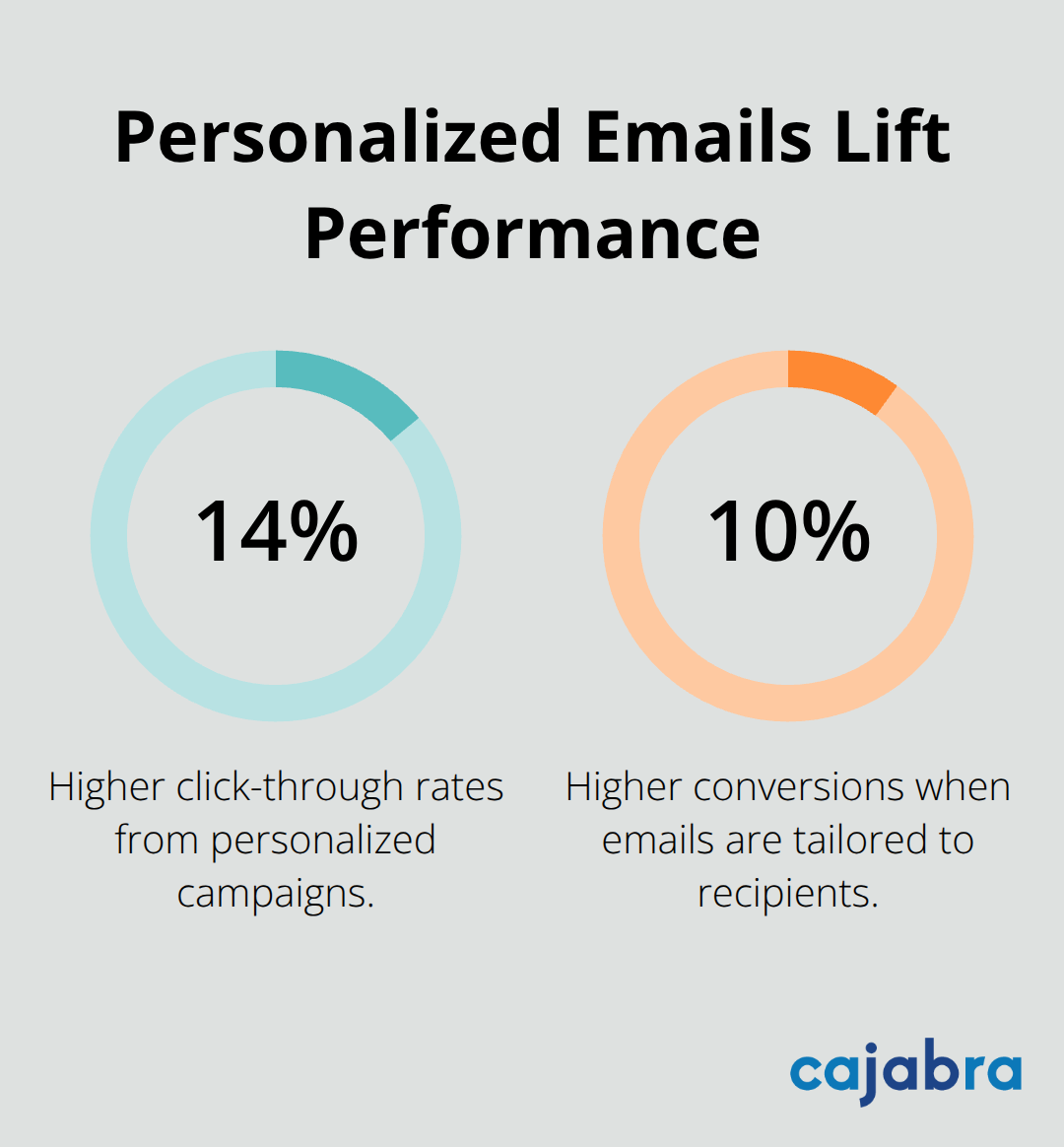

Email marketing delivers a staggering 4400% return on investment for accounting firms, which makes it the most profitable marketing channel available. This translates to $44 earned for every dollar spent, far exceeding social media advertising or traditional marketing methods. Amazon data shows personalized email campaigns improve click-through rates by 14% and conversions by 10%, which proves that targeted messages drive real business results.

Email bypasses the noise of social media algorithms and puts your message directly into your prospects' inboxboxes. Litmus research reveals email marketing generates $36 for every $1 invested, while mobile optimization becomes essential since professionals check emails on smartphones regularly. This direct communication channel lets accounting firms reach business owners and individuals exactly when they need financial guidance, without competition for attention against countless other posts.

Regular email communication positions your firm as the go-to financial expert in clients' minds. Monthly newsletters establish thought leadership while they keep your services top-of-mind when prospects face tax deadlines or financial decisions. Educational content that answers common client questions builds trust faster than any sales pitch, which transforms subscribers into loyal clients who refer others to your practice.

Email campaigns achieve open rates of 20-30% on average, with well-targeted messages reaching 40-50% engagement rates. Click-through rates of at least 2% serve as good benchmarks (with higher rates common in properly targeted emails). These metrics far exceed social media engagement rates, where organic reach continues to decline across all platforms.

The foundation for successful email campaigns starts with the right strategies and implementation approach.

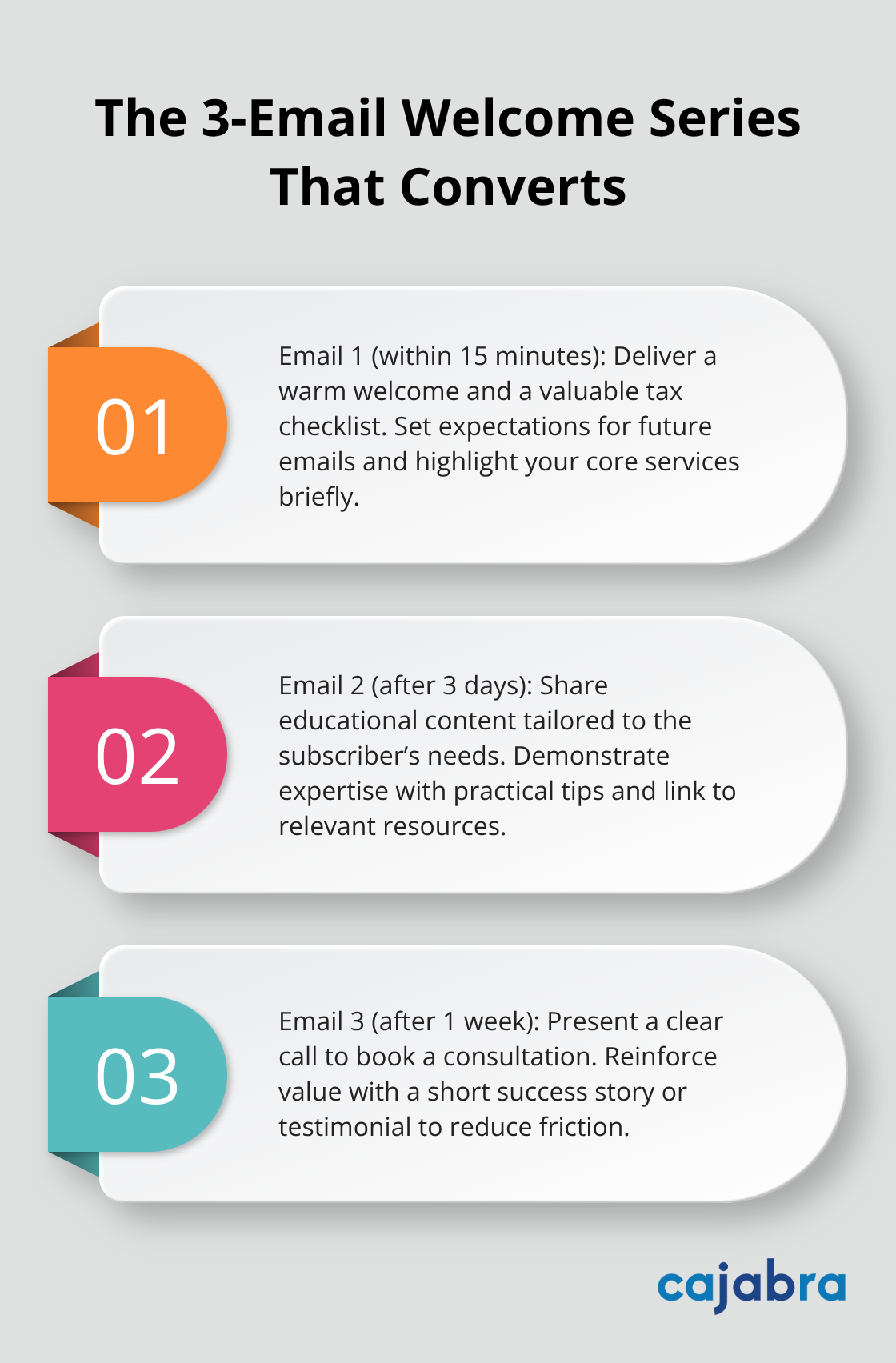

Welcome sequences form the backbone of successful email marketing for accounting practices because they immediately establish your expertise and set proper expectations. A three-email welcome series that introduces your firm, shares a valuable tax checklist, and explains your service philosophy helps convert prospects into clients. The first email should arrive within 15 minutes of signup, the second after 3 days with educational content, and the third after a week with a clear call to schedule a consultation. This automated approach nurtures prospects while you focus on existing client work.

Tax season reminders sent 6-8 weeks before deadlines produce 60% higher response rates than last-minute notifications. January emails about tax document preparation, February messages that highlight deduction opportunities, and March deadline reminders keep your firm top-of-mind when prospects need help most. Year-end tax planning emails sent in November and December capture business owners who seek strategies to reduce their tax liability before December 31st. Quarterly estimated tax reminders for self-employed clients prevent penalties and position your firm as proactive rather than reactive.

Monthly newsletters that feature specific tax law changes, industry-specific deductions, and practical financial tips establish your firm as the trusted advisor prospects seek. Content that addresses common client questions like retirement account contribution limits, business expense categories, and home office deductions demonstrates expertise without aggressive sales tactics. Case studies that showcase how you helped similar businesses save money through strategic planning prove your value better than generic service descriptions (email marketing that explains complex concepts in simple terms builds trust with prospects who feel overwhelmed by financial decisions).

Automated email sequences handle routine client communication while you focus on high-value activities. Birthday emails with tax planning tips, anniversary messages that celebrate client relationships, and service reminder emails maintain consistent touchpoints throughout the year. Reactivation campaigns target inactive subscribers with special offers or valuable content (multiple contacts are often required before prospects convert to clients). These automated workflows maintain professional relationships without constant manual effort.

The success of these strategies depends heavily on the content marketing tools and platforms you choose to implement them.

Mailchimp and Kit stand out as the most effective email marketing platforms for accounting firms because they offer professional templates, automated workflows, and detailed analytics without technical expertise requirements. Mailchimp provides industry-specific templates that look professional and mobile-responsive designs that work perfectly on smartphones (where professionals regularly check their emails throughout the day). Kit excels at automation sequences and offers superior deliverability rates, which means more of your emails reach client inboxes rather than spam folders. Both platforms integrate seamlessly with popular accounting software like QuickBooks and Xero, allow you to sync client data automatically, and create targeted campaigns based on service usage patterns.

Client segmentation based on service type, business size, and engagement level produces dramatically better results than generic messages sent to your entire list. Individual tax clients require different messages than small business owners who need ongoing bookkeeping services, while established clients respond better to advanced tax strategies compared to prospects who need basic education. Geographic segmentation works particularly well for accounting firms because tax laws vary by state, and local business regulations affect different client groups differently. Behavioral segmentation tracks which subscribers open tax-related content versus business advisory emails (this allows you to tailor future campaigns to their demonstrated interests and increase click-through rates from 2% to 8% or higher).

Welcome email sequences that deliver a tax checklist immediately, followed by a service overview after three days, then a consultation booking link after one week convert 35% more prospects than single welcome messages. Deadline reminder sequences start 60 days before tax season, with follow-ups at 30 days, 14 days, and final warnings at 3 days to capture procrastinating clients who might otherwise file elsewhere. Birthday and business anniversary emails with personalized tax tips maintain relationships year-round, while reactivation campaigns that offer free consultations can resurrect 15-20% of inactive subscribers who stopped engagement with previous content. Marketing automation tools can schedule these sequences to run automatically, ensuring consistent communication without manual intervention.

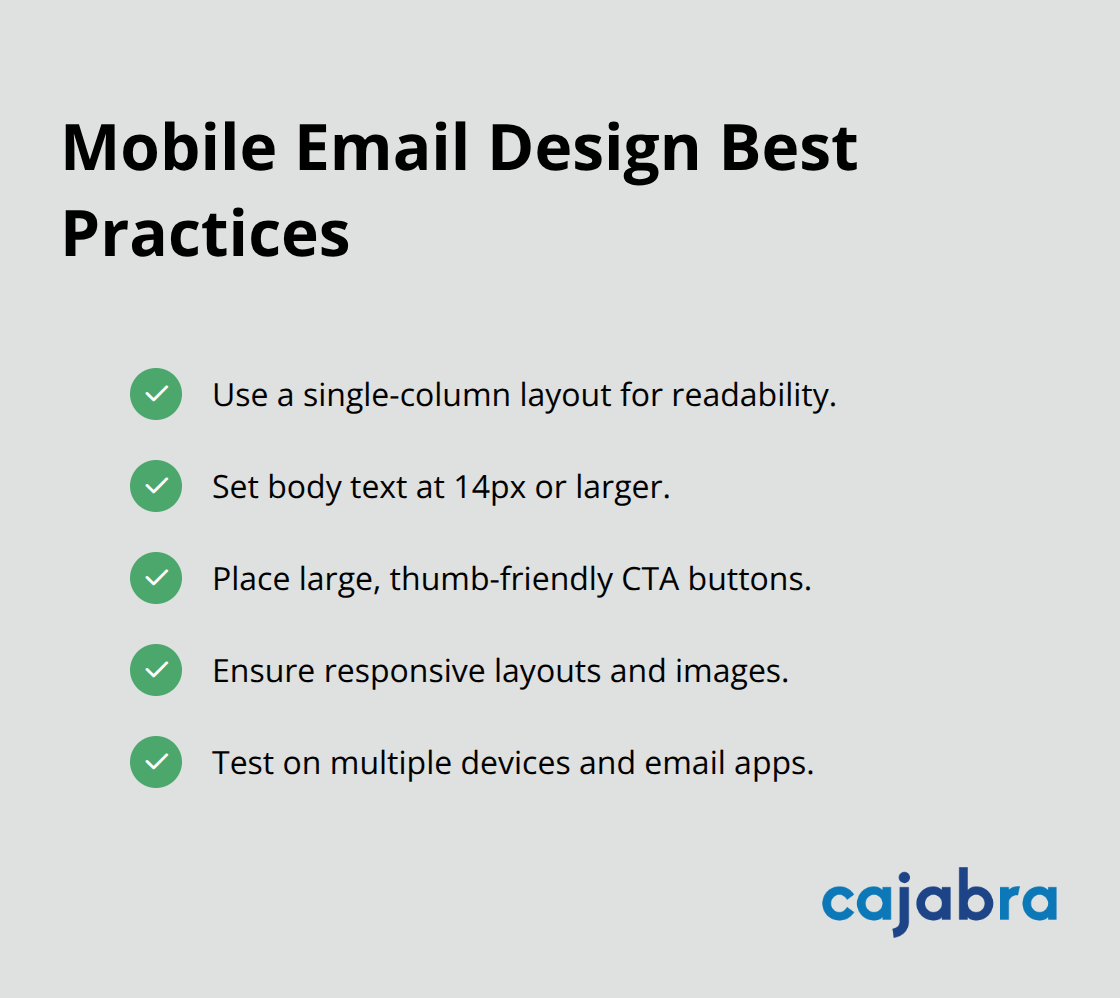

Single-column layouts with larger fonts (14px minimum) improve accessibility across all devices and increase engagement rates significantly. Thumb-friendly call-to-action buttons positioned prominently within emails drive more clicks than small text links buried in paragraphs. Email designs must adapt to different screen sizes automatically because mobile users delete emails that display poorly within seconds of opening them.

Implementing these client engagement best practices ensures your emails perform well across all devices and maintain professional standards that reflect your accounting expertise.

Email marketing for accountants delivers exceptional results when you implement strategic campaigns. The 4400% ROI demonstrates clear value, while direct inbox access reaches decision-makers exactly when they need financial guidance. Automated welcome sequences, seasonal tax reminders, and educational newsletters build authority and generate consistent revenue streams.

Choose a professional platform like Mailchimp or Kit, then segment your client list based on service type and business size. Create automated workflows that handle routine communication while you focus on high-value client work. Mobile optimization remains essential since professionals check emails on smartphones throughout the day (making responsive design a necessity for engagement).

Consistent email campaigns transform accounting practices from reactive service providers into proactive financial advisors. Monthly newsletters establish thought leadership, while targeted automation sequences nurture prospects into loyal clients who refer others to your practice. We at Cajabra, LLC help accounting firms implement these strategies through our JAB System™ that moves practices from overlooked to overbooked in 90 days.