At Cajabra, LLC, we know that client relationships are the backbone of any successful accounting firm.

Improving client engagement and satisfaction isn't just good practice-it's essential for long-term success and growth. In this post, we'll explore practical strategies to boost client engagement and enhance overall satisfaction.

Get ready for actionable tips that will transform your client relationships and set your firm apart in a competitive market.

At Cajabra, LLC, we understand that client relationships form the foundation of any successful accounting firm. Client engagement involves the depth and quality of interactions between your firm and its clients. It's about creating meaningful connections that extend beyond basic service provision. Client satisfaction measures how well your services meet or exceed client expectations.

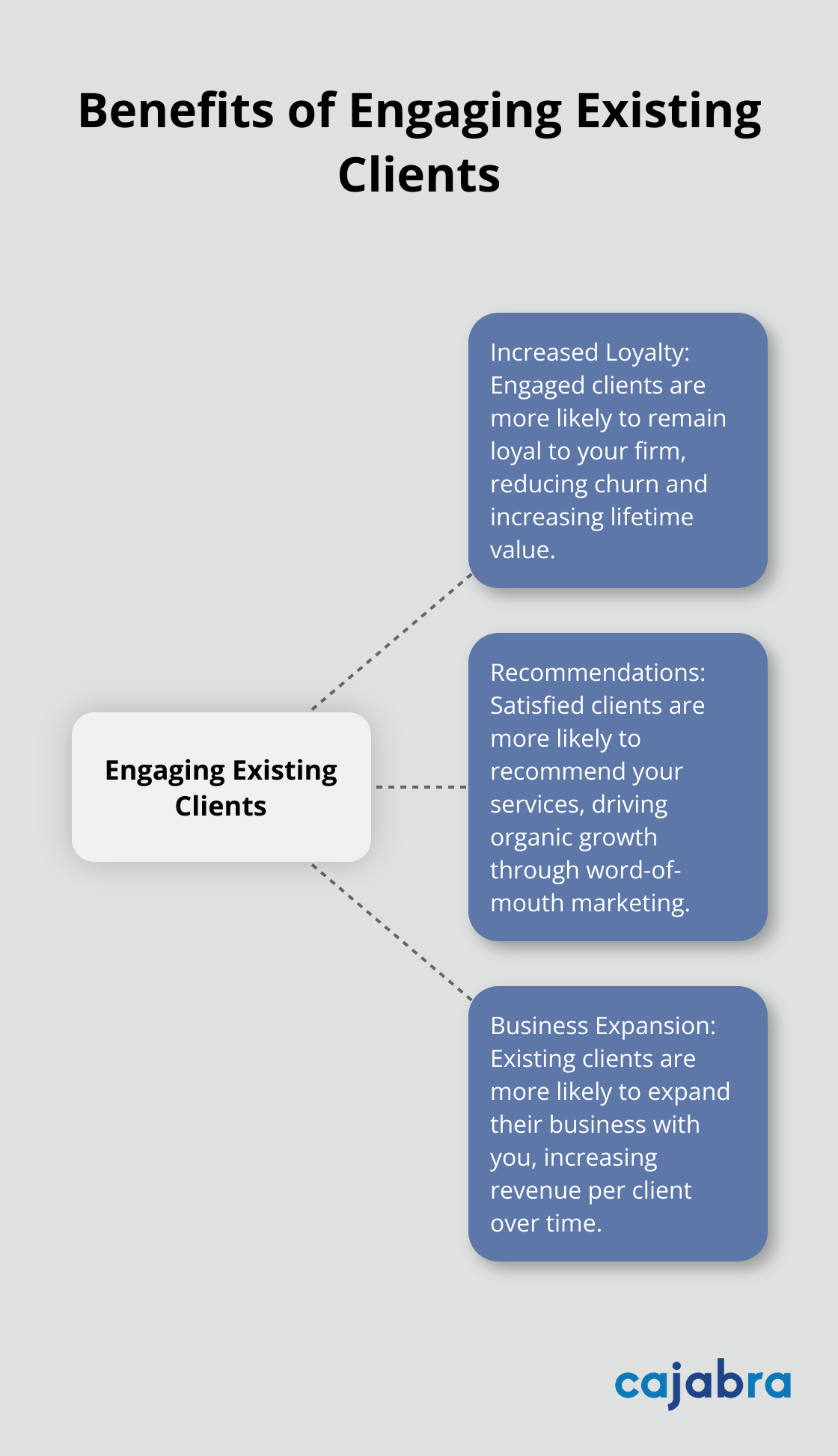

For accounting firms, strong client engagement can transform business outcomes. Engaged clients tend to:

A new report claims that, for the first time ever, marketing to existing customers is exceeding that to new ones. This underscores the substantial financial impact of maintaining satisfied and engaged clients.

To enhance client engagement and satisfaction, you must track the right metrics. Here are some key indicators to focus on:

While these metrics provide valuable insights, don't overlook qualitative aspects. Regular check-ins, feedback sessions, and even informal conversations can offer invaluable insights into client sentiment.

Client engagement isn't just about keeping clients happy-it's about creating a partnership where both parties thrive and succeed together. As we move forward, let's explore specific strategies to boost client engagement and take your firm's client relationships to new heights.

Abandon the one-size-fits-all approach. Use your client's preferred communication channel (email, phone, or video calls). According to McKinsey's research, 76% of consumers expect a more personalized experience from brands they engage with.

Set up quarterly reviews with each client. These sessions go beyond numbers; they provide opportunities to understand evolving business needs. Ask targeted questions about goals and challenges. This information helps tailor your services and demonstrate your value.

Don't wait for clients to bring problems to you. Anticipate their needs and offer solutions preemptively. If you notice a client's cash flow tightening, reach out with strategies to improve their financial position.

Share industry insights relevant to your clients' businesses. This could include tax law changes, economic trends, or new accounting technologies.

Implement a client portal for secure document sharing and real-time collaboration. SmartVault offers an online document storage and secure file-sharing solution that includes a built-in client portal.

Use data analytics tools to gain deeper insights into your clients' financials. This allows you to identify trends and opportunities that might otherwise go unnoticed. Share these insights with your clients to showcase the value you bring beyond basic number-crunching.

Create a systematic approach to gather client feedback. Use short, targeted surveys after key interactions or projects. The Net Promoter Score (NPS) serves as a simple yet effective metric to gauge client satisfaction.

Take action on the feedback you receive. If multiple clients express confusion about your reports, revamp your reporting format. If they request more frequent updates, adjust your communication schedule. Your responsiveness to feedback can significantly boost client loyalty.

Supercharging client engagement requires continuous effort and adaptation. These strategies will not only enhance client satisfaction but also position your firm as an indispensable partner. The next section will explore how to further elevate client satisfaction through superior service delivery.

Efficiency forms the foundation of client satisfaction. Implement project management tools (like Asana or Trello) to track tasks and deadlines. This approach ensures nothing slips through the cracks and allows for faster response times.

Automate routine tasks to free up time for value-added activities. For example, use software to send automatic follow-up emails after client meetings.

A recent study found that 59% of consumers feel companies have lost touch with the human element of customer experience. Streamlined processes not only save time but also enhance the overall client experience.

Financial reports often overwhelm clients. Break down complex information into digestible chunks. Use visual aids like graphs and charts to illustrate key points.

Implement a tiered reporting system. Provide a high-level summary for quick insights, followed by more detailed breakdowns for those who want to explore deeper. This approach caters to different client preferences and time constraints.

Interactive reporting tools allow clients to explore data on their own, which fosters engagement and understanding.

Accounting services should not follow a one-size-fits-all approach. Conduct regular needs assessments with your clients to understand their evolving requirements. Use this information to customize your service offerings.

For instance, offer specialized advice on cross-border taxation for clients expanding internationally. Provide targeted forecasting and budgeting services for those struggling with cash flow.

Research shows that personalized recommendations influence customers' intention to purchase. The same principle applies to accounting services - relevance drives satisfaction.

The accounting landscape constantly evolves. Stay ahead of the curve by investing in ongoing professional development for your team.

Encourage certifications in emerging areas (such as data analytics or blockchain accounting). Attend industry conferences to network and learn about cutting-edge practices.

Share your knowledge with clients through regular updates or webinars on relevant topics. This positions your firm as a thought leader and adds value beyond traditional accounting services.

Client engagement and satisfaction drive success for accounting firms in today's competitive landscape. Personalized communication, proactive advisory services, and streamlined processes transform client relationships and set firms apart. Engaged clients remain loyal, recommend services, and expand their business, leading to increased revenue and sustainable growth.

We at Cajabra specialize in helping accounting firms improve client engagement through targeted marketing strategies. Our JAB System™ moves accountants from overlooked to overbooked in 90 days (securing retainer-based clients and maximizing revenue from existing relationships). This approach builds lasting partnerships that drive mutual success for years to come.

Take action now. Assess your current client engagement strategies and identify areas for improvement. Implement new approaches and measure their impact. You will build a reputation as a trusted advisor, attracting new clients and top talent, creating a cycle of growth and success.