At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

Client engagement best practices can transform your business, boosting loyalty and driving growth. In this post, we'll reveal proven strategies to enhance your client interactions and deliver exceptional value.

Get ready to revolutionize your approach to client engagement and watch your firm thrive.

Client engagement forms the foundation of successful accounting firms. It involves the creation of strong, enduring relationships with clients that transcend basic transactions. At its essence, client engagement requires the active involvement of clients in their financial journey, ensuring they feel valued and consistently receive service that surpasses their expectations.

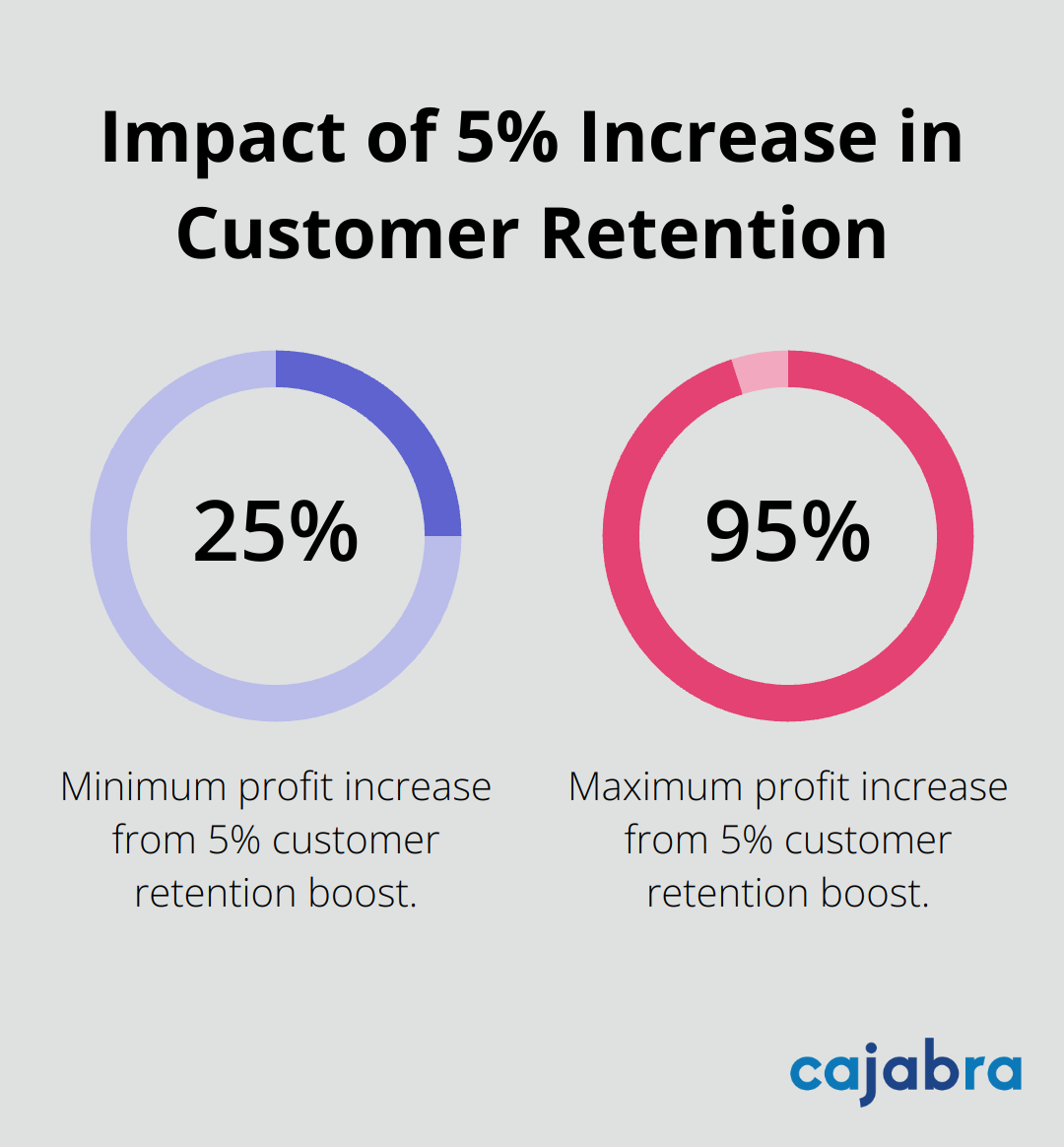

For accounting firms, robust client engagement transforms business outcomes. It's not merely about client retention; it's about creating firm advocates. Engaged clients tend to seek additional services, refer new business, and provide invaluable feedback. A study by Bain & Company reveals that increasing customer retention rates by 5% increases profits by 25% to 95%.

To enhance client engagement effectively, firms must track specific metrics:

To elevate client engagement, consider these effective approaches:

As we move forward, let's explore how effective communication strategies can further enhance client engagement and solidify your firm's position as a trusted advisor.

Effective communication forms the foundation of client engagement in accounting. To elevate your firm's communication strategy, you must tailor your messages to each client segment. A startup might prefer quick, digital updates, while an established business may value detailed quarterly reviews.

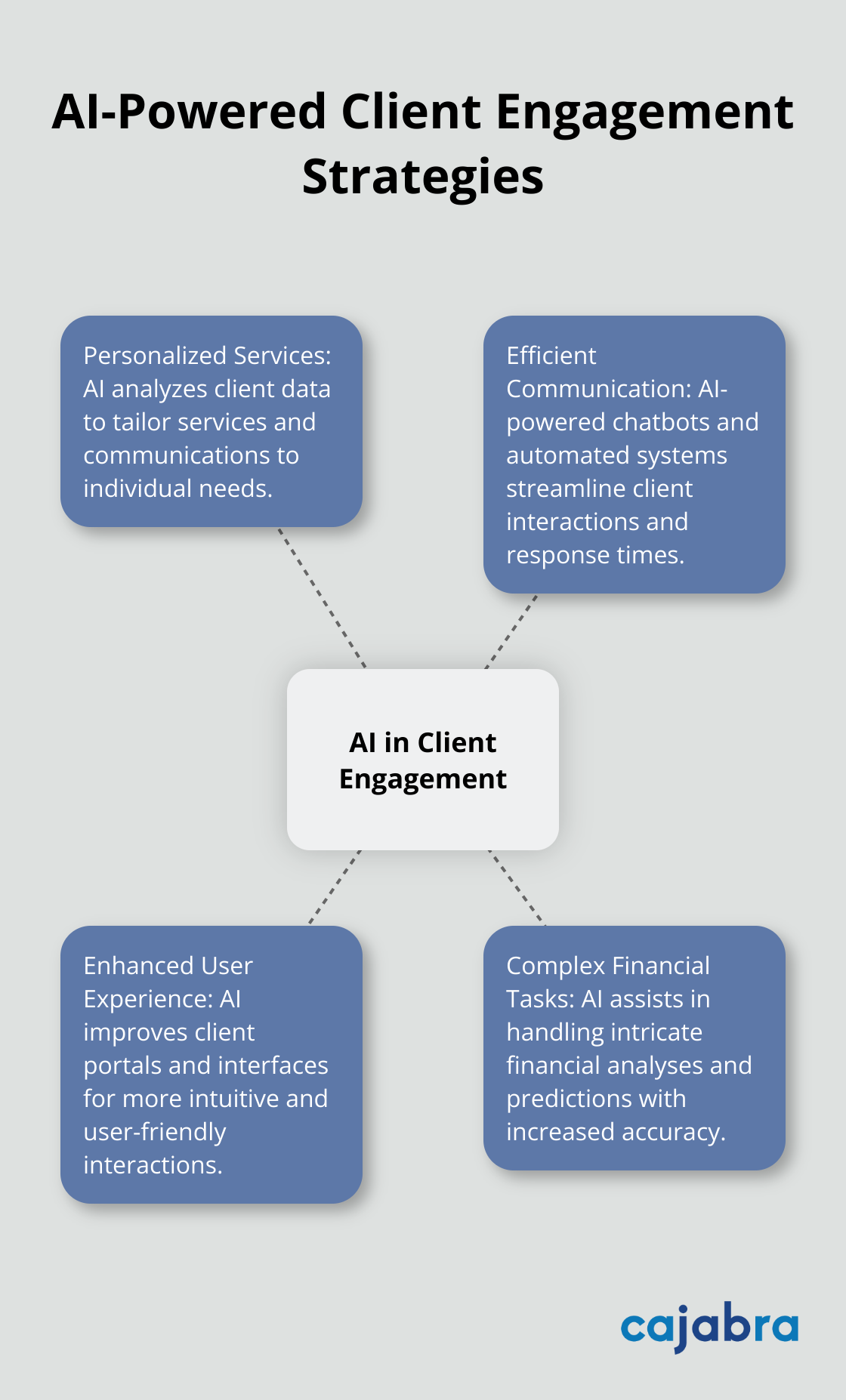

AI tools can transform client engagement strategies, offering personalized and efficient services. Use your client management system to track preferences, past interactions, and key business milestones. This data will enable you to craft messages that resonate on a personal level.

In today's digital landscape, technology adoption is non-negotiable. Implement a secure client portal where clients can access their financial documents, make payments, and schedule appointments. This approach not only enhances convenience but also showcases your firm's commitment to innovation.

AI-powered chatbots can handle complex financial tasks while enhancing customer communication and user experience. This frees up your team to focus on more complex client needs.

Proactive communication builds trust and maintains client engagement. Set up a system of regular check-ins tailored to each client's needs and preferences. This could include:

A consistent communication rhythm adds value to your service and keeps clients informed.

Different clients prefer different communication channels. Some favor emails, while others respond better to phone calls or text messages.

Develop a multi-channel strategy that includes:

Diversifying your communication channels increases the likelihood of reaching clients in their preferred manner, enhancing engagement and satisfaction.

Now that we've explored effective communication strategies, let's examine how value-added services can further boost client engagement and solidify your position as a trusted advisor.

We at Cajabra, LLC understand the power of proactive financial advice in transforming client relationships. This approach positions your firm as a strategic partner in your clients' financial success.

Set up quarterly financial health check-ups for your clients. Review their financial statements, cash flow projections, and tax positions during these sessions. Identify potential risks or opportunities and present actionable recommendations.

Proactive financial advice is crucial for winning clients, expanding services, and growing your accounting firm.

Educational resources and workshops significantly enhance client engagement. These offerings showcase your expertise and commitment to client success.

Create a series of webinars or in-person workshops on topics relevant to your clients' industries. For example, if you serve many e-commerce businesses, host a workshop on optimizing inventory management for tax purposes.

Develop a resource library on your website with downloadable guides, templates, and calculators. Topics could include cash flow forecasting, budgeting for small businesses, or navigating complex tax regulations.

A report indicates that firms offering client education programs see a 30% increase in client satisfaction scores. This increased satisfaction directly translates to stronger engagement and loyalty.

Data analytics provide tailored insights, demonstrating value and boosting engagement. Advanced analytics tools offer clients a deeper understanding of their financial position and future prospects.

Implement predictive analytics to forecast future financial trends for your clients. This could include projecting cash flow, estimating future tax liabilities, or identifying potential areas for cost savings.

Use benchmarking data to show clients how they compare to industry peers. This information can prove invaluable for strategic decision-making and highlight areas where your firm can provide additional support.

A recent survey reveals that 79% of accountants expect a surge in strategic advisory work, and 81% say AI improves productivity.

The key to successful value-added services lies in tailoring them to your clients' specific needs and industries. Regularly solicit feedback to ensure your offerings remain relevant and valuable. Consistent delivery of these enhanced services will create a level of engagement that sets your firm apart in a competitive market.

Firms offering value-added services see an average revenue increase of 18% per client, demonstrating the significant impact these services can have on your business growth.

Client engagement best practices transform accounting firms. Personalized communication, technology integration, and value-added services create lasting partnerships. These strategies foster trust, loyalty, and mutual success in an increasingly competitive landscape.

Effective implementation starts with an assessment of current engagement levels. Firms must prioritize actions aligned with their goals and invest in technology that supports seamless communication. Regular client feedback and adaptation to industry trends ensure continuous improvement in engagement efforts.

We at Cajabra specialize in elevating client engagement through targeted marketing strategies. Our JAB System™ and Premium Online Presence Package can revolutionize your firm's approach to client acquisition and retention. Embrace these strategies and position your accounting practice as a leader in your field.