At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

Client engagement goes beyond just providing services; it's about creating meaningful connections that drive better results for both parties.

In this post, we'll explore practical strategies to increase client engagement and show you how to implement them effectively in your accounting practice.

Client engagement in accounting directly impacts client loyalty, revenue growth, and brand differentiation while improving employee engagement. Effective client engagement can transform accounting practices, as we've observed at Cajabra, LLC.

When clients feel valued and understood, they tend to seek additional services and maintain long-term relationships with your firm.

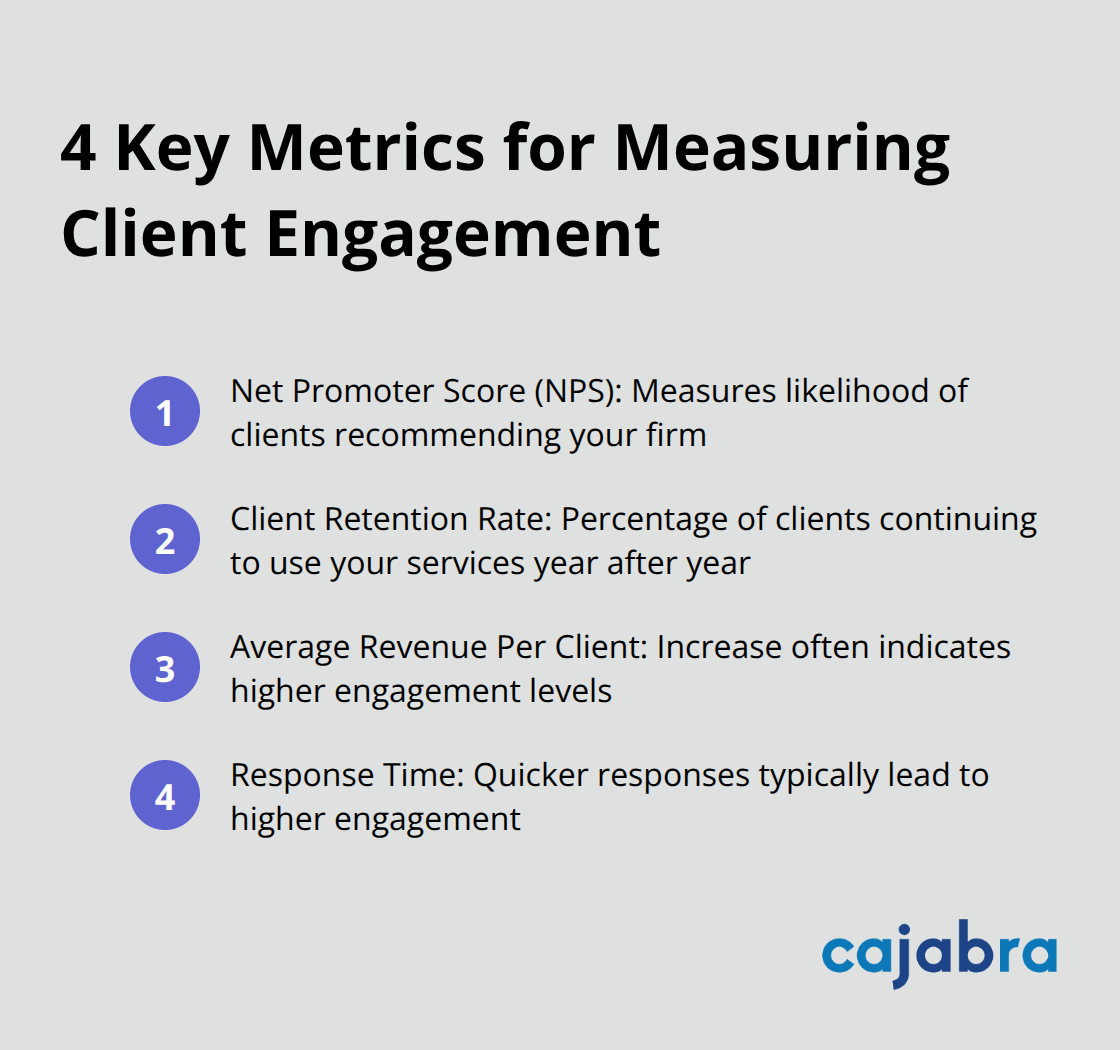

To enhance client engagement, you must measure it. Here are some essential metrics to track:

Use data and client surveys to customize your services to each client's specific needs. For instance, if you know a client plans to expand their business, offer proactive guidance on the tax implications of growth.

During client meetings, focus on understanding their concerns and goals. This approach allows you to provide more valuable advice and strengthens the client relationship.

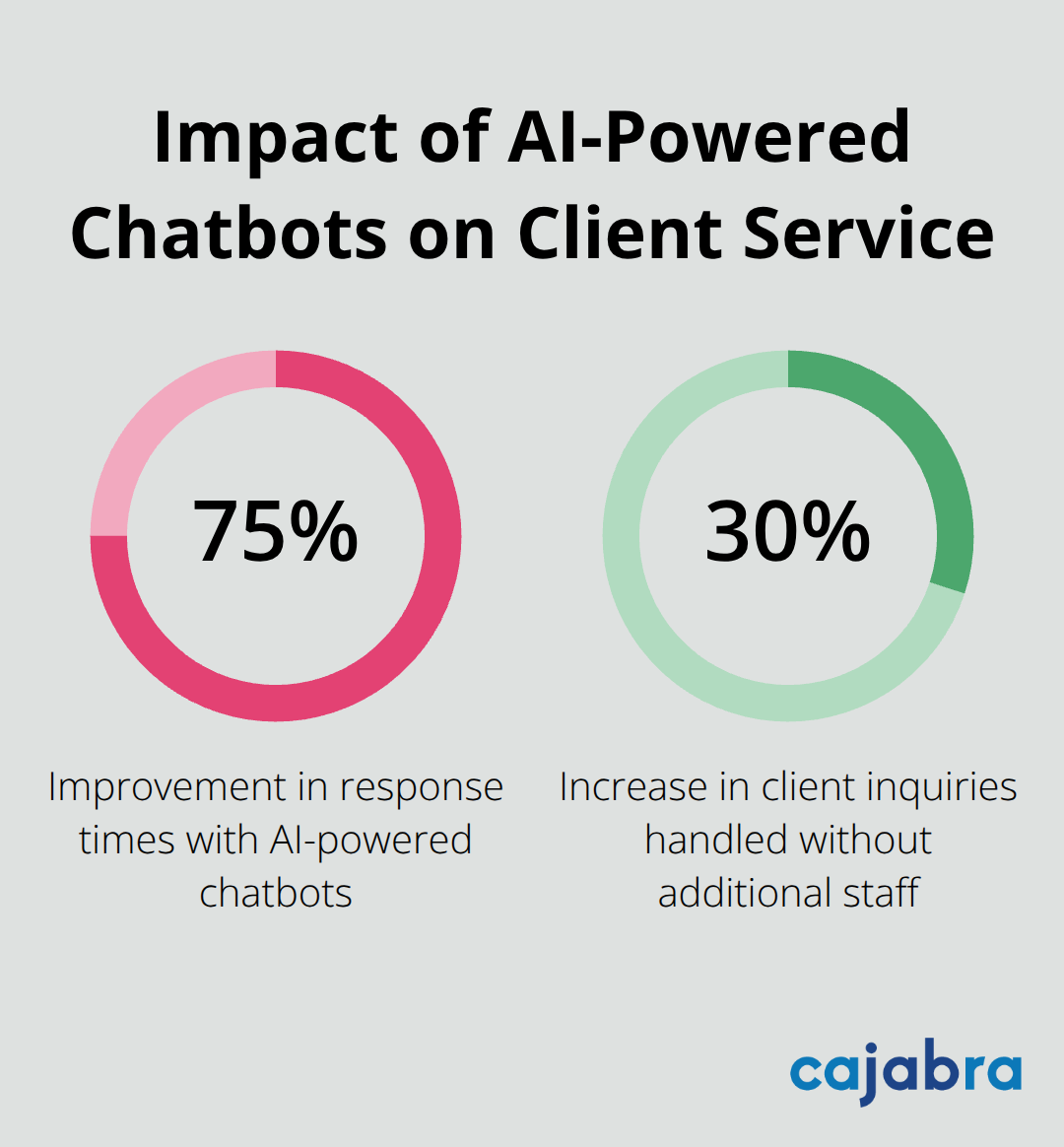

Use client portals for easy document sharing and communication. Implement chatbots for quick responses to common questions outside of business hours (this can significantly improve client satisfaction).

Client engagement requires consistent attention and refinement. The next section will explore how to implement these strategies effectively in your accounting practice.

One-size-fits-all communication doesn't work in accounting. Use your client management system to track preferences and adapt your approach. Some clients prefer brief, weekly email updates, while others value in-depth quarterly meetings. A Salesforce study found that 81% of consumers say they will reassess their budget over the next 12 months as they seek more personalized experiences – accounting services should be no exception.

Don't wait for clients to bring problems to you. Review their financial data regularly and reach out with insights and recommendations. If you notice a client's cash flow tightening, schedule a call to discuss potential solutions before it becomes a crisis. This proactive approach adds value and positions you as an indispensable partner in their business success.

Modern clients expect smooth, efficient interactions. Implement user-friendly client portals for secure document sharing and real-time collaboration. The goal? Make working with you as effortless as possible.

Try AI-powered chatbots to handle routine queries outside business hours. This can improve response times by 75%, enabling firms to handle 30% more client inquiries without additional staff. This ensures your clients get immediate responses, improving their overall experience with your firm.

Knowledge empowers clients and boosts engagement. Host monthly webinars on relevant topics like tax planning strategies or cash flow management. Create a resource library on your website with easy-to-understand guides and videos explaining complex accounting concepts.

Fulfilling this desire for knowledge increases engagement and demonstrates your expertise and value.

To systematically enhance client engagement across your firm, create a structured program. This program should include regular check-ins, personalized communication strategies, and a system for tracking and analyzing engagement metrics.

The next section will explore how to develop and implement such a program effectively, ensuring that your entire team is aligned in delivering exceptional client experiences.

Start with a thorough evaluation of your existing client engagement. Use client satisfaction surveys, Net Promoter Score (NPS), and retention rates to establish a baseline. A PwC study reveals that 73% of customers point to experience as an important factor in their purchasing decisions, behind price and product quality (underscoring the importance of understanding your current position).

Analyze your client interactions next. Determine the frequency and channels of communication. Identify if you proactively reach out or merely respond to inquiries. This audit will uncover gaps in your current approach.

With your baseline established, define Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) goals. Try to increase your NPS score by 15 points within the next 12 months or boost client retention rates by 10% in the coming year.

Create a step-by-step plan to achieve your goals. This might include:

Prioritize these initiatives based on potential impact and ease of implementation.

Your team forms the frontline of client engagement. Invest in training programs that focus on active listening, empathy, and problem-solving skills. Consider role-playing exercises to practice handling difficult client situations. This hands-on approach can significantly improve your team's confidence and competence in client interactions.

Implement a robust CRM system to track all client interactions. This allows you to monitor engagement levels, identify at-risk clients, and spot opportunities for upselling.

Use analytics tools to measure the effectiveness of your engagement initiatives. Track metrics like response times, meeting frequency, and content engagement rates. This data-driven approach allows you to continuously refine your strategy.

Client engagement forms the foundation of success for accounting firms. Personalized communication, proactive advice, and technology leverage transform client relationships and drive better results. The strategies we explored, from AI-powered chatbots to educational webinars, offer practical tools to increase client engagement and satisfaction.

A robust client engagement program requires ongoing effort. It begins with assessment, goal-setting, and roadmap development. Staff training and CRM system utilization play vital roles in this journey. These efforts yield long-term benefits, including higher retention rates, increased revenue per client, and a stronger industry reputation.

Engaged clients become firm advocates, leading to valuable referrals and a stronger market position. They also seek additional services, creating cross-selling and upselling opportunities. At Cajabra, LLC, our specialized marketing services (including the JAB System™) help accountants attract ideal clients and build lasting, profitable relationships.