At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

A well-crafted client engagement plan is key to building and maintaining these relationships. It helps you understand your clients' needs, set clear goals, and deliver exceptional service.

In this post, we'll show you how to create an effective client engagement plan that will boost client satisfaction and drive your firm's growth.

A client engagement plan serves as a strategic roadmap for accounting firms. It outlines how a firm will interact with, serve, and retain clients. This plan isn't just a nice-to-have; it's essential for any firm that aims to grow and improve client satisfaction.

An effective client engagement plan includes several critical elements:

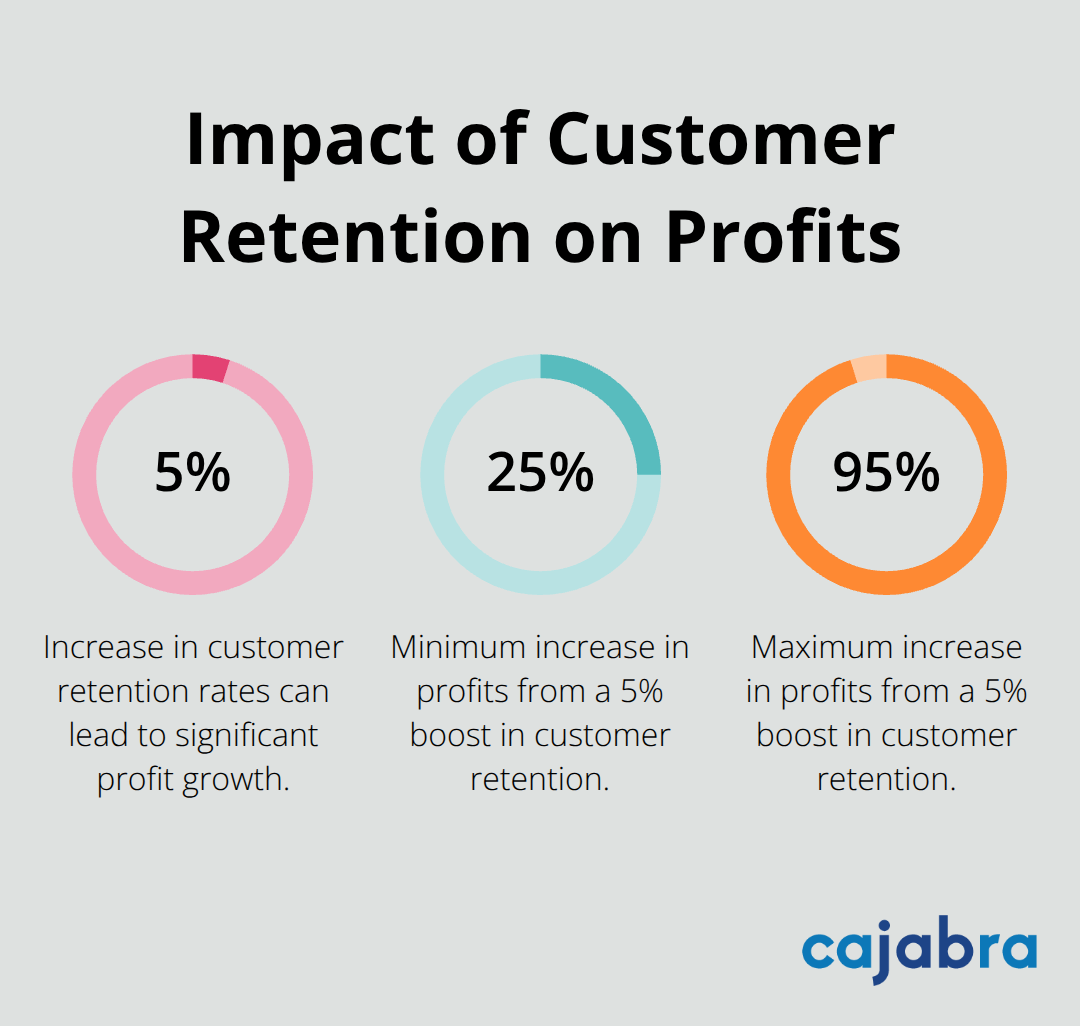

A well-executed client engagement plan offers tangible benefits for both accounting firms and their clients:

For Firms:

For Clients:

A PwC survey revealed that 73% of customers point to experience as an important factor in their purchasing decisions, behind price and product quality. This underscores the importance of a solid engagement plan in attracting and retaining clients.

The most effective client engagement plan is one that aligns with your firm's unique strengths and your clients' specific needs. It's not a one-size-fits-all solution, but a dynamic tool that evolves as your firm grows and your clients' needs change.

Some firms (like Cajabra) incorporate these principles into their service offerings. For example, Cajabra's JAB System™ helps firms focus on retainer-based clients and leverage tools like their Client Optimizer to create engagement plans that drive real results.

As we move forward, let's explore how to develop a comprehensive client engagement strategy that will set your firm apart and drive long-term success.

The foundation of any effective engagement strategy is a thorough understanding of your clients. This goes beyond basic demographics. You need to know their business challenges, growth aspirations, and even personal goals.

One effective method is to conduct annual client surveys. These should include questions about their satisfaction with your services, areas where they need more support, and their business objectives for the coming year. Analyze this data to identify trends and common needs across your client base.

Another powerful tool is client segmentation. Let's explore four alternative segmentation methods that will elevate your advisory services, optimize your operations, and deliver greater value to clients.

Once you understand your clients, it's time to set clear, measurable goals for your engagement strategy. These should align with both your clients' needs and your firm's objectives.

For example, if you've identified that many of your clients struggle with cash flow management, a goal might be to increase the number of clients using your cash flow advisory services by 30% over the next six months.

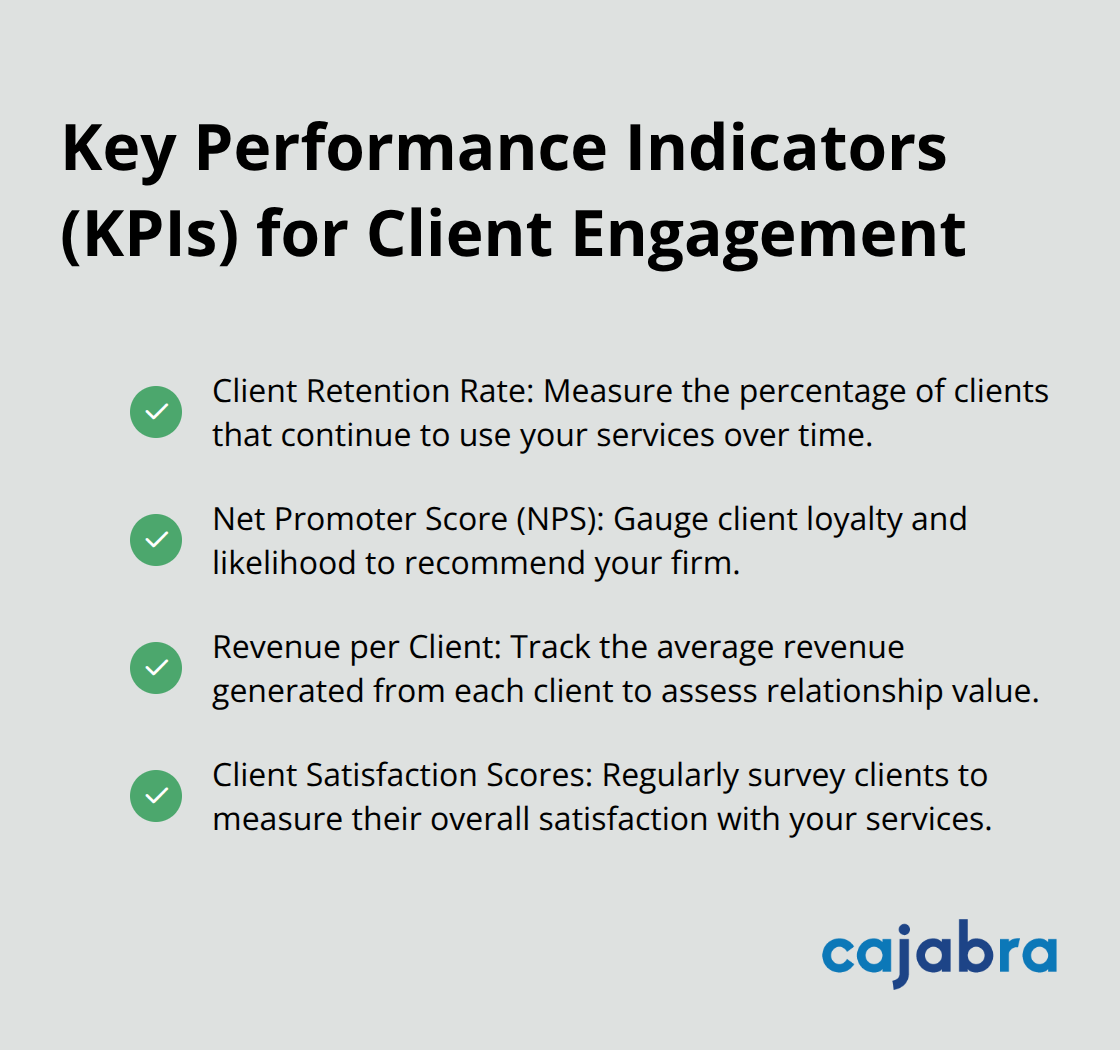

Or, if client retention is a priority, you might set a goal to improve your Net Promoter Score (NPS). According to aggregated data, the average Net Promoter Scores for B2B industries range from 37 to 69, while for B2C, from 16 to 80.

Effective client engagement relies on consistent, valuable communication. Develop a plan that outlines how often you'll communicate with clients and through which channels.

Consider implementing a mix of:

Try to tailor your communication frequency and content to different client segments. High-value clients might appreciate more frequent, personalized touchpoints, while smaller clients might prefer less frequent, more general updates.

Leverage technology to streamline your engagement efforts and provide a better client experience. A robust Customer Relationship Management (CRM) system can help you track client interactions, set reminders for follow-ups, and personalize your communications.

Client portals are another valuable tool. They provide a secure platform for document sharing and collaboration, enhancing transparency and efficiency in your client relationships.

Some firms dramatically improve their client engagement by implementing tools that help capture ideal clients and enhance online reputation (which are crucial elements of a strong engagement strategy).

The next step in creating an effective client engagement plan involves implementing and monitoring your strategy. This ensures that your plan doesn't just remain a document, but becomes an active part of your firm's operations.

A successful client engagement plan requires clear role assignments within your firm. Designate a client engagement champion to oversee the plan's implementation and keep everyone on track. This individual should possess a deep understanding of your clients and your firm's capabilities.

Distribute specific roles to team members:

Ensure each team member understands their role in the engagement process. Schedule regular team meetings to reinforce these responsibilities and address any challenges.

Technology plays a pivotal role in client engagement. Here's how to harness tech for better engagement:

The goal is to use technology to enhance (not replace) personal interactions. The right balance of tech and human touch can significantly boost client engagement.

To ensure your engagement plan's effectiveness, track key metrics consistently. Some important KPIs to monitor include:

Use these metrics to identify areas for improvement. If certain strategies don't yield results, pivot. The most successful firms continuously refine their approach based on data and feedback.

Create an environment where team members feel empowered to suggest improvements to the engagement plan. Encourage open communication and regular brainstorming sessions to identify new ways to enhance client relationships.

Implement a system for collecting and acting on client feedback. This could include regular surveys, post-service follow-ups, or informal check-ins. Use this feedback to refine your engagement strategies and address any pain points in the client experience.

An effective client engagement plan transforms accounting firms. It builds strong client relationships, increases retention, and drives revenue growth. Firms must understand client needs, set clear goals, and implement comprehensive strategies to enhance service delivery and satisfaction.

We at Cajabra developed the JAB System™ to help accountants secure retainer-based clients and maximize marketing efforts. Our approach includes tools like the Client Optimizer, which can enhance client engagement strategies and online reputation.

Start implementing your client engagement plan today. You will see results in stronger client relationships, increased revenue, and a more robust accounting practice. Take the first step now and watch your firm transform from overlooked to overbooked.