Selling your accounting practice represents one of the most significant financial decisions you'll make as a business owner. The difference between a mediocre sale and maximum value often comes down to strategic preparation and timing.

We at Cajabra, LLC have seen practice owners leave substantial money on the table by rushing the process. Smart preparation can increase your sale price by 30-50% compared to unprepared sellers.

Your financial documentation determines whether serious buyers engage or walk away within the first week. Clean books require three years of audited financial statements, complete tax returns, and monthly profit-and-loss statements with zero discrepancies. Practices with messy financials sell for 20-30% less than those with pristine records according to industry brokers.

Your accounts receivable report must show collection patterns, and any outstanding debts need clear documentation. Buyers specifically examine consistent cash flow trends, so prepare monthly cash flow statements that demonstrate stability. Missing documentation signals operational problems and reduces buyer confidence immediately.

Document every client relationship with signed engagement letters and service agreements. Practices with formal contracts for 80% or more of their revenue command higher multiples because buyers see predictable income streams. Analyze your client retention rates over the past five years - rates above 95% significantly increase valuations.

Create a detailed client analysis that shows revenue per client, service mix, and contract renewal dates. Long-term clients who pay monthly retainers are worth more than seasonal tax clients, so highlight your recurring revenue percentage. Map out which clients generate the highest margins and document any client concentration risks where single clients represent more than 10% of total revenue.

Buyers want operations that run without the owner's constant involvement. Document every process from client onboarding to tax preparation workflows with step-by-step procedures that any qualified staff member can follow. Your technology stack needs complete documentation that includes software licenses, user accounts, and integration points between systems.

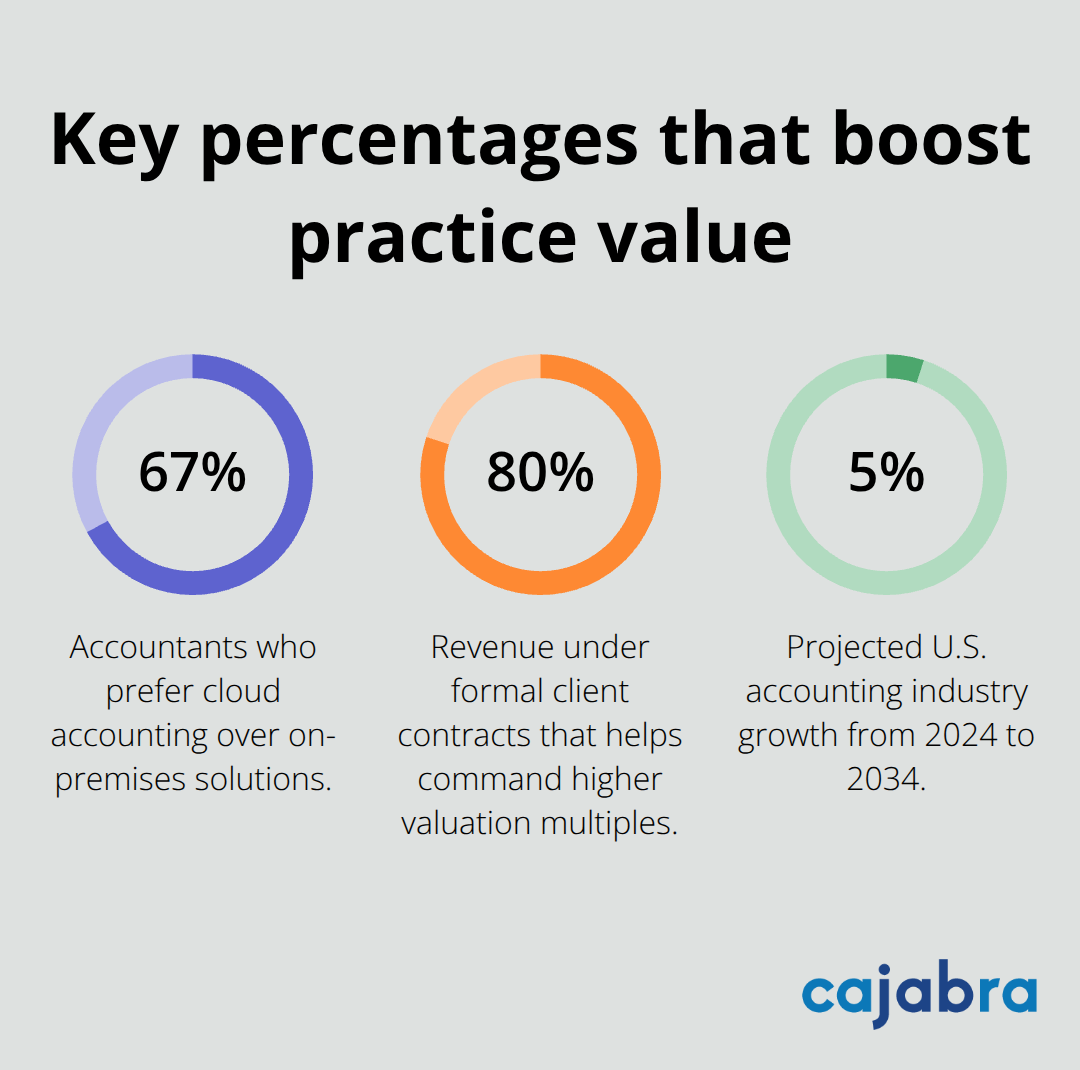

Cloud-based practices offer operational advantages that buyers value, as 67% of accountants prefer cloud accounting to traditional on-premises solutions. Create an organizational chart that shows staff responsibilities and cross-training capabilities (this reduces transition risk for buyers). Strong operational systems reduce buyer risk and justify premium prices because the practice can maintain quality service during ownership transition.

The next step involves understanding exactly how buyers calculate what your practice is worth through different valuation methods.

Your practice's true value depends on concrete calculations, not industry rumors or wishful thinking. Three primary valuation methods determine what buyers will pay, and each reveals different aspects of your practice's worth. Revenue multiples vary dramatically based on practice characteristics and market conditions, with small accounting firms typically selling for 0.8x to 1.2x annual revenue while larger practices command 1.8x to 2.5x according to industry transaction data. However, cash flow multiples provide more accurate valuations since they reflect actual earning power rather than gross numbers. Most service businesses (including accounting practices) sell for 1.5 to 2 times cash flow to owner, which makes this metric more reliable than simple revenue calculations.

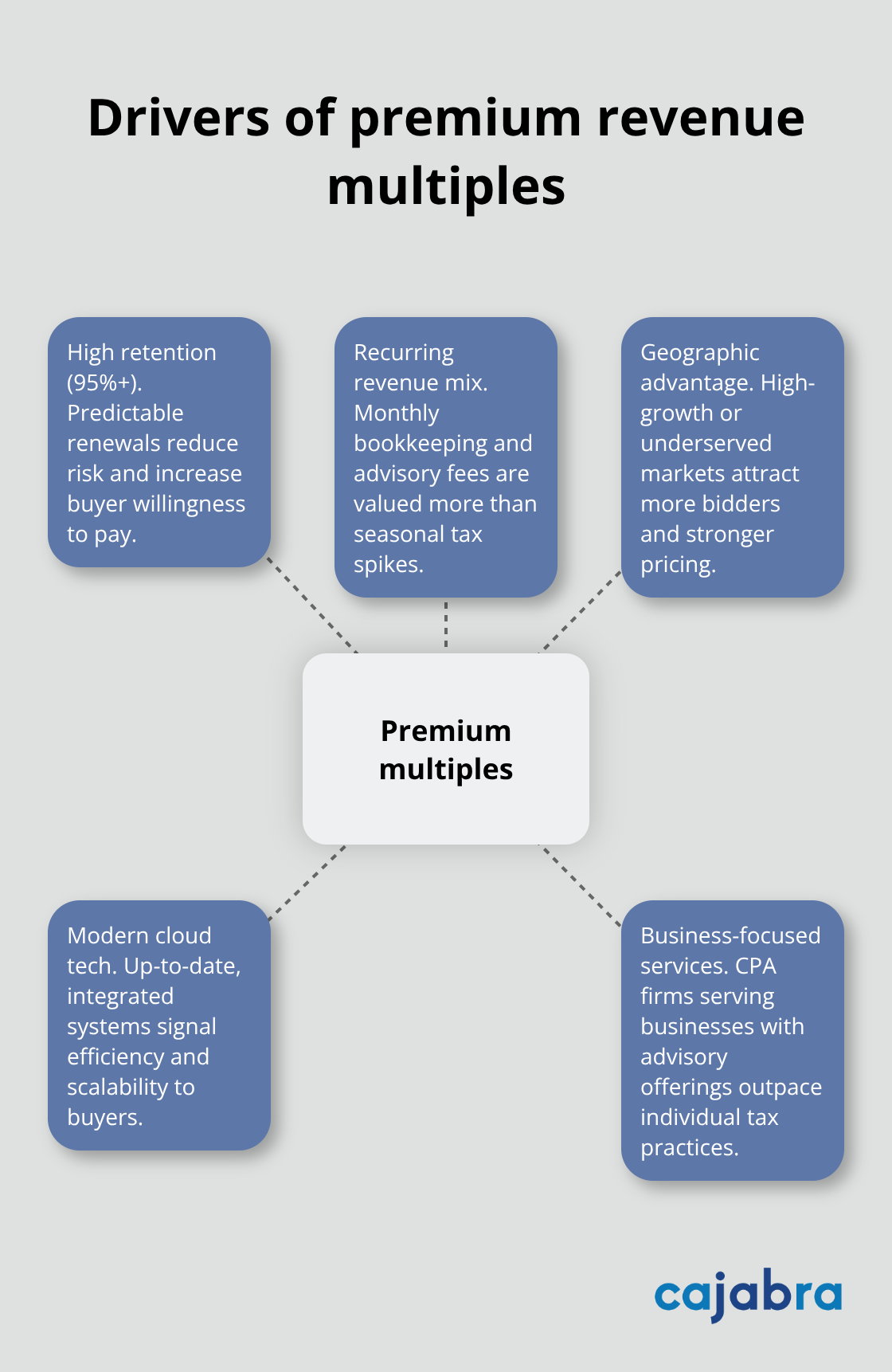

Revenue multiples vary dramatically based on practice characteristics and market conditions. Practices with 95% or higher client retention rates command premium multiples because buyers value predictable income streams. Recurring revenue from monthly bookkeeping and advisory services justifies higher multiples than seasonal tax preparation work, with business-focused CPA firms receiving significantly better valuations than individual tax practices.

Geographic location affects multiples too - practices in high-growth markets or underserved areas attract more buyers and higher prices. Technology adoption plays a major role, as cloud-based practices with modern systems appeal to more buyers than firms that use outdated software.

Asset-based valuations focus on tangible and intangible assets but typically undervalue service businesses like accounting practices. This method works better for firms with significant equipment, real estate, or proprietary software but misses the value of client relationships and recurring revenue streams. The approach calculates book value plus goodwill adjustments, yet it fails to capture the true earning potential that drives buyer decisions in service-based acquisitions.

Market comparison analysis examines recent sales of similar practices in your geographic area and service niche, which provides realistic price benchmarks. Most buyers and business brokers use earnings-based valuation models for accounting firms, primarily focusing on Seller's Discretionary Earnings, demonstrating the importance of proper market positioning and buyer competition. This method requires access to comparable transaction data and adjustments for differences in client mix, technology systems, and operational efficiency.

Once you understand these valuation methods, you can implement specific strategies that maximize each component of your practice's worth. Growing an accounting practice requires strategic planning and execution to enhance client retention and streamline operations that directly impact your firm's valuation.

Recurring revenue transforms accounting practices from seasonal businesses into predictable income machines that buyers pay premium prices for. Monthly bookkeeping contracts, advisory retainers, and payroll services create stable cash flows that justify higher valuation multiples. Convert tax clients into year-round relationships through monthly financial reviews, cash flow forecasts, and business advisory services.

The accounting industry is projected to grow 5% from 2024 to 2034, which creates opportunities for advisory expansion that increases practice value immediately.

Advisory services generate the highest margins and most stable revenue streams in modern accounting practices. Business owners pay $500-2,000 monthly for strategic guidance, financial planning, and performance analysis that goes beyond basic compliance work. Target clients with annual revenues between $500,000-5 million who need regular financial oversight but cannot afford full-time CFOs. Package your expertise into monthly retainer agreements that include financial statement analysis, budget variance reports, and quarterly business reviews. Client retention rates above 95% become achievable when you provide value rather than seasonal services, and high retention directly correlates with premium sale prices.

Buyers pay more for practices that operate independently of the owner because transition risk decreases significantly. Document every client interaction, standardize service delivery processes, and cross-train staff members to handle multiple responsibilities. Cloud-based workflow management systems allow practices to serve clients efficiently while they reduce owner dependency that threatens valuations. Staff productivity increases by 25-40% when proper systems eliminate repetitive tasks and streamline communication. Strong operational efficiency justifies higher multiples because buyers see sustainable businesses rather than owner-dependent practices that require constant involvement to maintain service quality and client satisfaction.

Strategic preparation takes 6-12 months before you sell accounting practice assets for maximum value. Clean financial records, documented client contracts, and detailed process manuals increase sale prices by 30-50% compared to rushed transactions. Professional business brokers improve outcomes by 15-25% through accurate valuations and qualified buyer networks.

Convert seasonal clients into monthly retainer relationships during preparation. Advisory services and recurring revenue streams command premium multiples that buyers pay willingly. Document operational processes to reduce transition risk and prove your practice operates without constant owner involvement.

Peak buyer activity occurs between September and January (making this the optimal window for practice sales). Cash transactions protect sellers better than earnout structures that shift financial risk. We at Cajabra help accounting firms build the recurring revenue streams that maximize practice valuations through our JAB System™.