Mental accounting in marketing is a powerful concept that shapes consumer behavior and decision-making. At Cajabra, LLC, we've seen firsthand how understanding this psychological principle can revolutionize marketing strategies.

In this post, we'll explore the fundamentals of mental accounting and its practical applications in marketing. We'll also provide actionable insights for accountants and financial advisors to leverage this concept in their client services.

Mental accounting is a cognitive bias that influences how people categorize, evaluate, and spend their money. This concept, introduced by economist Richard Thaler, explains why consumers often make irrational financial decisions.

Mental accounting significantly affects consumer decision-making. A study by Prelec and Simester in 2001 found that people tend to spend more when using credit cards compared to cash. This occurs because credit card spending feels less "real" and is mentally categorized differently from cash transactions.

Understanding mental accounting can help businesses tailor their marketing strategies more effectively. For instance, framing a product as a "once-in-a-lifetime opportunity" can trigger consumers to use their "splurge" account, even if the purchase isn't strictly necessary.

One key principle of mental accounting is the tendency to treat money differently based on its source. A survey by the National Endowment for Financial Education found that 70% of lottery winners go bankrupt within a few years. This happens partly because windfall gains are often mentally categorized as "free money" and spent more frivolously than earned income.

Another principle is the sunk cost fallacy. Kahneman and Tversky's 1984 study showed that people are more likely to continue investing in a failing project if they've already invested significant resources. This explains why consumers might keep paying for unused gym memberships or continue watching a bad movie just because they paid for the ticket.

Marketers can leverage mental accounting principles to influence consumer behavior. For example, offering a gift card instead of a cash discount can increase sales. A study by White in 2008 found that consumers treat gift cards as separate from their main finances, leading to higher spending.

Additionally, price anchoring can be a powerful tool. By presenting a higher-priced option first, marketers can make subsequent options seem more reasonable (even if they're still premium-priced).

Understanding mental accounting isn't just about exploiting consumer biases. It's about creating marketing strategies that align with how people naturally think about money. This approach can lead to more effective campaigns and higher customer satisfaction.

As we move forward, we'll explore specific mental accounting strategies that marketers can employ to enhance their campaigns and drive consumer engagement.

Mental accounting principles offer powerful tools for marketers to influence consumer behavior that vary over populations and contexts. We've identified several strategies that effectively tap into these psychological tendencies, driving sales and enhancing customer engagement.

Price framing is a potent technique that can significantly impact purchasing decisions. A study by Gupta and Kim in 2009 found that consumers' willingness to pay higher prices for products depends heavily on contextual factors, such as location and framing.

For example, presenting a product as "$1 per day" instead of "$365 per year" can make it seem more affordable, even though the total cost remains the same. This approach aligns with how consumers mentally categorize small, daily expenses versus large, annual costs.

Bundling products is another effective strategy. Combining related items reduces the cognitive load on consumers, making the decision process easier. This tactic works particularly well when pairing a popular item with a less desirable one, as it can increase overall sales.

Decoy pricing involves introducing a third option to influence consumers' perception of value. This strategy can shift preferences between two existing options.

For instance, a software company might offer:

The decoy plan makes the Premium option appear more attractive, potentially increasing its sales. This technique leverages consumers' tendency to make comparative assessments rather than absolute value judgments.

Loss aversion is a central assumption where losses and disadvantages have greater impact on preferences than gains and advantages. Marketers can use limited-time offers or exclusive deals to create a sense of urgency and potential loss. For example, "Only 3 seats left at this price!" can drive quicker purchasing decisions.

Another effective tactic is to offer free trials. Once consumers have experienced a product or service, the prospect of losing access can be a strong motivator to purchase.

Anchoring is a cognitive bias where people rely heavily on the first piece of information offered when making decisions. In pricing, this can be used to influence perceived value.

A common application is displaying the original price alongside a discounted price. Even if the discounted price is still high, it appears more attractive in comparison to the anchor.

High-end restaurants often use this principle by including a very expensive wine on their menu. This makes other premium wines seem more reasonably priced in comparison.

Understanding and applying these mental accounting strategies allows marketers to create more compelling offers and drive consumer behavior. However, it's important to use these techniques ethically, ensuring that they provide genuine value to customers while benefiting the business.

Now that we've explored how to leverage mental accounting in marketing, let's examine how accountants and financial advisors can apply these principles to enhance their client services and improve financial decision-making processes.

Accountants and financial advisors can leverage mental accounting principles to improve client services and financial outcomes. Understanding how clients categorize and perceive money allows advisors to develop more effective strategies for budgeting, investment, retirement planning, and tax management.

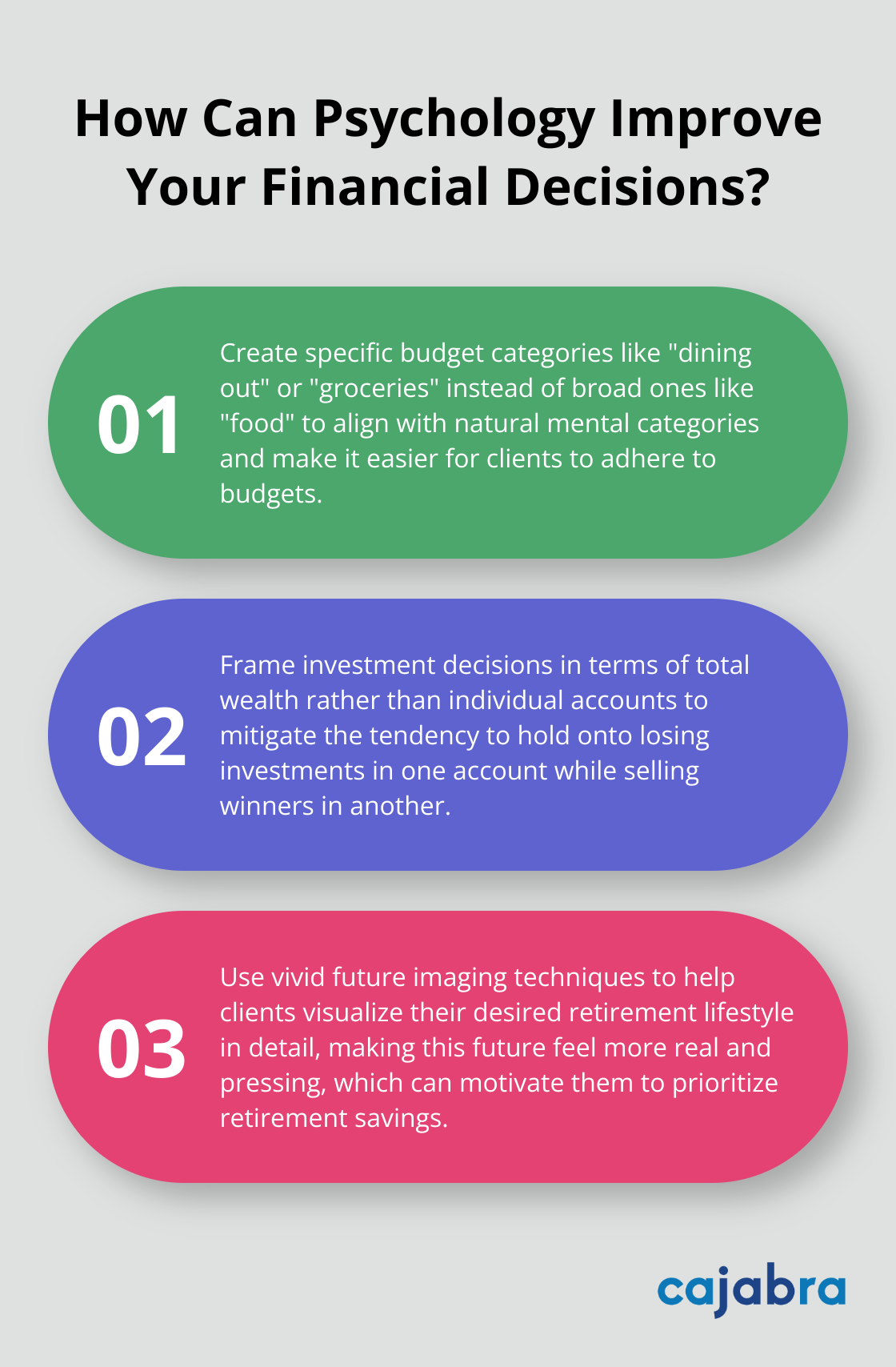

Mental accounting offers practical applications in budgeting. Advisors should help clients create more effective budgets by aligning them with natural mental categories. Instead of traditional budgets with broad categories like "entertainment" or "food," advisors might suggest more specific allocations like "dining out" or "groceries." This approach aligns with how people naturally think about their spending, making it easier to adhere to budgets.

A study by Zhang and Sussman in 2018 found that consumers often allocate funds based on the source of the money rather than on rational economic principles. Advisors can use this insight to help clients earmark specific income sources for particular expenses or savings goals. For instance, advisors might suggest that a client use their annual bonus exclusively for retirement savings to prevent that money from being mentally categorized as "fun money" and spent frivolously.

Mental accounting significantly impacts investment behavior. Many investors create separate mental accounts for different investment goals, often leading to suboptimal portfolio allocation. Financial advisors should address this by helping clients view their entire investment portfolio holistically.

One effective strategy frames investment decisions in terms of total wealth rather than individual accounts. This approach can mitigate the tendency to hold onto losing investments in one account while selling winners in another (a behavior often driven by mental accounting biases).

Advisors should also be aware of the "house money effect," where investors take on more risk with profits than they would with their initial investment. Educating clients about this bias can encourage more consistent risk management across all investment decisions.

Mental accounting plays a crucial role in retirement planning. Many people struggle to save adequately for retirement because it feels like a distant, abstract goal. Financial advisors can combat this by making retirement more concrete and immediate in clients' minds.

One effective technique uses vivid future imaging. Helping clients visualize their desired retirement lifestyle in detail can make this future feel more real and pressing. This can motivate clients to prioritize retirement savings in their mental accounting.

Another strategy leverages the power of default options. Studies have shown that people are more likely to stick with pre-set choices. Advisors can use this tendency to encourage higher retirement contributions by suggesting opt-out rather than opt-in policies for retirement plans.

Mental accounting insights can also inform withdrawal strategies in retirement. For instance, advisors might recommend separating retirement income into different "buckets" for essential expenses, discretionary spending, and long-term care. This approach aligns with how retirees naturally think about their needs and can lead to more satisfying retirement experiences.

Mental accounting in marketing provides powerful tools for understanding and influencing consumer behavior. Marketers can craft more effective strategies by recognizing how individuals categorize and value money differently. Accounting professionals can also apply these principles to improve their clients' financial decision-making processes, from budgeting to retirement planning.

The future of marketing and financial advisory services will likely involve more sophisticated applications of mental accounting principles. Advancements in data analytics and artificial intelligence will enable increasingly personalized and effective strategies for engaging consumers and guiding financial decisions. This evolution will create new opportunities for businesses to enhance their marketing efforts and provide more tailored financial solutions.

Cajabra applies these behavioral insights to help accounting firms thrive in a competitive marketplace. Our specialized marketing services (including the JAB System™) leverage the latest in behavioral economics and marketing psychology. We aim to move accountants from overlooked to overbooked, combining cutting-edge strategies with a deep understanding of mental accounting principles.