Most accounting firms struggle to stand out in an increasingly competitive market where services appear identical to potential clients.

Effective branding for accounting firms transforms how prospects perceive your expertise and value. We at Cajabra, LLC have seen firms increase their average client fees by 40% through strategic brand positioning.

This guide reveals the specific branding strategies that separate thriving practices from struggling ones.

The accounting industry generates over $180 billion annually in the United States alone, yet most firms compete solely on price because clients perceive their services as identical commodities. This race to the bottom destroys profit margins and forces firms into unsustainable business models. High-growth accounting firms invest significantly more in marketing compared to average performers, creating substantial competitive advantages.

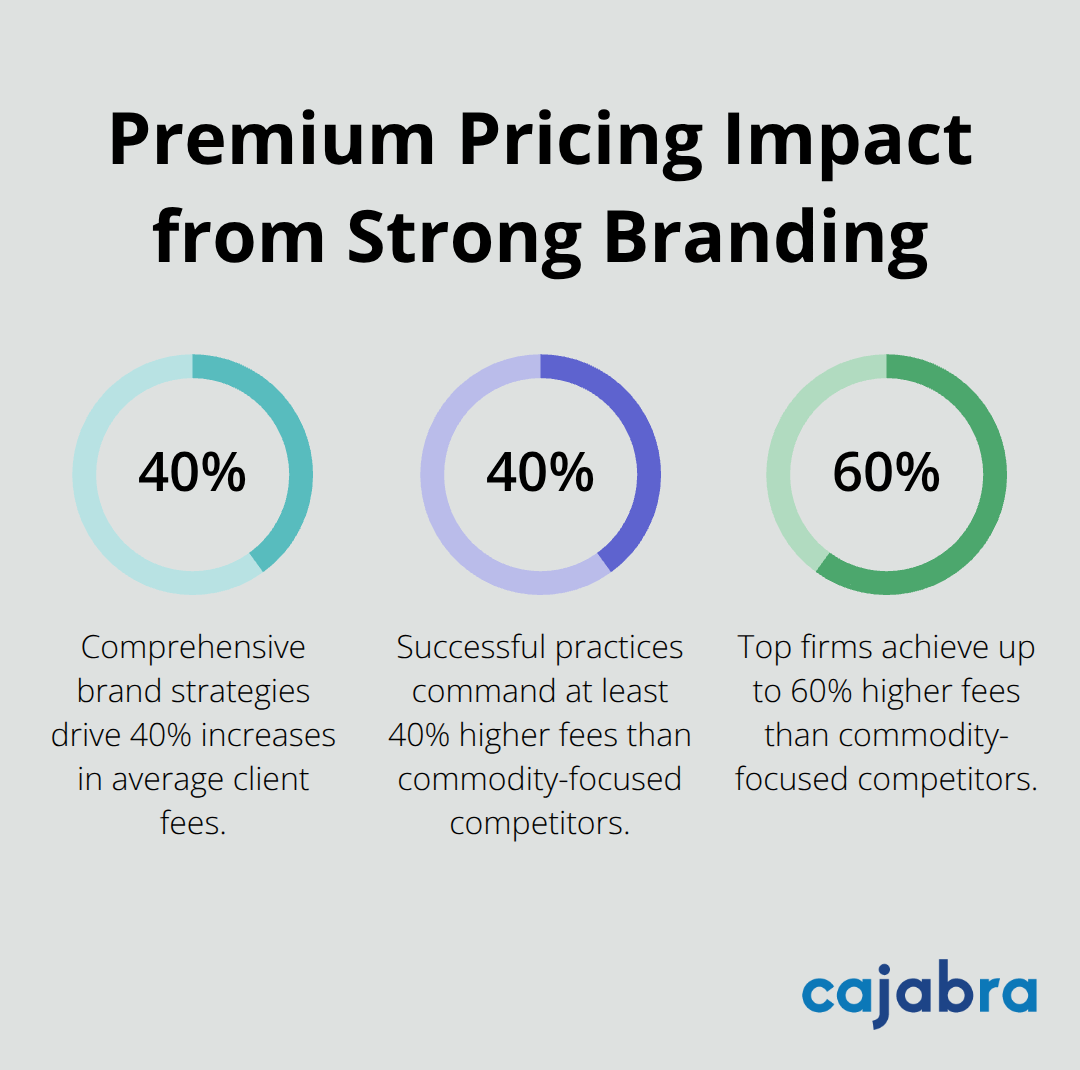

Strategic brand positioning enables firms to charge premium rates through expertise rather than price competition. Mid-size accounting firms report significant increases in client referrals after brand alignment workshops, while repositioning from compliance-focused to strategic advisory services doubles average engagement sizes. Firms with compelling brand identities win more RFPs and attract higher-value clients who seek emotional connections beyond basic competencies. The most successful practices command 40-60% higher fees than commodity-focused competitors because clients perceive greater value in their specialized approach.

Professional brand identity establishes immediate credibility with affluent individuals and high-growth businesses who increasingly demand sophisticated advisory relationships. Consistent visual identity, clear messaging, and authentic positioning build trust faster than credentials alone. Clients make decisions within seconds of viewing firm materials, making first impressions through brand presentation absolutely critical for client acquisition. Authenticity matters more than polish - firms that mimic larger competitors dilute trust and fail to resonate with their target market.

Strong brand positioning transforms one-time transactions into recurring retainer relationships through strategic partner positioning rather than seasonal service provision. This shift creates predictable revenue streams and reduces client acquisition costs over time while establishing sustainable growth patterns. As the public accounting profession evolves, firms must update their brand and marketing message to differentiate themselves and attract ideal clients. Marketing compliance and regular brand audits maintain transparency while ongoing training helps teams embody brand messages consistently across all client interactions.

The foundation of effective brand positioning starts with the essential visual and messaging elements that communicate your firm's unique value proposition to potential clients.

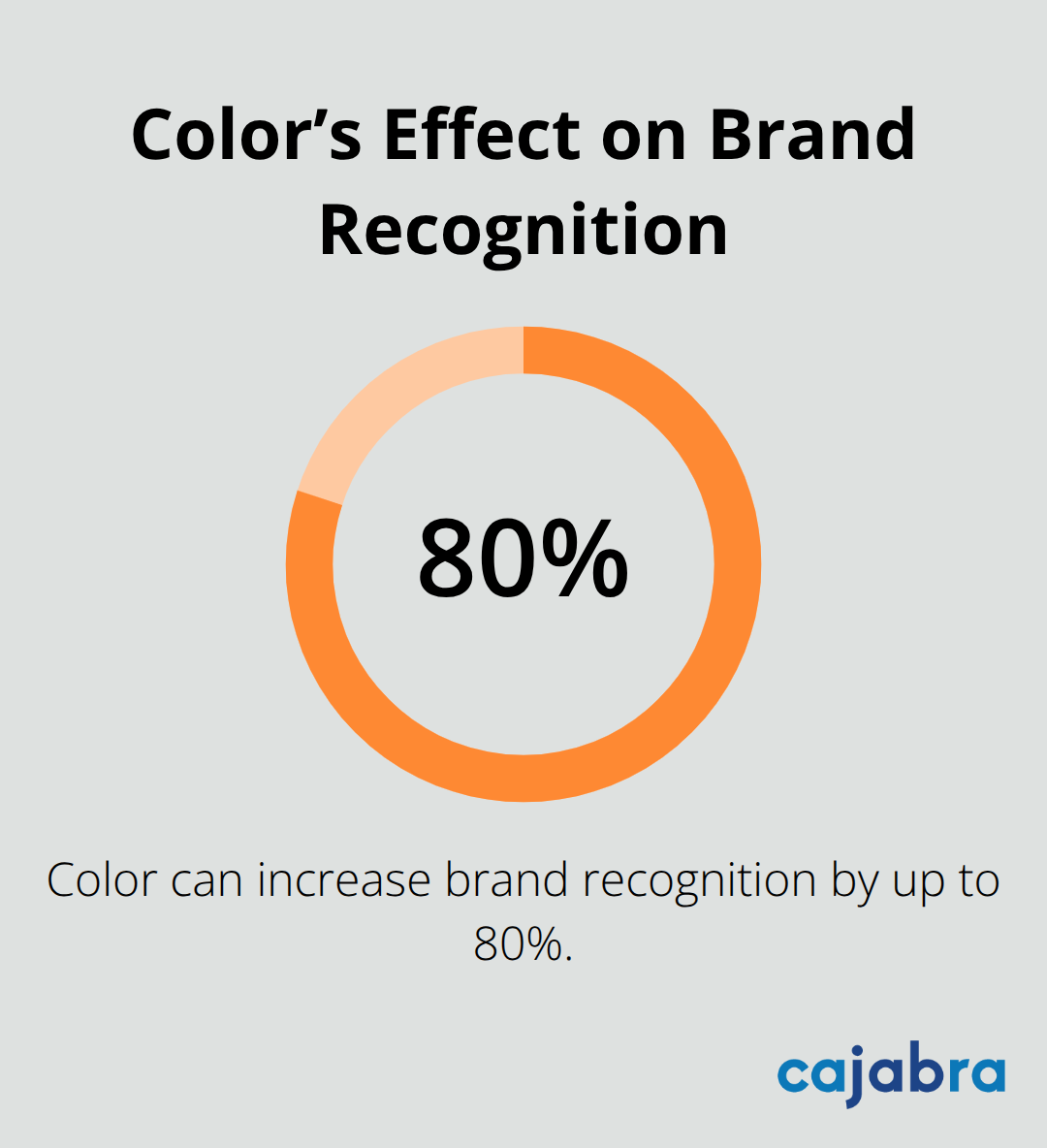

Professional visual identity serves as the foundation for client perception, with research showing that first impressions significantly affect the effectiveness of initial client encounters. Color psychology plays a vital role in financial services branding, with research indicating that color can increase brand recognition by up to 80%. Modern accounting firms that implement minimalist logo designs with hidden symbols reflecting their values see higher engagement rates than traditional approaches. Typography choices matter significantly - clean, professional fonts increase perceived credibility compared to outdated serif styles that suggest inflexibility.

Strategic logo development requires careful consideration of industry expectations while maintaining distinctive elements that separate your firm from competitors. Minimalist design trends simplify communication and make logos more memorable across digital platforms and print materials. Hidden meanings or symbols in logos create deeper connections with clientele, reflecting their values and vision through subtle visual cues. Custom logo designs convey professionalism (a factor clients prioritize when choosing financial services), while consistent application across all materials builds brand recognition and customer loyalty.

Value proposition development requires specific positioning around pain points your firm solves rather than generic service listings. Firms position themselves as strategic partners rather than compliance providers and achieve higher conversion rates from initial consultations. Your messaging strategy should target specific audiences like medical professionals or tech entrepreneurs who value specialized expertise over generalist approaches. Thought leadership content that addresses industry-specific challenges generates more qualified leads than broad financial advice. The most successful firms develop unique brand voices that appeal to younger clientele while maintaining professional credibility through consistent communication frameworks.

Brand voice implementation requires detailed guidelines that specify tone, vocabulary, and messaging hierarchy for every client interaction. Staff training programs that emphasize brand embodiment result in higher client satisfaction scores according to recent industry studies. Digital presence optimization through cohesive visual elements, messaging consistency, and strategic content distribution creates seamless client experiences that reinforce brand positioning. CRM systems should track brand message adherence across all communications to maintain professional standards while personalizing client relationships through authentic engagement strategies (particularly important for retainer-based service models).

These foundational brand elements must translate into practical implementation strategies that maximize your firm's digital presence and client acquisition potential.

Modern accounting firms require sophisticated digital infrastructure that converts visitors into high-value clients through strategic website optimization. Your website must load within three seconds or you lose 40% of potential clients according to Google's research. Mobile-responsive design generates more leads than desktop-only sites, while client testimonials and case studies boost conversion rates when you display them prominently. Search engine optimization that focuses on industry-specific keywords like forensic accounting or estate planning drives more qualified traffic than generic terms.

Professional photography and clean layouts increase perceived firm value. Chatbots and contact forms that you place strategically throughout site pages capture leads that would otherwise leave without contact. Site architecture must prioritize service pages that address specific client pain points rather than generic service descriptions that blend into competitor messages.

Analytics systems track which content generates the highest-value prospects and enable data-driven optimization of your marketing spend. Landing pages optimized for Google Ads and LinkedIn campaigns should feature clear value propositions and single call-to-action buttons that eliminate decision paralysis.

Thought leadership content that addresses industry-specific challenges generates more qualified leads than broad financial advice according to recent marketing studies. Weekly blog posts that target niche audiences like medical professionals or technology entrepreneurs establish expertise while they improve search rankings for specialized terms.

Webinars and educational events showcase competency while they generate contact information from engaged prospects who attend sessions. Email campaigns that nurture prospects through educational content achieve higher open rates than promotional messages (automated follow-up sequences convert more leads into initial consultations).

Service delivery must align with brand position through consistent communication protocols, regular client check-ins, and proactive advisory recommendations. These practices reinforce strategic partner relationships rather than transactional interactions that commoditize your services.

Client onboarding processes should reflect your brand values through professional documentation, clear communication timelines, and systematic follow-up procedures. Regular client satisfaction surveys help you identify gaps between brand promise and actual service delivery (this feedback loop strengthens both client retention and referral generation).

Strategic branding for accounting firms transforms commodity services into premium advisory relationships that command higher fees and generate predictable revenue streams. Firms that implement comprehensive brand strategies report 40% increases in average client fees while they build sustainable competitive advantages through differentiated market positions. The most successful practices combine professional visual identity with clear value propositions that address specific client pain points rather than generic service offerings.

Consistent brand voice across all communications reinforces strategic partner relationships while thought leadership content establishes expertise that attracts high-value prospects. Digital presence optimization through modern websites, targeted content marketing, and systematic client experience alignment creates seamless brand interactions that convert visitors into retainer-based clients. These integrated approaches generate measurable results through improved client acquisition rates and enhanced revenue growth patterns.

Implementation requires systematic execution across visual identity development, messaging strategy refinement, and digital infrastructure optimization (each element must work together to create cohesive brand experiences). We at Cajabra, LLC help accounting firms move from overlooked to overbooked through strategic brand development that secures retainer-based clients within 90 days. Your brand investment directly impacts long-term profitability through premium pricing power and reduced client acquisition costs that create sustainable growth trajectories for forward-thinking accounting practices.