Most accounting firms struggle to attract new clients because they lack a structured approach to marketing. Without a clear marketing plan for accounting firm growth, practices often waste money on ineffective tactics.

We at Cajabra, LLC have seen firms transform their client acquisition by following proven marketing frameworks. This guide walks you through building a comprehensive plan that generates consistent leads and grows your practice.

High-growth accounting firms understand the power of targeting specific client segments, with marketing budgets varying significantly across different firm sizes and growth stages. Firms that specialize in niches like startups, nonprofits, or restaurants generate higher profit margins than generalist practices through focused expertise and premium positioning.

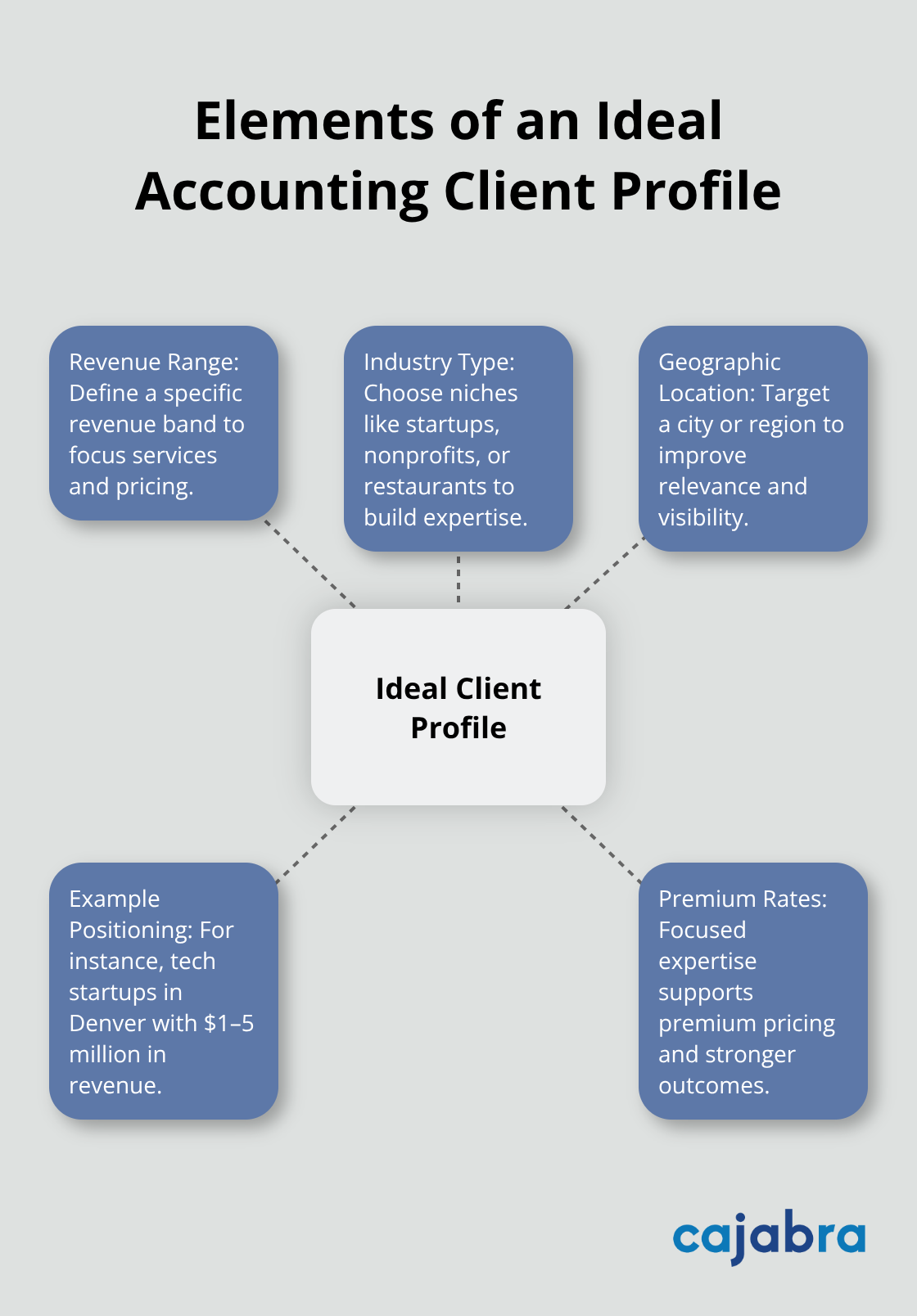

Your ideal client profile should include specific revenue ranges, industry types, and geographic locations. A tax firm in Denver that targets tech startups with $1-5 million revenue will outperform a general practice that tries to serve everyone. This focused approach allows you to develop deep expertise and command premium rates.

Research from the Association for Accounting Marketing provides insights into how accounting firms of all sizes structure their marketing approaches and understand marketplace dynamics. Study your competitors' websites, pricing structures, and service offerings to identify gaps in the market.

If three firms in your area focus on individual tax returns but none specializes in small business advisory services, that represents a significant opportunity. Document which firms charge premium rates and examine why their positioning allows higher pricing (often through specialized expertise or proven results).

Your value proposition must address specific client pain points rather than generic accounting services. Firms that position themselves as industry experts command higher fees than generalists through specialized knowledge and proven track records.

Instead of offering basic bookkeeping, focus on outcomes like helping restaurants reduce food costs or helping contractors improve cash flow timing. This messaging differentiates your practice and attracts clients willing to pay premium rates for specialized expertise.

Structure your services around client outcomes rather than traditional accounting tasks. High-growth firms package their expertise into advisory services that solve business problems. A construction accounting specialist might offer cash flow optimization, project profitability analysis, and equipment financing guidance.

This approach positions you as a strategic partner rather than a commodity service provider. Clients pay more for solutions that directly impact their bottom line (versus standard compliance work that every firm offers).

With your ideal client profile defined and competitive positioning established, you need to examine the local market landscape to identify specific opportunities for growth.

Your website serves as the primary conversion tool for accounting firms, with prospective clients reviewing websites, comparing testimonials and assessing credentials before ever making contact. A professional website must load within three seconds and include specific lead generation elements like consultation booking forms, downloadable tax guides, and client testimonials with measurable results.

High-growth firms invest in responsive designs that work seamlessly across mobile devices, since 60% of initial website visits now occur on smartphones. Your site needs clear navigation, professional photography, and compelling calls-to-action on every page to convert visitors into leads.

Content marketing generates over three times as many leads as outbound marketing and costs 62% less. Create industry-specific blog posts that address client pain points like cash flow management for restaurants or tax planning for contractors.

SEO optimization requires you to target long-tail keywords such as "construction accounting Denver" or "nonprofit tax services Atlanta" rather than generic terms. This focused approach helps you rank higher in search results and attracts qualified prospects who need your specific expertise. Effective content development requires strategic planning to ensure consistent value delivery.

Email campaigns deliver $36 return for every dollar invested, which makes automated sequences essential for lead nurturing. Set up welcome series, tax deadline reminders, and educational newsletters that keep your firm top-of-mind with prospects and existing clients.

LinkedIn generates the highest engagement rates for B2B accounting services, while Facebook advertising works effectively for individual tax clients. Post educational content twice weekly and respond to comments within four hours to build authority and trust with potential clients (consistency matters more than frequency). Client engagement strategies can significantly improve your social media performance.

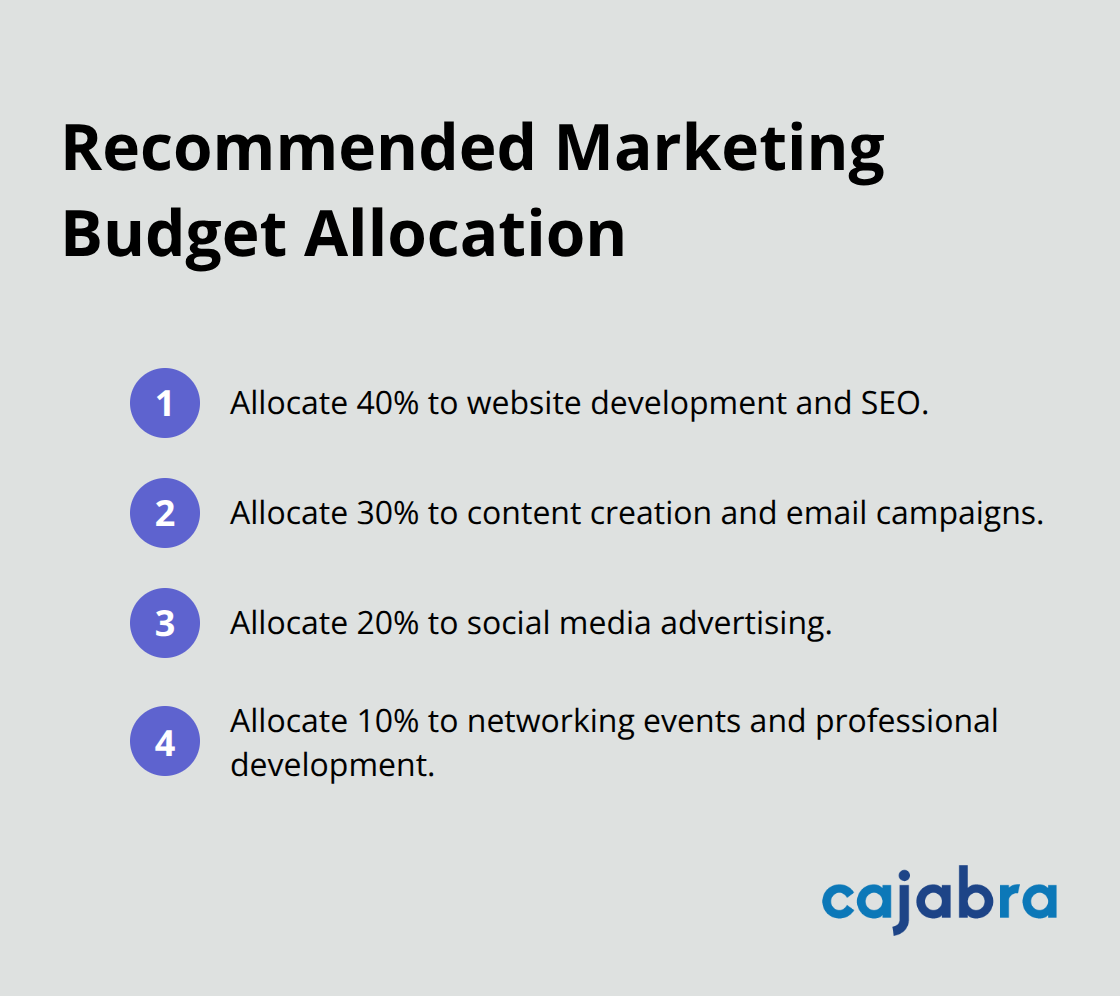

Your digital foundation requires careful budget allocation across these channels to maximize return on investment and support sustainable growth.

High-growth accounting firms allocate 29.6% of their budget to conferences and events compared to slower-growing practices according to Association for Accounting Marketing research. Start with specific targets like acquiring 12 new clients within six months or generating 50 qualified leads monthly through your website. Track cost per acquisition, which should stay below $466.20 for bookkeeping clients and $27.75 for individual tax clients to maintain profitability.

Monitor website conversion rates (try for 3-5% of visitors scheduling consultations), email open rates (target 25% for accounting newsletters), and LinkedIn engagement metrics. These numbers provide clear benchmarks for campaign effectiveness and help you adjust tactics quickly when performance drops below expectations.

Allocate 40% of your marketing budget to website development and SEO, 30% to content creation and email campaigns, 20% to social media advertising, and 10% to networking events and professional development. A firm with $500,000 annual revenue should invest $10,500 yearly in marketing, with $4,200 for website optimization, $3,150 for content marketing, $2,100 for LinkedIn and Facebook ads, and $1,050 for industry events.

Focus spending on channels that generate qualified leads rather than spreading resources thin across every platform. LinkedIn advertising typically costs $6-12 per click for accounting services but converts better than Facebook for business clients, while Google Ads for tax preparation keywords can cost $15-25 per click during peak season.

Plan marketing activities in 90-day cycles that align with accounting seasonal demands. Launch tax planning content in September, year-end advisory campaigns in November, and business formation services in January when entrepreneurs start new ventures. Schedule weekly blog posts, bi-weekly email newsletters, and monthly webinars to maintain consistent prospect engagement throughout the year.

Create monthly action plans that specify exact deliverables like publishing four industry-specific articles, sending eight targeted emails, and posting 16 LinkedIn updates. This structured approach prevents marketing gaps during busy seasons and maintains momentum when client work intensifies. Track progress weekly and adjust tactics based on lead generation results rather than waiting for quarterly reviews (consistency beats perfection in marketing execution).

A successful marketing plan for accounting firm growth requires three fundamental components: clear target market identification, strategic digital foundation development, and disciplined budget allocation with measurable goals. Firms that implement these elements systematically achieve 20% annual growth rates compared to the 11% median for the accounting industry. Consistent execution matters more than perfect strategy.

High-growth firms maintain regular content publication schedules, track performance metrics monthly, and adjust tactics based on actual lead generation data rather than assumptions. This disciplined approach separates thriving practices from those that struggle with client acquisition. Your next step involves choosing one marketing channel and implementing it completely before you expand to additional tactics (start with website optimization and SEO-focused content creation since these generate the highest return on investment for most accounting practices).

We at Cajabra, LLC specialize in helping accounting firms implement proven marketing systems that generate consistent leads. Our JAB System™ helps accountants move from overlooked to overbooked through strategic marketing approaches and automated lead generation systems. This allows you to focus on client service while we handle the marketing complexities that drive sustainable practice growth.