Accounting firms lose 15-20% of their clients annually, costing them thousands in revenue and growth opportunities. Poor communication and lack of proactive service drive most departures.

We at Cajabra, LLC know that implementing effective client retention strategies for accounting firms can reduce turnover by up to 50%. The right approach transforms one-time clients into long-term partnerships.

Poor communication drives client departures more than any other factor, though specific statistics on inadequate contact as the main frustration vary by study. Missed deadlines destroy the trust that firms spend years to build. When accounting firms fail to communicate changes in tax law or business regulations proactively, clients feel abandoned during critical decision periods.

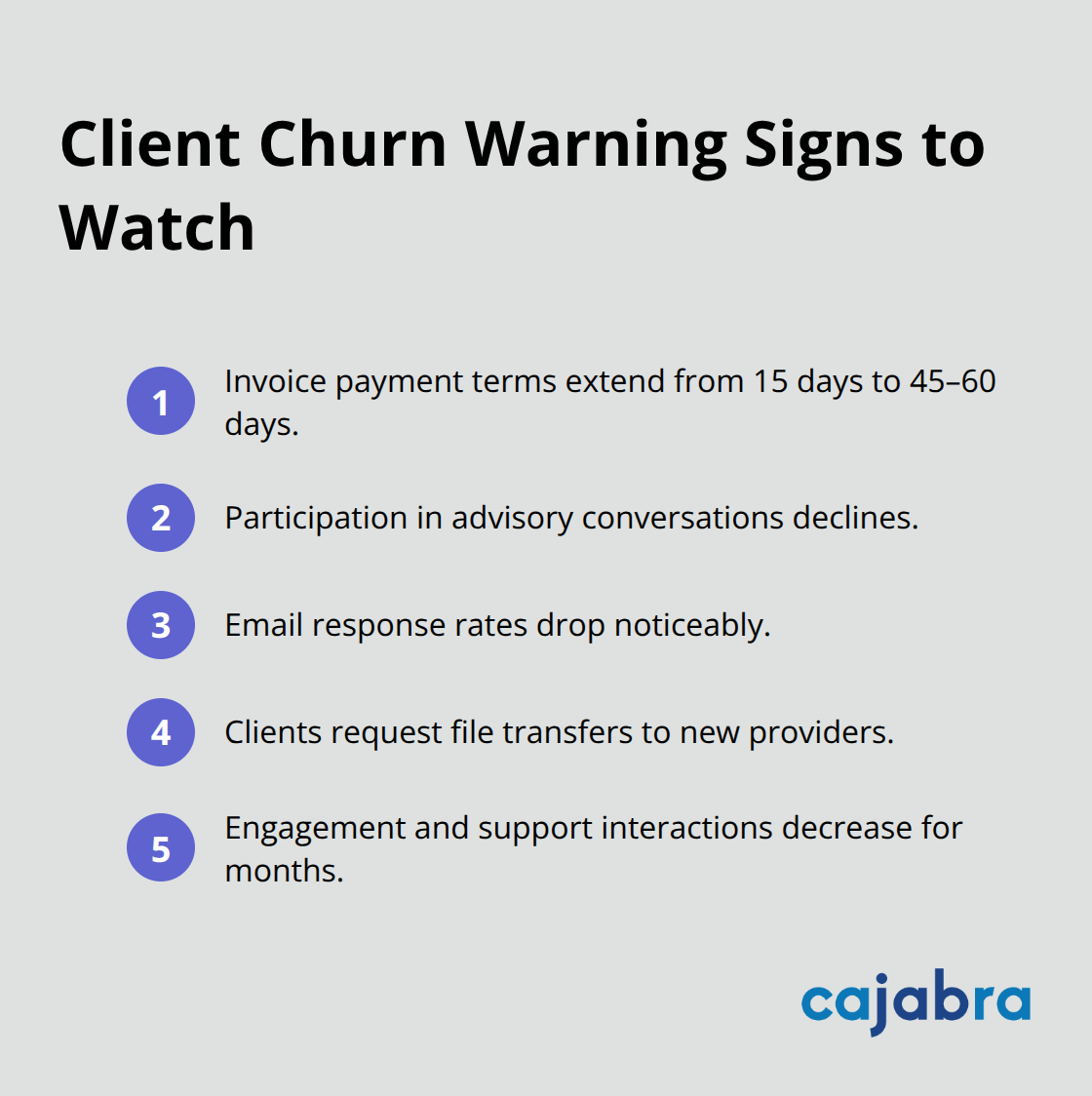

Late payment patterns signal deeper dissatisfaction issues that most accounting firms ignore until clients leave. Clients who previously paid within 15 days but now stretch to 45-60 days actively shop for alternatives. Reduced participation in advisory conversations, declining response rates to emails, and requests for file transfers represent the final stages before departure. Research shows that behavioral changes including decreased engagement and fewer support interactions occur months before clients switch firms.

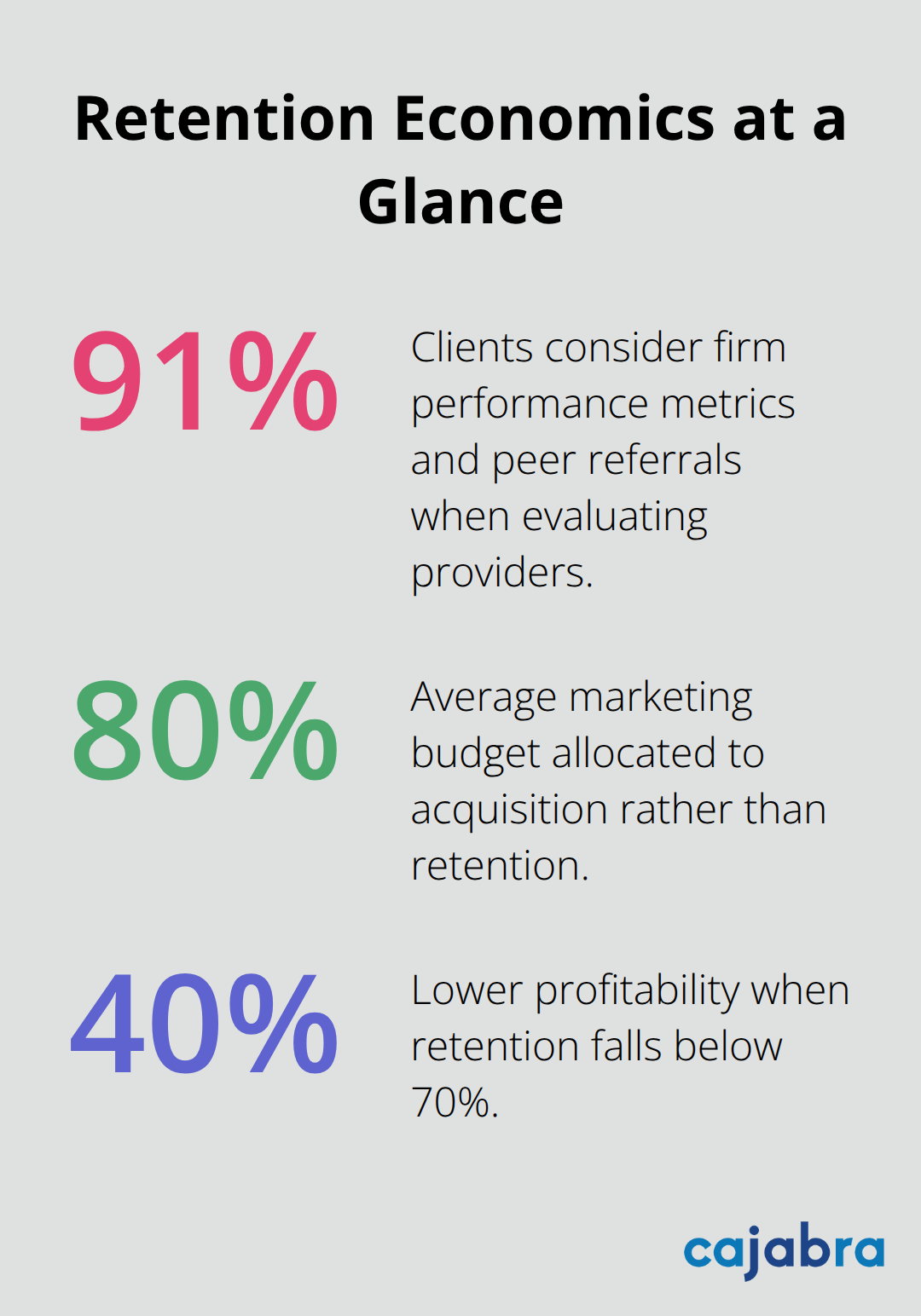

Service quality issues compound client frustration faster than pricing concerns. Firms that miss tax deadlines, submit incorrect filings, or fail to return calls within 24 hours lose clients at twice the industry average rate. ClearlyRated data shows that 91% of clients consider firm performance metrics and peer referrals when they evaluate their current provider. Poor service creates negative word-of-mouth that damages reputation beyond the immediate client loss.

Firms spend five to 25 times more to replace a single accounting client than to retain an existing one, yet most allocate 80% of their marketing budget to acquisition rather than retention. A mid-sized firm that loses just 10 clients annually sacrifices approximately $150,000 in immediate revenue plus $300,000 in lifetime value (based on average client billing rates). The Journal of Accountancy reports that firms with retention rates below 70% operate at 40% lower profitability than those that maintain 85% or higher retention.

Client acquisition demands extensive marketing campaigns, multiple sales meetings, and complex onboarding processes that drain resources for months before they generate positive returns. Most accounting firms struggle to attract new clients because they lack a structured approach to marketing. These proven retention strategies can help firms break this expensive cycle and build sustainable growth.

Monthly check-ins generate higher retention rates than firms that contact clients only during tax season. These conversations should focus on business performance metrics, upcoming regulatory changes, and growth opportunities rather than basic compliance updates. Successful firms schedule 15-minute quarterly calls specifically to discuss client goals and challenges outside of immediate accounting needs. The most effective approach involves targeted questions about cash flow patterns, expansion plans, and operational concerns that traditional services might not address.

Firms that provide comprehensive advisory services retain clients longer than compliance-only providers. Research shows clients prefer firms that understand their specific industry challenges and offer tailored solutions. Monthly financial dashboards, quarterly business reviews, and annual strategic planning sessions create touchpoints that competitors rarely match. These services position firms as business partners rather than seasonal service providers, which makes client departure decisions significantly more difficult.

Proactive communication prevents client departures before they occur. Firms should send monthly newsletters with industry updates, tax law changes, and business insights that clients can immediately apply. Weekly email updates during busy seasons reassure clients that their needs remain a priority. The most successful firms establish communication schedules that clients expect and appreciate (rather than random outreach that feels intrusive).

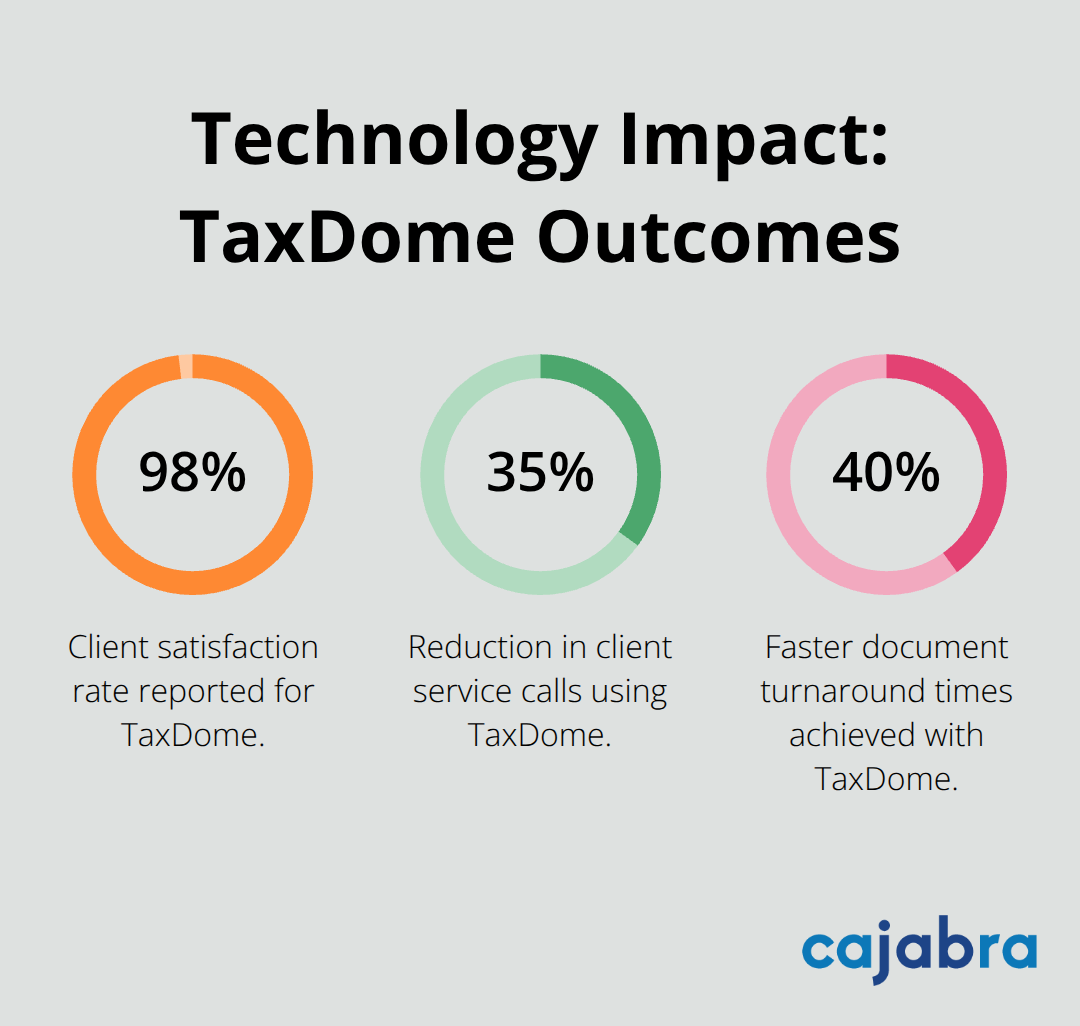

Client portals with real-time financial data access reduce service inquiries while they increase satisfaction scores. TaxDome and similar platforms streamline document collection and communication, but the human element remains essential for retention success. Automated reminder systems for tax deadlines, quarterly payments, and filing requirements prevent the missed deadlines that drive client departures. Firms that use data analytics to track client engagement patterns identify retention risks months before clients consider alternatives.

The right technology tools support these retention strategies, but implementation requires careful selection of platforms that enhance rather than replace personal relationships.

Client portal systems transform accounting firms from reactive service providers to proactive business partners. TaxDome leads the market with 98% client satisfaction rates because it combines document management, communication tools, and real-time financial dashboards in one platform. Firms that use TaxDome report 35% fewer client service calls and 40% faster document turnaround times. The platform costs $50-150 per month per user but generates ROI within 60 days through improved efficiency.

SmartVault offers similar functionality at $25-75 monthly with stronger security features that appeal to larger clients. Both platforms eliminate email chains and missed communications that drive client departures.

Automated reminder systems reduce missed deadlines by 85% while they increase client satisfaction scores. QuickBooks Practice Management provides smart features for task management, document sharing, and project management for accounting firms. The system costs $200 monthly but prevents the deadline failures that cause 60% of client departures.

Karbon automates follow-up sequences for new clients. The platform sends welcome emails, document requests, and progress updates without manual intervention. Firms report 25% higher retention rates during the first year when they implement structured engagement process workflows.

Client performance tracking reveals retention risks months before clients consider alternatives. Thomson Reuters OneSource is the industry's most trusted end-to-end cloud automation solution for tax, trade, and financial reporting professionals. The platform costs $300-500 monthly but helps firms intervene before relationships deteriorate.

Firms that use predictive analytics retain 15% more clients annually because they address problems proactively rather than reactively. The most successful implementations track engagement scores, response times, and service utilization to create early warning systems. These metrics trigger immediate outreach when client behavior patterns decline (before relationships reach the breaking point).

Successful client retention strategies for accounting firms demand consistent execution across communication, technology, and service delivery. Firms that maintain monthly client contact, provide proactive advisory services, and use automated systems retain 50% more clients than those that rely on seasonal interactions. The financial impact proves significant: firms that increase retention by just 5% boost profitability by 25-95%.

Strong client relationships generate predictable revenue streams that reduce operational stress and marketing costs. Retained clients spend more annually, refer new business, and trust firm recommendations during economic uncertainty (especially during tax law changes). These relationships create competitive advantages that new firms cannot replicate quickly.

Implementation starts with selecting the right technology platform, establishing monthly communication schedules, and training staff on proactive service delivery. Firms should track engagement metrics, response times, and satisfaction scores to identify retention risks early. We at Cajabra, LLC help accounting firms build comprehensive marketing systems that support long-term client relationships through our JAB System™.