Most accounting firms are stuck in a cycle of feast or famine, struggling to attract consistent high-value clients while drowning in administrative work. The gap between having expertise and actually getting noticed by prospects who need it is wider than ever.

At Cajabra, LLC, we've seen firsthand how marketing for accounting firms fails when it's treated as an afterthought. This guide cuts through the noise and shows you exactly what works to fill your pipeline with retainer clients who stick around.

Most accounting firms operate with a marketing handicap that competitors don't talk about: time scarcity. According to the Hinge 2025 High Growth Study, firms allocate over 12% of revenue to marketing when they're serious about growth, yet many accounting practices spend closer to 1% because partners are consumed by client work and compliance deadlines. This creates a vicious cycle where the firm needs more clients to justify hiring marketing staff, but can't attract those clients without marketing. The result is sporadic networking events, outdated websites that haven't been refreshed in five years, and social media accounts that go silent for months.

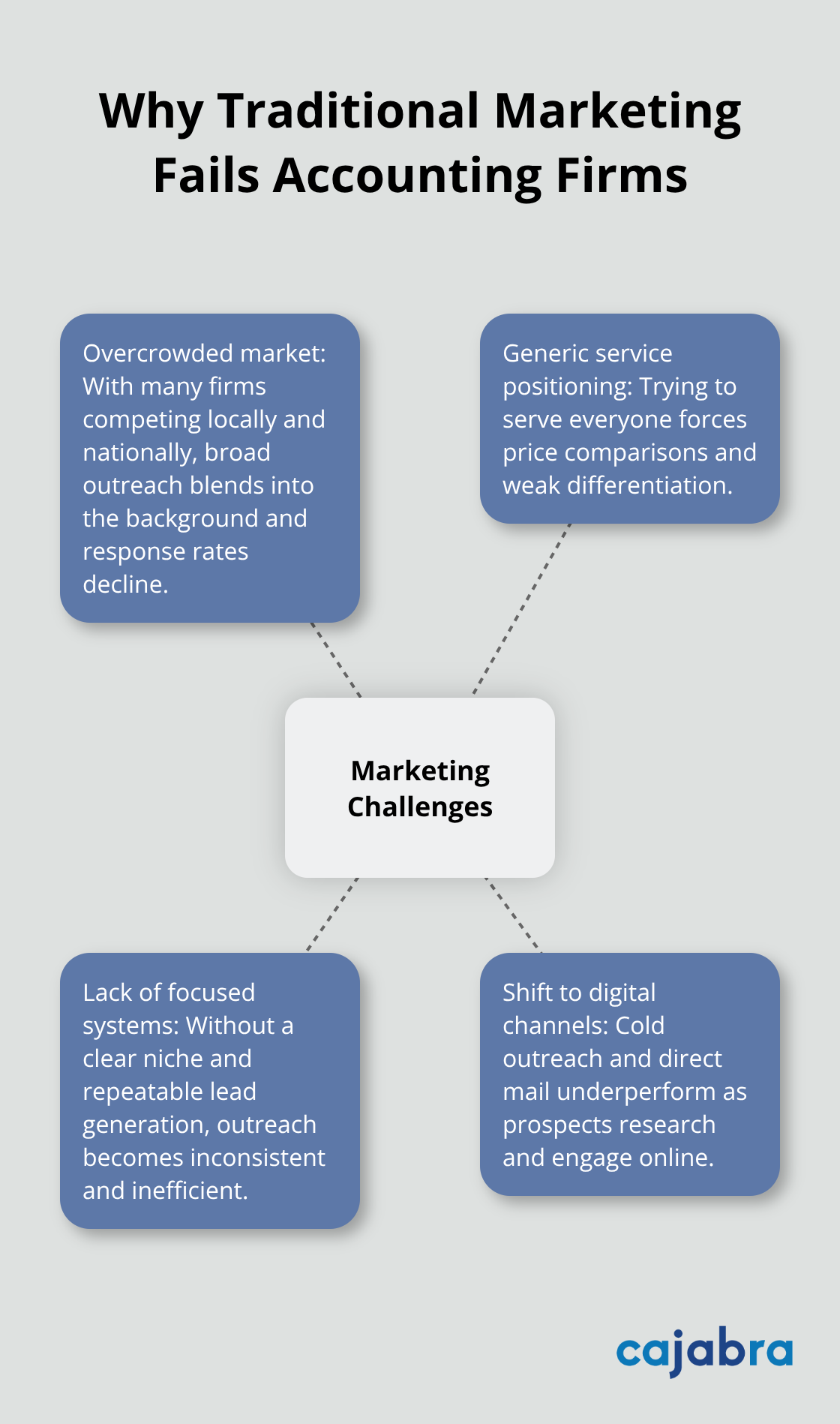

Traditional tactics like cold calling and direct mail have become increasingly ineffective, with response rates dropping as prospects shift to digital channels. IBISWorld reports over 85,000 accounting firms competing in the US market, which means generic approaches no longer work. Firms that try to be everything to everyone-tax prep, bookkeeping, payroll, advisory-get lost in the noise and compete on price rather than value. The firms winning right now are those with a clear niche, a professional digital presence, and systems that generate leads consistently without requiring a partner to personally chase every prospect.

The real problem isn't that accounting firms lack expertise or client service skills. The problem is that high-value retainer clients never find them. A prospect searching for a CPA near me encounters dozens of firms with similar credentials, similar service menus, and similar websites. Without a strong online reputation, client testimonials, and thought leadership content that demonstrates real expertise, firms look interchangeable. Local SEO matters significantly for accounting practices, yet most firms treat these as optional.

Email marketing generates between $36 and $40 for every dollar spent according to industry benchmarks, but many firms have no email strategy at all. The gap between knowing what works and actually implementing it is where accounting firms get stuck. Firms need systems that work without constant attention, websites that convert visitors into qualified leads, and a content strategy that builds authority in their target market (which we'll explore in the next section). This requires moving beyond the feast-or-famine mentality and treating marketing as a predictable business function, not a random activity squeezed in between client calls.

Your website is where prospects form their first impression, and most accounting firm websites fail at the most basic task: converting a visitor into a lead. A functional website isn't enough anymore. Your site needs to load in under three seconds on mobile, clearly explain what problems you solve for specific client types (not generic tax services), include recent client testimonials that highlight real outcomes, and make it simple for prospects to book a consultation.

Local SEO matters significantly for accounting practices. Optimize your Google Business Profile with accurate hours, service categories, and photos. Create location-specific service pages if you serve multiple markets. Encourage satisfied clients to leave reviews on Google and industry directories. Firms that actively manage their online reputation see higher inquiry rates from local searches.

Content marketing separates firms that attract high-value clients from those that compete on price. The firms winning in 2025 publish consistent, specific content that addresses real client pain points: tax planning strategies for real estate investors, year-end tax optimization for professional services firms, or quarterly bookkeeping tips for e-commerce businesses. This isn't about generic blog posts. It's about demonstrating expertise in a specific niche.

One accounting firm publishing twelve targeted articles per year about healthcare practice tax strategies will outrank competitors publishing generic tax tips. Your content reaches prospects across your website, LinkedIn, and email to existing clients. LinkedIn specifically works for accounting firms because decision-makers and CFOs use the platform to find professional services. Post insights about tax law changes, share client success stories anonymously, and engage in industry discussions.

Targeted advertising accelerates results when your website conversion optimization for accounting firms are already in place. Google Ads and LinkedIn advertising allow you to reach prospects actively searching for accounting services in your niche or geographic area. A properly structured Google Ads account focuses on high-intent keywords like "accountant for startups" or "tax planning for real estate" with conversion-optimized landing pages.

Budget matters less than strategy. A firm spending $500 monthly on precisely targeted campaigns will generate better returns than one spending $3,000 on broad, generic keywords. Track your cost per qualified lead, conversion rate from lead to client, and lifetime value of clients acquired through each channel. This data guides your next budget decision and reveals which systems actually produce retainer clients worth your time.

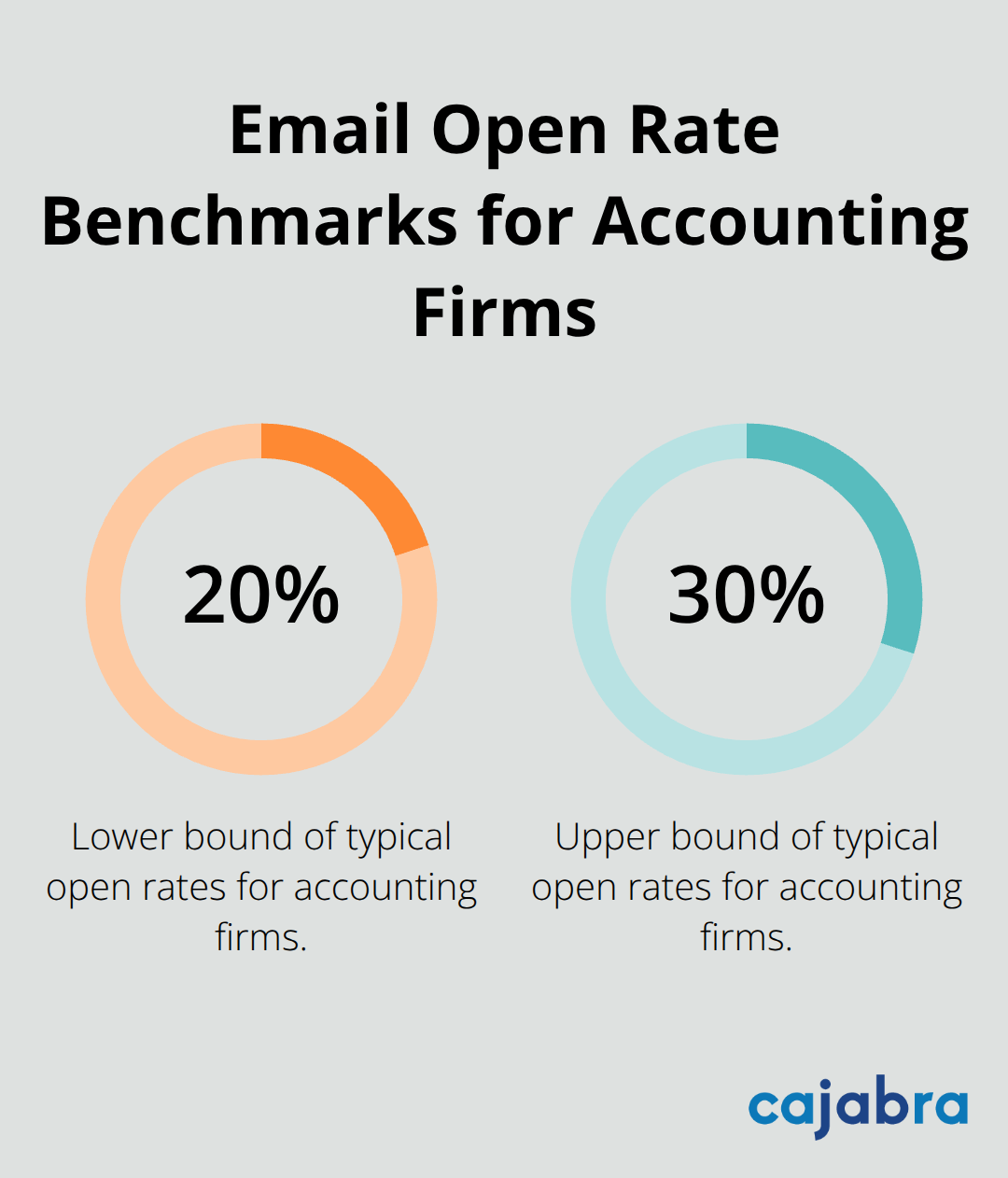

Most accounting firms treat lead generation like a part-time job for a partner who already works sixty hours a week. The result is inconsistent pipeline, months of feast followed by months of famine, and constant stress about where the next client comes from. Firms that escape this trap implement email nurture sequences that work automatically. Capture every prospect who visits your website, downloads a resource, or requests a consultation, then send them a sequence of three to five emails over two weeks that positions your firm as the expert. One accounting firm sends a welcome email with their year-end tax planning guide, a second email three days later highlighting a specific tax strategy relevant to their niche, and a third email after one week offering a fifteen-minute consultation. This sequence converts cold prospects into qualified leads without a single phone call. Track your email open rates (industry average sits around 20% to 30% for accounting firms) and adjust subject lines and send times based on what your audience actually opens.

Implement a retargeting system that keeps your firm visible to prospects who visited your website but did not convert. Google and Facebook retargeting ads cost significantly less than acquiring new traffic and remind prospects about your services when they research accounting solutions elsewhere online. A prospect who visited your website three weeks ago might see your ad about tax planning for real estate investors and finally book that consultation. Set a monthly retargeting budget of two hundred to five hundred dollars and monitor which ads produce the lowest cost per lead. This approach works because prospects often need multiple exposures to a message before they take action.

Develop a client retention and upsell strategy that treats your current clients as your highest-priority growth channel. The Hinge 2025 High Growth Study found that high-growth accounting firms focus heavily on expanding relationships with existing clients rather than only chasing new business. Schedule quarterly business reviews with clients to discuss their evolving needs, introduce new services they might benefit from, and ask for referrals to similar businesses. One firm increased revenue per client by 35% over eighteen months simply by documenting what each client needed and proactively presenting relevant services. Create a simple tracking system showing which clients are candidates for bookkeeping upgrades, payroll services, or advisory work. This approach produces revenue from people who already trust you, which costs far less than acquiring brand-new clients.

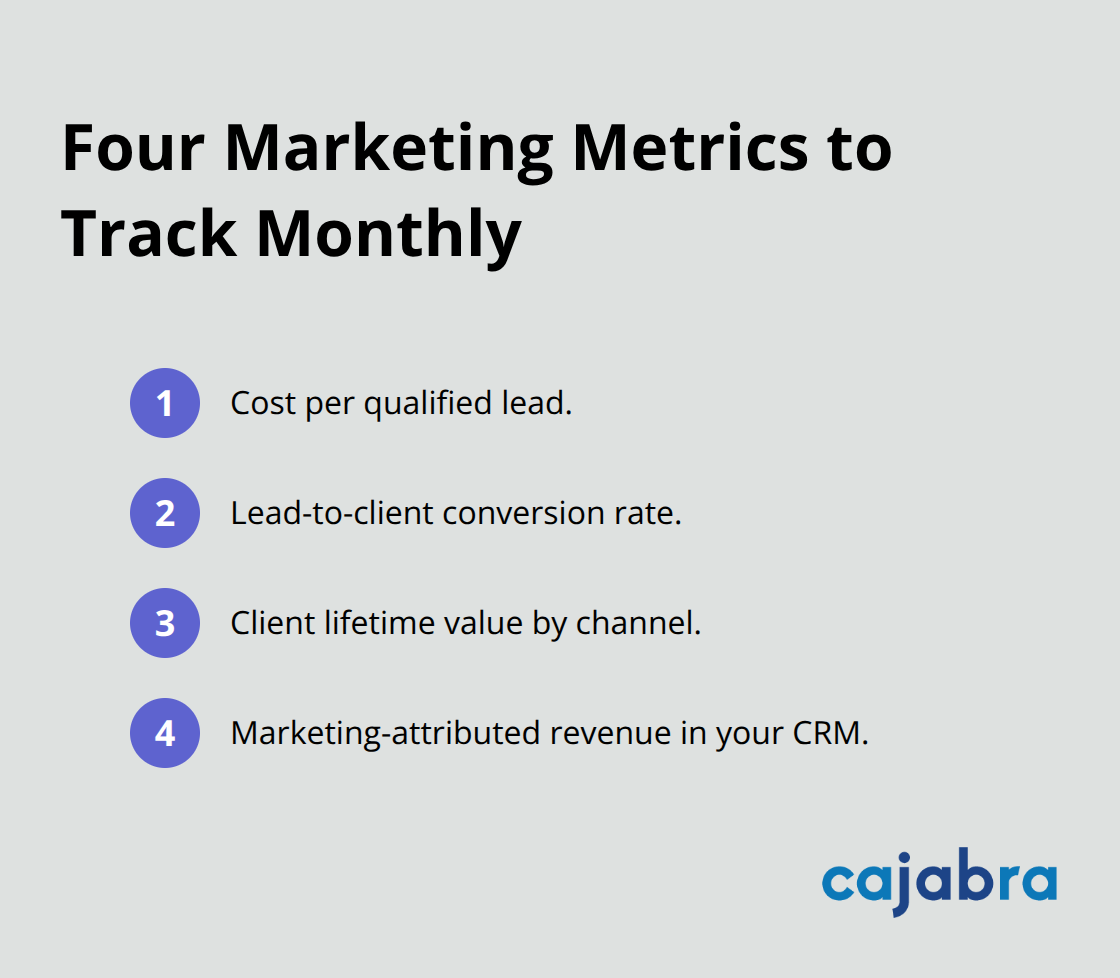

Measuring what actually works separates firms that grow from those that spin their wheels. Most accounting firms have no idea which marketing activities produce clients and which waste time. Start tracking four specific metrics immediately. First, measure your cost per qualified lead by dividing total marketing spend by the number of leads generated. Second, track your lead-to-client conversion rate by monitoring how many leads become paying clients and how long the sales cycle takes. A firm converting 20% of leads into clients performs well; if you fall below 10%, your sales process or lead quality needs work. Third, calculate the lifetime value of clients acquired through each channel so you know which marketing investments actually produce profitable relationships.

A client acquired through Google Ads might cost four hundred dollars but stay for five years and generate fifteen thousand dollars in revenue, while a referral might cost nothing but disappear after one year. Fourth, monitor your marketing-attributed revenue by using your CRM to track which clients came from which source. This requires discipline but reveals exactly which systems deserve more budget. Use a simple spreadsheet or CRM tool like HubSpot or Pipedrive to track these numbers monthly. Most accounting firms spend money on marketing without ever knowing whether it worked, which is precisely why so many firms feel like marketing is a waste. When you measure and adjust based on real data, your marketing becomes predictable and scalable.

The accounting firms winning right now built systems that produce consistent, qualified leads instead of treating marketing as an afterthought. Marketing for accounting firms works when you focus on three core elements: a website that converts visitors into leads, content that demonstrates expertise in your niche, and measurement systems that reveal which activities actually produce retainer clients. The gap between struggling firms and thriving ones isn't talent or credentials-it's execution and the willingness to track what actually works.

You now understand why traditional tactics fail, which digital systems generate real results, and exactly how to measure whether your marketing produces clients worth your time. Start with one system this month rather than attempting everything at once. If you optimize your website and Google Business Profile completely before adding email sequences, or commit to publishing one piece of targeted content weekly for three months, consistency beats perfection every single time.

At Cajabra, LLC, we work with accounting firms to handle marketing so you can focus on serving clients and building expertise. Explore how Cajabra transforms your firm's growth and move from overlooked to overbooked through tailored lead-generating websites and effective sales funnels. The firms that thrive implement these systems today and measure results tomorrow.