Most accounting firms rely on outdated marketing tactics that simply don't work anymore. Your competitors are capturing high-value clients with modern accounting marketing strategies while you're stuck with inconsistent leads and limited visibility.

At Cajabra, LLC, we've seen firsthand how the right approach transforms accounting practices. This guide shows you exactly which strategies separate thriving firms from those struggling to grow.

Most accounting firms remain invisible online. According to data from firms analyzed in the 2025 AAM High Growth Study, accounting practices that don't invest in modern marketing strategies watch their client acquisition costs rise while their pipeline stays thin. Firms that rely solely on referrals and networking miss the 54% of search traffic that flows to the top three Google results. When a prospect searches for tax strategies, accounting services, or financial guidance, your firm doesn't appear. This visibility gap means high-value retainer clients-the ones that generate consistent revenue-find your competitors instead. The problem isn't that these clients don't exist; it's that your marketing channels don't reach them.

A 75% credibility gap exists between firms with professional, modern websites and those clinging to outdated designs. Prospects judge your firm's legitimacy in seconds based on your online presence, and if your website looks like it was built in 2015, they move to the next option.

Traditional marketing creates feast-or-famine cycles. Accounting firms that depend on referrals face unpredictable income swings because they lack a systematic way to produce leads consistently. One month you're busy; the next month your pipeline empties. This unpredictability makes it impossible to plan hiring, invest in staff development, or forecast revenue growth. Worse, referral-based practices attract clients similar to your existing ones-often smaller accounts that pay less. Retainer clients who produce recurring revenue require intentional marketing systems that attract them, not hope they'll be referred to you.

Automated lead-generation systems, SEO-optimized content, and strategic positioning create predictable client flow. Without these systems, you compete on price and relationship history instead of expertise and value. The firms that grow fastest-those in the high-growth category with 38.5% average revenue growth according to the 2025 AAM study-allocate 2.1% of revenue to marketing and build scalable acquisition channels. They don't wait for referrals; they attract clients actively searching for specialized expertise in their niche. These firms understand that modern prospects expect to find you online before they ever consider working with you.

This gap between traditional and modern approaches explains why so many accounting firms plateau. The firms that break through this ceiling recognize that marketing isn't optional-it's the engine that powers sustainable growth. Understanding what separates these high-growth firms from the rest requires examining the specific strategies they implement.

The accounting firms winning market share right now aren't the oldest or the cheapest-they're the ones prospects find first when searching for specialized expertise. Your positioning determines whether you attract price-sensitive commodity clients or high-value retainer accounts willing to pay for strategic guidance. This starts with a clear, defensible market position that separates you from generic tax preparation shops. Instead of positioning yourself as a general accountant serving everyone, identify a specific industry vertical where you genuinely excel-healthcare practices, real estate investors, e-commerce founders, or professional service firms. This specificity matters because prospects in these niches search for accountants who understand their unique tax challenges and business models. A dental practice owner searching for tax write-offs specific to their industry will convert faster and pay higher retainer fees than someone vaguely looking for accounting help. Your website, content, and messaging must reinforce this positioning consistently across every touchpoint. This means your homepage should immediately communicate who you serve and what problems you solve for them, not generic statements about being a trusted accounting partner. High-growth firms allocate 29.6% of their marketing budget to conferences and events according to the 2025 AAM study, because in-person relationship building in your target market accelerates trust and attracts qualified leads who already operate in your chosen niche.

Most accounting firm websites fail because they focus on credentials instead of client outcomes. Prospects don't care about your certifications or how long you've been in business-they care whether you can solve their specific problems. Your homepage needs a clear call-to-action above the fold, typically a button to schedule a consultation or download a valuable resource like a tax strategy guide specific to your target industry. Website design directly impacts credibility, as design quality, mobile responsiveness, and loading speed influence how prospects perceive your firm. If your site takes more than three seconds to load or requires horizontal scrolling on mobile devices, prospects leave and contact a competitor instead. Beyond aesthetics, your website must function as a lead-generation machine with strategic funnels that capture email addresses. Lead magnets like industry-specific tax guides, retirement planning checklists, or accounting process templates convert around 10% of website visitors into leads when the offer aligns with visitor intent. These captured emails feed into automated nurture sequences that keep prospects engaged until they're ready to hire. SEO-optimized landing pages for specific services-such as S-corp tax strategies for freelancers or accounting for medical practices-rank on Google and attract organic traffic continuously without ongoing ad spend. This systematic approach to website design and optimization separates firms that produce consistent leads from those dependent on referrals and networking alone.

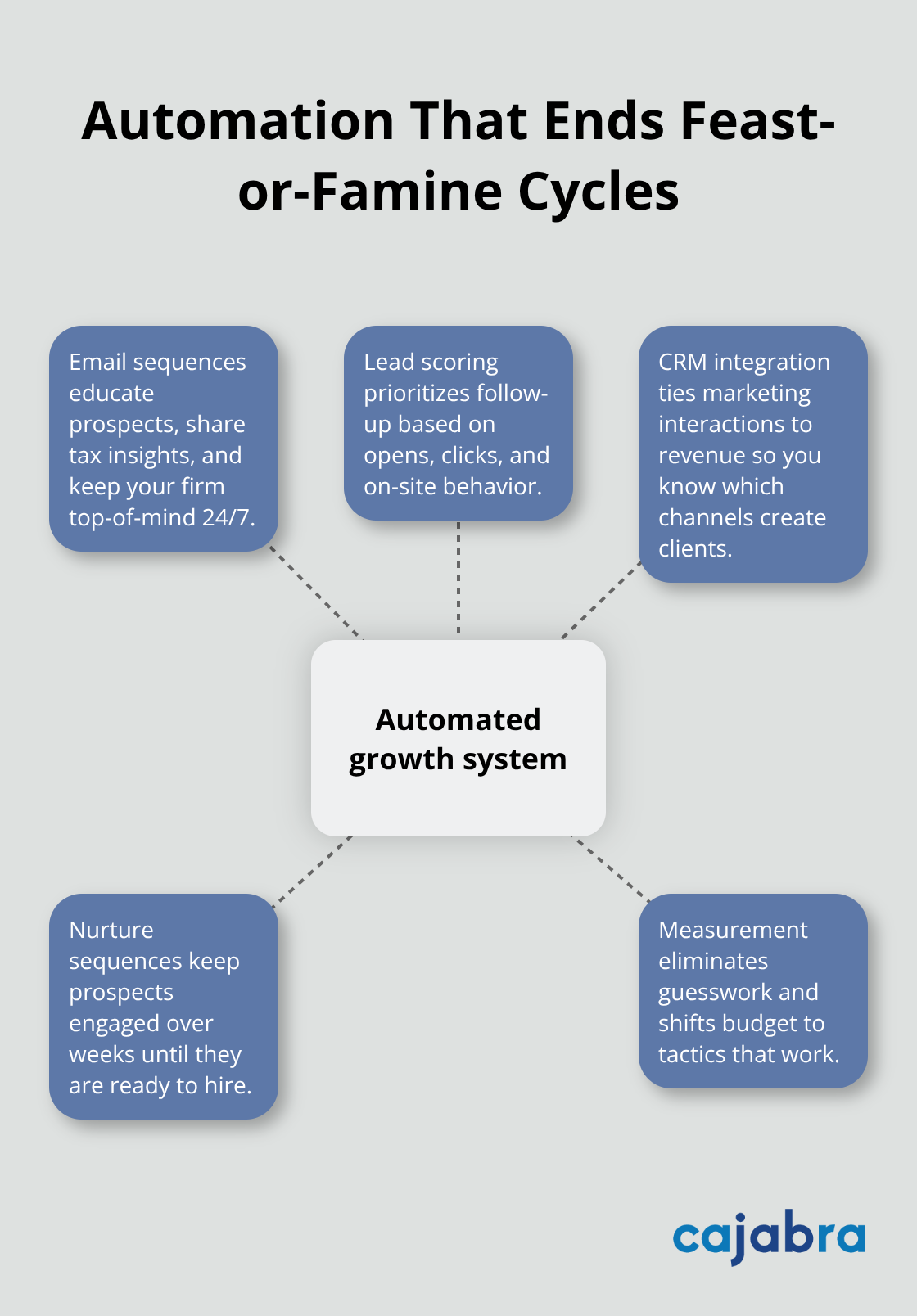

Accounting firms that scale fastest implement marketing automation that requires minimal daily attention once configured. Email sequences educate prospects about your services, share valuable tax insights, and remind them of your availability-all working 24/7 without manual effort. A prospect who downloads your tax guide automatically receives a welcome email, then receives helpful content over the following weeks, keeping your firm top-of-mind when they're ready to hire. This automation directly addresses the feast-or-famine problem because prospects flow through your nurture sequences consistently regardless of referral volume. Lead scoring systems identify which prospects show genuine interest through email opens, link clicks, and website behavior, so your team focuses follow-up energy on warm leads instead of cold outreach. CRM integration ties marketing activities directly to revenue, showing exactly which channels, content pieces, and campaigns produce paying clients. This measurement eliminates guesswork about marketing effectiveness and directs budget toward tactics that work. Firms using these systems report more predictable pipelines and higher close rates because prospects are educated and warm before your team ever contacts them.

These systems form the foundation for sustainable growth, but they only work when paired with the right content strategy that attracts your ideal clients in the first place.

The firms that grow fastest concentrate on maximizing existing client relationships while systematically attracting new ones through channels that don't require constant manual effort. This dual approach separates sustainable growth from chaotic scaling that burns out your team.

Your existing clients represent your fastest path to higher revenue. High-growth accounting firms understand that expanding relationships with current clients costs far less than acquiring entirely new ones. A client paying $3,000 annually for tax preparation can become a $15,000 retainer client through strategic advisory positioning. This expansion happens when you identify unmet needs within your existing base-retirement planning gaps, entity structure optimization, quarterly tax planning they're not currently receiving.

Implement a quarterly business review process where you sit down with top clients and discuss their upcoming goals, tax implications, and potential strategies. Document these conversations in your CRM so your team sees expansion opportunities. Firms using this approach report higher revenue per existing client.

Email marketing to current clients costs nearly nothing but drives consistent cross-sell revenue. Send monthly tax tips relevant to their industry, quarterly tax planning summaries, or annual strategy guides. This keeps your firm visible and reminds clients of services they're not yet using.

AI-powered systems with features like chatbots, predictive analytics, and AI-integrated CRMs answer common questions about service pricing, intake requirements, and tax deadlines-qualifying leads automatically while your team focuses on high-value conversations. Email sequences powered by AI personalization adjust messaging based on prospect behavior, dramatically improving open rates and conversions compared to generic broadcasts.

Content generation tools accelerate your blogging output; you spend 20 minutes reviewing and refining AI-drafted posts instead of 2 hours writing from scratch. This efficiency multiplier means you can publish more content without expanding your marketing team. These systems (when configured properly) run continuously without daily oversight, freeing your staff to focus on client service and strategic work.

Track which marketing channels produce retainer clients specifically-not just leads or website visits. A channel driving 50 leads means nothing if none convert to retainers. Use your CRM to tag leads by source, then measure which sources generate the highest-value clients.

High-growth firms allocate marketing budgets across diverse channels, but they ruthlessly cut underperformers. If LinkedIn generates tire-kickers while your industry-specific blog attracts retainer-quality prospects, shift budget toward the blog. This data-driven approach (supported by your CRM and analytics tools) ensures every marketing dollar produces measurable returns.

Sustainable growth requires systems that run on their own, not heroic effort from your team. When you construct lead-generation channels that produce consistent prospects, automated nurture sequences that educate them, and processes that maximize existing client value, your firm scales without the chaos that typically accompanies growth. These interconnected systems create a self-reinforcing cycle where new clients flow in predictably while existing clients expand their service usage and referral activity.

The accounting firms winning today abandoned outdated marketing approaches and built systems that attract high-value retainer clients consistently. The gap between firms that plateau and those that scale comes down to intentional, data-driven accounting marketing that reaches prospects actively searching for specialized expertise. Your firm has three choices: continue relying on referrals and accept an unpredictable pipeline, compete on price and watch margins shrink, or implement the strategies outlined in this guide and position yourself as the obvious choice for clients in your target market.

The firms growing fastest allocate meaningful budget to marketing, optimize their websites for conversions, create content that ranks on Google, and automate their lead nurture sequences. They measure results by revenue impact, not vanity metrics. They expand existing client relationships while systematically attracting new ones. This combination produces sustainable growth without burning out your team.

Start with one channel that addresses your biggest gap. If your website needs modernization, fix that first. If your content strategy doesn't exist, publish industry-specific blog posts. If your lead nurture sequences are missing, build them. Small improvements compound into significant visibility and revenue gains over time. At Cajabra, LLC, we help accounting firms move from overlooked to overbooked through systems that secure retainer-based clients in 90 days.