Accounting firms face intense competition in today's market, making effective marketing more important than ever. The best marketing strategies for accounting firms combine digital presence with strategic client positioning.

We at Cajabra, LLC have identified proven approaches that generate measurable results. This guide covers practical tactics that accounting professionals can implement immediately to grow their practice.

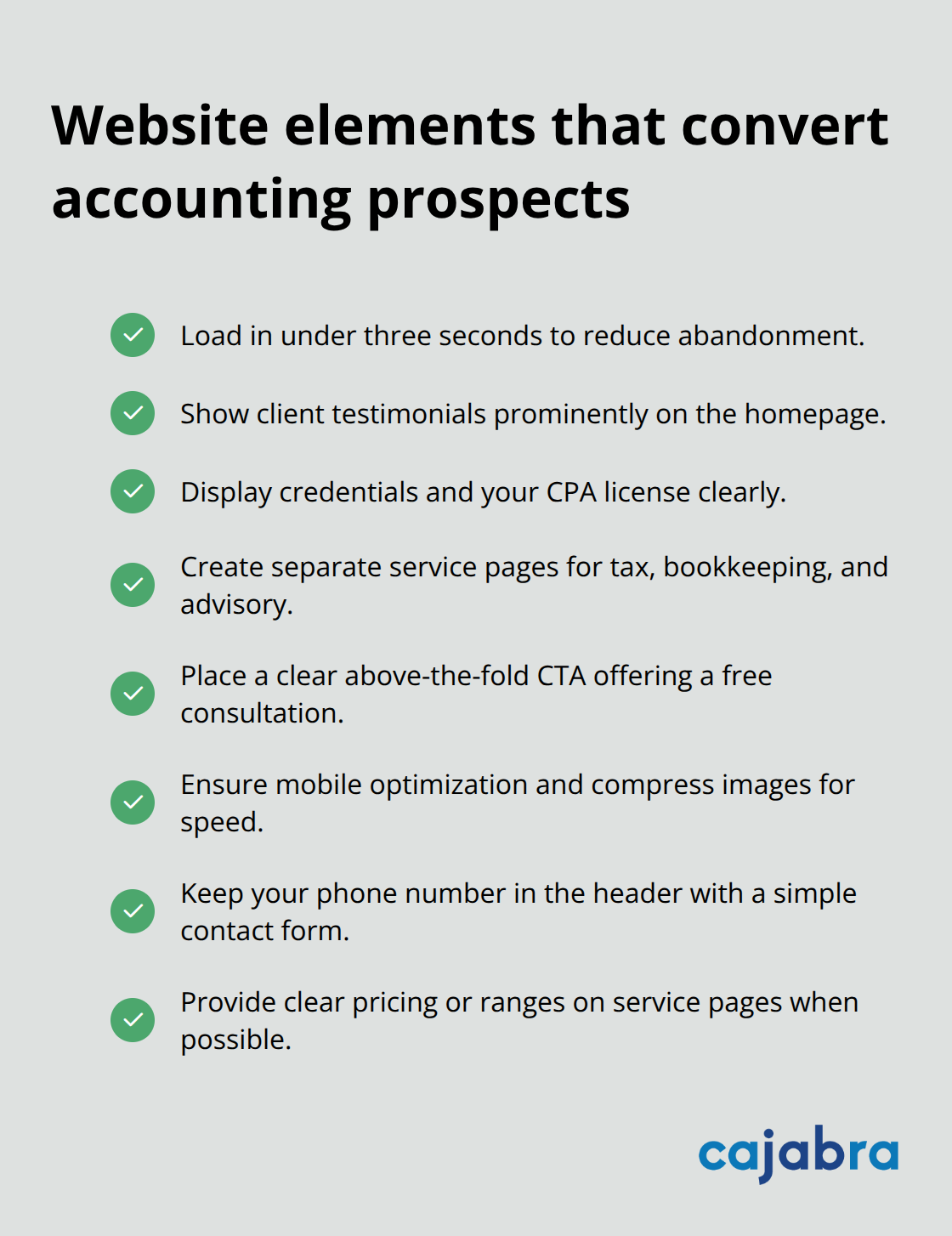

Your website serves as the foundation for all digital marketing efforts, and accounting firms need specific elements to convert visitors into clients. A professional website must load within three seconds to avoid losing over half of users (according to Google research). Include client testimonials prominently on your homepage, display your credentials clearly, and create separate service pages for tax preparation, bookkeeping, and business advisory services.

Add a clear call-to-action above the fold that offers a free consultation or tax assessment. Most accounting websites fail because they focus on features rather than client benefits. Your homepage should immediately communicate how you solve client problems, not just list your services.

Modern accounting websites require specific design elements that build trust and drive action. Place your phone number in the header of every page and include a contact form that captures essential client information. Create dedicated landing pages for each service you offer, with clear pricing information when possible.

Mobile optimization remains non-negotiable since over 50% of web traffic comes from mobile devices. Test your website speed regularly and optimize images to maintain fast load times. Include your CPA license number and professional certifications prominently to establish credibility immediately.

Local search engine optimization generates the highest-quality leads for accounting firms because people search for accountants near them. Set up your Google Business Profile completely with current hours, services, and regular posts about tax deadlines or financial tips. Collect client reviews consistently since 87% of consumers read online reviews.

Target location-specific keywords like "tax accountant in [city name]" and "CPA near me" in your website content. Create location pages for each city you serve and include your address on every page. Local SEO requires patience but delivers predictable results within six months of consistent effort.

Educational content positions your firm as the go-to expert in your market and builds trust with potential clients. Write blog posts that answer common client questions about tax deductions, business expenses, and financial planning. Companies with blogs generate significantly more leads than those without blogs.

Create content around tax season topics like "Business Deductions Most Entrepreneurs Miss" or "Quarterly Tax Planning for Small Businesses." Video content performs exceptionally well and will account for the majority of internet traffic. Record short videos that explain complex tax concepts in simple terms and post them on YouTube and LinkedIn.

These digital marketing fundamentals create the foundation for more advanced client acquisition strategies that focus on strategic market positioning.

Strategic positioning transforms accounting firms from commodity services into specialized experts that command premium fees. Niche specialization generates higher conversion rates because potential clients prefer accountants who understand their specific industry challenges. Restaurant owners seek CPAs familiar with food service margins and labor costs, while medical practices need accountants versed in healthcare regulations and insurance reimbursements.

This targeted approach allows firms to charge premium fees compared to generalists while reducing marketing costs through focused messaging. Specialized firms attract clients who value expertise over price, creating sustainable competitive advantages in crowded markets.

Retainer-based service packages provide predictable monthly revenue and deeper client relationships compared to traditional hourly billing. Structure packages around monthly bookkeeping, quarterly tax planning, and annual strategy sessions rather than isolated transactions. Professional services firms benefit significantly from retainer models, though many freelancers underprice retainers by substantial margins compared to project equivalent rates.

Monthly retainers create cash flow predictability that allows firms to invest in growth initiatives and hire quality staff. Clients prefer fixed monthly fees because they eliminate billing surprises and create budget certainty for their businesses.

Referral programs amplify growth when existing clients become active advocates for your specialized services. Implement systematic referral requests during positive client interactions and offer meaningful incentives like service credits or charitable donations. Professional networks within your chosen niche multiply referral opportunities exponentially when you consistently demonstrate expertise at industry events and online communities.

Active participation in trade associations and professional groups positions your firm as the preferred accounting partner within specific industries. These relationships generate higher-quality referrals because they come with built-in trust and credibility.

The foundation of strategic positioning requires sophisticated automation and technology systems that streamline client acquisition and retention processes. Effective marketing transforms industry insights into client-attracting content that builds authority and generates consistent revenue growth.

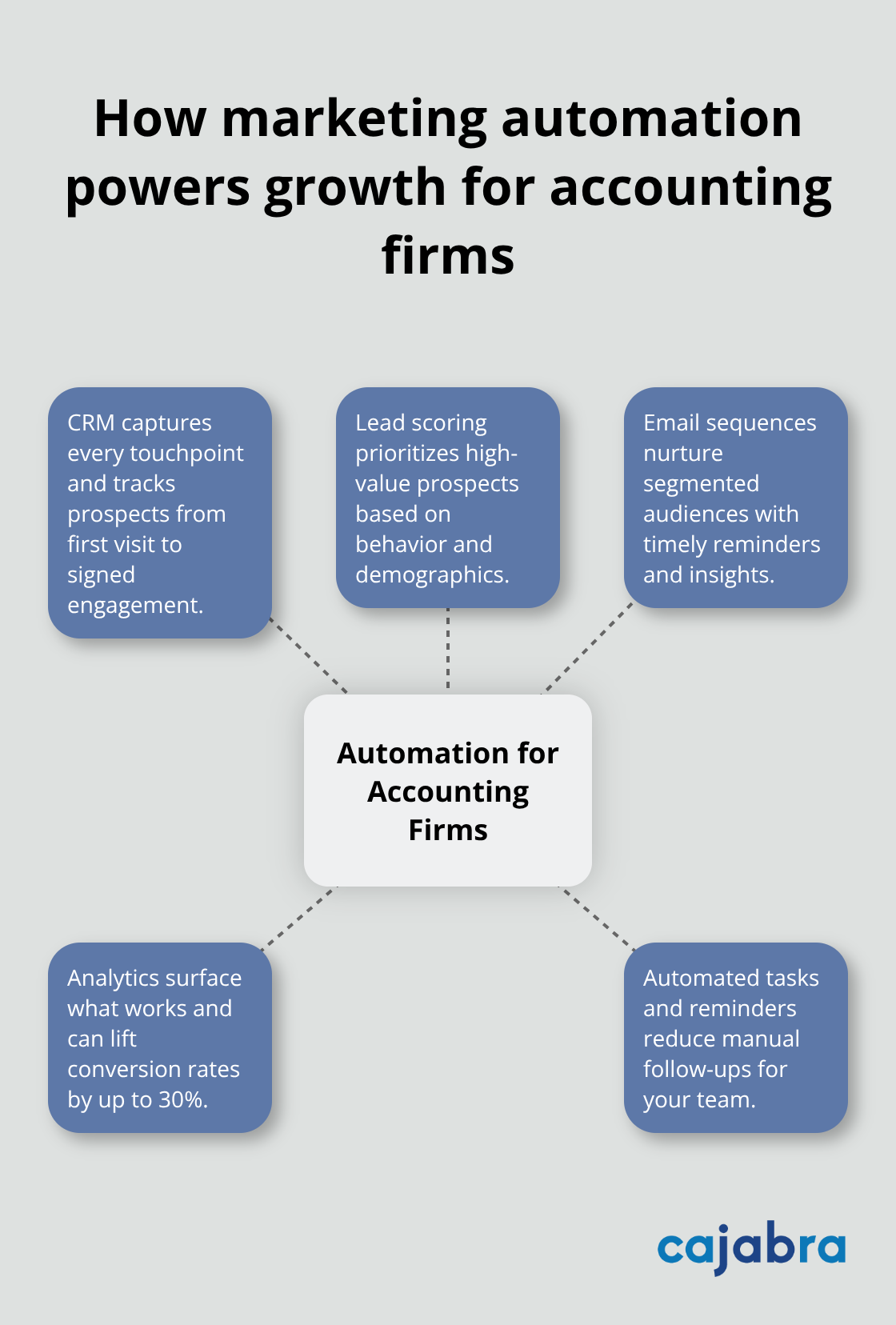

Marketing automation solutions eliminate manual tasks that consume valuable time while they generate consistent client acquisition results. Customer relationship management platforms track every prospect interaction from initial website visit through final contract signature. These systems provide data-driven insights that improve conversion rates by up to 30%. Modern CRM systems like HubSpot or Salesforce automatically score leads based on engagement levels, website behavior, and demographic information. This automation allows accounting firms to prioritize high-value prospects immediately.

Professional CRM platforms integrate seamlessly with email marketing tools and social media schedulers. They create comprehensive automation workflows that nurture leads without constant manual intervention. These systems capture prospect information automatically when visitors download resources or schedule consultations. The software tracks communication history and sets automatic follow-up reminders for sales teams. Advanced CRM features include lead scoring algorithms that identify prospects most likely to convert into paying clients.

Email marketing delivers strong returns on investment, making it a highly effective digital channel for accounting firms. Automated email sequences should target specific client segments with relevant content like quarterly tax reminders for business owners or year-end planning tips for high-net-worth individuals. Schedule welcome series for new subscribers, monthly newsletters with tax updates, and seasonal campaigns around major deadlines.

Personalization increases open rates significantly, so segment your email list by client type, service needs, and engagement history. Track metrics like open rates above 20% and click-through rates above 3% to optimize campaign performance continuously.

Social media management tools like Buffer or Hootsuite allow accounting firms to maintain consistent online presence without daily time investment. Schedule educational content across LinkedIn, Facebook, and Instagram during peak engagement hours when your target audience stays most active. LinkedIn performs best for B2B accounting services and generates three times more leads than other platforms for professional services firms.

Post industry insights, tax tips, and client success stories consistently while you engage with comments and messages promptly. Automation tools provide analytics that identify top-performing content types, optimal posting times, and audience demographics that inform future content strategies.

The best marketing strategies for accounting firms combine digital fundamentals with strategic positioning and automation technology. Professional websites that convert prospects, local SEO optimization, and educational content marketing create the foundation for sustainable growth. Niche specialization allows firms to command premium fees while retainer-based packages generate predictable monthly revenue streams.

Implementation requires a phased approach over 6-12 months. Start with website optimization and Google Business Profile setup in month one (budget of $3,000-$5,000). Add content marketing and email automation in months 2-3 with ongoing costs of $500-$1,000 monthly. Social media management and CRM systems follow in months 4-6.

Success depends on consistent execution rather than perfect timing. Firms that implement these strategies systematically see measurable results within 90 days. We at Cajabra, LLC help accounting firms implement the JAB System™ that moves practices from overlooked to overbooked through retainer-based client acquisition and automated marketing systems.