Small businesses struggle to create content that connects with their audience and drives real results. Most owners spend hours brainstorming only to produce generic posts that get ignored.

We at Cajabra, LLC know that effective small business content ideas come from understanding your customers deeply and addressing their specific challenges. The right approach transforms your content from noise into a powerful growth engine.

Who Is Your Ideal Customer

Most small businesses create content without truly knowing who they're talking to. This backwards approach wastes time and money while it delivers poor results. Smart business owners start with deep customer research before they write a single post.

Study Customer Data Beyond Basic Demographics

Age and location tell you nothing about what keeps your customers awake at night. HubSpot research shows that 29% of marketers actively use content marketing. Dig into customer support tickets, survey responses, and sales call notes to find problems that repeat. Interview your best customers about their biggest challenges before they found your business. Track which products they buy together and when they typically make purchases. This data reveals content opportunities that generic demographic profiles miss completely.

Find Content Gaps Your Competitors Ignore

Your competitors probably create the same content everyone else does. Semrush data shows 58% of businesses use AI for content research, but most still miss obvious gaps. Analyze the top 10 competitors in your space and catalog their content themes for three months. Look for questions customers ask that no one addresses properly. Check their social media comments for concerns that remain unresolved. Most competitors focus on product features while they ignore implementation challenges, troubleshooting guides, or industry-specific applications (these gaps become your content goldmine).

Track Real Metrics That Drive Business Growth

Social media vanity metrics lie to you constantly. Likes and followers mean nothing if they don't convert to customers. Focus on metrics that predict business growth: click-through rates to your website, email signups from social posts, and direct messages that ask about your services. Content Marketing Institute research reveals that 90% of content marketers use social media for distribution, but few track the right metrics. Monitor which content types generate the most qualified leads and double down on those formats. Comments that ask specific questions indicate high buyer intent (while generic praise suggests low-quality traffic).

Once you understand your audience deeply, you can create content marketing for small businesses that speaks directly to their needs and drives real business results.

What Content Types Actually Convert Customers

Behind-the-Scenes Content Builds Trust Fast

Behind-the-scenes content works because people buy from businesses they trust, and transparency builds that trust fast. Nike generates massive engagement when they show their design process, from initial sketches to final product tests. Small businesses can apply this same strategy without huge budgets.

Document your daily operations, show how products get made, or film quick tours of your workspace. The key is consistency over production value. Wyzowl research shows 89% of customers want more video content from brands in 2024, and behind-the-scenes footage costs almost nothing to produce while it delivers authentic connection.

Educational Content Solves Real Problems

Educational content that solves specific customer problems outperforms promotional posts by massive margins. B2B marketers face challenges creating the right content for their audience, with 40% citing this as their primary concern this year.

Focus on step-by-step solutions to problems only your customers face. A local plumber gets more leads from a video that shows how to stop a specific type of leak than from generic maintenance tips. Document your customer support calls for three weeks and turn the most common questions into detailed how-to content.

User-Generated Content Amplifies Results

User-generated content amplifies this effect because customers trust peer experiences more than company claims. Encourage customers to share their success stories, then repurpose these testimonials across all platforms (this approach costs nothing but generates the highest conversion rates because prospects see real results from real people).

Customer interviews provide authentic testimonials that resonate with potential customers. Showcase your company culture to foster connection and relatability. Share insights about your production process to enhance brand authenticity.

These content types form the foundation of effective inbound content marketing, but success depends on proper planning and execution tools.

What Tools Actually Work for Content Planning

Content planning without the right tools wastes hours every week and produces inconsistent results. Hootsuite brings scheduling, content creation, analytics, and social listening to one place, making it a comprehensive social media management solution. Buffer and Later offer simpler alternatives for small businesses, while CoSchedule provides advanced calendar management that integrates with WordPress and email marketing tools. Choose one platform and use it consistently rather than jump between multiple tools that create more confusion than efficiency.

Smart Content Repurposing Multiplies Your Reach

One piece of content should generate at least five different posts across platforms. Transform a single blog post into Instagram carousel slides, LinkedIn articles, Twitter threads, and YouTube shorts without losing the core message. Semrush research shows 76% of content marketers use AI to draft content copy, but most miss the repurposing opportunity completely.

Record yourself as you explain a blog post concept for 60 seconds and you have video content for three platforms. Turn customer testimonials into quote graphics, case study posts, and success story videos. This approach multiplies your content output while it maintains quality and consistency.

Track Metrics That Predict Revenue Growth

Most small businesses track meaningless vanity metrics instead of numbers that predict revenue. Focus on three metrics that matter: conversion rates from content to email signups, cost per lead from each content type, and customer lifetime value from content-generated leads.

Google Analytics shows which blog posts drive the most qualified traffic, while social media analytics reveal which content formats generate actual business inquiries. Content Marketing Institute data shows 84% of businesses use paid channels to accelerate distribution, but organic content that converts consistently outperforms paid promotion in long-term ROI (this advantage compounds over time as search rankings improve).

Test different content formats for 30 days, measure results against revenue, then double down on winners while you eliminate content that generates engagement without conversions.

Final Thoughts

Successful small business content ideas start with deep customer research and end with measurable revenue growth. The businesses that win focus on solving real problems through educational content, behind-the-scenes transparency, and authentic customer stories rather than chasing vanity metrics. Your next step is simple: pick one content type that resonates with your audience and create it consistently for 30 days.

Track conversion rates, not likes. Measure leads generated, not followers gained. This focused approach beats scattered efforts across multiple platforms every time (long-term content success requires treating content as a business system, not a creative hobby).

Document what works, eliminate what doesn't, and scale the winners. Most small businesses fail because they create content randomly instead of strategically. We at Cajabra, LLC help accounting firms transform their marketing approach through systematic content strategies that generate retainer-based clients through our JAB System™. Content marketing works when you treat it like the revenue-generating business function it should be.

Content marketing teams waste 21 hours per week on manual planning tasks, according to CoSchedule's 2024 State of Marketing report. The right content marketing planning tool changes everything.

We at Cajabra, LLC have seen businesses double their content output while cutting planning time in half. The key lies in selecting software that matches your team's specific workflow needs.

What Features Actually Matter in Content Planning Tools

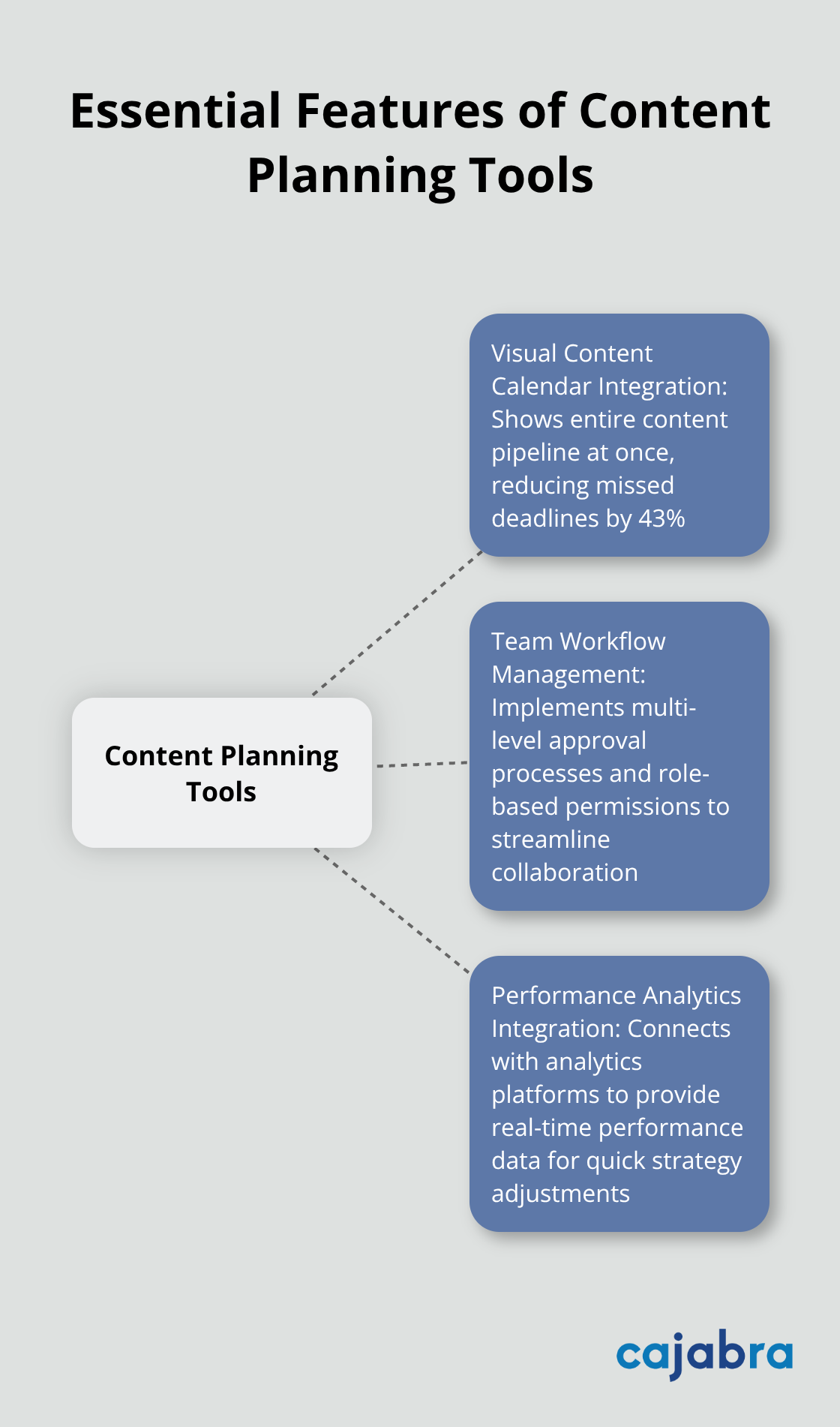

Your content planning tool needs three non-negotiable features that separate winners from time-wasters. Teams that use tools without proper calendar functionality spend 67% more time on coordination tasks. Smart scheduling prevents content gaps and maintains consistent publishing rhythms across channels.

Visual Content Calendar Integration

A robust visual calendar shows your entire content pipeline at once. Teams report 43% fewer missed deadlines when they can drag and drop content between dates. The calendar must display multiple content types simultaneously - blog posts, social media updates, email campaigns, and video content. Tools like Monday.com excel here with color-coded project timelines that prevent scheduling conflicts (starting at $8 per user monthly). Your calendar should integrate with Google Calendar and Outlook to sync with existing workflows. Real-time updates across team members prevent double-booking and content overlaps that waste resources.

Team Workflow Management

Multi-level approval processes eliminate bottlenecks that slow content production. HubSpot's workflow system allows content to move through writer, editor, and manager approval stages automatically. Teams need role-based permissions so freelancers access only assigned projects while managers oversee everything. Notion increased Mangopay's team collaboration to 91% monthly participation when they centralized all content discussions. Comment threads attached to specific content pieces replace endless email chains. Task assignment with deadline notifications keeps projects moving forward without constant check-ins (eliminating up to 10 hours of weekly coordination time).

Performance Analytics Integration

Your tool must connect directly with Google Analytics, social media platforms, and email marketing systems. Buffer's analytics show which content types generate the most engagement within 24 hours of publication. Real-time performance data helps teams adjust strategies quickly rather than wait for monthly reports. ON24 quadrupled their blog output after they implemented centralized tracking that showed exactly which topics drove traffic. The analytics dashboard should display ROI metrics, not just vanity numbers like likes and shares.

These core features form the foundation of effective content planning, but the market offers dozens of tools that claim to deliver them. The next step involves comparing the top platforms to find which one matches your team's specific needs and budget constraints.

Which Tools Deliver Real Results

HubSpot Combines CRM with Content Planning

HubSpot Content Marketing Software connects content performance directly to lead generation and customer acquisition metrics. The platform moves content through approval stages automatically with workflow automation, while their content scoring system ranks ideas based on business impact and resource requirements. Teams using HubSpot complete content approval cycles faster compared to email-based workflows. The free version includes basic content calendar features for up to five users, which makes it accessible for teams that want to test the platform. Advanced analytics and automation features require the Marketing Hub Professional plan at $890 monthly, putting it beyond reach for smaller organizations.

CoSchedule Eliminates Coordination Overhead

CoSchedule saves users hours weekly through their ReQueue feature, which automatically reshares top-performing social media posts. The editorial calendar uses color-codes to organize content by type, status, and team member, providing instant visibility into project bottlenecks. Teams can publish blog posts directly from the interface through WordPress integration. Their Marketing Suite starts at $29 monthly for small teams but scales to $149 for agencies that manage multiple client accounts. The platform works best for teams that publish across multiple channels simultaneously and need centralized campaign management.

Hootsuite Targets Social Media Teams

Hootsuite Content Planning Features serve teams where social media drives the majority of content marketing efforts. The platform supports bulk upload capabilities for high-volume posting across all major social networks. Their content curation tools suggest topics based on industry keywords and competitor analysis. The analytics dashboard tracks engagement metrics in real-time, helping teams identify optimal posting times and content formats. However, Hootsuite lacks robust blog content planning features and email marketing integration that other platforms provide (starting at $99 monthly for larger businesses with limited collaboration features on lower-tier options).

Each platform excels in specific areas, but selecting the right tool requires more than feature comparison. The implementation strategy determines whether your team actually adopts the new system or abandons it within the first month. Success depends on measuring content marketing ROI and tracking performance metrics that align with your business goals.

How to Implement Your Content Planning Tool Successfully

The first 30 days determine whether your team adopts the new platform or abandons it for familiar spreadsheets. Start by mapping your current content creation process from idea generation to publication. Document every step your team takes currently, including who approves what and when deadlines typically occur.

Teams that skip this mapping phase experience higher tool abandonment rates. Import your existing content calendar into the new platform immediately rather than starting fresh. This gives your team familiar reference points while they learn new features.

Configure approval workflows to match your current hierarchy exactly. Forcing new processes during tool adoption creates unnecessary resistance that derails implementation success.

Roll Out Features Gradually

Roll out platform features weekly rather than overwhelming your team with everything simultaneously. Week one should focus solely on calendar navigation and basic content scheduling. Week two introduces collaboration features like comments and task assignments.

Teams that use this phased approach report 60% faster platform mastery compared to comprehensive training sessions. Create video tutorials for each feature using your actual content examples rather than generic demonstrations.

Monday.com users who receive role-specific training complete projects faster than those getting general platform overviews. Assign power users within each department who can answer questions without involving management constantly.

Measure Time Savings Over Feature Usage

Track time savings rather than feature usage statistics during the first quarter. Document how long content approval cycles take before and after implementation. Successful teams see approval times drop from 5-7 days to 2-3 days within 60 days of proper implementation.

Monitor content publishing consistency by tracking missed deadlines and last-minute rushes. The most important metric involves content performance improvements (track whether your published content generates more engagement and conversions than pre-tool content).

Teams that focus on business impact metrics rather than platform usage data make better optimization decisions and justify their tool investment to leadership more effectively. Consider implementing content marketing KPIs to track your progress systematically.

Final Thoughts

The right content marketing planning tool transforms chaotic workflows into streamlined systems that save 21 hours weekly. Visual calendars, team collaboration features, and performance analytics form the foundation of effective content planning software. Small teams under 10 people benefit most from CoSchedule's affordable pricing and automated resharing capabilities, while growing businesses need HubSpot's CRM integration to connect content performance with lead generation metrics.

Large organizations require Hootsuite's bulk publishing features for high-volume social media management. Implementation success depends on gradual feature rollouts and measuring time savings rather than usage statistics (teams that map existing workflows before switching platforms achieve 60% faster adoption rates). Your content marketing planning tool investment pays dividends when it reduces approval cycles from seven days to three days while maintaining publishing consistency.

We at Cajabra, LLC help accounting firms implement systematic marketing approaches that generate consistent client acquisition. Our specialized marketing services move accountants from overlooked to overbooked through proven systems and automated workflows. Start your tool selection by identifying your team's biggest time-wasting activities, then choose the platform that addresses those specific pain points most effectively.

AI content planning is reshaping the digital landscape, offering unprecedented opportunities for businesses to create engaging and targeted content at scale.

At Cajabra, LLC, we've seen firsthand how effective AI content strategies can transform marketing efforts and drive results.

This guide will walk you through the essential steps to plan your AI content effectively, from setting clear goals to implementing robust workflows.

What Are Your AI Content Goals?

Pinpoint Your Audience's Pain Points

Successful AI content planning starts with a clear understanding of your goals. This foundational step shapes every aspect of your strategy, from tool selection to content creation.

Start by identifying your target audience's needs. AI target audience tools use advanced technology to take out the heavy lifting of reaching your ideal market and increasing revenue. For example, if you're an accounting firm targeting small businesses, you might discover that your audience struggles with cash flow management during tax season. This insight can guide your AI content to address specific pain points, making it more valuable and engaging.

Set Measurable Content Objectives

Specific goals lead to specific results. Try to set concrete, measurable objectives for your AI-generated content. For instance, you might aim to become the go-to source in a niche topic or secure the majority of AI citations for a specific topic or industry. These concrete goals will help you track progress and adjust your strategy as needed.

Integrate AI Content into Your Marketing Funnel

Your AI content shouldn't exist in isolation. It needs to fit seamlessly into your overall marketing strategy. Map out your customer journey and identify where AI-generated content can have the most impact. For example, use AI to create personalized email sequences for nurturing leads or develop a series of blog posts that address common objections in the decision-making phase.

Align AI Content with Brand Voice

Ensure that your AI-generated content aligns with your brand's unique voice and tone. This consistency (across all marketing channels) helps build trust and recognition with your audience. Provide clear guidelines and examples to your AI tools to maintain this consistency.

Optimize for Search Engines

While creating content for your audience is paramount, don't forget about search engines. Use AI tools to conduct keyword research and optimize your content for SEO. This approach will help your content reach a wider audience and drive organic traffic to your site.

Now that you've established clear goals for your AI content strategy, it's time to explore the tools that will help you achieve these objectives. Let's move on to choosing the right AI platforms for your content creation needs.

Which AI Tools Will Elevate Your Content Strategy?

Pinpoint Your Content Requirements

Before you explore AI tools, identify your specific content needs. Do you require assistance with blog posts, social media content, or email campaigns? Some tools excel in particular areas. Jasper.AI offers versatility for various content types, while Copysmith focuses on e-commerce copy. Select tools that align with your content objectives.

Check Integration and Workflow Compatibility

The ideal AI tool fits seamlessly into your existing workflow. Look for platforms that integrate with your current content management system, SEO tools, and analytics software. For example, if you use WordPress, consider AI tools like Frase or MarketMuse (which offer direct WordPress integration). This compatibility can reduce manual work and streamline your content production process.

Evaluate Customization and Learning Capabilities

AI tools aren't universal solutions. The ability to customize outputs and train the AI on your brand voice proves invaluable. GPT-3 based platforms offer high levels of customization but may require more setup time. Specialized tools like Phrasee for email subject lines might provide quicker results for specific tasks. Balance the trade-offs between customization and ease of use based on your team's technical expertise.

Consider Industry-Specific Solutions

For accounting firms seeking AI-powered marketing services, Cajabra, LLC offers the JAB System™. This system transforms how accountants approach their marketing, aiming to move them from overlooked to overbooked in just 90 days. While other AI tools offer general content creation, our system addresses the unique challenges and opportunities in the accounting industry.

Test and Monitor Performance

Try a trial period to test the tool's effectiveness for your specific needs. Monitor key metrics like content quality, production time, and engagement rates to ensure the AI tool delivers real value to your content strategy. (This approach helps you make data-driven decisions about which tools to incorporate long-term.)

Now that you've selected the right AI tools for your content strategy, it's time to develop a robust workflow that maximizes their potential. Let's explore how to create an efficient content creation process that leverages AI while maintaining quality and brand consistency.

How to Create an Efficient AI Content Workflow

Map Your Content Creation Journey

Start by outlining your content creation process from idea generation to publication. Identify the stages where AI can provide the most value. For example, use AI for initial topic research and outline creation. This approach can reduce time to build AI applications by up to 50%.

Establish clear guidelines for AI usage. Determine which tasks suit AI and which require human expertise. AI excels at generating data-driven content and initial drafts, while humans add nuance and emotional appeal.

Assign Clear Roles and Responsibilities

Designate specific roles within your team to manage different aspects of the AI content workflow. Appoint an AI prompt engineer to craft effective prompts and refine AI outputs. Select content editors to review and enhance AI-generated drafts, ensuring alignment with your brand voice and quality standards.

Create a content calendar that outlines topics, deadlines, and responsible team members. Tools like Trello or Asana can help manage this process effectively. A study revealed that marketers who proactively plan their marketing are 331% more likely to report success than their peers.

Implement Strong Quality Control Measures

Establish a multi-step review process to maintain content quality. Begin with an initial AI-generated draft, followed by human editing for accuracy, tone, and brand alignment. Use plagiarism detection tools to ensure originality, as AI can sometimes produce content similar to its training data.

Implement a scoring system for AI-generated content. Rate outputs based on relevance, accuracy, and engagement potential. This approach helps refine your AI prompts over time and improves overall content quality.

Create an Efficient Approval System

Set up a streamlined approval process to avoid bottlenecks. Use collaboration tools like Google Docs or Notion for real-time editing and feedback. Configure automated notifications to alert team members when content is ready for review or approval.

Establish clear criteria for content approval, including SEO requirements, brand guidelines, and factual accuracy. This clarity speeds up the review process and ensures consistency across all content pieces.

Continuously Refine Your Workflow

Monitor the performance of your AI content workflow regularly. Track metrics such as content production speed, quality scores, and engagement rates. Use these insights to identify areas for improvement and optimize your process.

Try to foster a culture of continuous learning within your team. Encourage team members to share insights and best practices for working with AI tools. This collaborative approach will help you stay at the forefront of AI content creation techniques and create an effective strategy that resonates with your target audience and delivers measurable results.

Final Thoughts

AI content planning transforms marketing strategies for businesses. It enhances human creativity rather than replaces it, striking a balance between AI-generated content and human oversight. AI handles data analysis and initial drafts, while humans add nuance and brand authenticity. (This combination leads to more engaging and impactful content.)

The field of AI evolves rapidly, with new tools and techniques emerging regularly. Continuous learning and adaptation prove essential for success in AI content planning. Experimentation, result monitoring, and strategy adjustments based on performance data and audience feedback drive improvement.

At Cajabra, LLC, we offer the JAB System™ for accounting firms to leverage AI-powered marketing strategies. This system helps accountants transform their online presence and secure retainer-based clients. AI content planning becomes a powerful asset in your marketing arsenal when you keep your audience's needs at the forefront.

Podcasting has exploded in popularity, with millions of shows vying for listeners' attention. At Cajabra, LLC, we know that standing out requires more than just hitting record and hoping for the best.

A well-crafted podcast content plan is the secret weapon that can elevate your show from amateur to professional. This guide will walk you through the essential steps to create a content strategy that keeps your audience coming back for more.

Table of Contents

- Who Is Your Podcast For?

- How Do You Generate Compelling Episode Ideas?

- How to Structure a Compelling Podcast Episode

- Final Thoughts

Who Is Your Podcast For?

Find Your Niche

At Cajabra, LLC, we've observed that podcasts often falter when they attempt to appeal to everyone. A successful podcast requires a laser-focused audience. Ask yourself: What unique perspective can you offer? You might be an accountant who excels at explaining complex tax laws in simple terms. Or perhaps you're a history enthusiast passionate about untold stories of local heroes. Your niche should combine your expertise with your passion.

A 2023 study by Edison Research revealed that 41% of monthly podcast listeners tune in to shows that teach them something new. This statistic underscores the importance of bringing valuable, specialized knowledge to your audience.

Know Your Audience Inside Out

After you identify your niche, it's time to understand your potential listeners. Use social media listening tools to track conversations related to your topic. Join online forums and Facebook groups where your target audience congregates. Pay attention to the questions they ask and the problems they face.

Create Listener Personas

Take your research and create listener personas. These are fictional representations of your ideal listeners. Give them names, jobs, and backstories. Consider their goals, challenges, and how your podcast fits into their daily lives.

For example, if you're creating a podcast about personal finance for millennials, one of your personas might be "Sarah, a 28-year-old marketing manager who wants to buy her first home but struggles with student loan debt."

These personas will provide a clear picture of who you're addressing every time you record. This approach will make your content more focused, relatable, and valuable to your listeners.

Tailor Your Content

With your niche defined and personas created, you can now tailor your content to meet your audience's specific needs. Try to address their pain points, answer their questions, and provide solutions to their challenges. This targeted approach will set you apart in the crowded podcasting landscape.

Engage with Your Audience

Don't stop at creating personas. Actively engage with your real listeners. Encourage feedback through social media, email, or your podcast's website. This interaction will help you refine your understanding of your audience and continually improve your content.

As you move forward with your podcast planning, the next crucial step is to generate and organize your episode ideas. This process will ensure that you consistently deliver content that resonates with the audience you've now clearly defined.

How Do You Generate Compelling Episode Ideas?

Mind Mapping for Topic Generation

At Cajabra, LLC, we believe the key to a successful podcast lies in its content. To generate compelling episode ideas, start with mind mapping techniques. Place your podcast's main theme in the center and branch out with related subtopics. For example, if your podcast focuses on personal finance for millennials, your branches might include budgeting, investing, debt management, and side hustles.

Content Marketing Institute suggests creating an effective content calendar that easily adapts to new initiatives, centralized planning, and tracking. You can apply this insight to your podcast by transforming your mind map into a structured content plan.

Creating a Content Calendar

Consistency plays a vital role in podcasting. Develop a content calendar that outlines your episodes for at least the next three months. This approach allows you to maintain a regular publishing schedule and gives you time to prepare high-quality content.

Use tools like Trello or Asana to organize your ideas and track your progress. Assign specific dates to each episode topic and include notes on potential guests or resources you'll need.

Diversifying Episode Formats

Variety keeps your podcast fresh and appealing to different listener preferences. Plan for a mix of episode formats:

- Solo episodes: Share your expertise on a specific topic.

- Interviews: Bring in guests to provide new perspectives.

- Q&A sessions: Address listener questions to boost engagement.

- Case studies: Analyze real-world examples related to your niche.

According to Edison Research, 74% of podcast listeners tune in to learn new things. By varying your formats, you cater to this desire for diverse knowledge and keep your content dynamic.

Aligning with Listener Personas

Ensure each episode aligns with your listener personas. For example, if you're targeting "Sarah," the 28-year-old aspiring homeowner, you might plan an interview with a mortgage expert or a solo episode on creative ways to save for a down payment.

These strategies will help you create a content plan that keeps you organized and ensures your podcast delivers value consistently. With a solid foundation of ideas, you're ready to structure your individual episodes for maximum impact (which we'll explore in the next section).

To create content that resonates with your audience, use marketing tools like Google Analytics and social media insights to gather data on your current listeners.

How to Structure a Compelling Podcast Episode

Hook Your Listeners from the Start

The first 30 seconds of your podcast determine whether listeners will stick around. NPR's This American Life, one of the most popular podcasts globally, often starts with a brief, intriguing anecdote related to the episode's theme. This technique, known as a "cold open," immediately captures the listener's attention.

To create an effective hook:

- Ask a provocative question

- Share a surprising statistic

- Tell a short, relevant story

- Tease an exciting reveal later in the episode

For example, a personal finance podcast might start with: "What if I told you that 72% of young adults are taking action to improve their financial health? Today, we'll explore how."

Create Clear and Concise Segments

After you hook your listeners, guide them through your content with clear segments. Each segment should focus on a specific subtopic or point related to your main theme.

A typical 30-minute episode might follow this structure:

- Introduction and hook (2 minutes)

- Main content segment 1 (8 minutes)

- Short break or transition (1 minute)

- Main content segment 2 (8 minutes)

- Guest interview or case study (8 minutes)

- Closing thoughts and call-to-action (3 minutes)

Use transition phrases or short music clips to signal the shift between segments. This helps listeners follow the flow of your content and maintains their attention throughout the episode.

End with Impact and Action

The conclusion of your podcast leaves a lasting impression and encourages listeners to take action.

Effective ways to conclude your episode include:

- Summarize key takeaways

- Provide a clear, actionable step listeners can take

- Tease the next episode to build anticipation

- Invite listeners to engage (e.g., "Share your thoughts on today's topic on our Facebook page")

Include a consistent sign-off phrase. This becomes part of your brand and signals to listeners that the episode is wrapping up.

Maintain Consistency in Structure

While variety in content keeps your podcast fresh, consistency in structure helps listeners know what to expect. Try to maintain a similar format across episodes (while allowing for flexibility when needed).

This consistency applies to:

- Episode length (aim for a consistent duration, give or take a few minutes)

- Segment order (e.g., always start with news, then move to the main topic)

- Regular features (such as a "Listener Question of the Week" segment)

Use Storytelling Techniques

Incorporate storytelling elements to make your content more engaging and memorable. This can include:

- Personal anecdotes related to the topic

- Case studies or examples that illustrate your points

- Analogies or metaphors to explain complex concepts

These techniques help listeners connect emotionally with your content and improve information retention.

Consider transforming a blog post into a podcast episode to diversify your content and cater to different audience preferences. This approach can save time and expand your reach across various content formats.

Final Thoughts

A podcast content plan serves as the foundation for a successful show. We at Cajabra, LLC understand the importance of a strong content strategy in marketing. Your plan should evolve with your show and audience, adapting to feedback and performance insights.

The podcasting landscape changes rapidly, so you must review and update your content plan regularly. Try new topics, formats, and guest speakers to maintain fresh and exciting content. Consistency in publishing schedule and episode structure will help you build a loyal listener base.

As you implement your podcast content plan, focus on delivering value to your listeners with every episode. A solid strategy can transform your podcast into a powerful tool for brand building and audience connection. For more insights on content marketing strategies, explore our resources at Cajabra, LLC.

At Cajabra, LLC, we know that a strong client engagement model is the backbone of any successful accounting firm.

In this post, we'll show you how to create an effective system that keeps your clients happy and your business thriving.

We'll cover everything from understanding client needs to leveraging technology for better communication and service delivery.

What Is a Client Engagement Model?

The Foundation of Client Relationships

A client engagement model forms the strategic framework that guides interactions with clients throughout their journey with an accounting firm. At its core, this model shapes how firms communicate, deliver services, and add value to their client relationships.

Key Components of Effective Engagement

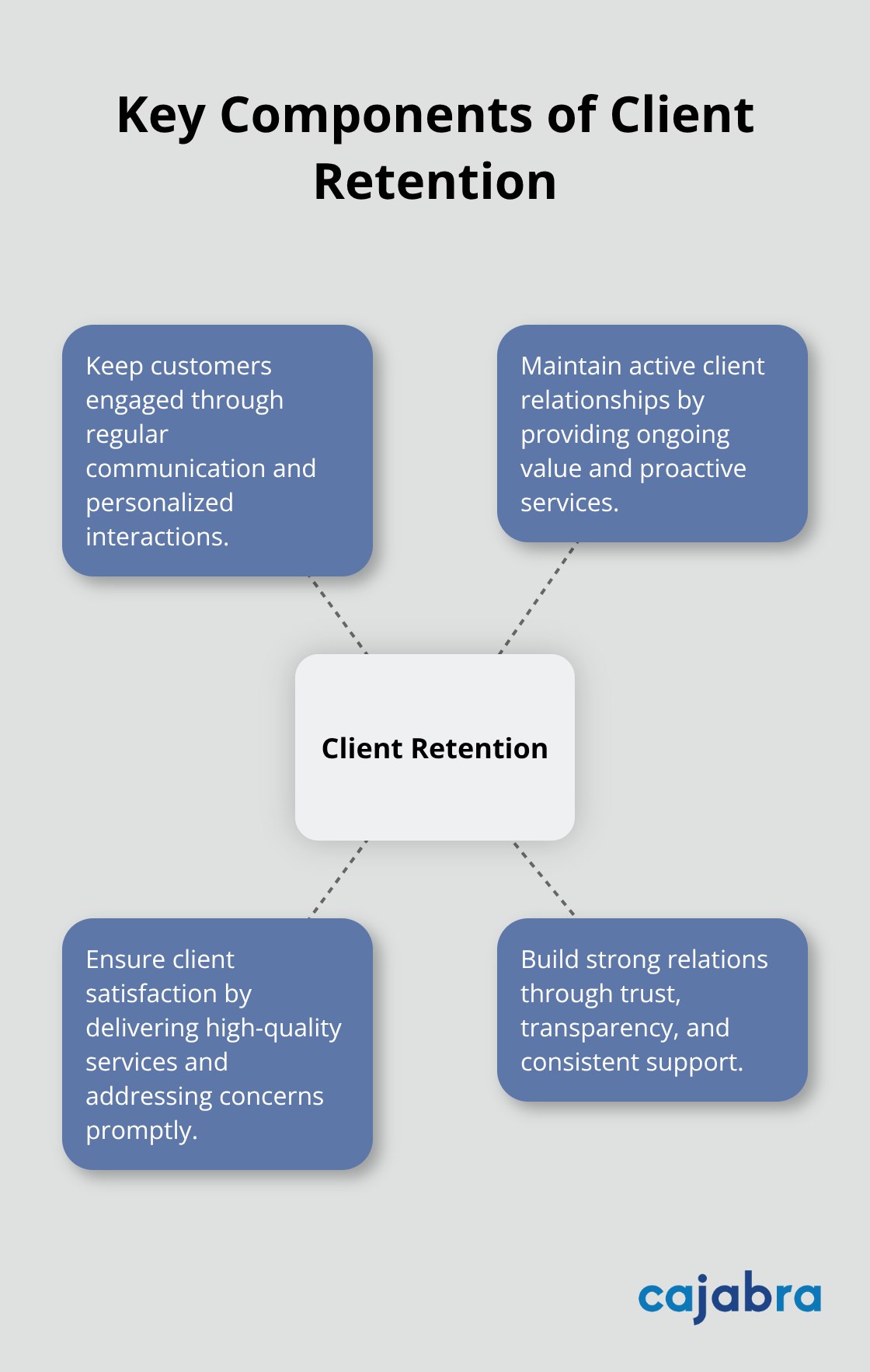

An impactful client engagement model consists of several critical elements:

- Clear Communication Channels: Firms establish dedicated portals and regular check-ins to maintain smooth information flow.

- Personalized Service Offerings: Accounting services are tailored to meet each client's unique needs (no one-size-fits-all approach).

- Proactive Problem-Solving: Firms anticipate and address potential challenges before they escalate into significant issues.

- Continuous Value Addition: Beyond basic accounting, firms provide insights that fuel business growth for their clients.

The Business Case for Strong Engagement

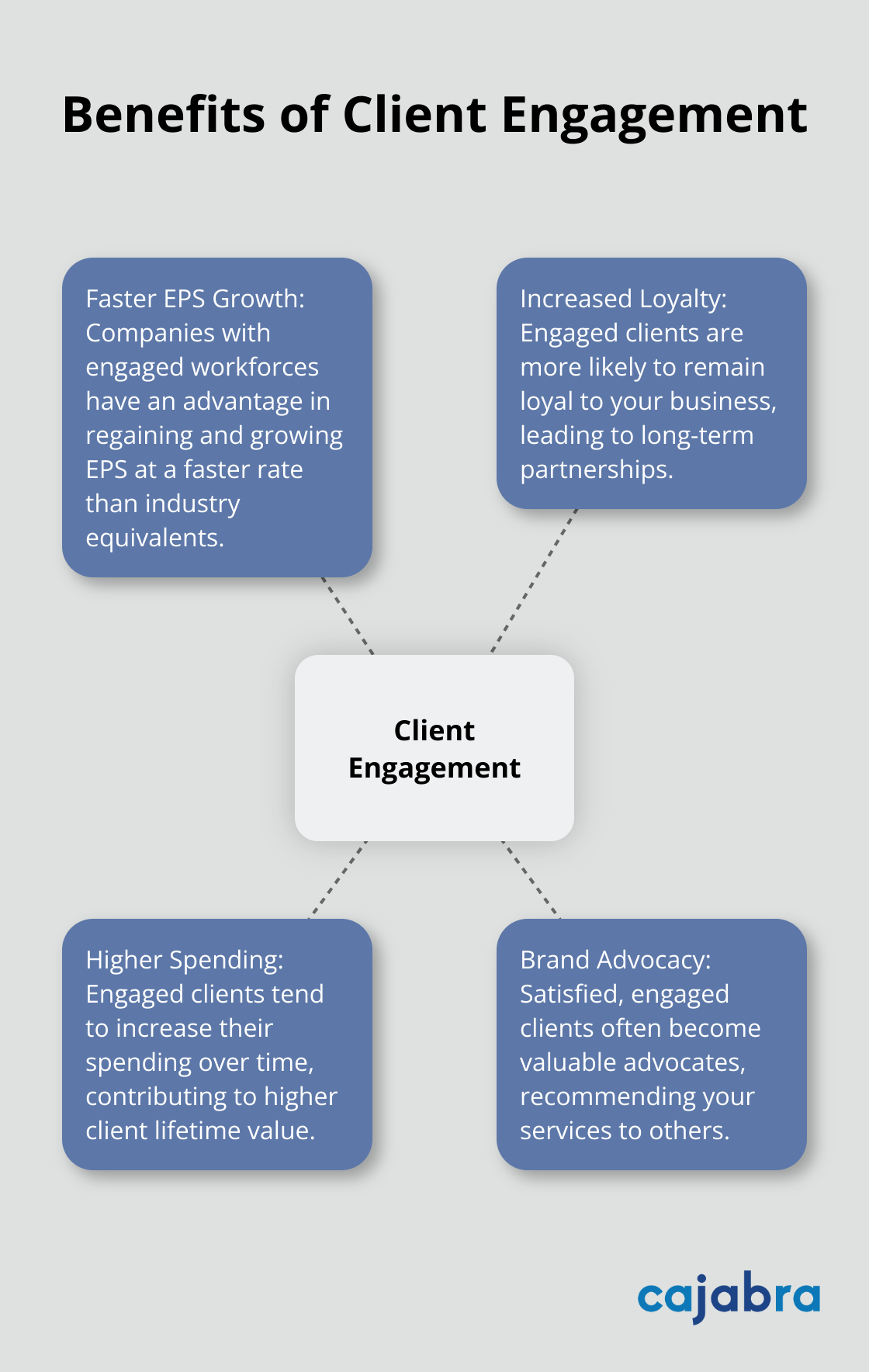

Implementing a robust client engagement model yields substantial benefits. A new report claims that, for the first time ever, marketing to existing customers is exceeding that to new ones. For accounting firms, this translates to:

- Higher Client Retention: Engaged clients tend to remain loyal, reducing churn and stabilizing revenue streams.

- Increased Referrals: Satisfied clients become powerful advocates.

- Expanded Service Opportunities: Engaged clients show more openness to additional services, increasing average revenue per client.

Client Benefits of Effective Engagement

Clients also reap significant advantages from a well-executed engagement model:

- Better Financial Outcomes: Tailored advice leads to improved financial health and decision-making.

- Reduced Stress: Clear communication and proactive problem-solving minimize financial surprises and anxiety.

- Business Growth Support: Strategic advice embedded in the engagement model helps clients scale their businesses effectively.

Technology as an Engagement Enabler

Modern technology plays a pivotal role in enhancing client engagement. Client portals, automated reminders, and data-driven strategies support a more engaging client experience. However, the human touch remains irreplaceable. Regular, personalized check-ins make a significant difference in building lasting relationships.

As we move forward, let's explore how to develop a client-centric approach that forms the heart of an effective engagement model.

How to Put Clients First in Your Accounting Practice

Know Your Clients Inside Out

At Cajabra, LLC, we understand that a client-centric approach transforms accounting firms. It's not just about crunching numbers; it's about understanding the people behind those numbers. Client retention focuses on keeping customers engaged, active, and satisfied over time through quality of service and building strong relations. Start by exploring your clients' businesses in depth. Schedule regular strategy sessions to discuss their goals, challenges, and industry trends. This knowledge allows you to anticipate needs and offer proactive solutions.

For example, if you notice a client's cash flow tightening, don't wait for them to reach out. Contact them with specific strategies to improve their situation. This level of attentiveness sets you apart and cements your role as a trusted advisor.

Tailor Your Communication

One-size-fits-all communication belongs in the past. Some clients prefer detailed monthly reports, while others want quick, actionable insights. Use client management software to track preferences and adjust your approach accordingly.

Try implementing a tiered communication system. For high-touch clients, schedule monthly video calls. For others, perhaps a quarterly check-in suffices. The key is consistency and relevance. Every interaction should add value to your client's business.

Build Relationships Beyond the Numbers

Trust forms the cornerstone of any successful client relationship. To build it, go beyond the balance sheet. Show genuine interest in your clients' personal and professional lives. Mark important dates like business anniversaries or major milestones (these small gestures often make a big impact).

Create opportunities for face-to-face interactions outside of tax season. Host educational workshops or networking events for your clients. These gatherings not only provide value but also strengthen your relationships in a more relaxed setting.

Leverage Technology for Enhanced Client Experience

Modern accounting firms use technology to enhance client relationships. Implement user-friendly client portals for seamless document sharing and communication. Use data analytics tools to provide personalized insights (this can significantly boost your value proposition). Automate routine tasks to free up time for more strategic client interactions.

Accounting practice management software, like Financial Cents, helps firms stay organized, efficient, and on top of every client engagement.

As we move forward, let's explore how technology can further enhance your client engagement model and streamline your accounting practice.

How Technology Boosts Your Client Engagement

At Cajabra, LLC, we've witnessed technology transform client relationships in accounting firms. Let's explore how you can use tech to elevate your client engagement.

Streamline Communication with Client Portals

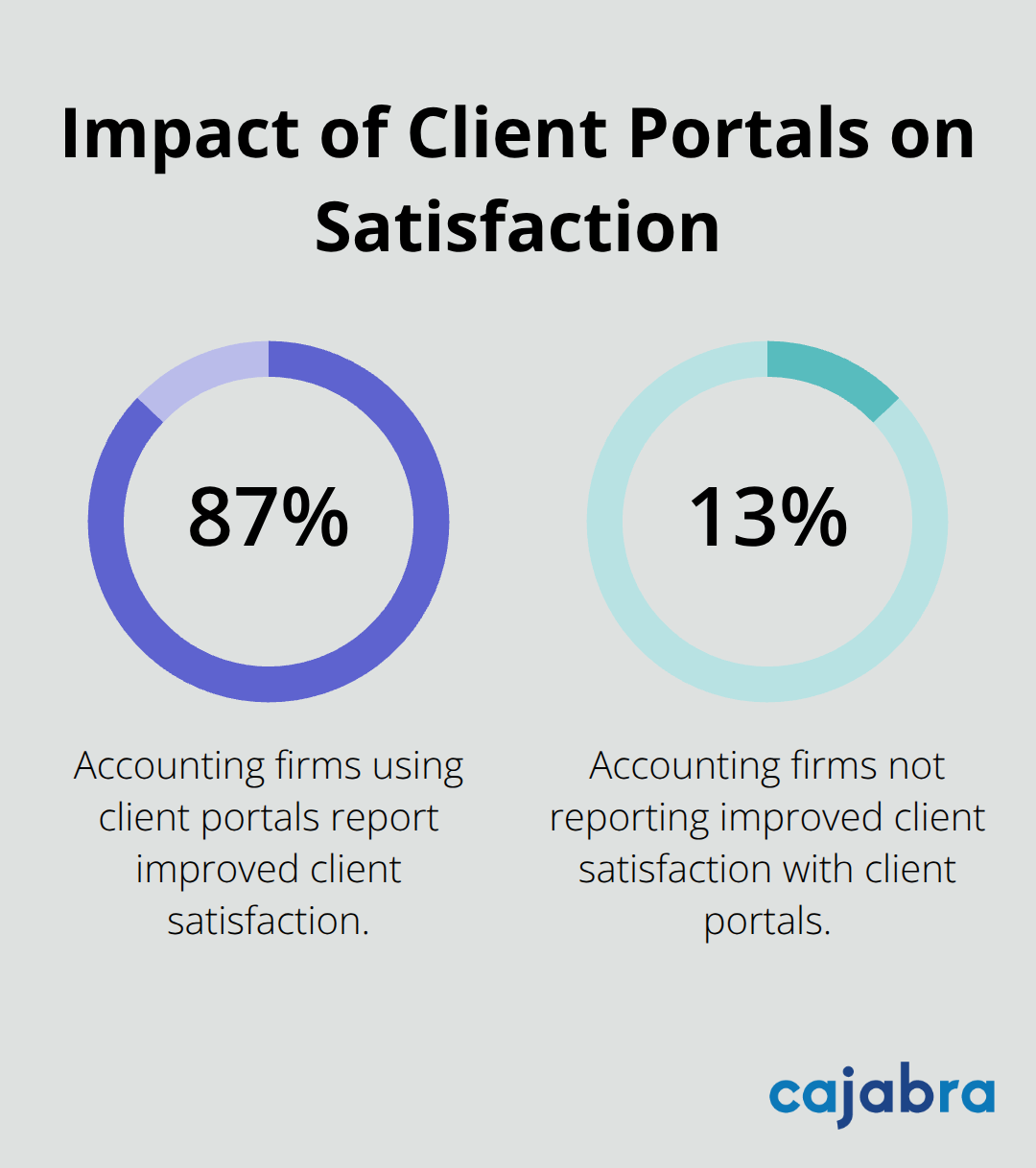

Client portals revolutionize accounting firms. They offer a secure, centralized platform for document sharing, real-time collaboration, and instant messaging. A study shows 87% of accounting firms using client portals report improved client satisfaction.

To maximize portal effectiveness:

- Select a user-friendly interface for easy client navigation.

- Offer mobile access for on-the-go convenience.

- Implement robust security measures to protect sensitive financial data.

- Provide training resources to help clients utilize the portal fully.

Use Data Analytics for Tailored Insights

Data analytics for accountants is the key to unlocking critical business insights, giving your firm the power to improve every aspect of public practice. A recent survey found 85% of accountants believe data analytics will significantly impact the profession in the next five years.

To use data analytics effectively:

- Invest in powerful analytics software that integrates with your existing systems.

- Train your team to interpret data and translate insights into actionable advice.

- Use predictive analytics to forecast financial trends for clients.

- Create customized dashboards that give clients real-time visibility into their financial health.

Automate for Efficiency and Focus

Automation can significantly impact accountants and their work. It allows for more time to focus on high-value client interactions.

To implement automation strategically:

- Start with routine tasks like data entry, invoice processing, and report generation.

- Use AI-powered tools for error detection and compliance checks.

- Set up automated reminders for deadlines and important dates.

- Explore chatbots to handle basic client queries outside of business hours.

Enhance Client Experience with Virtual Meetings

Virtual meeting platforms have become essential for maintaining strong client relationships. They offer flexibility and convenience, especially for clients with busy schedules.

Try to:

- Use high-quality video conferencing tools for clear communication.

- Share screens to walk clients through complex financial reports.

- Record meetings (with client permission) for future reference.

- Offer virtual workshops or webinars to provide additional value to clients.

Final Thoughts

An effective client engagement model transforms accounting firms. It builds stronger relationships, increases retention, and expands service opportunities. Clear communication, personalized services, proactive problem-solving, and continuous value addition form the core of this model. Technology enhances these elements, enabling more efficient and valuable services.

Accounting firms must adapt their strategies to meet changing client needs. Regular feedback and industry trend monitoring help maintain relevance. Flexibility ensures firms remain valuable partners in an evolving business landscape. These principles position firms as trusted advisors, not just service providers.

We at Cajabra specialize in elevating marketing and client engagement strategies for accounting firms. Our JAB System™ aims to transform how accountants attract and retain clients (moving them from overlooked to overbooked in 90 days). Start implementing these strategies today to watch your client relationships and business thrive.

LinkedIn has become a powerhouse for professional networking and business growth. At Cajabra, LLC, we've seen firsthand how a well-crafted LinkedIn content plan can drive engagement and boost brand visibility.

In this post, we'll share our proven strategies for creating an effective LinkedIn content plan that resonates with your audience and aligns with the platform's algorithm. Get ready to transform your LinkedIn presence and achieve your business goals.

How LinkedIn's Algorithm Works: Maximizing Your Content's Impact

The Engagement Factor

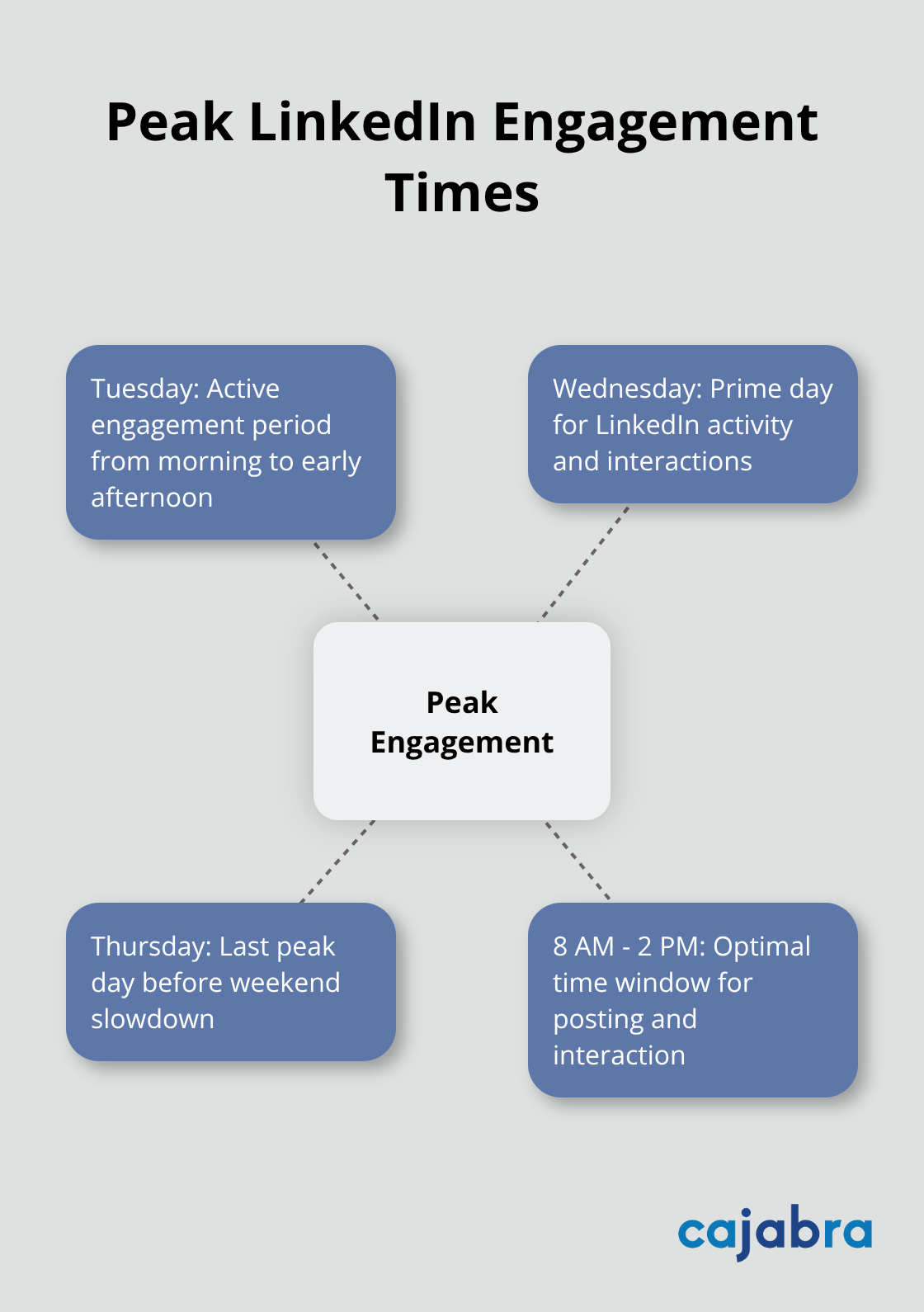

LinkedIn's algorithm prioritizes posts that generate rapid engagement. Posts that receive strong interaction in the first hour will be shown to second- and third-degree connections more frequently. To maximize impact, post when your audience is most active. Data indicates that Tuesday through Thursday, between 8 AM and 2 PM, typically yield the highest engagement rates.

Content Types That Excel

LinkedIn supports various content formats, but certain types consistently outperform others. Text-only posts with thought-provoking questions or insights often generate more engagement than image or video posts. However, when using visuals, infographics and data visualizations tend to perform exceptionally well, especially for B2B content.

The Importance of Dwell Time

LinkedIn's algorithm considers "dwell time" - how long users spend viewing your post. The platform is placing more weight on dwell time, meaning posts that keep users engaged for longer will see better distribution. Posts that provide enough depth to hold attention without becoming overwhelming are likely to perform well.

Strategic Hashtag Use

Using relevant hashtags can significantly increase your post's reach. Research indicates that posts with 3-5 targeted hashtags perform best. However, avoid overusing trending hashtags that aren't directly related to your content, as this can negatively impact your post's performance.

Adapting to Algorithm Changes

LinkedIn's algorithm evolves constantly. What works today might not be as effective tomorrow. This dynamic nature of the platform necessitates continuous monitoring and strategy adjustments to maximize your content's reach and impact.

Now that we understand how LinkedIn's algorithm works, let's explore how to develop a content strategy that aligns with these insights and drives real results for your business.

Crafting Your LinkedIn Content Strategy

Define Clear LinkedIn Objectives

Set specific, measurable goals for your LinkedIn presence. Do you want to generate leads, increase brand awareness, or establish thought leadership? For instance, you might target a 20% increase in profile views or 50 new qualified leads per month. These precise objectives will guide your content decisions and provide benchmarks for success measurement.

Analyze Your LinkedIn Audience

Use LinkedIn's audience insights tool to analyze and identify target audiences and their interests. This tool provides valuable insights into your followers, including demographics, job titles, and industries. If your target audience consists of CFOs in the tech sector, create content that addresses their unique challenges and interests. This focused approach can significantly boost engagement rates.

Create a Comprehensive Content Calendar

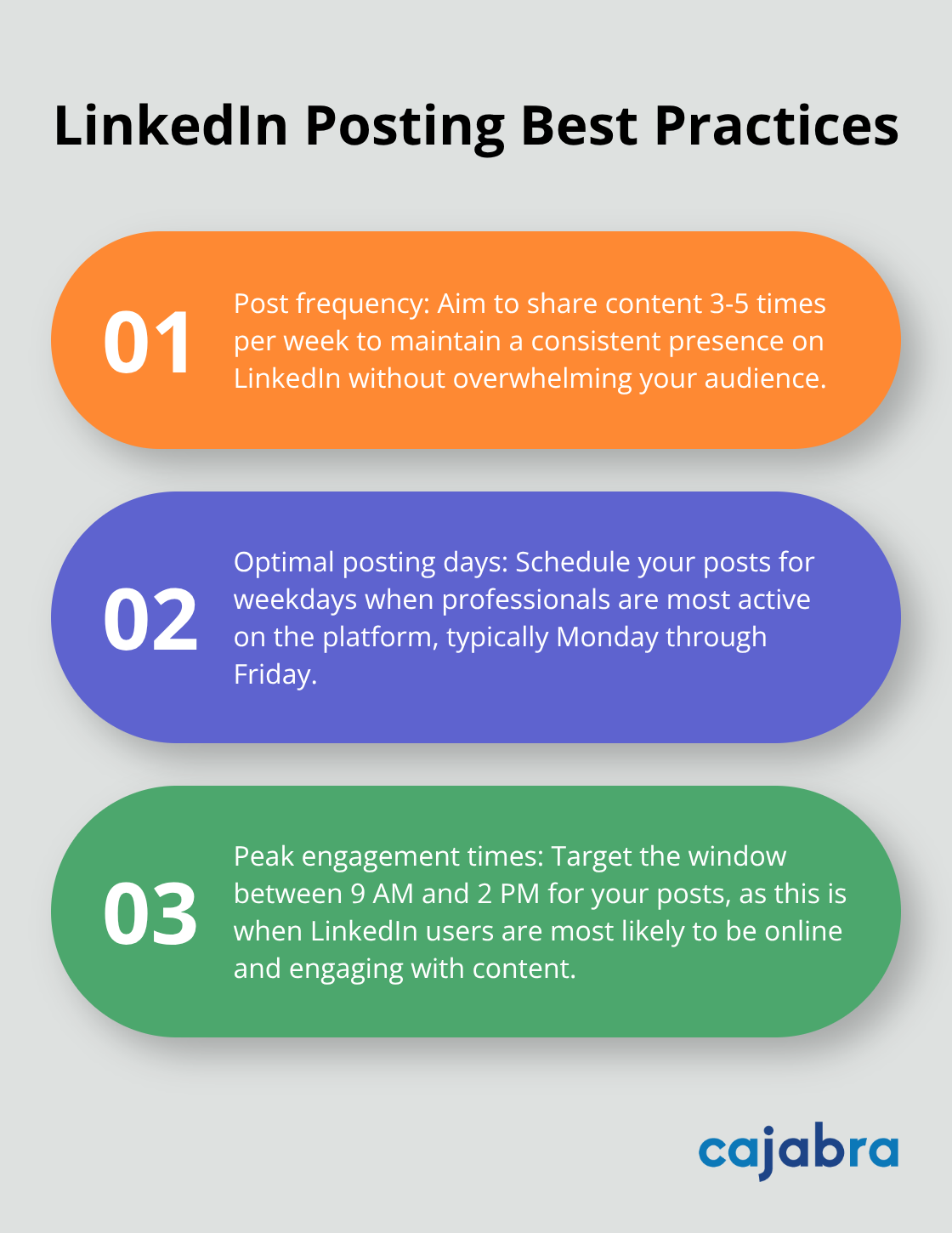

Develop a well-structured content calendar for consistency. Plan your content at least a month in advance. Include various content types: industry news, company updates, employee spotlights, and thought leadership pieces. Try to post 3-5 times per week, and schedule during peak engagement times (typically weekdays between 9 AM and 2 PM).

Balance Value and Promotion

Apply the 80/20 rule to your LinkedIn content: 80% value-driven content and 20% promotional. Value-driven content might include industry insights, how-to guides, or expert opinions. For promotional content, showcase client success stories or highlight unique aspects of your services.

Monitor and Adjust Your Strategy

Review your strategy regularly based on performance metrics. LinkedIn's analytics offer valuable insights into what resonates with your audience. This data-driven approach allows you to refine your content strategy continually.

With a solid LinkedIn content strategy in place, the next step is to master the art of content creation. Let's explore best practices for crafting engaging LinkedIn posts that capture attention and drive meaningful interactions.

How to Craft Compelling LinkedIn Content

At Cajabra, LLC, we've refined our LinkedIn content creation skills to maximize engagement and drive results. Here's how you can elevate your LinkedIn presence with content that captivates and converts.

Hook Your Audience Instantly

Your post's opening line must pique curiosity or offer immediate value. "We increased our client's revenue by 300% using this unconventional LinkedIn strategy" compels more than "Here's a post about LinkedIn marketing."

A LinkedIn study found that posts with strong opening lines see 20% higher engagement rates. Use questions, surprising statistics, or bold statements to grab attention. "Did you know that 80% of B2B leads come from LinkedIn?" serves as an effective opener.

Harness the Power of Visual Storytelling

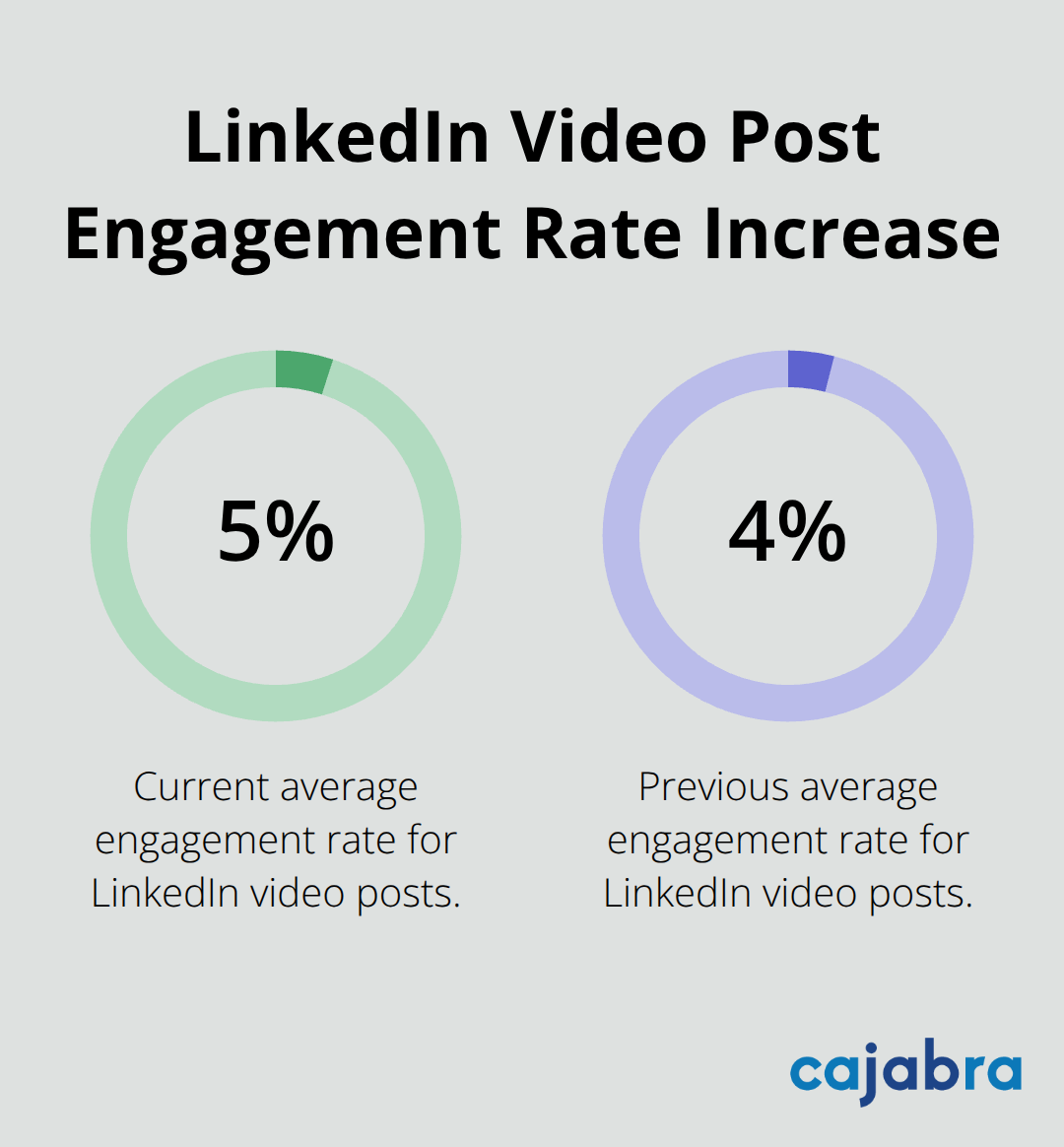

Video posts now sit at a 5.60% average LinkedIn engagement rate, showing a significant increase from 4.00%. This surge reflects how much the quality and relevance of visual content matter on the platform.

When you create visuals, focus on clarity and relevance. A well-designed chart explaining industry trends or a behind-the-scenes video of your team in action can significantly boost engagement. LinkedIn's algorithm favors native video content over external links.

Write Copy That Sparks Conversation

LinkedIn's algorithm performs best when you post between 8-10 AM and 12-2 PM. Craft your content to encourage comments and shares. Ask thought-provoking questions, request opinions on industry trends, or challenge common assumptions.

Instead of stating "AI is changing marketing," ask "How has AI transformed your marketing strategy in the past year?" This approach invites your network to share their experiences, fostering a dialogue that extends your post's reach.

Leverage LinkedIn's Unique Features

LinkedIn offers several native features that can amplify your content's impact. Polls have seen a 500% increase in usage since their introduction and typically generate 5x more engagement than standard posts.

Document sharing is another powerful tool. Uploading PDFs or slideshows directly to LinkedIn results in 3x more click-throughs compared to standard links. Use this feature to share industry reports, case studies, or how-to guides.

Live video gains traction, with LinkedIn reporting 7x more reactions and 24x more comments compared to native video uploads. Consider hosting live Q&A sessions or industry discussions to boost real-time engagement.

Maintain Consistency and Analyze Performance

Try to post regularly (3-5 times per week) and continually analyze your performance to refine your approach over time. Use LinkedIn's analytics tools to track engagement rates, follower growth, and post reach. This data-driven approach allows you to identify what resonates with your audience and adjust your content strategy accordingly.

Final Thoughts

An effective LinkedIn content plan requires strategic thinking and consistent effort. You must understand LinkedIn's algorithm, develop a targeted content strategy, and implement best practices for content creation. This approach will enhance your brand's visibility and engagement on the platform significantly.

Success on LinkedIn doesn't happen instantly. You should post consistently and maintain high content quality. Try different content types, formats, and posting times to find what resonates with your audience. LinkedIn's built-in analytics tools will help you track engagement rates, follower growth, and post reach.

We at Cajabra have witnessed how a well-executed LinkedIn content plan can transform an accounting firm's online presence. Our specialized marketing services for accountants use LinkedIn's power to boost firms' visibility. Implement these strategies to establish a strong LinkedIn presence that drives real business results.

At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

A well-crafted client engagement plan is key to building and maintaining these relationships. It helps you understand your clients' needs, set clear goals, and deliver exceptional service.

In this post, we'll show you how to create an effective client engagement plan that will boost client satisfaction and drive your firm's growth.

What Is a Client Engagement Plan?

Definition and Purpose

A client engagement plan serves as a strategic roadmap for accounting firms. It outlines how a firm will interact with, serve, and retain clients. This plan isn't just a nice-to-have; it's essential for any firm that aims to grow and improve client satisfaction.

Key Components of Effective Plans

An effective client engagement plan includes several critical elements:

- Scope of Services: The plan should clearly define the specific deliverables, timelines, and expectations for each client.

- Communication Strategy: It must detail how and when the firm will interact with clients (e.g., monthly check-ins, quarterly reviews, annual planning sessions).

- Feedback Mechanisms: The plan should incorporate methods for gathering and acting on client feedback, such as regular surveys or informal conversations.

- Success Metrics: It's important to include a section on measuring success. The plan should outline the Key Performance Indicators (KPIs) that will track the effectiveness of engagement efforts.

Benefits for Firms and Clients

A well-executed client engagement plan offers tangible benefits for both accounting firms and their clients:

For Firms:

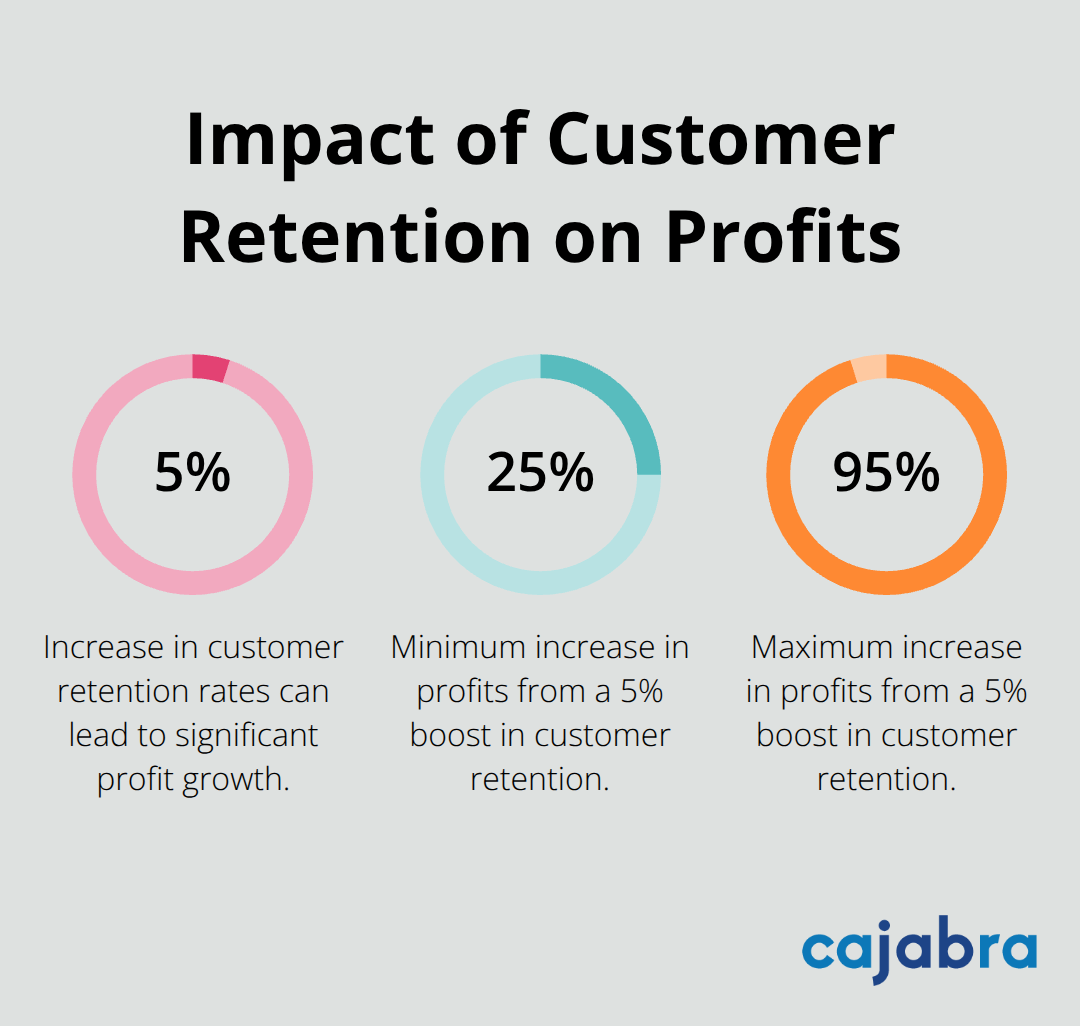

- Increased Revenue: Research by Bain & Company found that increasing customer retention rates by 5% increases profits by 25% to 95%.

- Improved Client Retention: Consistent engagement helps build stronger, longer-lasting client relationships.

For Clients:

- Personalized Service: Clients receive more tailored attention and solutions.

- Clear Communication: Expectations and deliverables are well-defined from the outset.

- Value Understanding: Clients gain a better grasp of the value the firm provides.

A PwC survey revealed that 73% of customers point to experience as an important factor in their purchasing decisions, behind price and product quality. This underscores the importance of a solid engagement plan in attracting and retaining clients.

Tailoring Plans to Your Firm

The most effective client engagement plan is one that aligns with your firm's unique strengths and your clients' specific needs. It's not a one-size-fits-all solution, but a dynamic tool that evolves as your firm grows and your clients' needs change.

Some firms (like Cajabra) incorporate these principles into their service offerings. For example, Cajabra's JAB System™ helps firms focus on retainer-based clients and leverage tools like their Client Optimizer to create engagement plans that drive real results.

As we move forward, let's explore how to develop a comprehensive client engagement strategy that will set your firm apart and drive long-term success.

How to Build a Client-Centric Engagement Strategy

Start with Deep Client Understanding

The foundation of any effective engagement strategy is a thorough understanding of your clients. This goes beyond basic demographics. You need to know their business challenges, growth aspirations, and even personal goals.

One effective method is to conduct annual client surveys. These should include questions about their satisfaction with your services, areas where they need more support, and their business objectives for the coming year. Analyze this data to identify trends and common needs across your client base.

Another powerful tool is client segmentation. Let's explore four alternative segmentation methods that will elevate your advisory services, optimize your operations, and deliver greater value to clients.

Set Measurable Engagement Goals

Once you understand your clients, it's time to set clear, measurable goals for your engagement strategy. These should align with both your clients' needs and your firm's objectives.

For example, if you've identified that many of your clients struggle with cash flow management, a goal might be to increase the number of clients using your cash flow advisory services by 30% over the next six months.

Or, if client retention is a priority, you might set a goal to improve your Net Promoter Score (NPS). According to aggregated data, the average Net Promoter Scores for B2B industries range from 37 to 69, while for B2C, from 16 to 80.

Create a Multi-Channel Communication Plan

Effective client engagement relies on consistent, valuable communication. Develop a plan that outlines how often you'll communicate with clients and through which channels.

Consider implementing a mix of:

- Quarterly business reviews: These in-depth sessions allow you to discuss performance, address concerns, and plan for the future.

- Monthly email newsletters: Share industry insights, tax updates, and firm news to keep clients informed and engaged.

- Social media updates: Use platforms like LinkedIn to share quick tips and showcase your expertise.

- Annual client appreciation events: These face-to-face gatherings can strengthen relationships and foster a sense of community among your clients.

Try to tailor your communication frequency and content to different client segments. High-value clients might appreciate more frequent, personalized touchpoints, while smaller clients might prefer less frequent, more general updates.

Implement Technology for Seamless Engagement

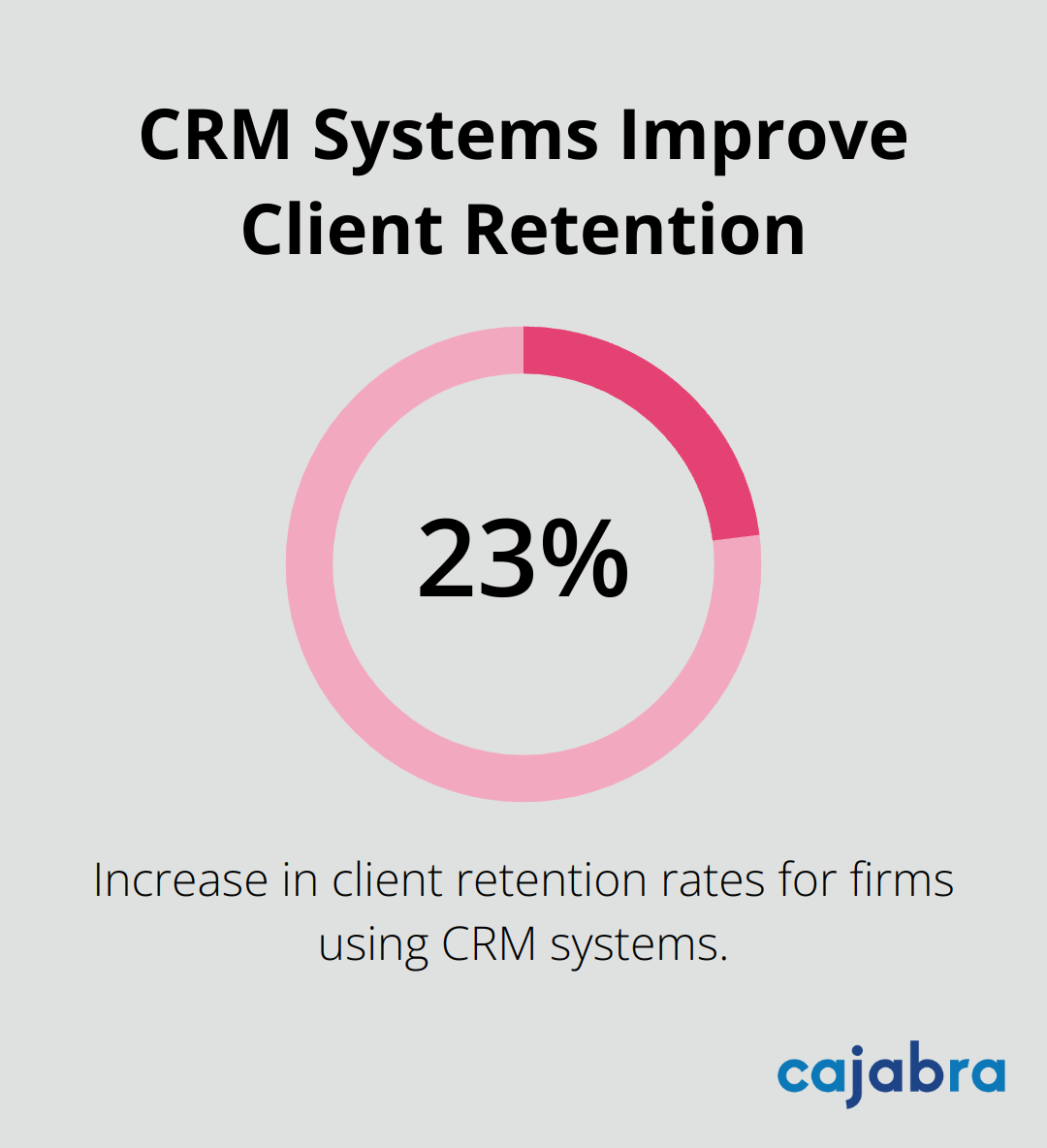

Leverage technology to streamline your engagement efforts and provide a better client experience. A robust Customer Relationship Management (CRM) system can help you track client interactions, set reminders for follow-ups, and personalize your communications.

Client portals are another valuable tool. They provide a secure platform for document sharing and collaboration, enhancing transparency and efficiency in your client relationships.

Some firms dramatically improve their client engagement by implementing tools that help capture ideal clients and enhance online reputation (which are crucial elements of a strong engagement strategy).

The next step in creating an effective client engagement plan involves implementing and monitoring your strategy. This ensures that your plan doesn't just remain a document, but becomes an active part of your firm's operations.

How to Implement Your Client Engagement Plan Effectively

Assign Clear Roles and Responsibilities

A successful client engagement plan requires clear role assignments within your firm. Designate a client engagement champion to oversee the plan's implementation and keep everyone on track. This individual should possess a deep understanding of your clients and your firm's capabilities.

Distribute specific roles to team members:

- Client Relationship Managers: Handle regular check-ins and maintain overall client relationships.

- Advisory Specialists: Identify opportunities for additional services and value-add consultations.

- Data Analysts: Track engagement metrics and provide insights for improvement.

Ensure each team member understands their role in the engagement process. Schedule regular team meetings to reinforce these responsibilities and address any challenges.

Leverage Technology for Streamlined Engagement

Technology plays a pivotal role in client engagement. Here's how to harness tech for better engagement:

- Implement a robust CRM system to track all client interactions and set reminders for follow-ups.

- Use automated email marketing tools to send personalized, timely communications to different client segments.

- Adopt cloud-based collaboration tools for seamless document sharing and real-time communication with clients.

- Invest in data analytics software to gain deeper insights into client behavior and preferences.

The goal is to use technology to enhance (not replace) personal interactions. The right balance of tech and human touch can significantly boost client engagement.

Measure, Analyze, and Adapt

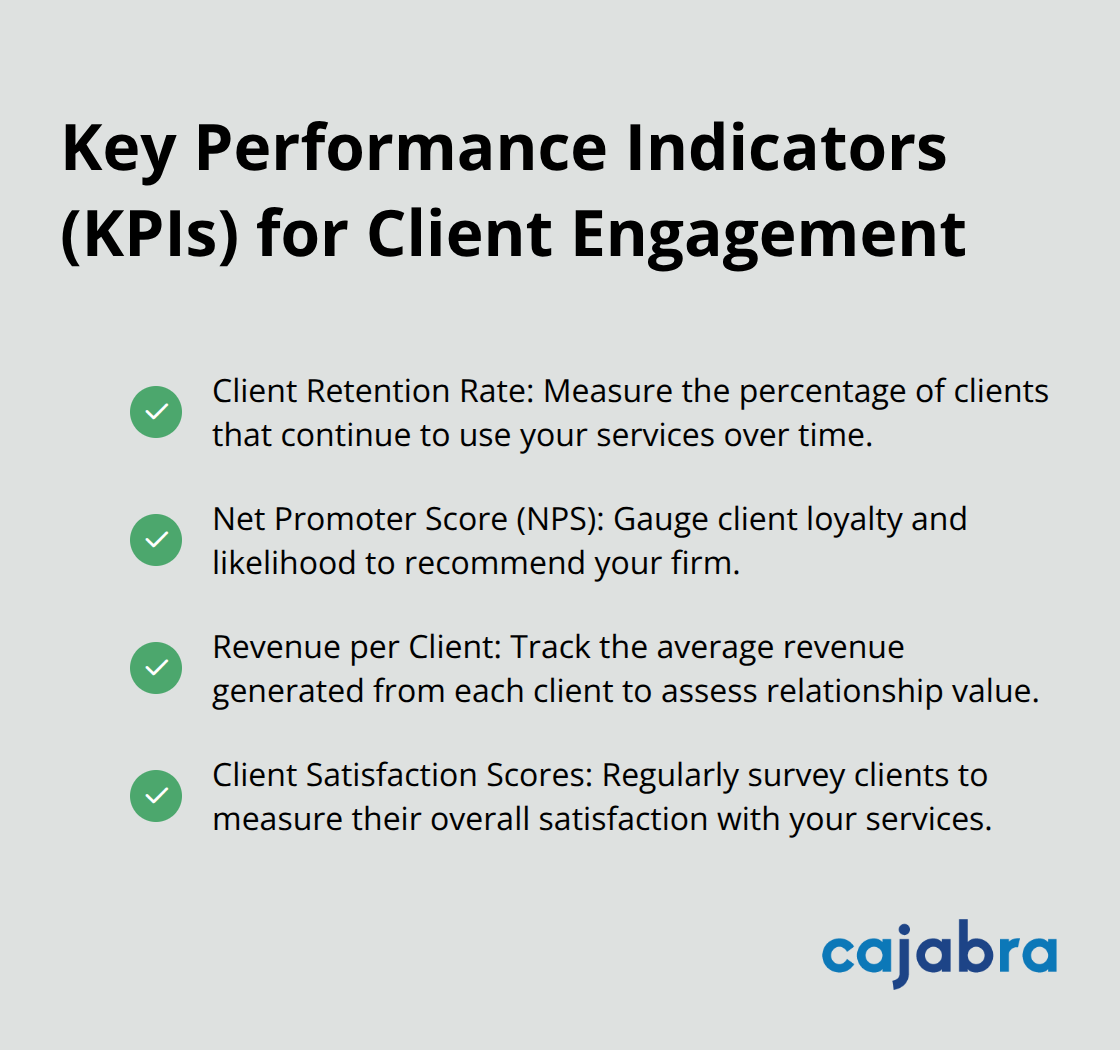

To ensure your engagement plan's effectiveness, track key metrics consistently. Some important KPIs to monitor include:

- Client Retention Rate: Try to achieve a high rate.

- Net Promoter Score (NPS): Aim to exceed industry benchmarks.

- Revenue per Client: Track how this metric changes as you implement your engagement plan.

- Client Satisfaction Scores: Regularly survey clients and aim for high satisfaction scores.

Use these metrics to identify areas for improvement. If certain strategies don't yield results, pivot. The most successful firms continuously refine their approach based on data and feedback.

Foster a Culture of Continuous Improvement

Create an environment where team members feel empowered to suggest improvements to the engagement plan. Encourage open communication and regular brainstorming sessions to identify new ways to enhance client relationships.

Implement a system for collecting and acting on client feedback. This could include regular surveys, post-service follow-ups, or informal check-ins. Use this feedback to refine your engagement strategies and address any pain points in the client experience.

Final Thoughts

An effective client engagement plan transforms accounting firms. It builds strong client relationships, increases retention, and drives revenue growth. Firms must understand client needs, set clear goals, and implement comprehensive strategies to enhance service delivery and satisfaction.

We at Cajabra developed the JAB System™ to help accountants secure retainer-based clients and maximize marketing efforts. Our approach includes tools like the Client Optimizer, which can enhance client engagement strategies and online reputation.

Start implementing your client engagement plan today. You will see results in stronger client relationships, increased revenue, and a more robust accounting practice. Take the first step now and watch your firm transform from overlooked to overbooked.

At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

Client engagement goes beyond just providing services; it's about creating meaningful connections that drive better results for both parties.

In this post, we'll explore practical strategies to increase client engagement and show you how to implement them effectively in your accounting practice.

What Is Client Engagement in Accounting?

Definition and Importance

Client engagement in accounting directly impacts client loyalty, revenue growth, and brand differentiation while improving employee engagement. Effective client engagement can transform accounting practices, as we've observed at Cajabra, LLC.

The Tangible Impact

When clients feel valued and understood, they tend to seek additional services and maintain long-term relationships with your firm.

Key Metrics for Measurement

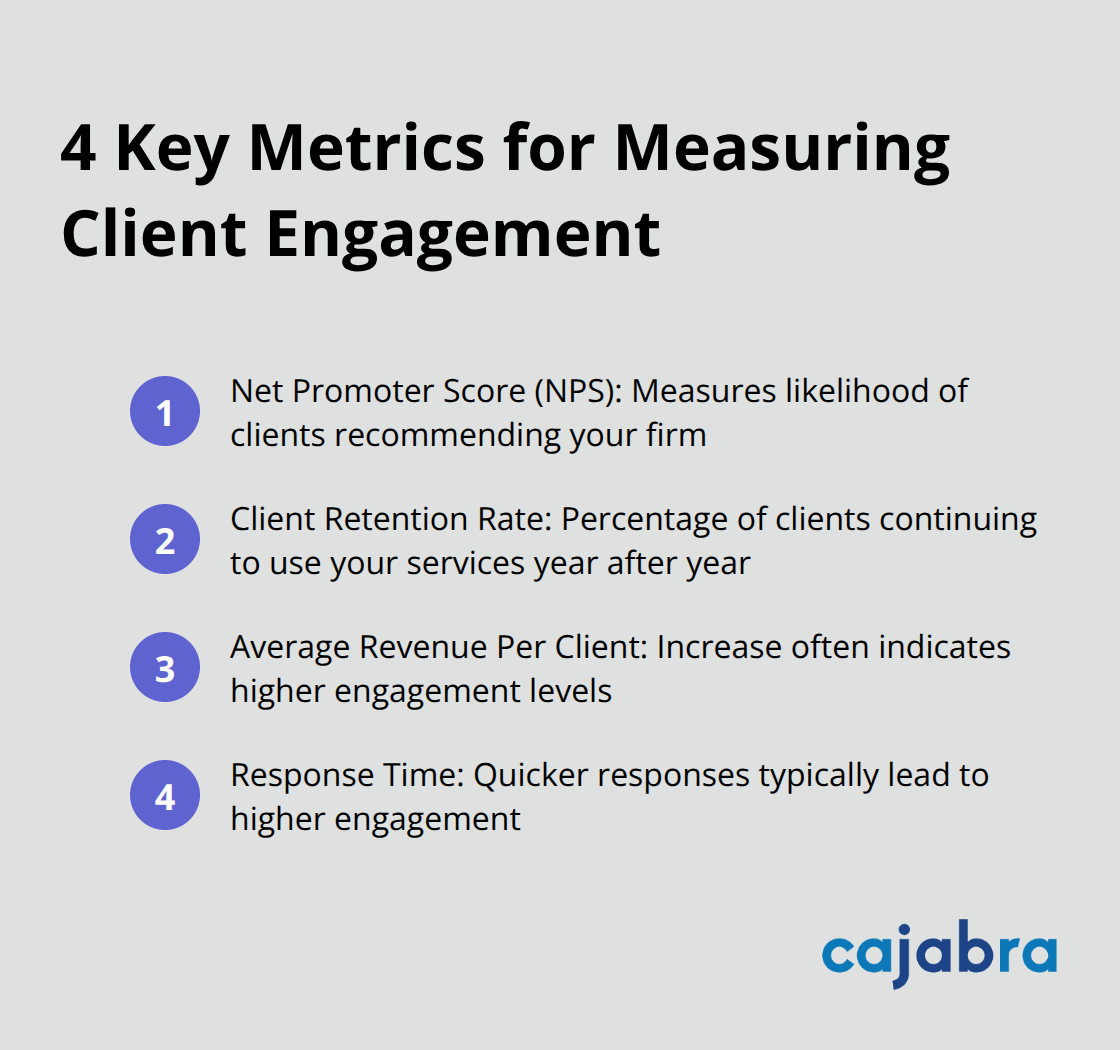

To enhance client engagement, you must measure it. Here are some essential metrics to track:

- Net Promoter Score (NPS): This gauges the likelihood of clients recommending your firm to others. It's calculated by subtracting the percentage of Detractors from the percentage of Promoters.

- Client Retention Rate: The percentage of clients who continue to use your services year after year.

- Average Revenue Per Client: An increase often indicates higher engagement levels.

- Response Time: Quicker responses typically lead to higher engagement.

Effective Engagement Strategies

Personalization is Key

Use data and client surveys to customize your services to each client's specific needs. For instance, if you know a client plans to expand their business, offer proactive guidance on the tax implications of growth.

Active Listening

During client meetings, focus on understanding their concerns and goals. This approach allows you to provide more valuable advice and strengthens the client relationship.

Technology Leverage

Use client portals for easy document sharing and communication. Implement chatbots for quick responses to common questions outside of business hours (this can significantly improve client satisfaction).

Client engagement requires consistent attention and refinement. The next section will explore how to implement these strategies effectively in your accounting practice.

How to Supercharge Client Engagement in Accounting

Personalize Your Communication

One-size-fits-all communication doesn't work in accounting. Use your client management system to track preferences and adapt your approach. Some clients prefer brief, weekly email updates, while others value in-depth quarterly meetings. A Salesforce study found that 81% of consumers say they will reassess their budget over the next 12 months as they seek more personalized experiences – accounting services should be no exception.

Become a Proactive Advisor

Don't wait for clients to bring problems to you. Review their financial data regularly and reach out with insights and recommendations. If you notice a client's cash flow tightening, schedule a call to discuss potential solutions before it becomes a crisis. This proactive approach adds value and positions you as an indispensable partner in their business success.

Use Technology for Seamless Interactions

Modern clients expect smooth, efficient interactions. Implement user-friendly client portals for secure document sharing and real-time collaboration. The goal? Make working with you as effortless as possible.

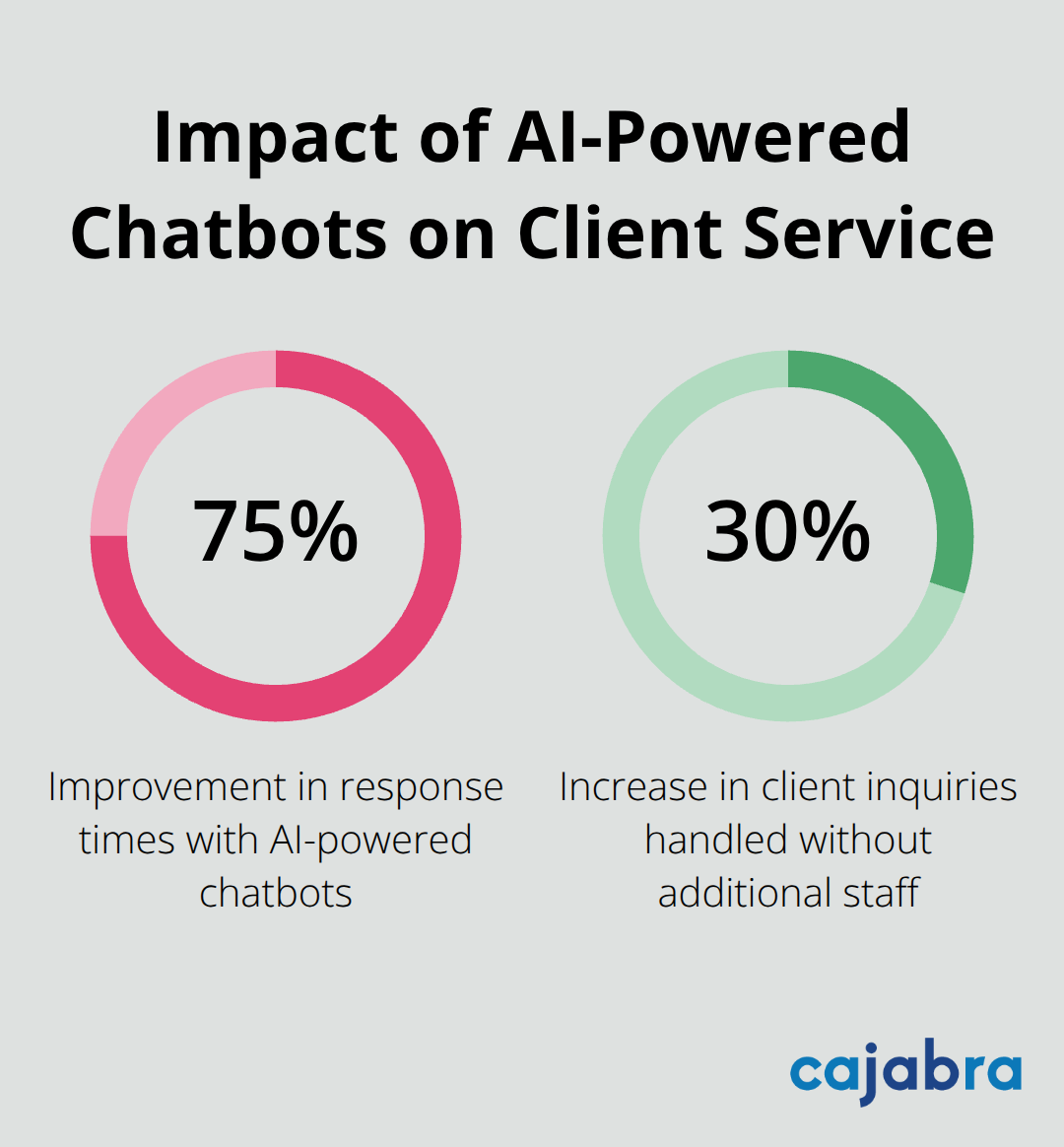

Try AI-powered chatbots to handle routine queries outside business hours. This can improve response times by 75%, enabling firms to handle 30% more client inquiries without additional staff. This ensures your clients get immediate responses, improving their overall experience with your firm.

Educate and Empower Your Clients

Knowledge empowers clients and boosts engagement. Host monthly webinars on relevant topics like tax planning strategies or cash flow management. Create a resource library on your website with easy-to-understand guides and videos explaining complex accounting concepts.

Fulfilling this desire for knowledge increases engagement and demonstrates your expertise and value.

Implement a Structured Engagement Program

To systematically enhance client engagement across your firm, create a structured program. This program should include regular check-ins, personalized communication strategies, and a system for tracking and analyzing engagement metrics.

The next section will explore how to develop and implement such a program effectively, ensuring that your entire team is aligned in delivering exceptional client experiences.

How to Build a Winning Client Engagement Program

Assess Your Current Engagement Levels

Start with a thorough evaluation of your existing client engagement. Use client satisfaction surveys, Net Promoter Score (NPS), and retention rates to establish a baseline. A PwC study reveals that 73% of customers point to experience as an important factor in their purchasing decisions, behind price and product quality (underscoring the importance of understanding your current position).

Analyze your client interactions next. Determine the frequency and channels of communication. Identify if you proactively reach out or merely respond to inquiries. This audit will uncover gaps in your current approach.

Set Clear and Measurable Goals

With your baseline established, define Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) goals. Try to increase your NPS score by 15 points within the next 12 months or boost client retention rates by 10% in the coming year.

Develop an Engagement Roadmap

Create a step-by-step plan to achieve your goals. This might include:

- Implementation of a new CRM system to track client interactions

- Establishment of a quarterly review process for all clients

- Creation of a content calendar for educational resources

- Setup of automated follow-up sequences for different client segments

Prioritize these initiatives based on potential impact and ease of implementation.

Train Your Staff

Your team forms the frontline of client engagement. Invest in training programs that focus on active listening, empathy, and problem-solving skills. Consider role-playing exercises to practice handling difficult client situations. This hands-on approach can significantly improve your team's confidence and competence in client interactions.

Use Technology for Tracking and Analysis

Implement a robust CRM system to track all client interactions. This allows you to monitor engagement levels, identify at-risk clients, and spot opportunities for upselling.

Use analytics tools to measure the effectiveness of your engagement initiatives. Track metrics like response times, meeting frequency, and content engagement rates. This data-driven approach allows you to continuously refine your strategy.

Final Thoughts

Client engagement forms the foundation of success for accounting firms. Personalized communication, proactive advice, and technology leverage transform client relationships and drive better results. The strategies we explored, from AI-powered chatbots to educational webinars, offer practical tools to increase client engagement and satisfaction.

A robust client engagement program requires ongoing effort. It begins with assessment, goal-setting, and roadmap development. Staff training and CRM system utilization play vital roles in this journey. These efforts yield long-term benefits, including higher retention rates, increased revenue per client, and a stronger industry reputation.

Engaged clients become firm advocates, leading to valuable referrals and a stronger market position. They also seek additional services, creating cross-selling and upselling opportunities. At Cajabra, LLC, our specialized marketing services (including the JAB System™) help accountants attract ideal clients and build lasting, profitable relationships.

At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

A well-crafted client engagement framework can transform how you interact with your clients, boosting satisfaction and retention rates.

In this post, we'll show you how to build an effective framework that aligns with your firm's goals and meets your clients' needs.

What Is a Client Engagement Framework?

The Foundation of Client Relationships

A client engagement framework forms the backbone of successful accounting firms. This structured approach transforms client interactions, creating a consistent and positive experience throughout their journey with your firm.

Core Components of Effective Engagement

- Clear Communication Channels: Establish multiple contact points (email, phone, secure messaging platforms) for seamless client interaction.

- Personalized Service Plans: Create tailored solutions that address each client's unique needs and objectives.

- Regular Check-ins: Schedule periodic reviews to assess progress and address concerns proactively.

- Proactive Problem-Solving: Anticipate potential issues and offer solutions before they escalate.

- Continuous Education: Keep clients informed about relevant financial updates and their business impact.

Quantifiable Benefits for Firms and Clients

A robust client engagement framework yields significant advantages. For accounting firms, it results in increased client loyalty, more referrals, and higher revenue per client. A 2025 study showed that brands have a powerful opportunity to implement deeper engagement strategies and stand out from competitors by gathering customer insights.

Clients benefit from more personalized service, better understanding of their financial position, and increased confidence in their accounting partner. This often translates to improved financial decision-making and business performance.

Measuring Engagement Success

To ensure framework effectiveness, track key performance indicators (KPIs) such as client satisfaction scores, retention rates, and average revenue per client. Use tools like Net Promoter Score (NPS) surveys to gauge client loyalty and identify areas for improvement.

The Impact of Structured Engagement

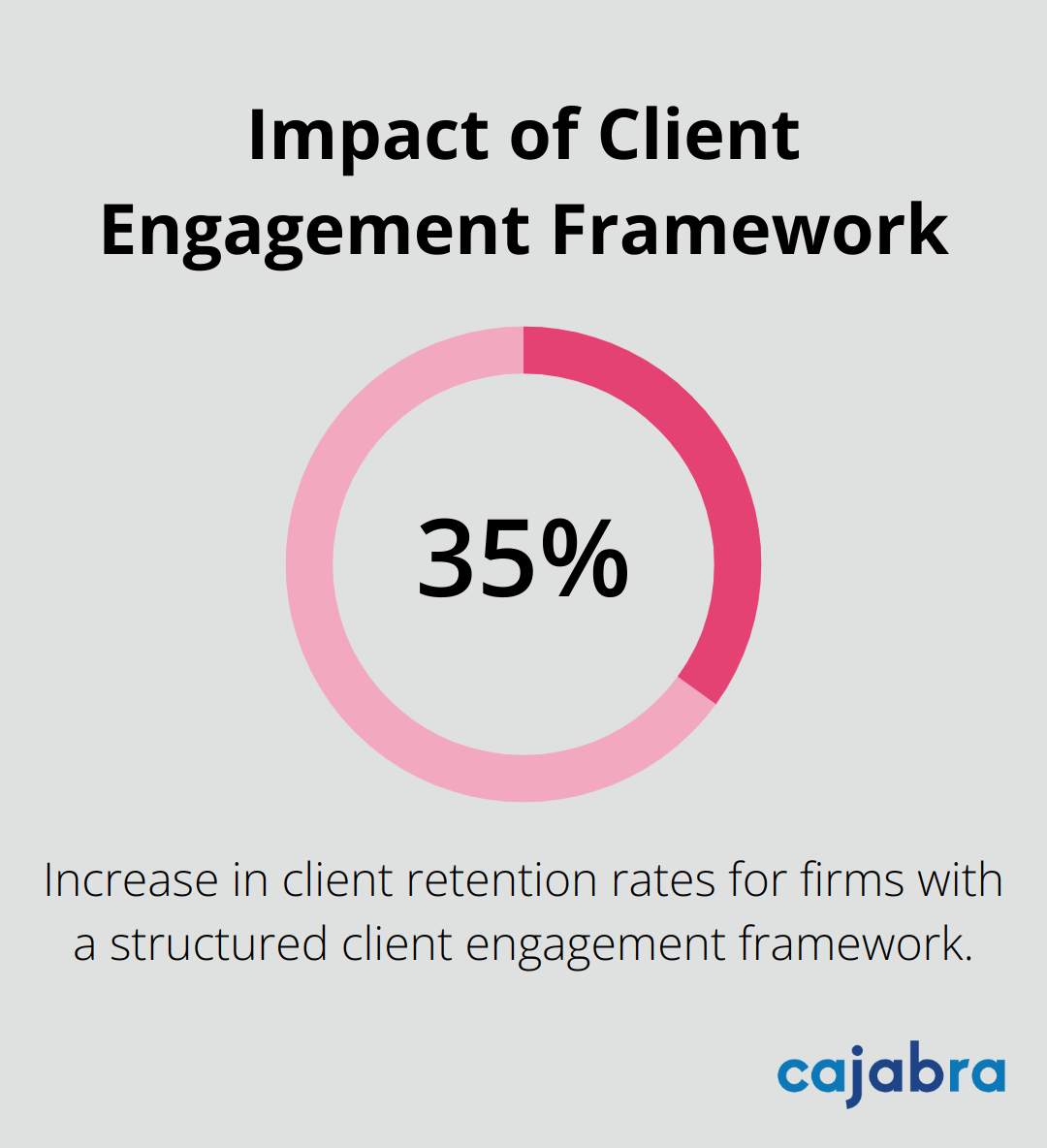

A 2024 study by the American Institute of CPAs found that accounting firms implementing a structured client engagement framework saw a 35% increase in client retention rates. This statistic underscores the critical role that engagement plays in the long-term success of accounting practices.

Evolving Your Approach

A client engagement framework requires ongoing refinement based on client feedback and changing market conditions. Continuous evolution of your approach will create lasting relationships that drive mutual success.

As we move forward, let's explore how to develop a client engagement strategy that aligns with your firm's goals and meets your clients' expectations.

How to Craft Your Client Engagement Strategy

Uncover Client Needs Through Active Listening

Start your strategy by conducting in-depth interviews with your clients. Ask open-ended questions about their business goals, pain points, and expectations from your services. A 2024 survey by the American Institute of CPAs revealed that firms who regularly conducted client needs assessments experienced a 28% increase in client satisfaction scores.

Use tools like SurveyMonkey or Typeform to create quick, targeted surveys that gather insights on client preferences and priorities. Analyze the results to identify patterns and tailor your services accordingly.

Personalize Your Communication Approach

Client communication requires a tailored approach. Develop a matrix that matches client preferences with communication channels. For example, tech-savvy clients might prefer video calls and instant messaging, while traditional businesses may value face-to-face meetings.

Implement a CRM system (like Salesforce or HubSpot) to track client interactions and preferences. This allows you to personalize each touchpoint, from email campaigns to product recommendations.

Set Clear, Measurable Objectives

Work with clients to establish specific, measurable goals for your engagement. Use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to define objectives. For instance, "Reduce tax liability by 15% within the next fiscal year" provides a clear, actionable goal.

Create a shared dashboard using tools like Trello or Asana to track progress towards these goals. This transparency builds trust and keeps both parties accountable.

Implement Regular Feedback Mechanisms

Establish a system for regular feedback. This can include quarterly surveys, annual reviews, or informal check-ins after major projects. Use this feedback to refine your services and address any concerns promptly.

Consider implementing a Net Promoter Score (NPS) system to gauge client satisfaction and loyalty over time. This metric can provide valuable insights into the effectiveness of your engagement strategy.

Leverage Technology for Enhanced Engagement

Utilize technology to streamline your engagement process. AI-powered analytics tools can help you identify trends in client behavior and preferences. Secure document sharing platforms (such as Dropbox Business or Google Workspace) facilitate smooth collaboration and information exchange.

The next step in creating an effective client engagement framework involves selecting and implementing the right tools and technologies to support your strategy. Let's explore how these can enhance your client relationships and streamline your processes.

Tech Tools for Client Engagement Success

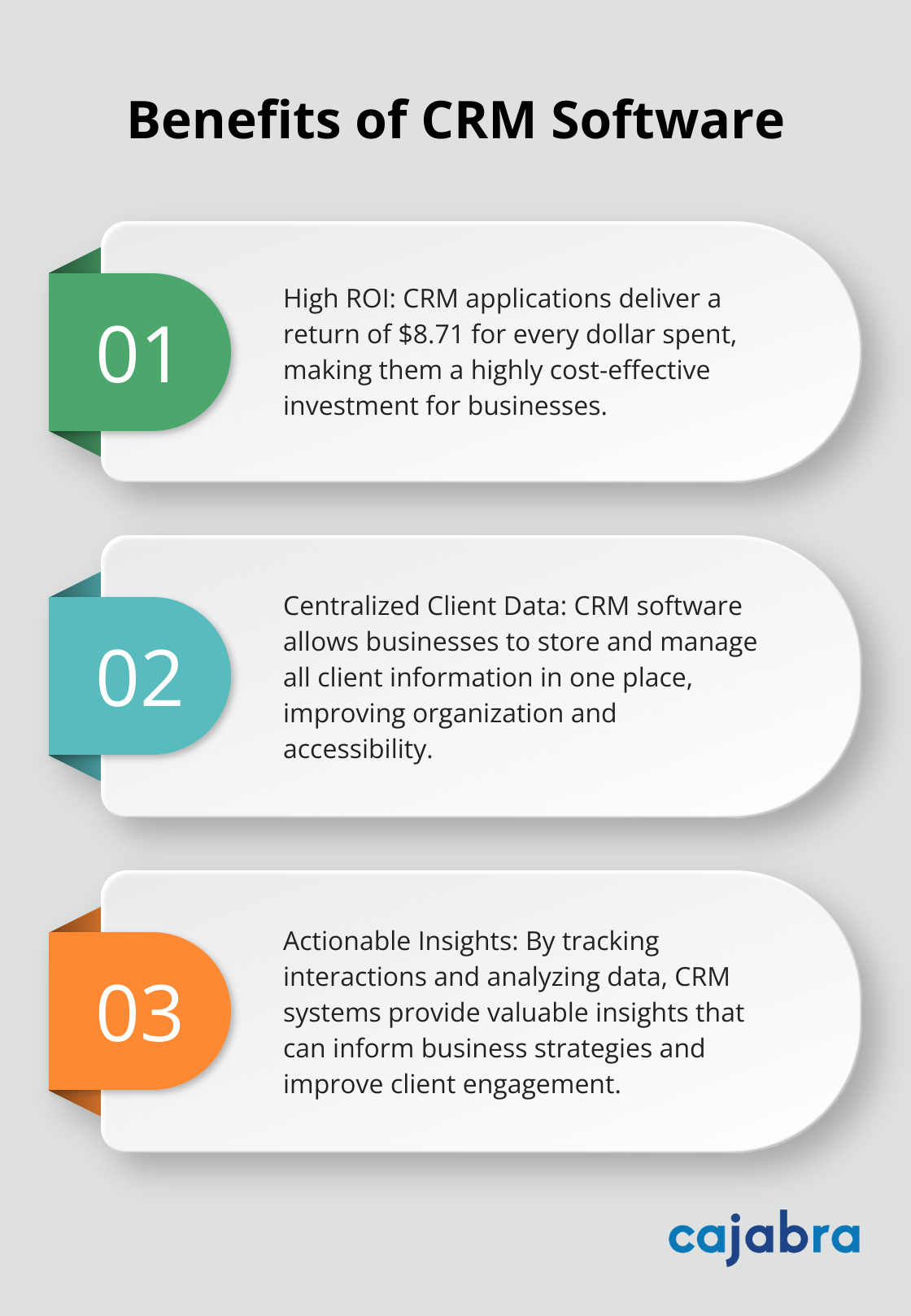

CRM Systems: The Foundation of Client Relationships