Most accounting firms rely on outdated marketing tactics that don't work anymore. Your competitors are invisible online, and so are you-which means you're all fighting for the same handful of clients.

At Cajabra, LLC, we've seen firsthand how digital marketing for accountants transforms firms from struggling to thriving. The strategies in this post aren't theoretical-they're proven methods that attract qualified leads and convert them into long-term clients.

The accounting industry has a marketing problem that most firms refuse to acknowledge. According to Ahrefs research, 96.55% of pages get no organic traffic, and for accounting firms using generic tactics, this number is probably worse. You post on LinkedIn and receive three likes. You run Facebook ads that convert at 0.5%. You write blog posts about topics nobody searches for.

Meanwhile, your competitors do the exact same things, which means you're all equally invisible. The global accounting market will reach $735.94 billion in 2025, yet most firms fight over the same local referral pool instead of capturing the massive online demand that exists right now. Gartner research shows that most buyers prefer to carry out independent research through digital channels before purchasing, which means potential clients are already searching for accounting services-they're just not finding you because your website looks outdated, your content doesn't answer their actual questions, and you have zero brand presence beyond your local network.

Most accounting firms are indistinguishable from each other. Your website offers tax preparation, bookkeeping, and consulting-exactly like the five other firms in your area. You post generic tax tips on LinkedIn that apply to everyone and nobody. Your brand identity is whatever your cousin designed in Canva five years ago. Potential clients can't tell why they should hire you instead of the firm down the street, so they choose based on price or a friend's recommendation. The firms that win right now have built a clear brand around a specific niche or service. They own keywords like "accounting for tech startups" or "bookkeeping for e-commerce" instead of competing on "accounting near me." This positioning attracts higher-quality leads who already pay premium fees because they know exactly what they're getting. Without a defined brand and a clear message about who you serve and why you're different, you remain invisible in search results and forgettable on social media.

You probably pay for ads, hire freelance writers, or manage social media yourself without seeing real results. Generic tactics don't work because they're designed for nobody, which means they resonate with nobody. A tax tip that applies to small business owners, real estate investors, and W-2 employees simultaneously helps none of them. A Facebook ad targeting accountants within 50 miles of your office reaches people who already have accountants. A blog post about "5 Tax Deductions You Didn't Know About" ranks nowhere because thousands of firms have written the exact same thing. Organic search delivers strong ROI for most businesses, yet most keywords have limited monthly search volume, which means you need a long-tail, targeted approach instead of chasing broad terms. Firms that shift their budget toward targeted strategies-SEO for specific niches, email nurturing of qualified prospects, and conversion-focused websites-see immediate improvements in lead quality and cost per acquisition.

The firms that dominate their markets have stopped trying to serve everyone. They've chosen a specific industry (real estate agents, e-commerce owners, medical practices) and built their entire marketing around that niche. This approach works because it allows you to speak directly to your ideal client's pain points. Your website copy addresses their specific tax challenges. Your blog posts answer the questions they actually search for. Your ads reach people who are actively looking for an accountant who understands their business. When you position yourself as the accounting expert for a particular niche, you attract clients who value specialization and pay higher fees. You also reduce your marketing costs because you're not wasting money reaching people who will never hire you. The firms that remain invisible are the ones still trying to be the best accountant for everyone in a 50-mile radius.

Your website either attracts the right clients or it costs you money. Most accounting firm websites fail because they prioritize looking professional over converting visitors into leads.

According to HubSpot research, 84% of consumers say authentic content from brands builds trust, yet most accounting sites feature generic stock photos, vague service descriptions, and no clear call-to-action telling visitors what to do next.

A high-converting website starts with a homepage that speaks directly to your niche. If you serve e-commerce businesses, your headline should state that explicitly. Your navigation should answer the specific questions those owners search for: tax strategies for sellers, quarterly bookkeeping requirements, sales tax compliance across marketplaces. Your homepage needs multiple clear conversion points-a button to schedule a consultation, a lead magnet like a tax checklist or pricing guide, a contact form.

Research from HubSpot shows that lead magnets convert visitors into email subscribers when positioned correctly. A website attracting even 200 visitors monthly can generate qualified leads through a single resource. Beyond the homepage, your site needs a blog section optimized for keywords your ideal clients actually search for.

Most accountants write about topics nobody searches for. Use keyword research tools like Ubersuggest to validate that people search for your topics with meaningful monthly volume and reasonable competition. A guide titled "Pricing Accounting Services for E-Commerce Stores" ranks better and attracts hotter leads than "The Importance of Bookkeeping." Content that solves a specific problem your niche faces ranks faster and converts higher because the visitor already looks for exactly what you offer.

Content marketing works when you stop writing generic tax tips and start answering the exact questions your niche searches for. LinkedIn dominates B2B content marketing, with 96% of B2B content marketers using it as their primary platform, yet most accountants post surface-level advice that generates no engagement. Instead, post long-form content around 500 words directly addressing your niche's pain points.

If you serve medical practices, write about tax deductions specific to healthcare providers, strategies to reduce self-employment taxes on practice income, or how to structure partnerships to minimize liability. This approach positions you as the expert who understands their business, not a generalist accountant. Pair your LinkedIn posts with a marketing strategy that targets the same topics.

Blogging correlates with 434% more indexed pages and roughly 55% more traffic than sites without consistent blog activity, according to HubSpot. Publish one post every two weeks addressing keywords your ideal clients search for. Update older posts quarterly to maintain relevance and SEO strength.

Email marketing delivers exceptional returns-approximately $36 earned per $1 spent according to HubSpot data. Capture emails through your lead magnets and send a weekly or biweekly newsletter featuring your best content, client wins, and timely tax tips. Segment your email list by client type so medical practice owners receive content relevant to their situation, not generic advice.

Paid ads work for accountants only when you target with precision and maintain a clear sales process to convert leads. Most accounting firms run broad Facebook ads targeting everyone within 50 miles, which wastes money reaching people who already have accountants. Instead, run Google Ads targeting high-intent keywords specific to your niche: tax planning for LLC owners, bookkeeping services for Shopify stores, or quarterly tax strategies for real estate investors.

Google Ads lets you target by search intent, meaning people actively look for your services right now. Set a daily budget of $15–25 to test campaigns before scaling. Track your cost per lead and cost per client acquisition. If you spend $200 to acquire a $3,000 annual client, that's profitable. If you spend $500, your ads need optimization or your niche selection needs adjustment.

Facebook and Instagram ads work differently-they reach people based on interests and demographics rather than search intent. Use these platforms for brand awareness and retargeting, not as your primary lead source. Around 65% of SMBs allocate resources to paid search campaigns, yet most don't measure results properly.

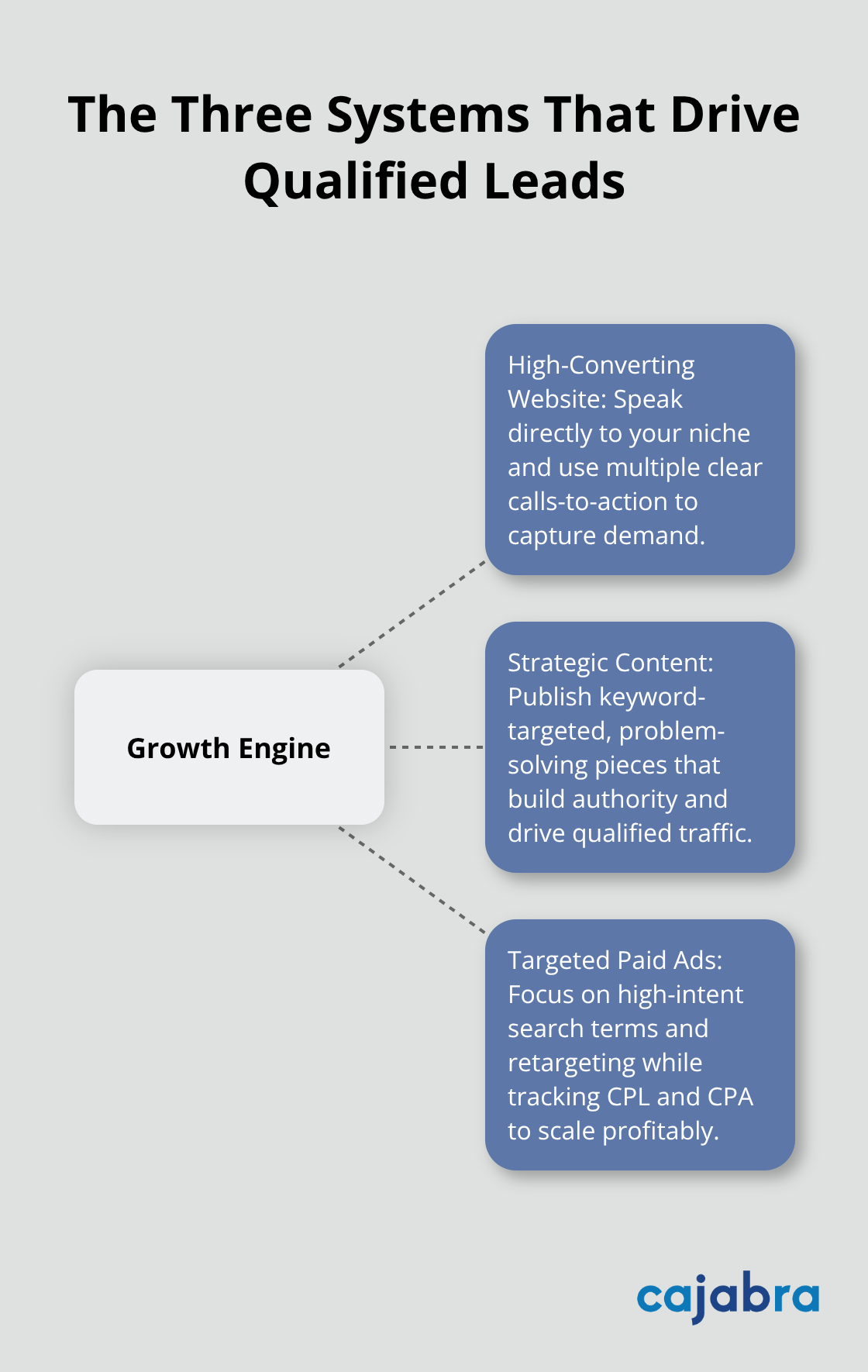

Use Google Analytics and conversion tracking through Google Ads or Facebook Pixel to monitor which campaigns generate actual clients, not just clicks or form submissions. Paid ads should complement your organic strategy, not replace it. The firms winning in 2025 combine SEO, content marketing, and targeted ads to own their niche across multiple channels. Once you attract qualified leads through these three systems, converting them into long-term retainer clients requires a sales funnel designed specifically for how accountants sell.

Attracting leads means nothing if your sales process loses them. Most accounting firms generate traffic and leads but never convert them into retainer clients because they lack a clear system to move prospects from awareness to signed engagement letters. Your website visitor reads a blog post, downloads your tax checklist, and joins your email list-then what? Without a clear follow-up sequence and sales process, that prospect vanishes. You need a sales funnel designed specifically for how accountants sell, which differs fundamentally from other service businesses.

Accountants sell based on trust, expertise, and understanding of the prospect's specific situation. Your funnel must demonstrate all three before asking for the sale. Start by mapping your ideal prospect's journey from first touchpoint to signed retainer agreement. A prospect searching for tax strategies for e-commerce sellers finds your blog post, downloads your free guide on sales tax compliance across marketplaces, and receives an automated email sequence introducing your firm and offering a 30-minute strategy call.

This call is where you qualify the prospect, understand their pain points, and determine if they fit your services. Most accounting firms skip this step and immediately pitch their services, which kills deals. Instead, use the discovery call to ask questions about their current accounting situation, their biggest tax challenges, and what they've tried before. Take notes. Show genuine interest in solving their specific problem, not just landing another client. After the call, send a customized proposal addressing the exact issues they mentioned during your conversation.

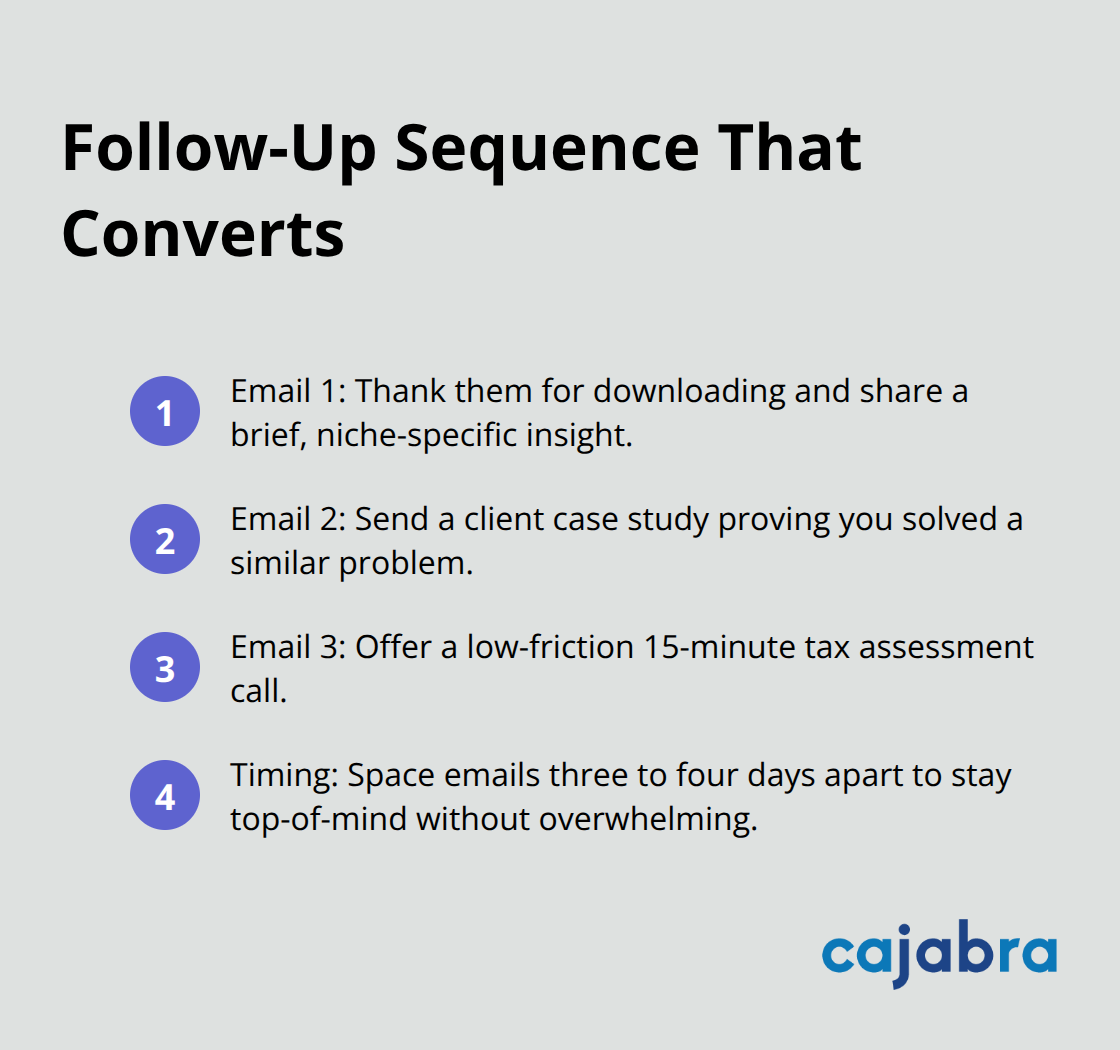

Email marketing delivers strong returns when executed strategically, yet most accountants treat email as an afterthought rather than a core revenue channel. Your follow-up sequence should include three to five emails over two weeks if the prospect doesn't book a call after downloading your lead magnet. The first email thanks them for downloading and offers a brief insight related to their industry. The second email shares a client case study or success story showing how you solved a similar problem. The third email presents a low-friction offer like a free 15-minute tax assessment call, removing the barrier to engagement.

Space these emails three to four days apart to maintain presence without overwhelming the prospect.

Retainer-based pricing flips the dynamic that most accounting firms operate within. You charge a fixed monthly fee for ongoing services, which creates predictable revenue for your firm and positions you as an ongoing advisor rather than a vendor. The prospect who downloads your lead magnet, receives your email sequence, and books a call should hear about retainer pricing during that initial conversation. Present your pricing as monthly retainers ranging from $300 to $1,500 depending on service scope, business complexity, and industry. Transparency about pricing during the sales call eliminates tire-kickers and attracts serious prospects willing to invest in quality advisory services.

After you close a new retainer client, your relationship doesn't end-it deepens. Schedule quarterly business reviews with each client to discuss their financial performance, upcoming tax planning opportunities, and how your services can evolve as their business grows. These reviews uncover upsell opportunities and strengthen the relationship, making the client less likely to shop around. Firms that implement structured sales funnels with clear follow-up sequences and retainer-based pricing models see dramatically higher close rates and client lifetime value compared to those relying on ad-hoc outreach and project-based pricing.

Digital marketing for accountants transforms firms from invisible to booked solid, yet most still rely on referrals and local networking while their ideal clients search online for solutions. The accounting market reaches $735.94 billion in 2025, and the firms winning right now attract qualified leads consistently through strategy, not hope. They build clear brands around specific niches, create websites that convert visitors into leads, and implement sales funnels that turn prospects into retainer clients.

Success requires you to combine SEO-optimized content targeting your niche's actual search behavior, a high-converting website with clear calls-to-action, targeted paid advertising reaching high-intent prospects, and a structured follow-up sequence that moves prospects toward signed agreements. When you execute these systems together, you stop competing on price and start attracting clients who value your expertise. Your marketing becomes predictable, your lead quality improves, and your cost per acquisition drops.

We at Cajabra, LLC built the JAB System to move accountants from overlooked to overbooked by securing retainer-based clients in 90 days. The firms that implement these strategies see immediate results, and we handle the digital marketing strategy, website optimization, and sales funnel design so you can focus on serving your clients.