At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

Client engagement strategies are essential for building trust, loyalty, and long-term partnerships with your clients.

In this post, we'll explore practical ways to boost client engagement and transform your accounting practice into a client-centric powerhouse.

Client engagement refers to the ongoing interaction between an accounting firm and its clients. It involves the creation of strong, lasting relationships that transcend simple transactions. At its core, client engagement actively involves clients in the financial process, keeps them informed, and provides value that exceeds their expectations.

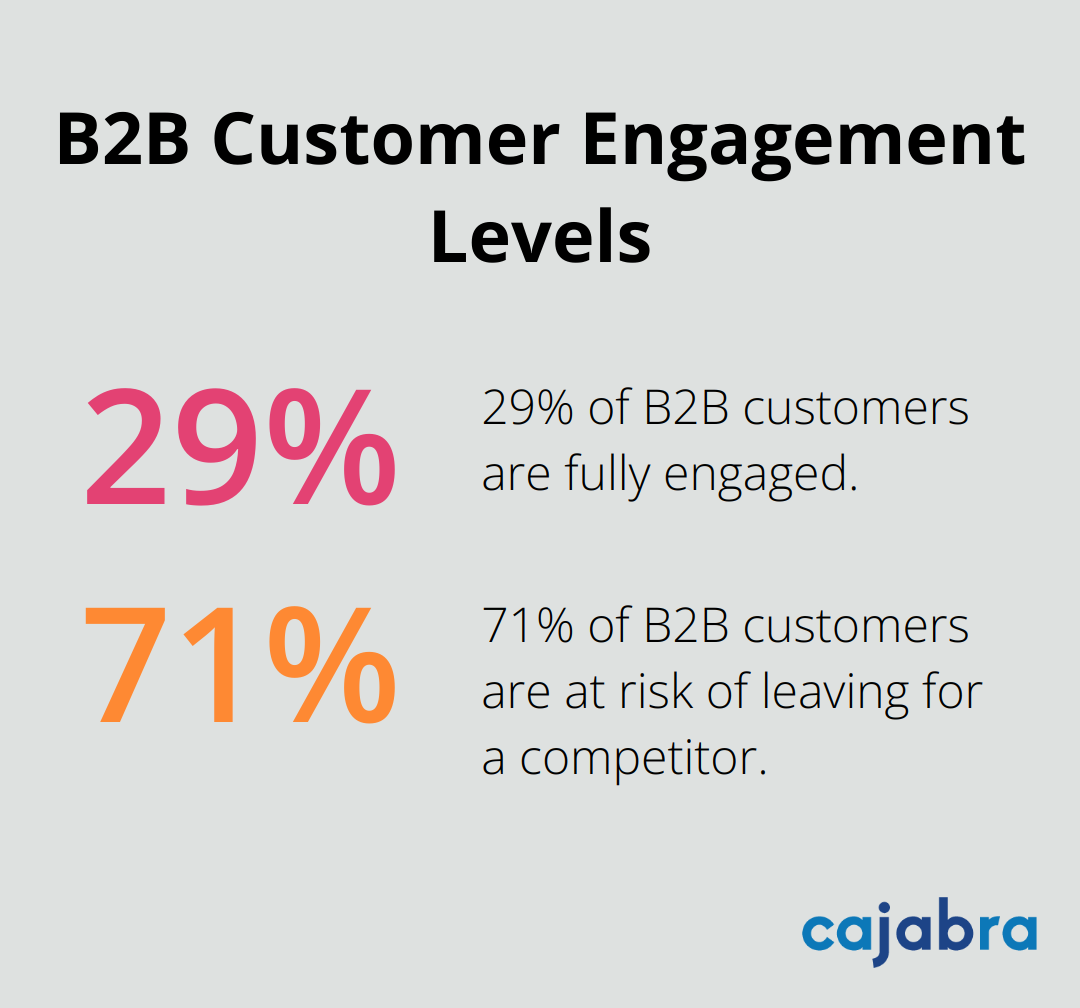

For accounting firms, client engagement is not just a nice-to-have-it's a necessity. Engaged clients tend to remain loyal, recommend services, and even increase their spending. However, according to Gallup, only 29% of B2B customers are fully engaged and 71% are at risk of leaving for a competitor.

In the accounting world, where trust is paramount, engagement forms the foundation for long-term partnerships. It's not just about number crunching; it's about becoming a trusted advisor. When clients feel valued and understood, they're more likely to seek additional services, thus increasing the firm's revenue potential.

To enhance client engagement, you must measure it. Here are some key metrics to track:

As we move forward, it's important to consider how these engagement strategies can be effectively communicated to clients. In the next section, we'll explore communication techniques that can significantly enhance your client relationships and drive engagement to new heights.

At Cajabra, LLC, we've witnessed the transformative power of effective communication in client relationships. Quality, relevance, and value trump mere frequency. Here's how you can elevate your communication game:

Client communication isn't one-size-fits-all. Some clients prefer emails, others phone calls, and some value face-to-face meetings. A Salesforce study revealed that 66% of customers expect companies to understand their unique needs and expectations. Learn each client's preferences and tailor your approach accordingly.

For example, a tech-savvy startup might appreciate quick updates via a messaging app. Conversely, a traditional business might value detailed monthly reports sent via email.

Consistency strengthens client relationships. Regular Check-ins with Clients can significantly impact client loyalty in the financial services sector. Implementing a robust Customer Retention Checklist can help you establish a consistent check-in schedule tailored to each client's needs and account complexity.

These check-ins should extend beyond numbers. Discuss their business goals, challenges, and how your services help them achieve their objectives. This proactive approach demonstrates your investment in their success beyond balancing books.

In our digital age, technology is essential for efficient communication. Client portals provide 24/7 access to financial documents, reports, and other vital information. This transparency builds trust and saves time for both parties.

Consider implementing a customer relationship management (CRM) system. A good CRM helps you track client interactions, set reminders for follow-ups, and ensures no important communication slips through the cracks.

Content creation powerfully engages clients and showcases your expertise. This could include blog posts about tax updates, video tutorials on using accounting software, or infographics explaining complex financial concepts.

Try creating a monthly newsletter with industry insights, tax tips, and updates on your firm's services. This keeps you top-of-mind with clients and positions you as a valuable resource.

The goal of your content should be to educate and inform (not sell). Providing genuine value naturally strengthens relationships with existing clients and attracts new ones.

These strategies can significantly enhance your client communication. It's about creating a dialogue, not a monologue. Focus on personalization, consistency, technology, and value-added content to build stronger, more engaged client relationships.

Now that we've covered effective communication strategies, let's explore how providing value-added services can further boost client engagement and solidify your position as a trusted advisor.

The accounting landscape demands more than number-crunching. A survey by Sage reveals that 79% of accountants are confident they can provide business management and advisory services. This shift presents an opportunity to expand service offerings.

Accountants should provide strategic business planning, risk management, or IT consulting services. For example, help clients select and implement accounting software that integrates with their existing systems to improve overall financial management.

Don't wait for clients to present problems. Take initiative to forecast potential financial issues and offer solutions before they become critical. This approach can save clients money and stress, solidifying your role as an indispensable partner.

Try conducting quarterly financial health checks for clients. Identify areas for improvement and potential risks. This regular engagement keeps you at the forefront of clients' minds and showcases your ongoing value.

In today's data-driven world, accountants who transform numbers into actionable insights become invaluable. Invest in data analytics tools and training to offer clients a deeper understanding of their financial position and market trends.

Use predictive analytics to forecast cash flow, helping clients make informed decisions about investments or expansions. A study investigates the impact of Big Data Analytics (BDA) on accounting manipulation in an emerging market context.

Knowledge empowers clients, and financial literacy boosts engagement. Host workshops, webinars, or create online courses covering topics like tax planning, financial forecasting, or understanding financial statements.

These educational initiatives provide value to clients and position you as an expert in your field. A Financial Planning Association study found that 78% of clients are more likely to refer their financial advisor if they offer educational resources.

Every client has unique needs and goals. Tailor your value-added services to each client's specific situation. This personalized approach (which may include industry-specific insights or specialized financial modeling) demonstrates your commitment to their success.

By implementing these strategies, you can stay connected with your clients, understand their needs, and provide value beyond basic accounting services.

Client engagement strategies form the foundation of success for accounting firms in today's competitive landscape. Personalized communication, technology-driven interactions, and value-added services transform firms into client-centric powerhouses. Regular check-ins, data-driven insights, and proactive financial planning demonstrate a commitment to client success beyond traditional accounting tasks.

The long-term benefits of improved client engagement include increased loyalty, more referrals, and higher revenue potential. Engaged clients remain more receptive to new service offerings, which creates opportunities for firms to expand and diversify. These advantages lead to a more stable client base and a stronger reputation in the industry.

We at Cajabra, LLC developed the JAB System™ to help accountants secure retainer-based clients and maximize revenue from existing relationships. Our specialized marketing services for accounting firms allow you to focus on serving your clients while we handle your marketing needs. Take action now: assess your current client engagement levels, identify areas for improvement, and implement the strategies discussed in this post.