At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

In today's digital age, client engagement software has become a game-changer for accountants looking to strengthen these connections.

This blog post explores how leveraging technology can significantly boost client engagement, streamline communication, and ultimately drive business growth.

Client portals transform the way accounting firms interact with their clients. These digital platforms serve as a centralized hub for communication, document sharing, and real-time information access.

Client portals eliminate endless email chains and phone tag. They provide a secure space where clients can access their financial documents, tax returns, and other important information 24/7. This self-service approach saves time for both parties and empowers clients to take a more active role in their financial management.

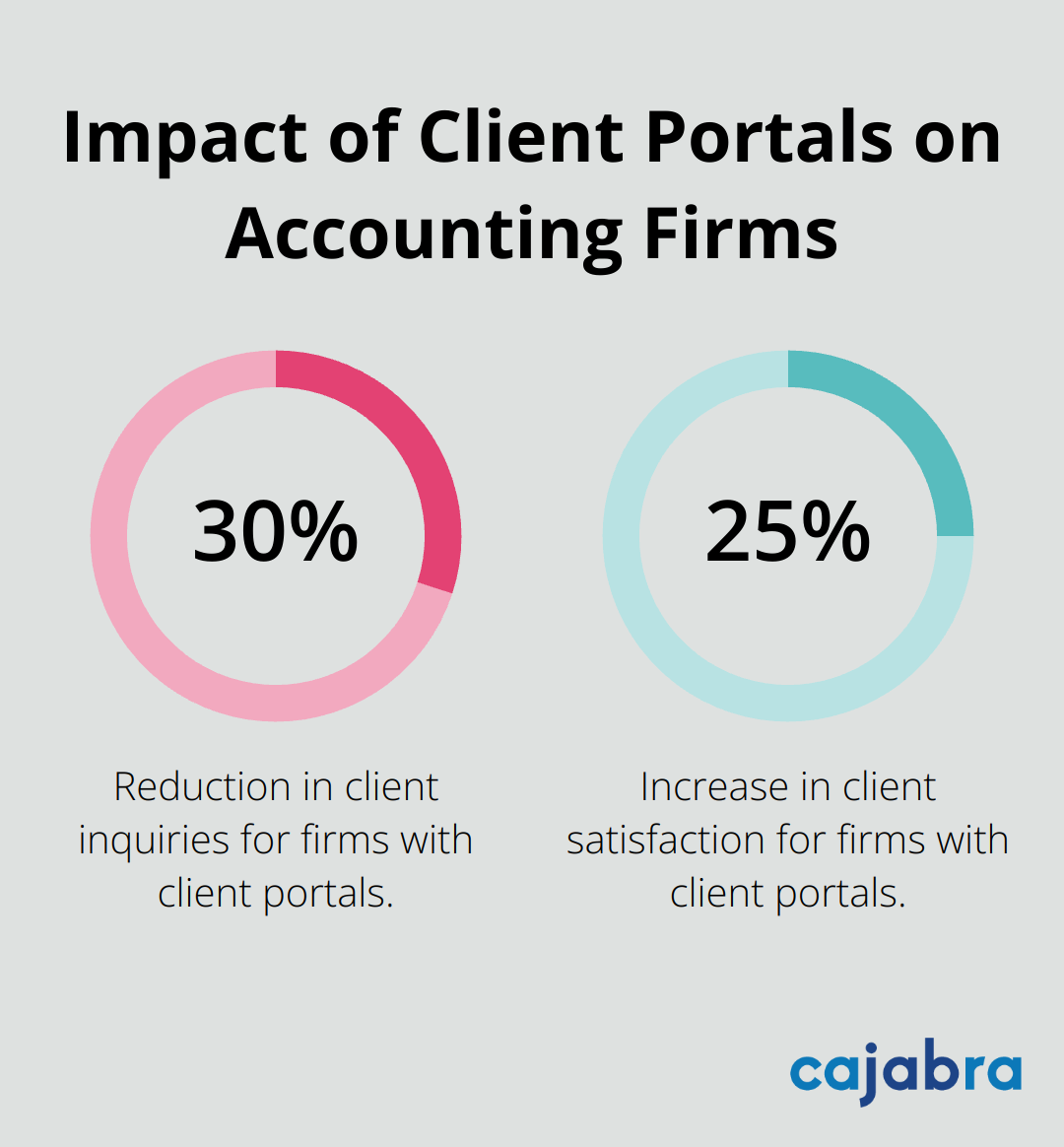

A study by Accounting Today reveals that firms with client portals experienced a 30% reduction in client inquiries and a 25% increase in client satisfaction. These numbers highlight the efficiency gains and improved client experience that portals deliver.

In an era of frequent data breaches, security is paramount. Client portals offer bank-level encryption for document storage and transfer, which ensures that sensitive financial information remains protected. This level of security maintains client trust and meets regulatory requirements.

The American Institute of CPAs (AICPA) emphasizes the importance of data security in accounting firms. A data breach can have significant financial and reputational consequences for a CPA firm, highlighting the critical role of secure platforms in protecting client information and maintaining compliance with industry standards.

Client portals enable real-time collaboration (a powerful feature that sets them apart). Accountants can share updates, request additional information, and conduct virtual meetings through the portal. This immediate interaction allows for faster decision-making and problem-solving.

A survey by CCH Wolters Kluwer found that accounting firms using collaborative tools like client portals saw a 40% increase in client retention rates. This statistic underscores the value that clients place on seamless, efficient communication with their financial advisors.

Many accounting software providers offer integrated portal solutions that can be set up quickly. The key is to choose a platform that aligns with your firm's specific needs and to provide thorough training for both staff and clients to ensure maximum adoption and benefit.

As we move towards more digital-centric business practices, client portals will play an increasingly vital role in accounting firms. They not only improve communication but also position firms as modern, tech-savvy partners in their clients' financial journeys. The next step in enhancing client engagement involves automating interactions through Customer Relationship Management (CRM) systems, which we'll explore in the following section.

To further enhance communication and streamline processes, firms should leverage technology such as client portals or mobile apps. This approach not only improves efficiency but also helps in creating a strong brand messaging strategy that aligns with your audience and boosts your marketing efforts.

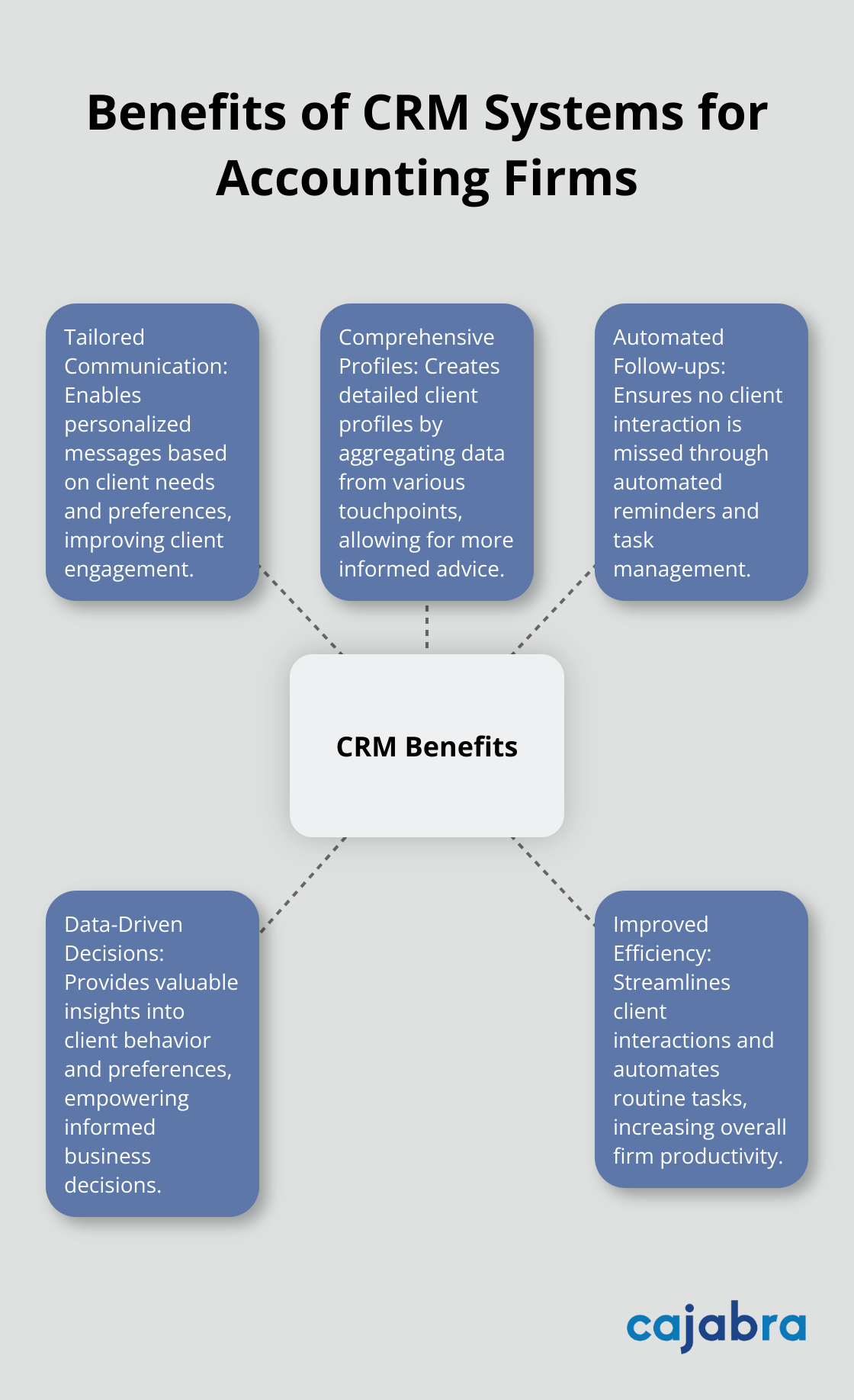

Customer Relationship Management (CRM) systems transform client interactions for accounting firms. These powerful tools offer a suite of features that automate and personalize client communications, going beyond simple contact management.

CRM systems enable accounting firms to send personalized messages to clients based on their specific needs and preferences. Firms can automatically send tax deadline reminders to relevant clients or share industry updates with those in particular sectors. With easier and faster access to important data through customer databases, firms can improve collaboration with clients and provide more personalized service.

Modern CRM platforms create detailed client profiles by aggregating data from various touchpoints. This includes past interactions, service preferences, and even social media activity. With this information readily available, accountants provide more informed and tailored advice.

CRM systems automate follow-ups and reminders, ensuring that no client interaction falls through the cracks. For instance, after a client meeting, the CRM automatically schedules a follow-up email or call.

Implementing a CRM system requires careful planning and staff training. However, the benefits in terms of improved client relationships, increased efficiency, and potential for growth make it a worthwhile investment for accounting firms looking to stay competitive in today's market.

CRM systems provide valuable insights into client behavior and preferences. This data empowers accounting firms to make informed decisions about service offerings, marketing strategies, and client engagement tactics. According to statistics, 57% of CRM automation is dedicated to lead nurturing, while 36% is focused on customer engagement. The next section will explore how data analytics can further enhance proactive client management and drive business growth.

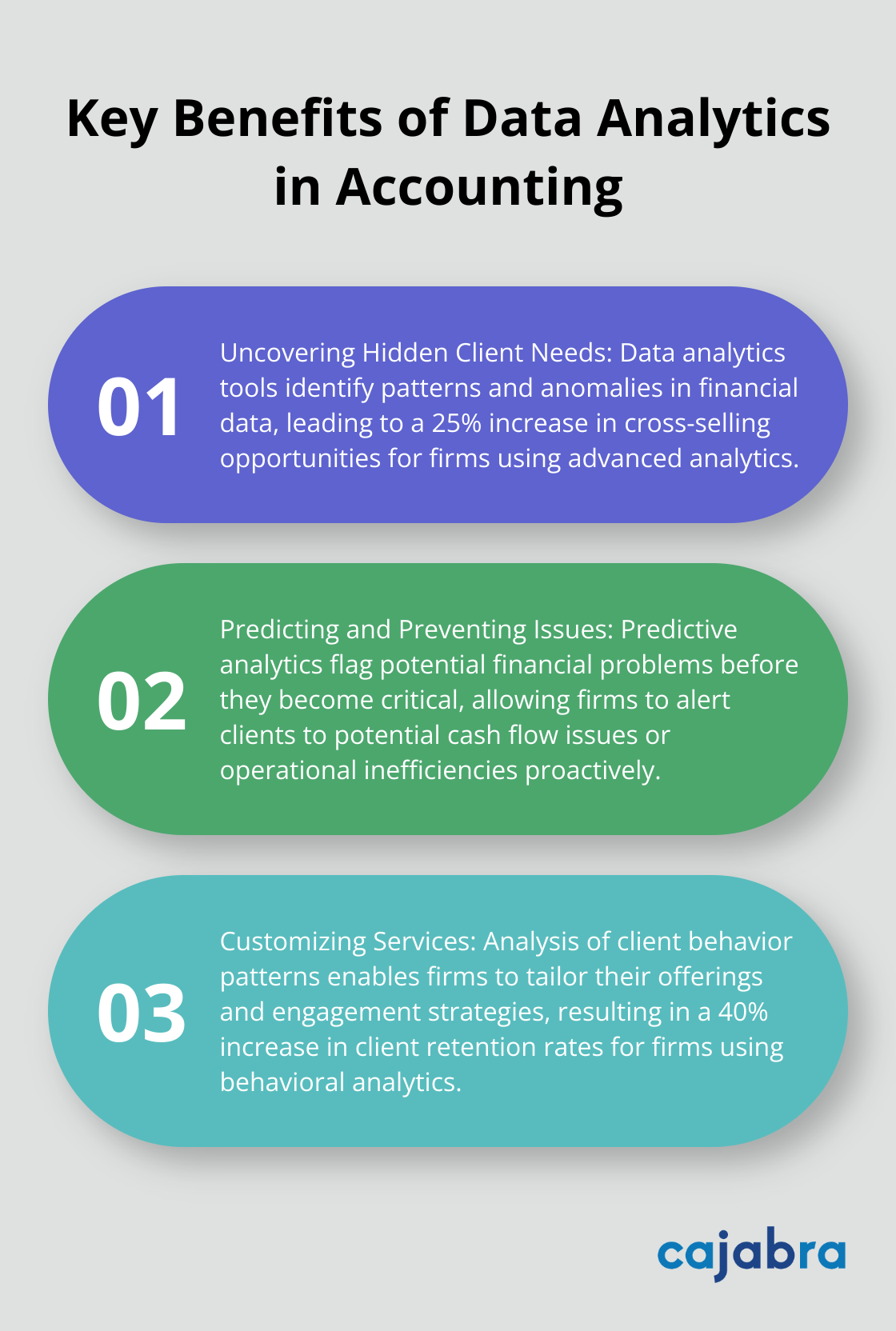

Data analytics tools sift through vast amounts of financial data to identify patterns and anomalies that might escape human observation. For example, analysis of a client's cash flow trends can spotlight opportunities for tax planning or investment advice before the client realizes the need.

A study by Accounting Today found that firms using advanced analytics experienced a 25% increase in cross-selling opportunities. This statistic underscores the value of data-driven insights in expanding service offerings and deepening client relationships.

Predictive analytics flag potential financial issues before they become critical. Monitoring of key performance indicators (KPIs) like debt-to-equity ratios or inventory turnover allows firms to alert clients to potential cash flow problems or operational inefficiencies.

AI-powered research tools can analyze tax law updates as they happen, helping CPA firms reduce costs and stay up-to-date with the latest regulations. This proactive approach not only protects clients but also positions firms as valuable strategic partners.

Analysis of client behavior patterns (such as most frequently used services or best-responded-to communications) enables firms to tailor their offerings and engagement strategies.

A survey by CCH Wolters Kluwer revealed that accounting firms using behavioral analytics to customize their services saw a 40% increase in client retention rates. This demonstrates the power of personalization in building long-term client relationships.

Implementation of data analytics doesn't require an overwhelming approach. Firms can start small by focusing on one area (e.g., accounts receivable aging) and gradually expand their analytical capabilities. The insights gained will improve client satisfaction and drive growth for the firm.

While data provides powerful insights, the human touch transforms these insights into action. Accountants should use analytics to inform client conversations and demonstrate value beyond number-crunching. This combination of data-driven insights and personal expertise positions firms as indispensable partners in their clients' financial success.

Client engagement software has become indispensable for accounting firms seeking to strengthen client relationships and drive business growth. These tools streamline operations, enhance client experiences, and enable proactive management. However, the human touch remains irreplaceable; successful firms balance technology with personal connections to ensure software enhances (rather than replaces) valuable expertise.

Implementing these solutions doesn't require an overwhelming approach. Firms can start by assessing current processes, choosing aligned software, and investing in proper training. Gradual introduction to clients, highlighting benefits, will ensure smooth adoption and maximum utilization of new tools.

At Cajabra, we help accounting firms leverage these technologies effectively. Our specialized marketing services empower firms to differentiate themselves, attract ideal clients, and become industry leaders. We combine cutting-edge software solutions with strategic marketing approaches to help accountants move from overlooked to overbooked in just 90 days.