At Cajabra, LLC, we know that a strong client engagement model is the backbone of any successful accounting firm.

In this post, we'll show you how to create an effective system that keeps your clients happy and your business thriving.

We'll cover everything from understanding client needs to leveraging technology for better communication and service delivery.

A client engagement model forms the strategic framework that guides interactions with clients throughout their journey with an accounting firm. At its core, this model shapes how firms communicate, deliver services, and add value to their client relationships.

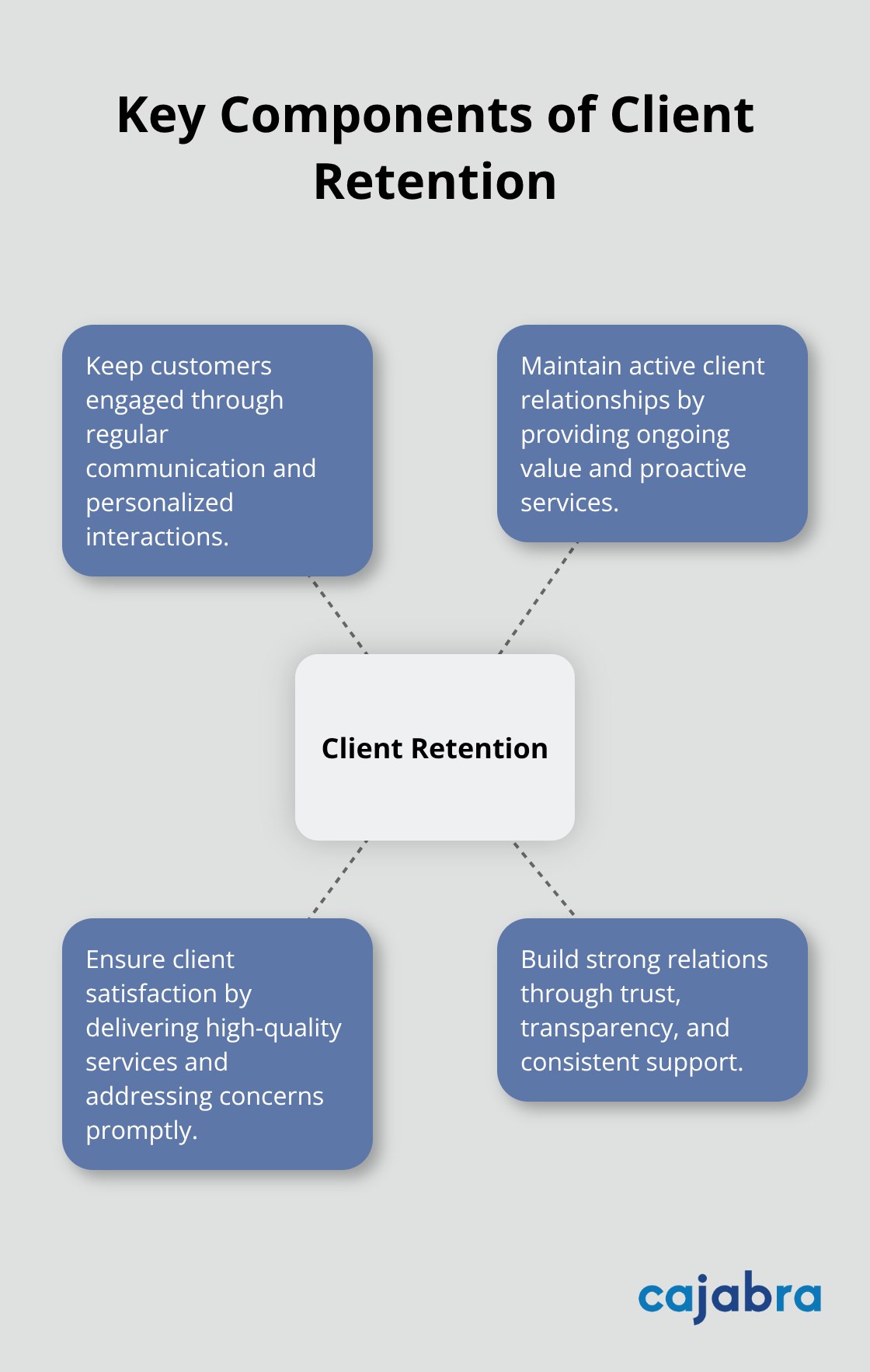

An impactful client engagement model consists of several critical elements:

Implementing a robust client engagement model yields substantial benefits. A new report claims that, for the first time ever, marketing to existing customers is exceeding that to new ones. For accounting firms, this translates to:

Clients also reap significant advantages from a well-executed engagement model:

Modern technology plays a pivotal role in enhancing client engagement. Client portals, automated reminders, and data-driven strategies support a more engaging client experience. However, the human touch remains irreplaceable. Regular, personalized check-ins make a significant difference in building lasting relationships.

As we move forward, let's explore how to develop a client-centric approach that forms the heart of an effective engagement model.

At Cajabra, LLC, we understand that a client-centric approach transforms accounting firms. It's not just about crunching numbers; it's about understanding the people behind those numbers. Client retention focuses on keeping customers engaged, active, and satisfied over time through quality of service and building strong relations. Start by exploring your clients' businesses in depth. Schedule regular strategy sessions to discuss their goals, challenges, and industry trends. This knowledge allows you to anticipate needs and offer proactive solutions.

For example, if you notice a client's cash flow tightening, don't wait for them to reach out. Contact them with specific strategies to improve their situation. This level of attentiveness sets you apart and cements your role as a trusted advisor.

One-size-fits-all communication belongs in the past. Some clients prefer detailed monthly reports, while others want quick, actionable insights. Use client management software to track preferences and adjust your approach accordingly.

Try implementing a tiered communication system. For high-touch clients, schedule monthly video calls. For others, perhaps a quarterly check-in suffices. The key is consistency and relevance. Every interaction should add value to your client's business.

Trust forms the cornerstone of any successful client relationship. To build it, go beyond the balance sheet. Show genuine interest in your clients' personal and professional lives. Mark important dates like business anniversaries or major milestones (these small gestures often make a big impact).

Create opportunities for face-to-face interactions outside of tax season. Host educational workshops or networking events for your clients. These gatherings not only provide value but also strengthen your relationships in a more relaxed setting.

Modern accounting firms use technology to enhance client relationships. Implement user-friendly client portals for seamless document sharing and communication. Use data analytics tools to provide personalized insights (this can significantly boost your value proposition). Automate routine tasks to free up time for more strategic client interactions.

Accounting practice management software, like Financial Cents, helps firms stay organized, efficient, and on top of every client engagement.

As we move forward, let's explore how technology can further enhance your client engagement model and streamline your accounting practice.

At Cajabra, LLC, we've witnessed technology transform client relationships in accounting firms. Let's explore how you can use tech to elevate your client engagement.

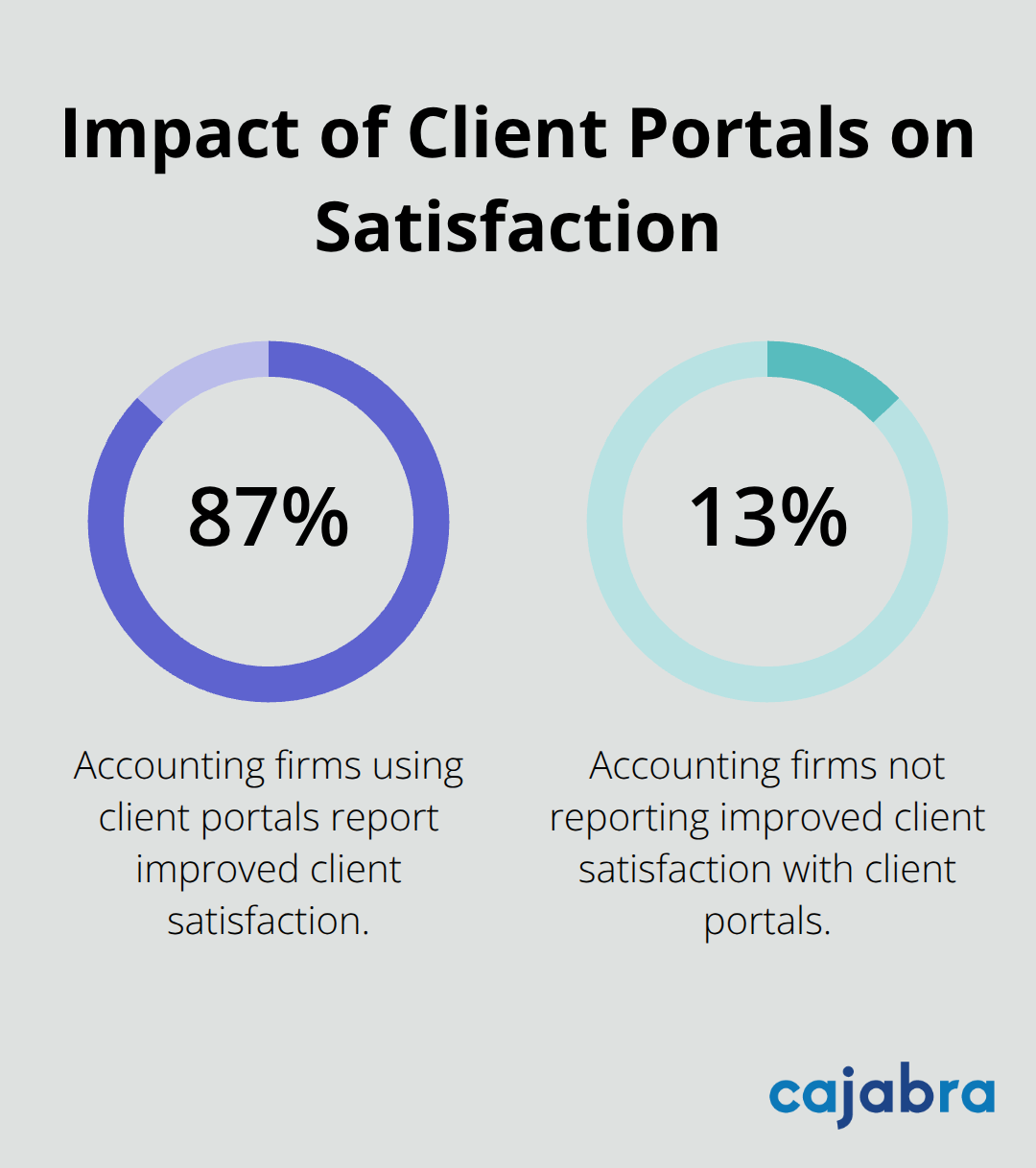

Client portals revolutionize accounting firms. They offer a secure, centralized platform for document sharing, real-time collaboration, and instant messaging. A study shows 87% of accounting firms using client portals report improved client satisfaction.

To maximize portal effectiveness:

Data analytics for accountants is the key to unlocking critical business insights, giving your firm the power to improve every aspect of public practice. A recent survey found 85% of accountants believe data analytics will significantly impact the profession in the next five years.

To use data analytics effectively:

Automation can significantly impact accountants and their work. It allows for more time to focus on high-value client interactions.

To implement automation strategically:

Virtual meeting platforms have become essential for maintaining strong client relationships. They offer flexibility and convenience, especially for clients with busy schedules.

Try to:

An effective client engagement model transforms accounting firms. It builds stronger relationships, increases retention, and expands service opportunities. Clear communication, personalized services, proactive problem-solving, and continuous value addition form the core of this model. Technology enhances these elements, enabling more efficient and valuable services.

Accounting firms must adapt their strategies to meet changing client needs. Regular feedback and industry trend monitoring help maintain relevance. Flexibility ensures firms remain valuable partners in an evolving business landscape. These principles position firms as trusted advisors, not just service providers.

We at Cajabra specialize in elevating marketing and client engagement strategies for accounting firms. Our JAB System™ aims to transform how accountants attract and retain clients (moving them from overlooked to overbooked in 90 days). Start implementing these strategies today to watch your client relationships and business thrive.