Starting an accounting practice requires strategic planning and systematic execution. The accounting services market reached $544.06 billion in 2023, with small practices capturing significant market share through specialized services.

We at Cajabra, LLC have identified three fundamental pillars that determine success: solid business foundations, effective client acquisition, and operational excellence. These elements work together to build sustainable growth and profitability.

Your business structure choice affects tax obligations, liability exposure, and operational flexibility for decades. Limited Liability Companies dominate the accounting industry because they protect personal assets while maintaining tax pass-through benefits. S-Corporation status becomes advantageous once annual profits exceed $60,000, as it reduces self-employment taxes.

The National Association of Certified Public Accountants reports that 67% of successful practices choose LLC structures initially, then convert to S-Corp status within three years. Register your EIN immediately through the IRS website - this process takes 15 minutes and costs nothing, yet many delay this step unnecessarily.

Your business plan must include realistic financial projections based on industry benchmarks rather than optimistic guesswork. According to the American Institute of CPAs, new practices require $15,000 to $25,000 in startup capital for technology, insurance, and initial marketing efforts.

Revenue projections should assume 15-20 clients in year one, with average monthly fees of $500-800 per client for comprehensive services. These numbers reflect actual market conditions rather than wishful thinking.

Practice management software like Drake Tax or Lacerte handles client communications, document storage, and workflow automation. Client relationship management systems track leads, automate follow-ups, and maintain detailed service histories.

QuickBooks Desktop Enterprise manages your own accounting while maintaining separation from client files. Cloud-based solutions enable remote work capabilities that 78% of accounting professionals now consider essential for competitive positioning (according to recent industry surveys).

These foundational elements create the infrastructure needed to attract and serve clients effectively, which leads directly to your next major challenge: building a professional presence that draws ideal clients to your practice.

Your website serves as your primary sales tool and must convert visitors within seconds of arrival. Research shows that potential clients research accounting firms online before making contact, which makes your digital presence the most important factor in client acquisition. Professional websites with clear service descriptions, client testimonials, and streamlined contact forms generate 3.5 times more leads than basic directory listings.

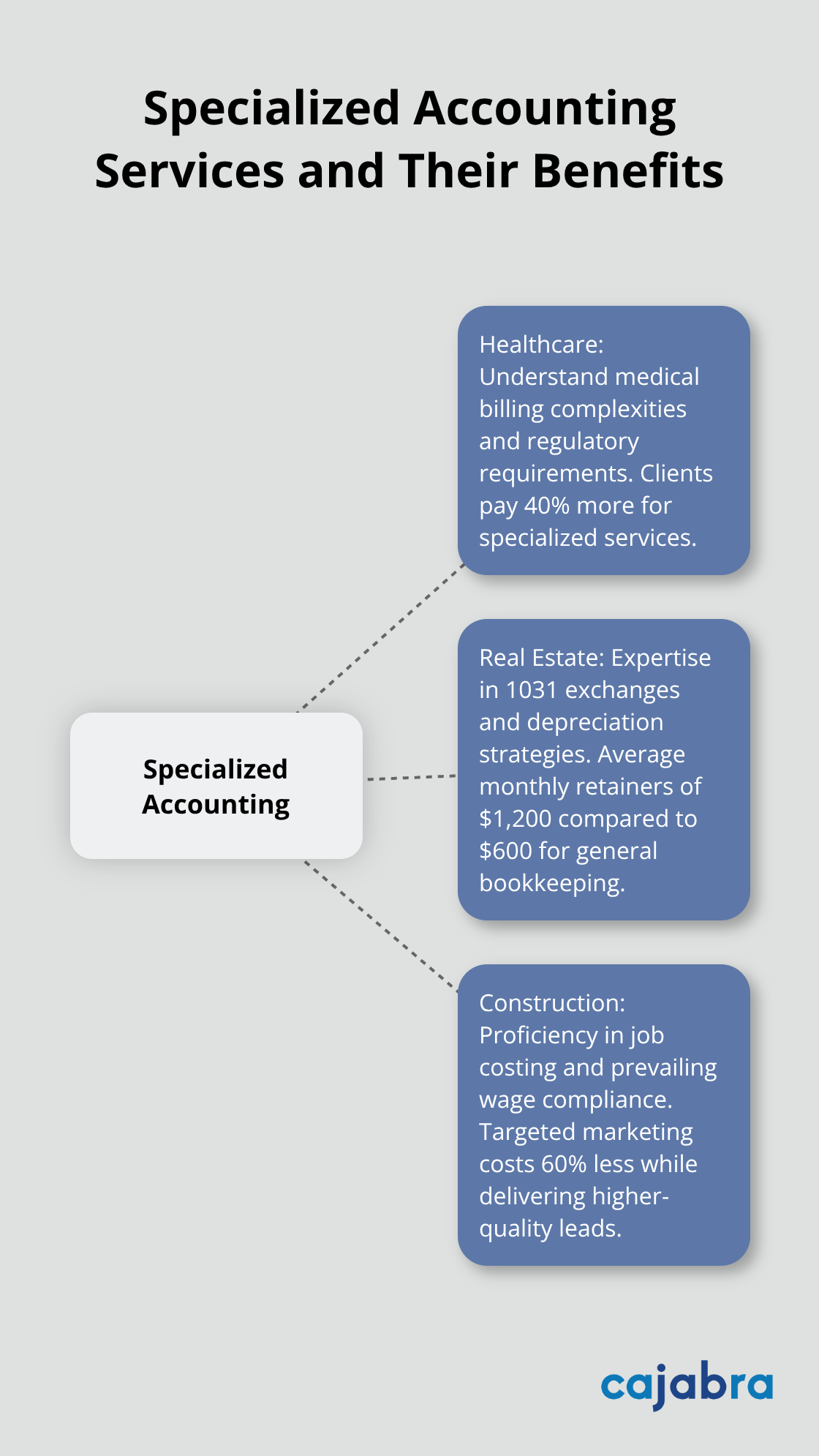

Generic accounting services compete on price while specialized practices command premium rates. Healthcare professionals pay 40% more for accounting services from firms that understand medical billing complexities and regulatory requirements. Real estate investors seek accountants familiar with 1031 exchanges and depreciation strategies, and they pay average monthly retainers of $1,200 compared to $600 for general bookkeeping.

Construction companies need expertise in job costing and prevailing wage compliance. Choose one industry, master their specific challenges, then build your entire marketing message around solutions to those problems. Google Ads that target construction accounting or medical practice bookkeeping cost 60% less than broad accounting keywords while they deliver higher-quality leads.

Referral partnerships with attorneys, financial planners, and business consultants create predictable lead flow without ongoing advertising costs. Estate planning attorneys refer clients who need tax preparation services, while business brokers connect you with companies that require due diligence work. The National Association of Tax Preparers reports that referral-based practices grow 45% faster than those that rely solely on digital marketing.

Contact five complementary service providers monthly, offer reciprocal referrals, and track which relationships generate the highest-value clients. Local business networking groups like BNI chapters produce 12-15 qualified referrals annually per active member (according to their internal statistics).

Blog posts about tax law changes and financial planning strategies position your firm as a thought leader in your chosen niche. Video content performs exceptionally well on LinkedIn, where 67% of accounting professionals discover new service providers. Weekly newsletters with tax tips and industry updates keep your name visible to prospects and existing clients alike.

Webinars about specific topics like Section 199A deductions or cryptocurrency taxation attract qualified leads who already recognize their need for specialized help. These educational approaches build trust before prospects ever contact you, which shortens sales cycles and increases conversion rates.

Once you establish these marketing foundations and begin attracting quality leads, your next priority becomes the operational systems that deliver exceptional service and support sustainable growth.

Standardized workflows separate practices that grow from those that plateau at 20 clients. Document every client interaction from initial consultation to final deliverable with process mapping software like Lucidchart or simple Google Docs templates. The CAS benchmark survey helps firms understand their performance against peers, and it shows CAS growth outpaces the profession's overall growth.

Create checklists for tax preparation, monthly bookkeeping, and year-end procedures that any team member can follow without supervision. Template libraries for engagement letters, client questionnaires, and deliverable formats maintain consistency across all client relationships. Time-tracking data reveals that structured firms bill 23% more hours annually because they eliminate decision fatigue and reduce task switching between different approaches for similar work.

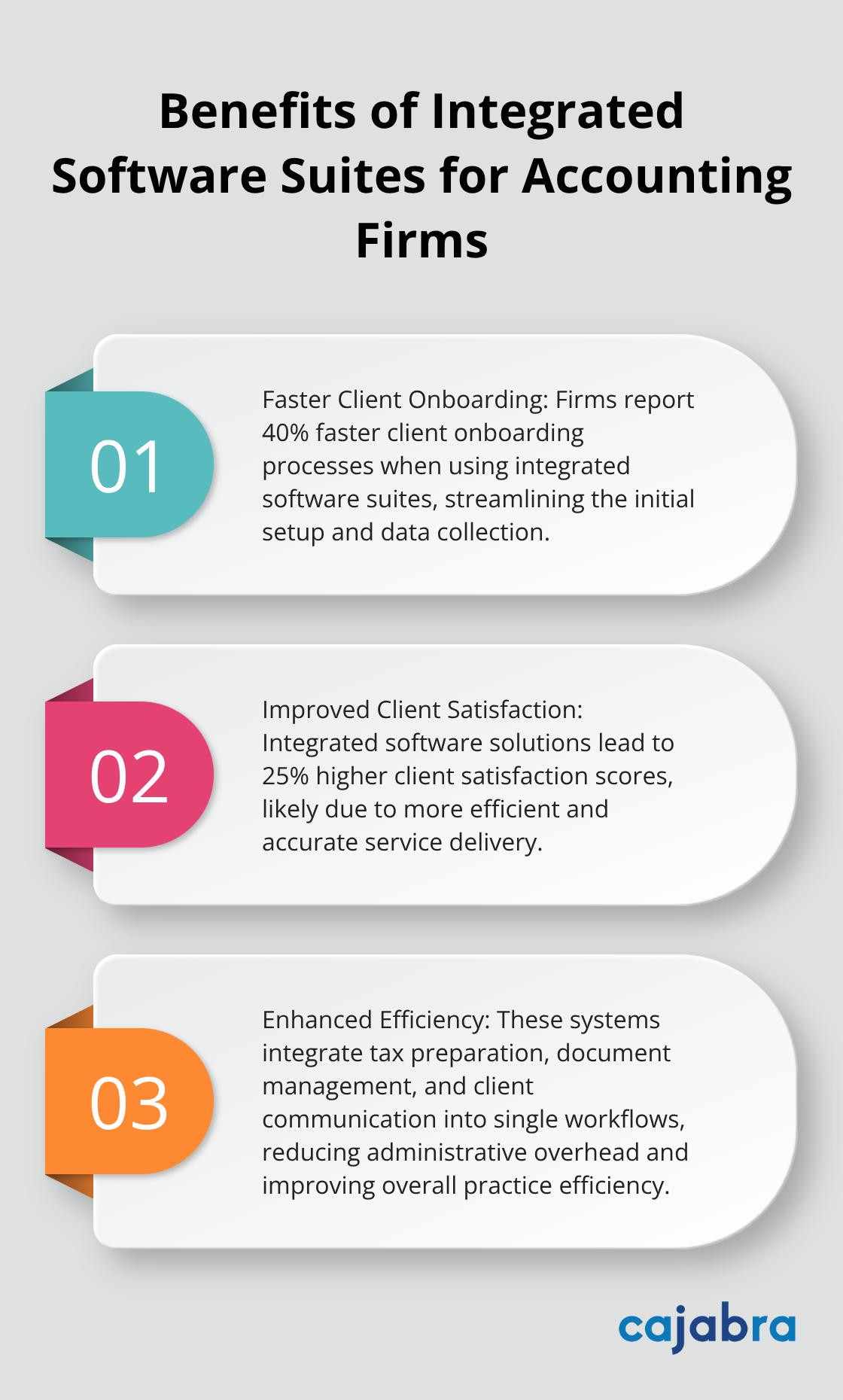

Practice management platforms like Thomson Reuters Practice CS or CCH Axcess integrate tax preparation, document management, and client communication into single workflows. These systems cost $200-400 monthly per user but generate ROI within six months through improved efficiency and reduced administrative overhead.

Cloud-based solutions enable remote work capabilities while they maintain security standards required for financial data. QuickBooks Online Advanced handles up to 25 users and integrates with over 750 third-party applications for payroll, time tracking, and client portals. Firms that use integrated software suites report 40% faster client onboarding and 25% higher client satisfaction scores (according to recent industry benchmarks).

Hire part-time staff during tax season, then convert top performers to full-time positions based on demonstrated competency rather than credentials alone. Community college accounting students often outperform experienced hires who lack systematic training in your specific processes and client service standards.

Training programs must include technical skills, client communication protocols, and quality control procedures. Written training manuals with video demonstrations reduce training time from six weeks to three weeks while they improve knowledge retention rates. Performance metrics like accuracy rates, client feedback scores, and productivity benchmarks identify team members ready for increased responsibilities and higher compensation levels.

Quality control checkpoints prevent errors before they reach clients and protect your professional reputation. Senior staff must review all tax returns before submission, while monthly bookkeeping requires dual approval for journal entries over $500. Error tracking spreadsheets identify patterns that indicate training gaps or system weaknesses.

Client feedback surveys after each engagement reveal service gaps that internal reviews miss. Anonymous feedback tools generate honest responses that help you address problems before they damage client relationships or generate negative reviews online.

Starting an accounting practice successfully demands consistent execution across three core areas: solid business foundations, strategic client acquisition, and operational excellence. The firms that thrive beyond year one maintain disciplined financial management, invest in technology that scales with growth, and build referral networks that generate predictable lead flow. Most new practices fail because they underestimate startup costs or price services too low to compete with established firms.

Avoid these mistakes when you budget $20,000 for your first year and charge premium rates for specialized expertise rather than compete on price for generic services. Your next steps involve choosing your niche market, implementing practice management software, and developing systematic marketing approaches that position your firm as the obvious choice for ideal clients. Focus on building systems that work without your constant supervision (your practice will grow into a valuable business asset rather than just another job).

We at Cajabra, LLC help accounting firms move from overlooked to overbooked through our JAB System™ that secures retainer-based clients within 90 days. The accounting industry rewards firms that execute proven strategies consistently rather than those that chase every new trend. Your success depends on the systems you build today and the discipline you maintain tomorrow.