Most accountants rely on referrals and hope for the best. This approach leaves money on the table and makes growth unpredictable.

Lead generation for accountants works differently when you have a system. At Cajabra, LLC, we've seen firms double their client base by moving away from random tactics and building a strategic approach instead.

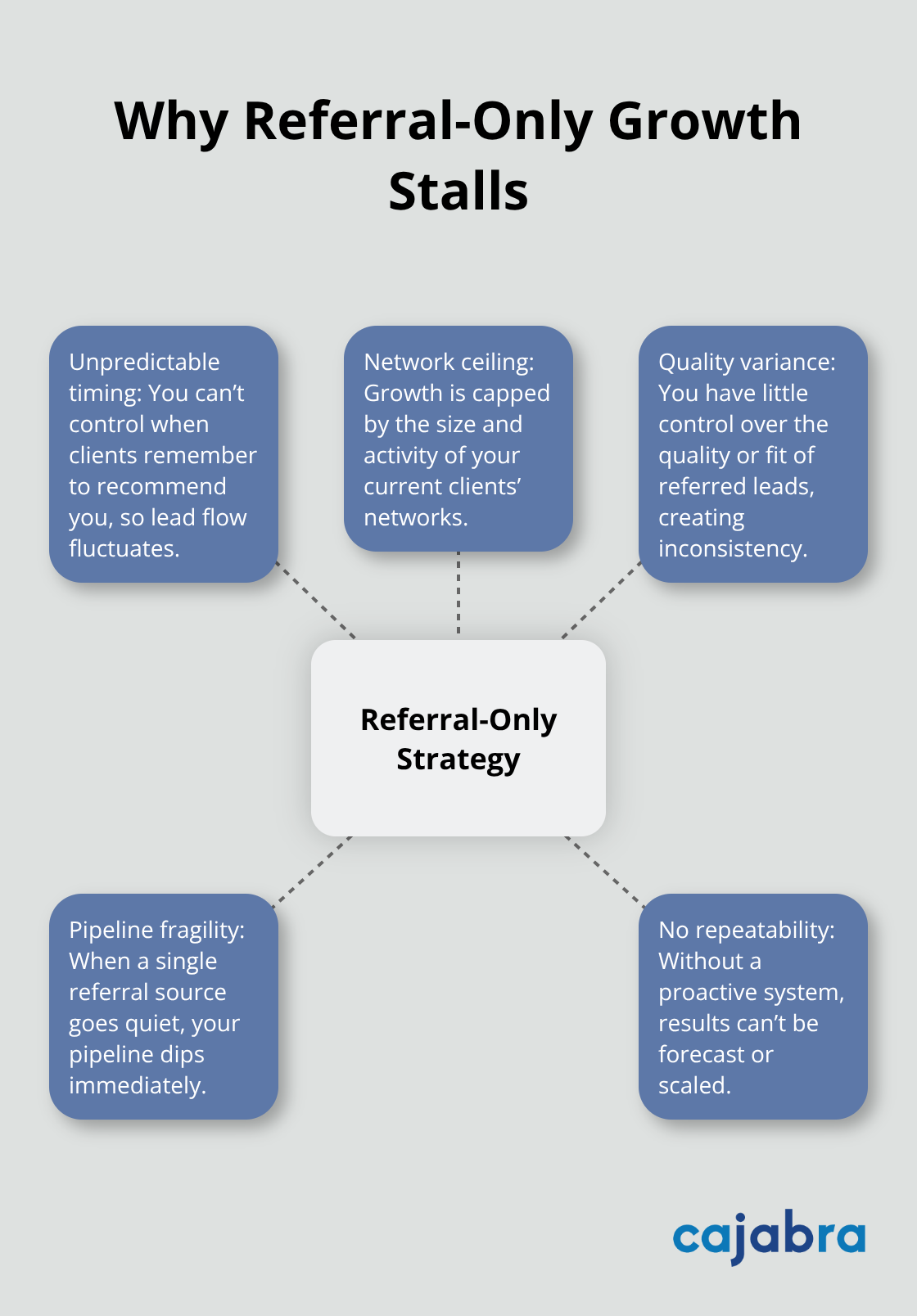

Referrals feel safe. An existing client calls a friend and mentions your name, and suddenly you have a warm lead. This works until it doesn't. The problem is that referrals are unpredictable and depend entirely on your clients remembering to recommend you at exactly the right moment.

Most accountants sit back and hope referrals arrive, which means their growth flatlines when referrals dry up. A study from the American Institute of CPAs found that firms relying primarily on referrals experience growth rates that vary significantly, with some reporting median increases of 6.7% in total net client fees. The real issue is that referrals alone create a ceiling on your practice size because they're limited by the network effect of your existing clients. You also lack control over the quality or consistency of incoming leads. When one referral source stops sending work, your pipeline suffers immediately.

Generic accounting marketing fails because business owners don't care about your credentials or how long you've been in business. They care about their specific problems: rising tax bills, cash flow confusion, payroll headaches, or audit anxiety. When you market yourself as just another accountant who handles bookkeeping and tax returns, you sound identical to every other firm. Business owners tune you out because you haven't shown them why you're different or why you matter to their situation. The accounting firms winning new clients are the ones who speak directly to the pain points of their ideal client, whether that's eCommerce businesses struggling with sales tax complexity or nonprofits drowning in compliance requirements. Vague messaging like "we handle all accounting services" doesn't convert prospects into clients. Specific, problem-focused messaging does. This means your website, your social media content, and your outreach need to address the exact challenges your target clients face through a strong brand messaging strategy, not generic industry language.

Accountants without a lead generation system waste time and money on tactics that don't work together. One month you try LinkedIn, the next month you cold call, the month after that you hope someone finds you through Google. This scattered approach means you never give any single strategy enough time or effort to actually work. Lead generation requires consistency, which only happens when you have a documented process and metrics tracking. Without a system, your lead pipeline looks like a series of random spikes followed by dry periods, making it impossible to forecast growth or plan hiring. You also pay for tools and services that don't integrate with each other, creating friction and wasting resources. The accounting firms that scale fast have replaced this chaos with a clear process: they know exactly where their leads come from, how they move those leads through a sales funnel, and what conversion rates they hit at each stage. They track metrics weekly and adjust based on data, not gut feel. Building a system takes work upfront, but it's the only way to move from hoping for growth to engineering it.

The difference between a stagnant practice and a growing one isn't talent or credentials. It's structure. Firms that scale have replaced hope with a repeatable process. They've identified their ideal client profile, crafted messaging that resonates with that specific audience, and built channels (website, content, outreach) that consistently attract qualified prospects. They measure what works and what doesn't, then double down on what produces results. This systematic approach transforms lead generation from a frustrating guessing game into a predictable engine that feeds your sales pipeline month after month. The firms stuck at the same revenue level year after year are the ones still waiting for referrals or running random marketing experiments without tracking results. The path forward requires you to stop treating lead generation as something you do occasionally and start treating it as a core business function that demands attention, measurement, and refinement through proven strategies for client engagement and satisfaction.

Educational content fails when accounting firms publish generic tax tips or year-end checklists that apply to everyone. The firms winning clients publish content that addresses the specific pain points of their target audience. If you serve eCommerce businesses, your content should tackle sales tax nexus issues, quarterly estimated payments, and inventory accounting. If you serve nonprofits, your content should address grant accounting, Form 990 complexity, and restricted fund management. Target Your Audience With Specific Content by publishing 6-8 posts per month if your blog is less than a year old. Consistency and specificity matter far more than volume alone.

Your website needs a clear value proposition in the headline that speaks directly to your ideal client's problem, not your credentials. Instead of "Full-Service Accounting Firm," try "Tax Strategy for eCommerce Sellers" or "Nonprofit Accounting and Grant Compliance." This specificity signals immediately that you understand their world. Your website should also feature case studies with concrete numbers-how much you saved a client in taxes or how many hours you freed up in their month. Generic testimonials like "Great service" don't convert; specific outcomes do.

Google My Business profiles for local accounting firms matter more than most accountants realize. Firms with optimized profiles that accumulate multiple five-star reviews appear higher in local search results. You should respond to every review, positive or negative, because engagement builds trust with potential clients.

Your sales funnel separates firms that convert prospects into clients from those that lose them to competitors. The funnel starts with attracting qualified traffic through content and positioning, then captures their contact information through a lead magnet. A lead magnet for accountants might be a tax planning calendar, industry-specific checklist, or ROI calculator gated behind an email signup form. The form should ask for only essential information-name, email, and company type-because longer forms kill conversion rates.

Once you capture their contact, you move them into an automated email sequence that provides value before asking for anything. This sequence should include case studies, insights about their industry, and answers to common objections. The conversion happens when you identify high-intent leads and reach out with a personalized message referencing something specific about their business. Cold email and LinkedIn outreach both work, but the message must address their actual situation, not your services.

Research shows that consistent multi-channel outreach through LinkedIn, email, and direct calls generates higher-quality discovery calls than relying on referrals alone. You need to track your conversion rates at each stage: how many website visitors become leads, how many leads open your emails, how many respond to outreach, and how many meetings convert to clients. This data reveals where your funnel leaks. Most accounting firms lose prospects in the nurture phase because they disappear after the first email. A systematic follow-up sequence over 4-6 touchpoints with case studies and insights significantly improves conversion.

The firms scaling fastest have replaced hope with measurement. They know exactly which channels produce qualified leads, which messages resonate with their audience, and which follow-up sequences move prospects toward a decision. This data-driven approach transforms lead generation from guesswork into a predictable process that you can refine and improve month after month. With these fundamentals in place, you're ready to implement the tools and systems that turn this strategy into consistent client acquisition.

The biggest mistake accounting firms make is buying tools before they know what they're trying to accomplish. You'll see firms subscribe to six different software platforms, hire a marketing person, and launch campaigns that go nowhere because they never defined their positioning or messaging first. Stop that. Start with positioning and messaging, then layer in tools and automation only after you know exactly what message you're sending and to whom.

Your positioning answers one question: what specific problem do you solve for which specific type of business? Not accounting problems in general. Specific problems. If you serve eCommerce sellers, your positioning might be: we eliminate sales tax complexity and recover unclaimed refunds for online retailers doing $1M+ in annual revenue. That's concrete. That's ownable. That's different from every other accounting firm in your market.

Once you have positioning, your messaging flows from it. Every piece of content, every cold email, every website headline should reflect this positioning. This is where most accountants fail. They create a website, send cold emails, and post on LinkedIn without a coherent message tying it together. The prospect sees conflicting signals and assumes you're just another generalist.

Spend two weeks on positioning and messaging before you touch a single tool. Interview your best clients and ask what problem you solved that made the biggest difference. Ask why they chose you over competitors. Document the patterns. That becomes your positioning. Then write it down in one sentence. Repeat it obsessively across every channel.

Once positioning is locked, implement tools that automate the repetitive parts of your lead generation process. Most accounting firms waste 10+ hours per week on manual tasks that software can handle. Use a CRM like HubSpot or Pipedrive to centralize all prospect information, track where each lead came from, and automate follow-up sequences.

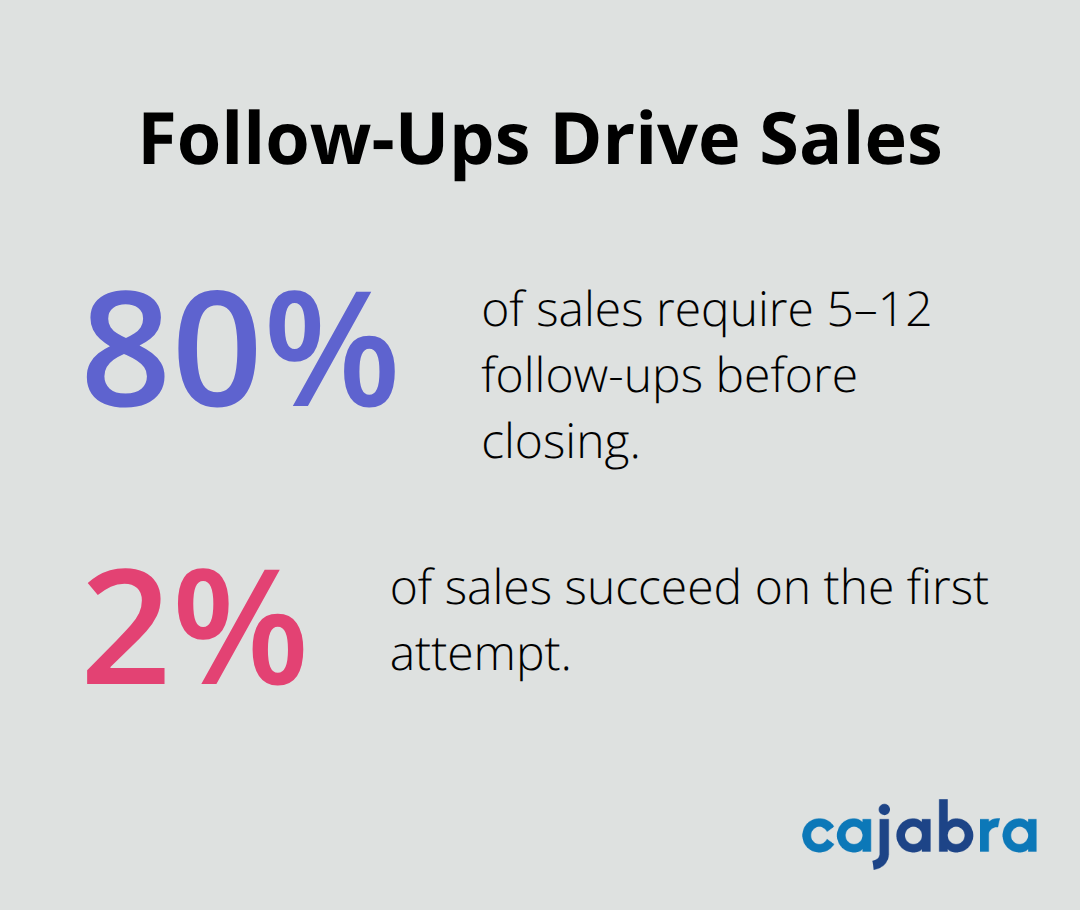

Set up email automation so that when someone downloads your lead magnet, they immediately receive a welcome email, followed by a second email three days later with a case study, and a third email a week after that asking for a call. This consistency matters far more than perfect messaging. Studies reveal that 80% of sales require 5–12 follow-ups, yet only 2% succeed on the first attempt.

Most accounting firms give up after the first email. Automation removes that temptation.

Use LinkedIn automation tools like Sales Navigator to identify prospects matching your ideal client profile, then set up a system where you send 20-30 personalized connection requests per week. Once connected, you can send a follow-up message referencing something specific about their business. This requires less time than you think and generates measurable results.

Track exactly how many messages you send, how many responses you get, and what percentage convert to calls. If you're sending 100 messages per month and getting two calls, your conversion rate is 2 percent. That's actionable data. Now test a different message, send another 100, and see if your conversion rate improves. This is how you refine your system. Most firms never track these metrics, so they never know what's actually working.

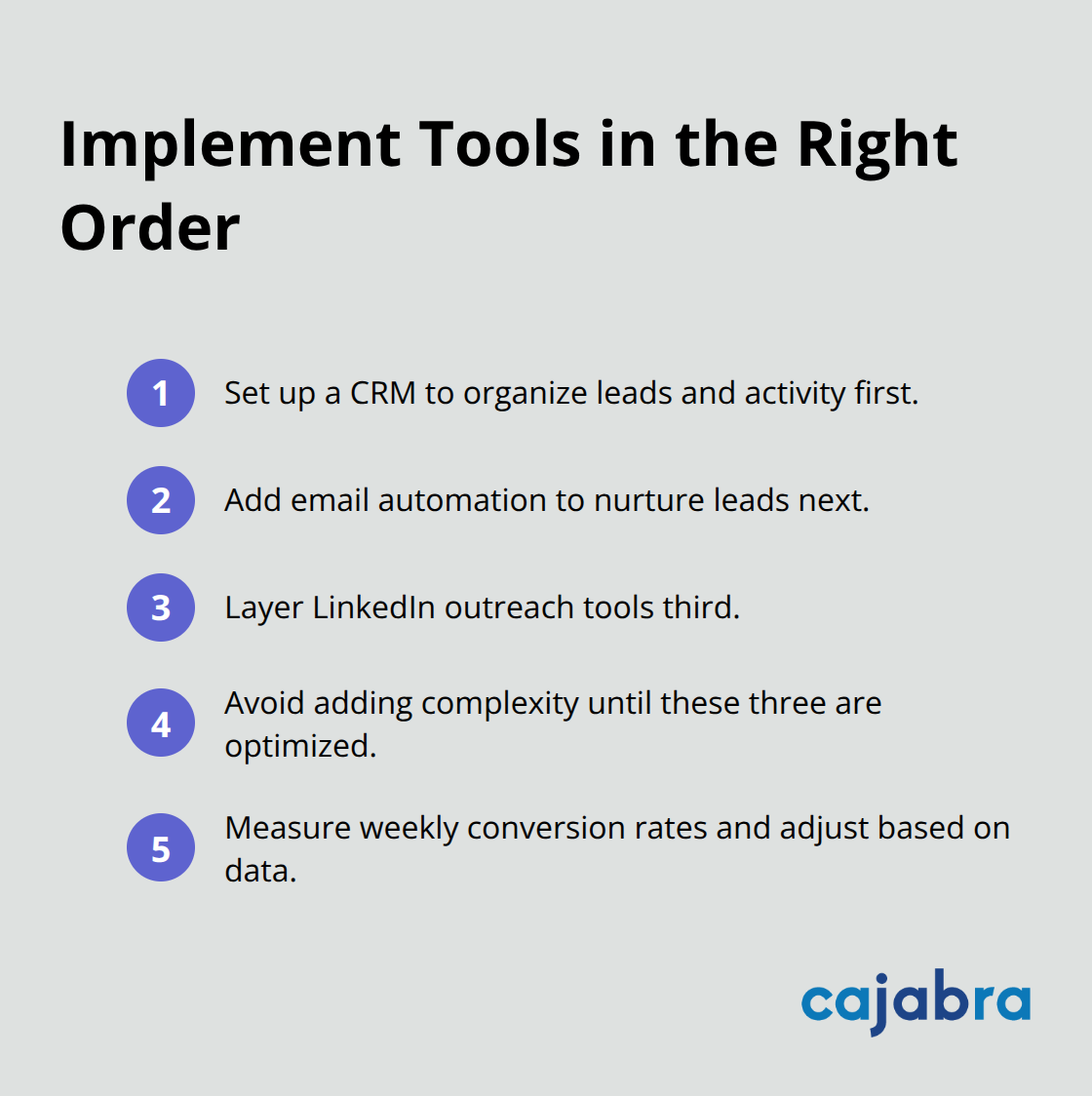

Implement your tools in this order: first a CRM to organize everything, then email automation to nurture leads, then LinkedIn tools to systematize outreach. Don't add more complexity until you've optimized these three.

Measure your conversion rate at each stage weekly and adjust based on what the data shows, not what feels right. The firms scaling fastest have replaced hope with measurement. They know exactly which channels produce qualified leads, which messages resonate with their audience, and which follow-up sequences move prospects toward a decision. This data-driven approach transforms lead generation from guesswork into a predictable process that you can refine and improve month after month.

Lead generation for accountants transforms from painful to predictable the moment you stop treating it as a side project and start treating it as a core business function. The firms winning right now have systems in place, not hope. You now understand that positioning comes first, messaging flows from positioning, and tools only matter after you answer the fundamental question of who you serve and what problem you solve for them. The accounting firms gaining ground move fast-they implement positioning this week, launch email automation next week, and track metrics the week after.

Implementation separates the firms that scale from those that stagnate. Most accountants read content like this, feel motivated, and return to their daily work without changing anything. You can break that pattern by picking one channel, one message, and one metric to track (your response rate, conversion rate, or call volume). This data becomes your roadmap for what to do next, and you refine your approach based on what actually works, not what feels right.

We at Cajabra, LLC built systems to help accountants move from overlooked to overbooked by securing retainer-based clients through strategic lead generation. If you want a partner to guide your lead generation strategy and build the systems that work, explore how Cajabra can help your firm scale.