Financial advisors face intense competition for clients in 2025. Traditional marketing methods no longer generate the leads they once did.

We at Cajabra, LLC have analyzed the most effective marketing for financial advisors strategies that actually work today. This guide reveals proven tactics that top advisors use to attract high-value clients and build sustainable practices.

Social media marketing has become the primary client acquisition channel for financial advisors. Putnam Investments reports that 92% of advisors who use these platforms see increased client acquisition. LinkedIn drives the highest conversion rates and generates 3x more qualified leads than Facebook or Twitter for financial services.

Advisors who post educational content 2-3 times weekly see 40% more engagement than those who post sporadically. Video content performs exceptionally well - financial planning videos receive 85% more views than text posts (HubSpot data shows this clear preference for visual content).

Client referrals account for 93% of new client acquisitions among financial advisors according to Kitces research, yet most advisors handle referrals passively. Active referral programs with structured incentives generate 5x more referrals than informal approaches.

Top-performing advisors implement quarterly referral campaigns that offer specific rewards like portfolio reviews or financial planning sessions for successful referrals. The key lies in timing - advisors who ask for referrals immediately after positive client experiences yield 67% higher success rates than random requests.

Financial planning workshops and webinars convert prospects at rates 4x higher than cold outreach methods. Advisors who host monthly educational sessions report average attendance of 25-40 prospects per event, with 15-20% who convert to clients within six months.

Topics that address retirement planning, tax strategies, and estate planning generate the highest attendance. Successful advisors combine live workshops with follow-up email sequences and create nurture campaigns that maintain engagement between events. This educational approach positions advisors as trusted experts rather than salespeople, which addresses the preference of 76% of investors who want to learn before they engage professional help (Edelman Financial Engines research confirms this trend).

These proven strategies form the foundation of successful advisor marketing, but digital marketing strategies amplify their effectiveness even further.

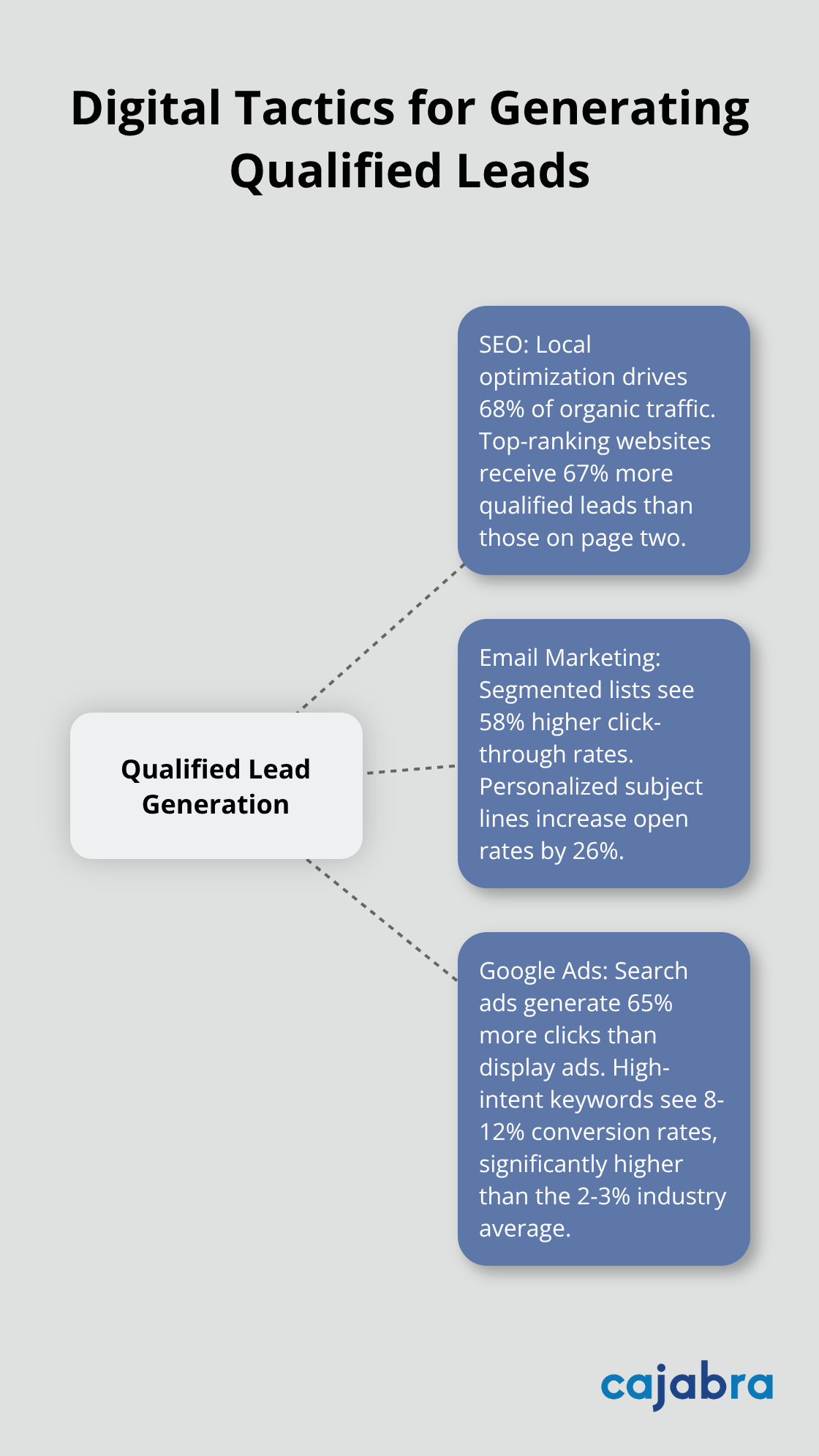

Local SEO generates the highest quality leads for financial advisors, with consumers who perform a local search frequently visiting nearby stores, highlighting the value of location-based optimization according to RankTracker research. Advisors who optimize for location-based keywords like "financial advisor near me" or "retirement planning [city name]" capture prospects who actively seek services in their area. The top-ranking financial advisor websites receive 67% more qualified leads than those on page two of search results.

Successful advisors target long-tail keywords with lower competition but higher conversion rates. Terms like "fee-only financial planner for teachers" or "retirement planning for federal employees" convert 3x better than generic "financial advisor" searches. Website pages that answer specific client questions rank higher and generate more qualified traffic than keyword-stuffed content (which Google now penalizes heavily).

Email campaigns remain a high ROI digital marketing channel for financial advisors, with email marketing continuing to show strong performance metrics according to DMA research. Advisors who segment their email lists based on client demographics and financial goals see 58% higher click-through rates than those who send generic newsletters to all subscribers.

Weekly market update emails that include actionable insights perform better than monthly newsletters filled with general financial tips. Personalized subject lines increase open rates by 26%, while emails sent on Tuesday mornings between 10-11 AM achieve the highest engagement rates. Automated drip campaigns that nurture prospects over 6-8 weeks convert 23% of subscribers into consultation requests.

Pay-per-click advertising provides instant visibility for financial advisors, with search ads that generate 65% more clicks than display ads in financial services. Advisors who target high-intent keywords like "retirement planning consultation" or "401k rollover advice" see conversion rates between 8-12%, significantly higher than the 2-3% average across all industries.

Successful Google Ads campaigns focus on specific services rather than broad financial planning terms. Ads that target "estate planning attorney near me" or "tax-loss harvesting strategies" cost 40% less per click while they generate higher-quality leads. Landing pages that match ad copy exactly and include clear calls-to-action convert 89% better than generic homepage destinations.

These digital tactics work best when advisors combine them with strong online credibility signals and effective content planning that prospects can verify before they schedule consultations.

Financial advisors have exactly 15 seconds to capture visitor attention before prospects leave their website. Research shows that 75% of consumers judge advisor credibility based on website design alone, while 88% abandon poorly designed sites immediately. Modern, mobile-optimized websites convert 40% more visitors into consultation requests than outdated designs with slow load times.

Professional websites that load in under 3 seconds generate 67% more qualified leads than slower sites. Advisors who include client testimonials, professional headshots, and clear service descriptions on their homepage see 45% higher conversion rates. The most effective advisor websites feature simple navigation, prominent contact forms, and compliance-friendly language that builds confidence without overwhelming visitors with financial jargon.

Google reviews directly influence 89% of prospective clients when they choose financial advisors, yet most advisors collect reviews passively. Advisors with 15+ Google reviews receive 3x more consultation requests than those with fewer than 5 reviews. The timing of review requests matters significantly - advisors who ask clients within 48 hours of positive interactions yield 73% response rates (compared to 12% for delayed requests).

Successful advisors implement systematic review collection through automated email sequences and personalized follow-up calls. Advisors who respond to all reviews, including negative ones, demonstrate professionalism and increase overall credibility. Advisors who maintain 4.5+ star ratings across Google, Yelp, and industry-specific platforms like BrokerCheck convert 58% more website visitors into actual clients than those with lower ratings.

Financial advisors must balance educational content creation with SEC and FINRA compliance requirements, which makes content marketing more complex than other industries. Compliance-friendly content that provides general financial education without specific investment advice generates 4x more organic traffic than promotional material. Advisors who publish weekly blog posts that address common financial questions rank higher in search results and attract 34% more qualified prospects.

The most effective advisor content focuses on financial literacy topics like retirement planning basics, tax strategy overviews, and estate planning fundamentals. Content that includes proper disclaimers and avoids specific investment recommendations passes compliance reviews while still provides value to prospects. Advisors who work with compliance-experienced content creators produce 60% more approved content than those who handle writing internally without specialized knowledge (which often leads to compliance issues).

Marketing for financial advisors has transformed into a digital-first approach that values education over aggressive sales tactics. Social media platforms, especially LinkedIn, deliver the highest quality leads when advisors share educational content on a consistent schedule. Referral programs still dominate client acquisition, but structured incentives and strategic timing make the difference between passive and active success.

Local SEO captures 68% of organic traffic for financial advisors, while email campaigns provide strong returns through targeted audience segments. Google Ads offer immediate visibility for high-intent searches, though success requires precise alignment between ad copy and landing pages. Professional website design determines credibility within seconds (75% of prospects judge advisors based on visual appeal alone), while online reviews influence 89% of client decisions.

The industry moves toward hyper-personalized financial plans powered by AI and advanced data analytics. ESG investments will surge among younger demographics, while compliance requirements grow more complex each year. We at Cajabra, LLC help accounting firms overcome similar challenges through our JAB System™, which transforms overlooked practices into overbooked firms within 90 days.