Selling an accounting practice represents one of the most significant financial decisions in a professional's career. The process requires careful planning, strategic positioning, and expert navigation of complex negotiations.

We at Cajabra, LLC have guided countless practitioners through successful accounting practice sales. This comprehensive guide covers every step from initial valuation to final transition.

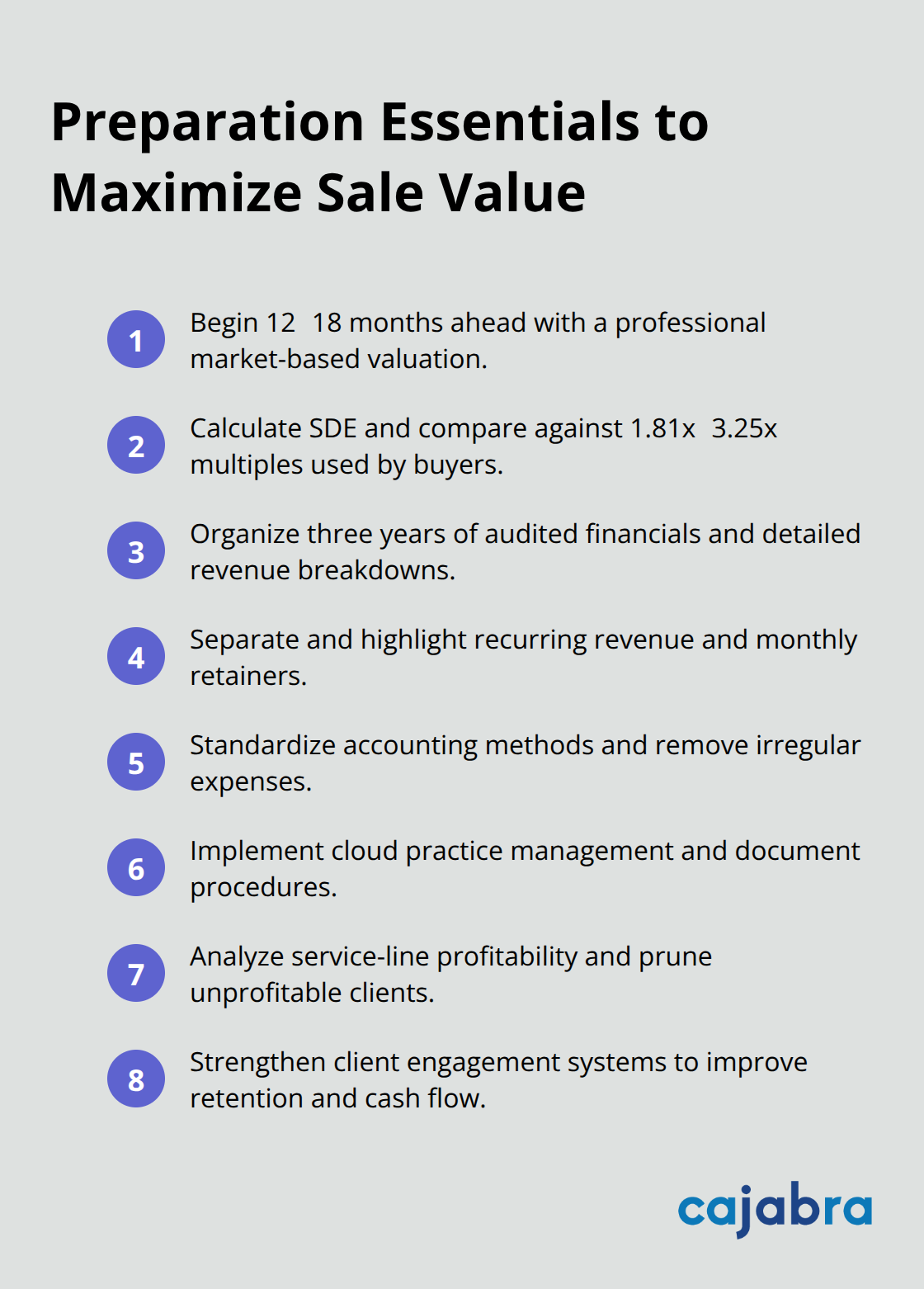

The foundation of a successful accounting practice sale lies in comprehensive preparation that begins 12 to 18 months before you list. Start with a professional business valuation that uses the market approach, which leverages actual transaction data from similar firms. CPA practices typically sell for 0.5 to 1.5 times gross revenue, with the AICPA's 2025 MAP Survey showing median revenue growth of 6.7% across surveyed firms. Calculate your Seller's Discretionary Earnings, as buyers often use SDE multiples that range from 1.81x to 3.25x to determine value.

Your financial records must demonstrate consistent profitability and growth patterns. Organize three years of audited financial statements, client retention data that shows rates above 90%, and detailed revenue breakdowns by service line. Document your recurring revenue streams separately, as monthly retainer arrangements significantly boost valuations. Clean up any irregular expenses, standardize your accounting methods, and present monthly financial summaries that highlight your practice's stability and predictable cash flow patterns.

Invest in modern practice management software and cloud accounting systems before you list. Document all operational procedures, create staff training manuals, and establish systems that function independently of your daily involvement. Focus on profit margin improvements through service line analysis and client profitability reviews. Eliminate unprofitable clients and services while you strengthen relationships with high-value accounts. Boost client engagement through improved service delivery and communication systems. These operational improvements can increase your valuation multiple and attract buyers who seek turnkey operations with established systems and processes.

Modern buyers expect firms to operate with current technology stacks that support remote work and client collaboration. Upgrade your accounting software to cloud-based platforms, implement secure client portals, and automate routine processes wherever possible. Document your technology assets and demonstrate how these systems reduce operational costs while improving service delivery. Buyers pay premium prices for practices that require minimal technology investment post-acquisition.

With your practice positioned for maximum value through proper preparation and documentation, the next step involves identifying and attracting qualified buyers who align with your firm's culture and growth objectives.

Your network contains the most qualified buyers for your accounting practice. Start with competitors who lack your specialized services or geographic coverage. Reach out to firms within a 50-mile radius that handle similar client sizes but offer complementary services.

Regional firms often seek acquisitions to expand their footprint, and they understand your market dynamics better than distant buyers. Contact former colleagues who started their own practices, as they frequently pursue strategic acquisitions for rapid growth.

Business brokers who specialize in accounting practice sales command higher prices than owner-handled transactions. Experienced brokers maintain databases of pre-qualified buyers and complete sales faster than individual sellers. Expect to pay commissions between 8% to 12% of the sale price, but brokers typically recover these costs through better valuations and terms. Interview at least three brokers before you select one, and choose specialists who complete at least 20 accounting practice sales annually. Verify their track record with recent transactions in your revenue range and geographic area.

Qualified buyers must demonstrate financial capability for your price plus capital requirements. Request proof of funds or pre-approval letters before you share detailed financial information. Evaluate their operational experience with staff management and client relationships, as inexperienced buyers often struggle with retention rates. Review their current client base size and service offerings to assess growth potential and operational synergies.

Cultural alignment matters significantly for client satisfaction during transitions and long-term practice success. Meet potential buyers in person to assess their communication style and professional approach. Buyers who understand your service delivery methods and share similar client service philosophies typically achieve smoother transitions. Observe how they interact with your staff during facility tours and client meetings. Test their knowledge of your specialized services and industry focus areas to gauge their commitment to maintaining service quality standards.

Once you identify qualified buyers who align with your practice culture and demonstrate financial capability, the negotiation phase requires strategic planning to structure favorable terms and protect your interests throughout the transaction process.

Market data shows CPA practices sell for multiples between 0.5 to 1.5 times gross revenue, but your price depends on specific performance metrics and buyer competition. Set your initial price at the higher end of this range if your practice shows consistent revenue growth and maintains strong client retention rates. Practices with recurring revenue streams command premium multiples, often reaching 1.3 to 1.5 times gross revenue. Factor in your geographic location, as urban practices typically sell for higher multiples than rural firms due to larger talent pools and diverse client bases. Research recent sales of comparable practices within 100 miles to establish realistic benchmarks that reflect current market conditions.

Structure payment terms with 10% to 20% cash at closing, followed by seller financing over five to seven years at market interest rates. Longer payment terms often justify higher sale prices, as buyers can manage cash flow more effectively while you receive premium valuations. Include personal guarantees from buyers and maintain security interests in practice assets until full payment completion.

Negotiate acceleration clauses that trigger full payment if buyers default on operational benchmarks or client retention targets. Establish clear payment priorities that position your seller note ahead of other debts, and require quarterly financial reports to monitor buyer performance throughout the payment period.

Base earn-out provisions on client retention percentages rather than revenue targets, as retention metrics provide clearer performance measurements. Structure these provisions to pay additional amounts when retention rates exceed 90% annually for three years post-sale. Cap total earn-out payments at 25% of the base purchase price to maintain reasonable risk exposure. Include specific definitions for client retention calculations and establish dispute resolution procedures for performance disagreements. These provisions align buyer incentives with practice preservation while protecting your financial interests.

Prepare comprehensive due diligence packages that include three years of tax returns, client aging reports, staff employment agreements, and technology asset inventories. Organize client contracts by service type and revenue contribution to demonstrate practice stability. Document all recurring revenue arrangements and highlight monthly retainer clients separately. Provide detailed staff compensation records and employment terms to help buyers assess transition costs. Include professional liability insurance policies and claims history to address buyer concerns about potential liabilities.

Engage attorneys who specialize in accounting practice acquisitions to draft purchase agreements that include non-compete clauses, client retention requirements, and transition support obligations. Include specific transition periods where you remain available for client introductions and operational guidance (typically 90 to 180 days depending on practice complexity). Negotiate professional liability insurance continuation and establish clear boundaries for post-sale client communication responsibilities. Structure non-compete agreements that protect buyer investments while allowing reasonable career flexibility for sellers.

Successful accounting practice sales demand strategic preparation that starts 12 to 18 months before you list your firm. You must focus on comprehensive business valuations, clean financial documentation, and operational improvements that show consistent profitability. Modern technology infrastructure and documented procedures boost buyer interest and drive higher final sale prices.

Sellers make critical mistakes when they allow inadequate preparation time, set unrealistic price expectations, and fail to qualify buyers properly. You should avoid emotional decisions during negotiations and resist the urge to handle complex transactions without professional guidance. Many sellers underestimate cultural fit importance, which leads to failed transitions and client retention problems.

Payment structure carries more weight than initial price in most transactions (seller financing with appropriate security measures protects your interests while buyers complete acquisitions). We at Cajabra, LLC help accounting firms build the recurring revenue streams and operational efficiency that command premium valuations through our proven marketing strategies. The accounting practice sales process takes six to twelve months from initial preparation to final closing, so you should start early and maintain operational excellence throughout the timeline.