Your accounting website might be costing you business without you realizing it. At Cajabra, LLC, we've seen countless firms lose potential clients simply because their site fails to convert visitors into leads.

Website optimization isn't optional anymore-it's the difference between thriving and struggling. The good news is that fixing these problems doesn't require a complete overhaul.

Why Your Website Design Is Costing You Clients

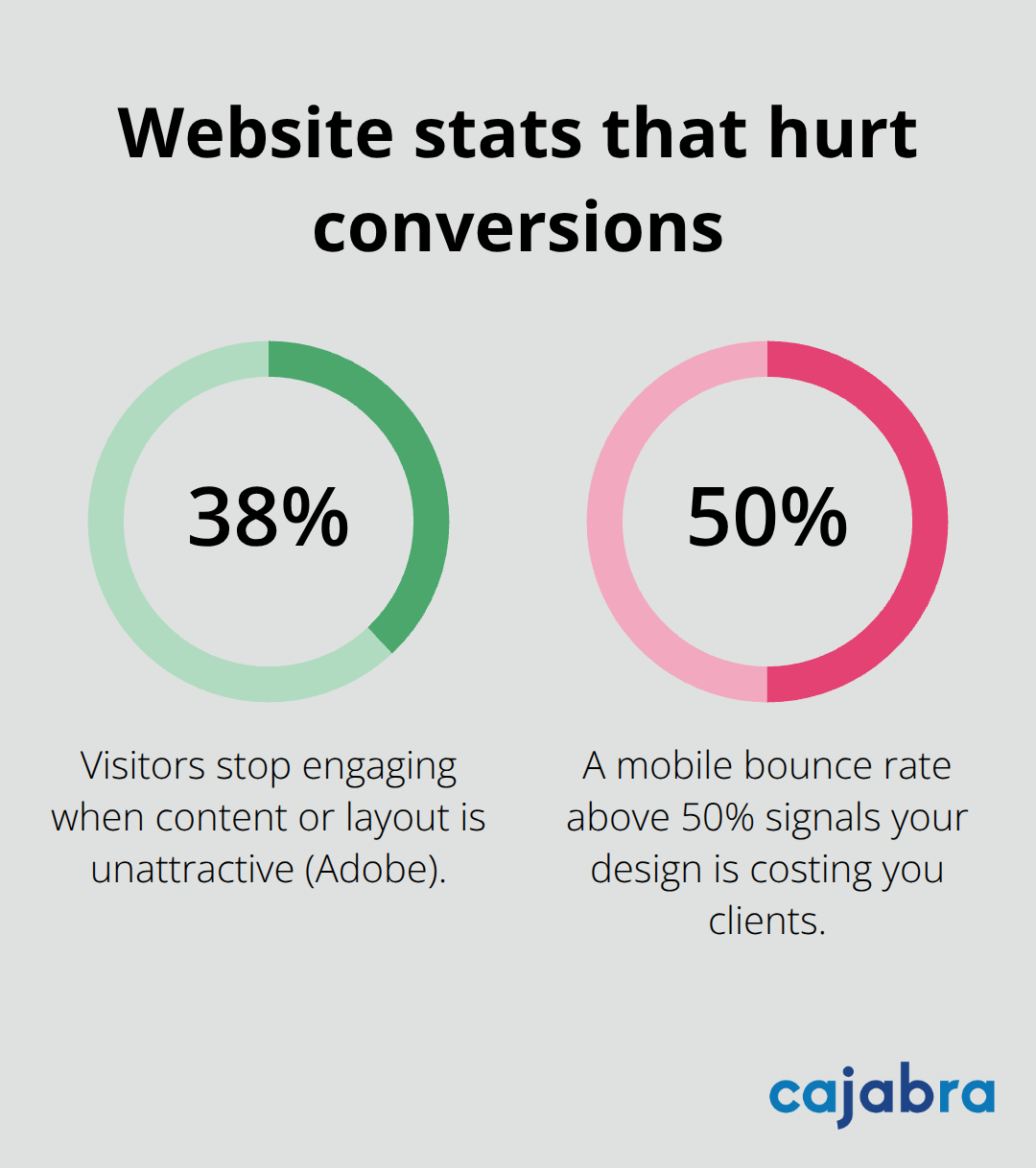

An outdated website layout signals to visitors that your firm operates behind the times. According to Adobe, 38% of people stop engaging with a site if the content or layout is unattractive. That means more than one-third of potential clients leave before they even learn what you offer. Slow loading speeds compound this problem significantly. Mobile-unfriendly design represents perhaps the worst offender. Over 70% of digital traffic now comes from mobile devices, yet many accounting firms still operate sites designed for desktop users. When someone searches for an accountant on their phone and lands on your site only to find unreadable text and broken navigation, they click to a competitor in seconds.

The financial cost is real and measurable. A firm losing even five qualified leads per month due to poor site design forfeits $50,000 to $100,000 in annual revenue, depending on your average client value.

Your Site's Speed Directly Impacts Lead Generation

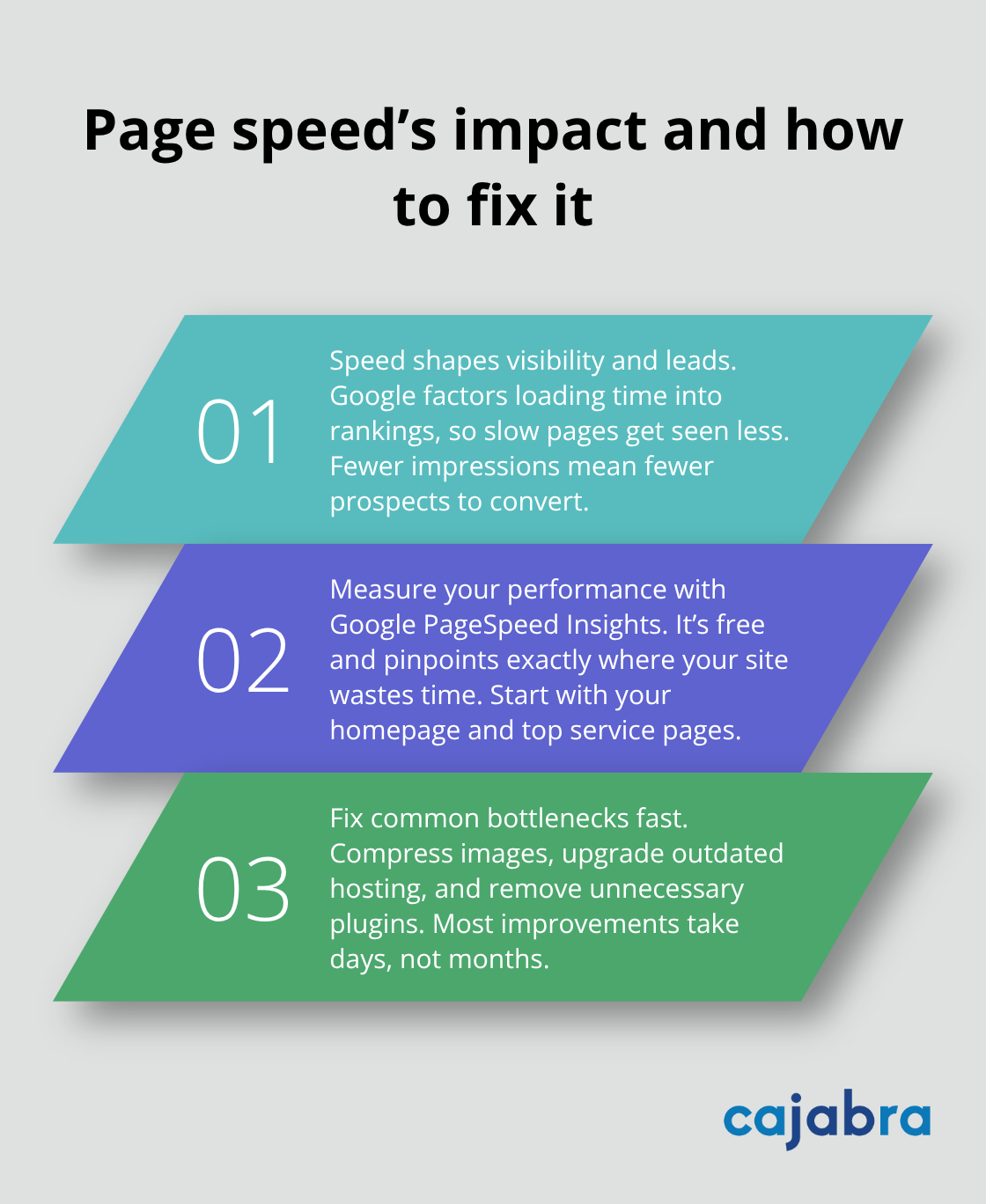

Page speed affects far more than user experience. Google uses loading speed as a ranking factor, meaning slow sites rank lower and receive less visibility. If your site takes five seconds to load instead of two, you lose search traffic before anyone even arrives.

Test your current site speed using Google PageSpeed Insights, which is free and shows exactly where your site loses time. Common culprits include unoptimized images, outdated hosting, and unnecessary plugins. Fixing these issues often takes just days, not months.

The Mobile-First Reality

Accounting firms that haven't redesigned for mobile operate with one hand tied behind their back. When a prospect researches accountants during their lunch break or while commuting, they use a phone. If your site forces them to pinch, zoom, and hunt for your phone number, they move on. A responsive design that automatically adjusts to any screen size isn't a nice-to-have anymore-it's the bare minimum. This shift matters because mobile users expect instant access to information and frictionless navigation.

Trust Signals Matter More Than Flashy Design

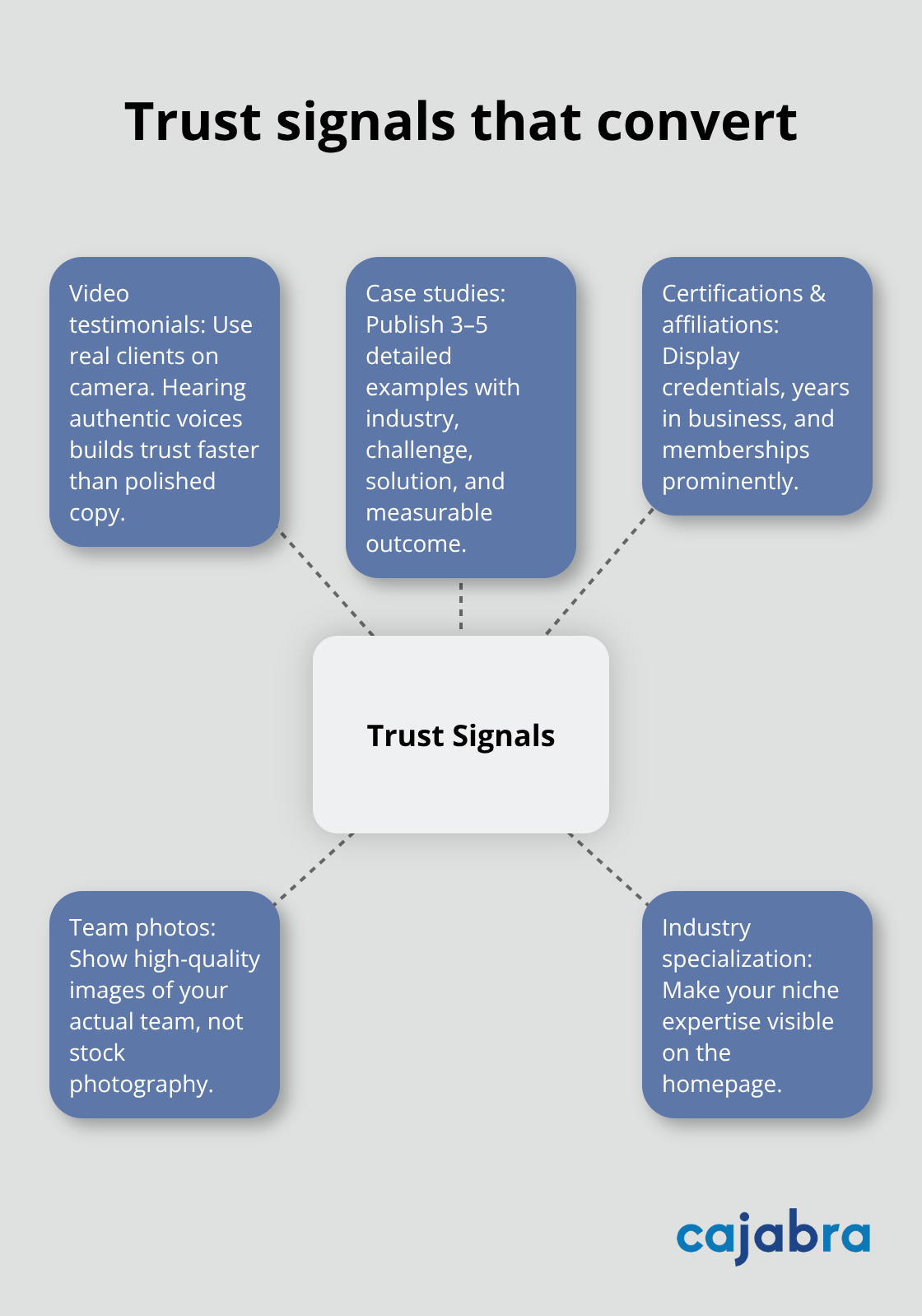

Outdated layouts don't just look bad; they actively harm your credibility. Visitors judge your firm's competence partly on how professional your site appears. Your visual branding-from your logo to your website design-tells clients whether you're serious about their finances before they even read your first email. Adding trust signals like client testimonials, case studies with real results, certifications, and your team's photos transforms a generic site into a credibility machine. These elements work because they're specific and verifiable, not generic claims about your expertise. The next section reveals exactly what accounting clients want to see on your website.

What Accounting Clients Want to See

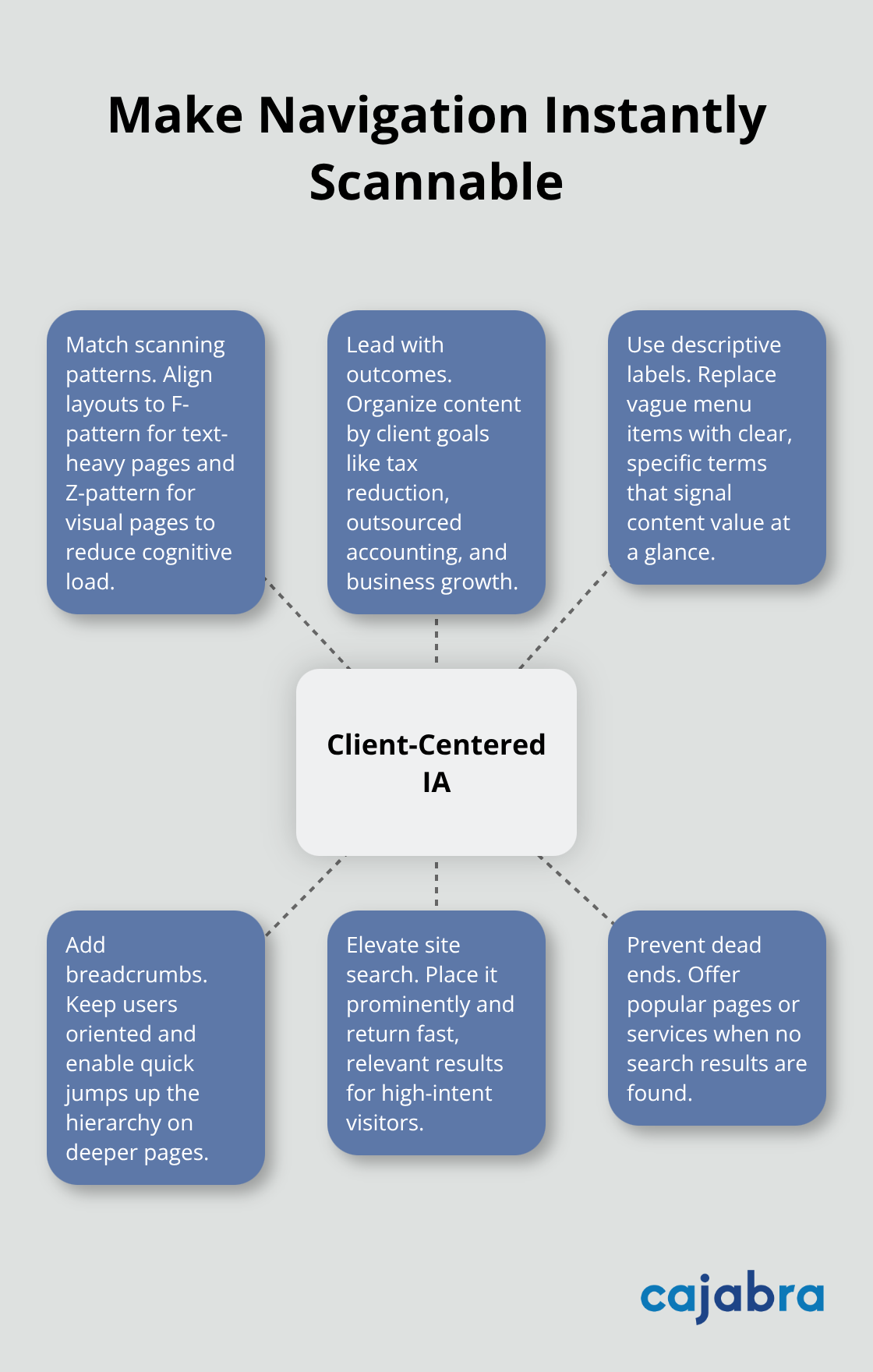

Accounting prospects arrive at your website with specific expectations, and vague generalities won't convert them into clients. They want to know immediately whether you handle their situation, how much it costs, and whether other businesses like theirs trust you. Campaign Monitor data shows that financial services email open rates sit around 27.1%, meaning prospects actively search for relevant information-they just won't wait long to find it. Your site must answer three core questions fast: What services do you offer, what will it cost, and can I trust you with my finances?

Pricing Transparency Stops Prospects From Leaving

Most accounting websites hide pricing behind vague language like "contact us for a quote." This approach backfires spectacularly. Prospects comparing three firms will click away from the one that won't show numbers and spend more time on the site that does. When you display clear service packages or at least price ranges, you pre-qualify leads before they ever call. Firms that show transparent pricing receive fewer inquiries overall, but those inquiries convert at much higher rates because unmotivated prospects self-select out. Specificity builds credibility because it shows you've thought through your offerings and aren't afraid to be direct.

Real Client Results Beat Generic Testimonials Every Time

A single sentence praising your expertise means almost nothing. A detailed case study showing that you solved a client's problem with measurable outcomes means everything. Forrester research indicates that UX improvements increase conversion rates by up to 400%, and case studies are a major UX component because they prove value. Include specifics: the client's industry, their challenge, your solution, and the measurable outcome. Avoid generic praise like "excellent service" or "great communication." Instead, show real numbers, real problems solved, and real client names (or at least their industry and company size). Video testimonials outperform written ones because prospects hear genuine tone and see real people, not polished marketing copy.

Contact Information Must Be Impossible to Miss

Your phone number should appear in the header of every page in a readable font size, ideally as a clickable link on mobile devices. Prospects researching accountants on their lunch break won't hunt through your site looking for a contact form buried in the footer. Make it the first thing they see. Consultation booking should take one click-either a prominent button linking to your calendar tool or a simple form that takes 30 seconds to complete. The easier you make it to start a conversation, the more conversations you'll have. Hesitant prospects often need a low-friction entry point; a free financial assessment or a 15-minute discovery call removes barriers to initial contact. Don't force them to commit to anything expensive or time-consuming before they've spoken with you.

Trust Signals Transform Generic Sites Into Credibility Machines

Outdated layouts don't just look bad; they actively harm your credibility. Visitors judge your firm's competence partly on how professional your site appears. Your visual branding-from your logo to your website design-tells clients whether you're serious about their finances before they even read your first email. Add trust signals like client testimonials, case studies with real results, certifications, and your team's photos. These elements work because they're specific and verifiable, not generic claims about your expertise. The next section reveals exactly how to fix your accounting website fast and start capturing the clients you're currently losing.

Fix Your Accounting Website in Three Moves

Audit Your Site Like a Prospect Would

Open your website on three devices: a desktop, a tablet, and a phone. Spend 30 seconds on your homepage and ask yourself honestly: Can I find the phone number? Do I understand what services you offer? Is the text readable without zooming? Do I see any client testimonials or proof that this firm is competent? If you hesitate on any of these questions, your prospects do too.

Use Google PageSpeed Insights to measure your actual load time. Anything over three seconds hemorrhages visitors. Check your Google Analytics to see how many people bounce from your mobile site within seconds. If your bounce rate exceeds 50% on mobile, your design actively costs you clients. Most accounting websites fail this audit because they were built five to ten years ago and never updated. A site designed for desktop browsers in 2016 feels ancient to someone viewing it on their iPhone today.

Redesign for Mobile First

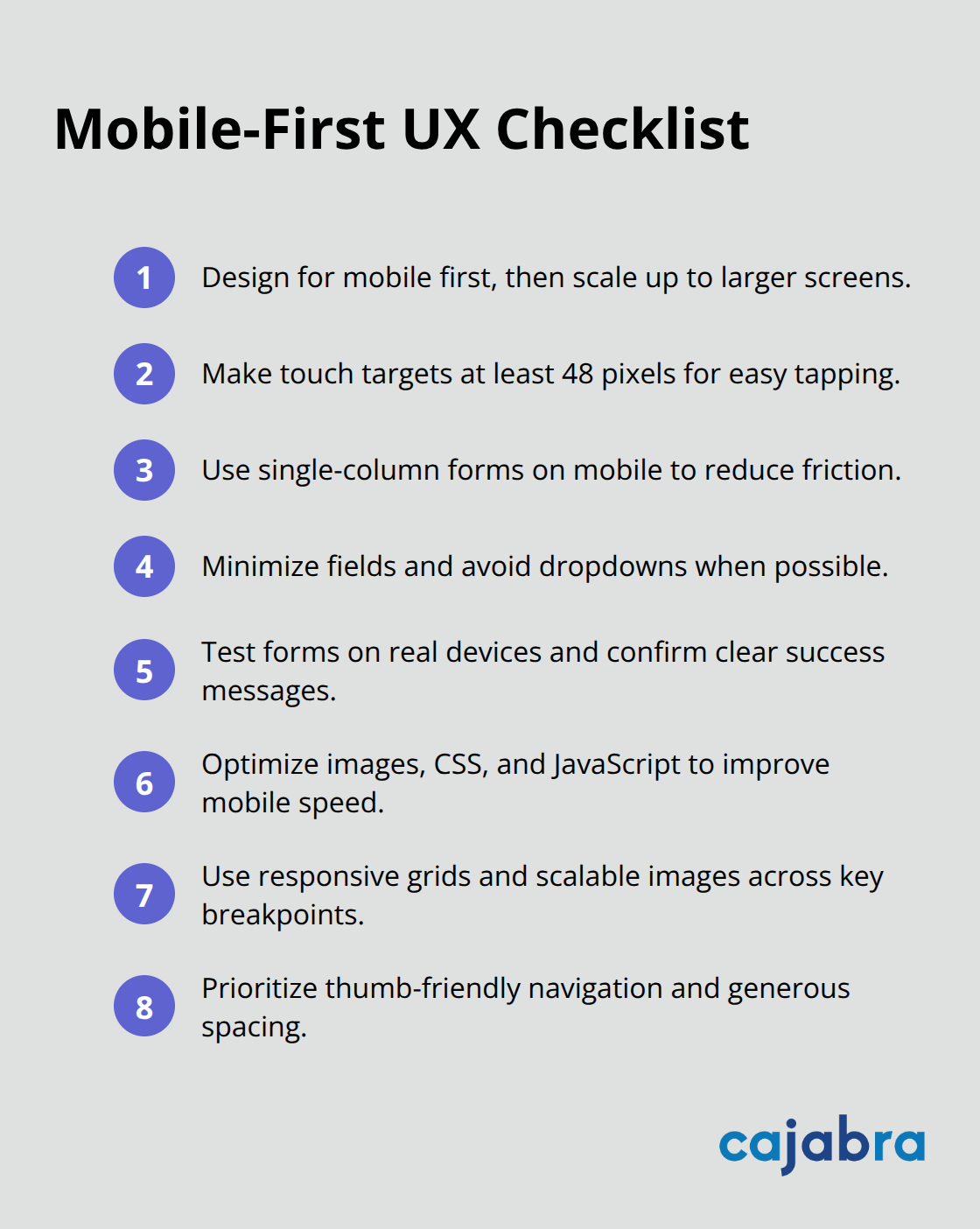

Mobile-first redesign is non-negotiable. This doesn't mean a complete rebuild; it means your site must function flawlessly on phones first, then scale up to larger screens. Responsive design automatically adjusts your layout, text size, and navigation based on screen size.

Your phone number should be the first clickable element visitors see. Your service descriptions should be scannable in 15 seconds, not buried under marketing fluff. Your consultation booking button should require one click, not three. Tools like Webflow allow you to build or rebuild your site without coding, and they enforce mobile-first design by default. If you hire a designer or agency, specify that mobile optimization is your priority, not an afterthought.

Over 70% of your traffic comes from mobile devices, so designing for desktop first is backwards. The firms winning new clients have sites that work perfectly on phones because that's where prospects research accountants during their lunch break.

Add Trust Signals That Convert

Trust signals separate firms that convert prospects from firms that get clicked away. Add a high-quality photo of your actual team on your About Us page, not stock photos of people who don't work for you. Include three to five detailed case studies showing real results: the client's industry, their specific problem, your solution, and a measurable outcome like tax savings or time freed up.

Video testimonials from actual clients outperform written reviews because prospects hear genuine tone and see real faces. Display your certifications, your years in business, and any industry affiliations prominently. If you've been in business for 25 years, say it. If you specialize in a specific industry like healthcare or real estate, make that visible on your homepage.

Research shows UX improvements increase conversion rates, and trust signals are the fastest way to improve your conversion rate because they directly answer the question every prospect has: Can I trust this firm with my finances? A site packed with real client results and real team photos converts at two to three times the rate of a generic site with stock photos and vague claims.

Final Thoughts

Your accounting website works 24/7 to attract clients or push them toward competitors-it's your most active marketing tool. A prospect who lands on your site and cannot find your phone number, see your pricing, or verify your credibility will not call back; they call the next firm in their search results instead. Website optimization directly impacts your bottom line because 38% of visitors abandon sites with poor design, over 70% of traffic comes from mobile devices, and UX improvements increase conversion rates by up to 400%.

Start with an honest audit of your current site on mobile, add three detailed case studies showing real client outcomes, and display your phone number prominently on every page. Test your load speed and fix anything over three seconds-these moves cost far less than hiring an expensive agency, yet they deliver measurable results within weeks. The firms that act now stop losing clients to better-designed competitors and start building a sustainable pipeline of qualified leads.

We at Cajabra, LLC help accounting firms modernize their digital presence through our Premium Online Presence Package, which transforms outdated websites into lead-generating assets. Your website can work for you instead of against you-the question is whether you will fix it today or lose another client tomorrow.

Most companies waste 60–70% of their content budget creating assets that get used once and forgotten. Content repurposing flips this equation by extracting multiple revenue streams from each piece you produce.

At Cajabra, LLC, we've seen firsthand how strategic repurposing cuts content costs while expanding reach across platforms. The data is clear: companies that repurpose content see 3x higher engagement rates than those starting from scratch every time.

The Real Economics of Content Reuse

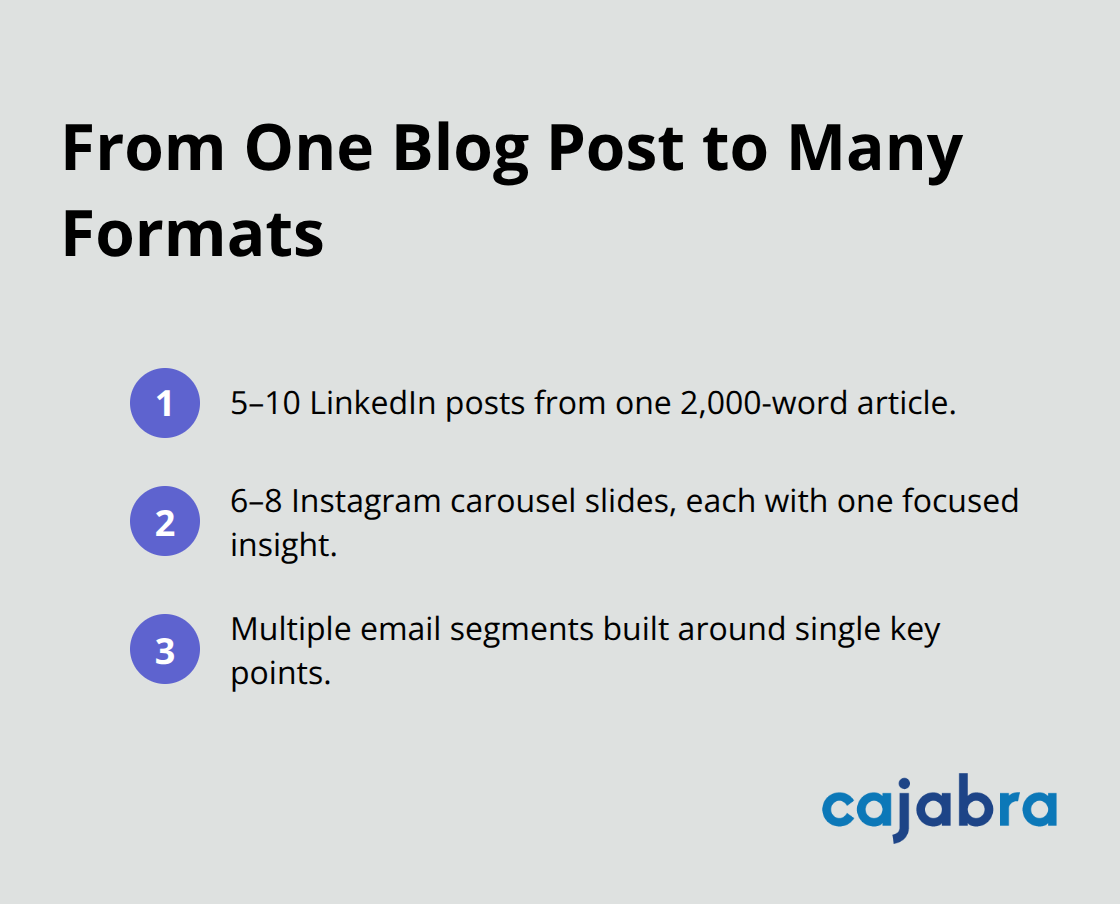

A single blog post that takes 8–10 hours to produce costs roughly $800–$1,200 in labor alone when you factor in research, writing, and editing. Most companies publish that piece once, watch it generate traffic for a few weeks, then move on to the next project. What they miss is that the same content can produce revenue across five or more channels without proportional increases in cost. A 2,000-word blog post, for example, yields 5–10 LinkedIn posts, 6–8 Instagram carousel slides, and multiple email segments, each focused on a single key insight. You extract modular value from work already completed rather than duplicating effort.

According to HubSpot research, repurposing content doubles engagement rates compared to relying solely on original assets. That's not incremental improvement-that's a fundamental shift in how your content performs.

Cost Reduction Without Sacrificing Reach

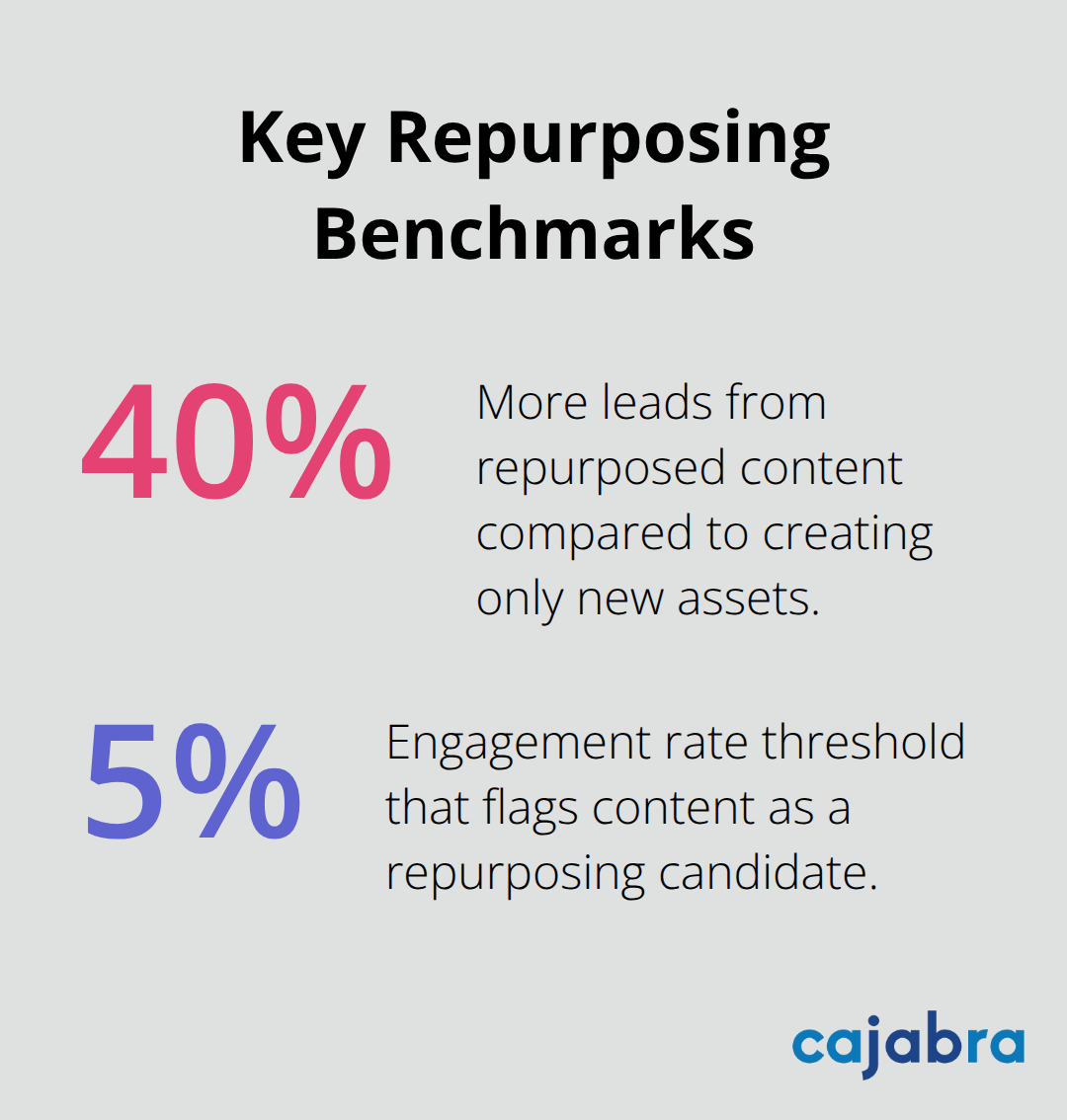

Content creation budgets are finite. Most teams face pressure to produce more without additional headcount, which forces a choice: create less frequently or lower quality. Repurposing eliminates this false choice. Transforming existing assets saves 60–80% of content creation time compared to starting from scratch for each platform. A 30-minute interview can become a magazine feature, an email series, multiple social posts, two radio spots, and a quote for your annual report-all from one conversation. Buffer reports that systematic repurposing expands reach by approximately 400% across new platforms, while another analysis shows that repurposed content produces up to 40% more leads than entirely new content. The financial math is straightforward: you distribute the creation cost across multiple revenue-producing assets instead of betting everything on a single channel.

Extending Content Value Far Beyond Launch

Evergreen content-pieces about timeless principles, foundational strategies, or recurring problems-should never become disposable. These assets remain relevant for years, yet most companies publish them once and archive them. High-performing content deserves a second, third, and fourth life across different formats and audience segments. A webinar recording transforms into shorter tutorial videos for users seeking quick guidance, or converts into a podcast episode for listeners during commutes. Video transcripts become 2,500+ word blog posts that boost time-on-page metrics and SEO performance. Case studies distill into focused blog posts targeting specific conversion keywords. The longer your content works, the higher your return on that initial investment. Quarterly content audits identify pieces with engagement above 5% or 1,000+ monthly visits-your repurposing goldmines worth maximizing across channels.

Identifying Your Repurposing Opportunities

Not all content deserves equal repurposing effort. Lead-generating assets such as blog posts, webinars, and case studies drive conversions and signups, making them prime candidates for multiple formats. Data-rich content yields the most modular assets: dozens of social posts, several blog articles, and multiple videos can emerge from one report. You should prioritize top-performing content with engagement above 5% or 1,000+ monthly visits for repurposing. Analytics platforms reveal which pieces attract traffic and hold reader attention. Once you identify these winners, the repurposing process becomes systematic rather than random, ensuring your effort targets assets that already prove their value.

The foundation for maximizing content ROI rests on understanding these economics. Once you recognize how much value sits dormant in your existing library, the next step involves selecting the right methods to unlock that potential across your specific channels and audience segments.

How to Turn One Piece of Content Into Five

A 2,000-word blog post sitting in your archive represents wasted potential if it only lives on your blog. The real power emerges when you systematically extract multiple formats from that single piece, each tailored to how different audiences consume information. Start with your highest-performing blog posts-those with 1,000+ monthly visits or 5% engagement rates-and break them into modular components. Each section becomes a standalone social post. Each data point becomes a visual graphic. Each key insight becomes an email segment.

Reformat Blog Posts Across Multiple Channels

A blog post about accounting firm cash flow management yields five to ten LinkedIn posts when you extract one actionable tip per post, six to eight Instagram carousel slides with each slide focusing on a single step or statistic, and multiple email newsletter segments sent across consecutive weeks. This approach works because you're not repeating the same content-you're reframing it for platform-specific audiences. LinkedIn professionals respond to detailed advice and industry context. Instagram users want visual simplicity and quick wins. Email subscribers expect deeper dives and exclusive insights.

HubSpot research shows that repurposed content delivers double the engagement compared to original assets alone. The multiplication happens because each format reaches different people at different moments in their decision journey.

Extract Insights From Your Data and Research

Research reports and datasets contain dozens of repurposing opportunities that most companies ignore. A single industry report with ten key findings becomes ten separate blog posts, each optimized for different search keywords and audience segments. That same report produces multiple infographics highlighting your most striking statistics, suitable for Pinterest or LinkedIn.

Data visualizations perform exceptionally well on social platforms. You can create short-form videos showing what your data reveals, breaking down complex findings into 60-second explanations. Webinar recordings transform into podcast episodes for audiences consuming content during commutes. Transcribe those webinars into 2,500+ word blog posts that rank for long-tail keywords and boost your time-on-page metrics.

The transcription approach works particularly well because you already have the audio and speaking points; the writing becomes an editing exercise rather than creation from zero. Ahrefs demonstrates this method by embedding videos within blog posts derived from transcripts, which increases reader engagement and time spent on page. Testimonials and case studies deserve similar treatment-extract quotes into social posts, compile multiple testimonials into a dedicated landing page, and distill a full case study into a focused blog post targeting specific conversion keywords your ideal clients actually search for.

Customize Your Format for Each Audience Segment and Platform

Platform algorithms reward consistency and relevance, but they punish generic copy-paste approaches. What performs on LinkedIn fails on Twitter, and what works on Facebook misses the mark on TikTok. LinkedIn audiences expect professional context, detailed explanations, and thought leadership positioning-your posts should run 150–250 words with a clear point-of-view. Twitter and X demand brevity and hooks that stop the scroll within the first five words. Instagram carousel posts need visual hierarchy and one insight per slide. Email newsletters tolerate longer-form content because subscribers already chose to receive your messages.

Rather than copying identical text across platforms, adapt the core message to match each channel's culture and format. A single insight about tax planning becomes a detailed LinkedIn post with industry context, a punchy three-tweet thread on X, an Instagram carousel with visual examples, and an email segment with implementation steps. This targeted approach costs almost nothing extra once you have the source material, yet it dramatically increases the likelihood that your message lands with each specific audience.

Repurposing without platform optimization wastes the opportunity. The next chapter explores the specific tools and systems that automate this adaptation process, allowing you to scale your repurposing efforts without proportional increases in team size or budget.

Automation and Analytics: The Real Tools That Scale Repurposing

Repurposing only works at scale when you stop treating it as a manual process. The gap between knowing you should repurpose content and actually executing it across five platforms comes down to tooling. Most teams lack a systematic way to distribute adapted content, track what performs where, and organize repurposing campaigns without chaos.

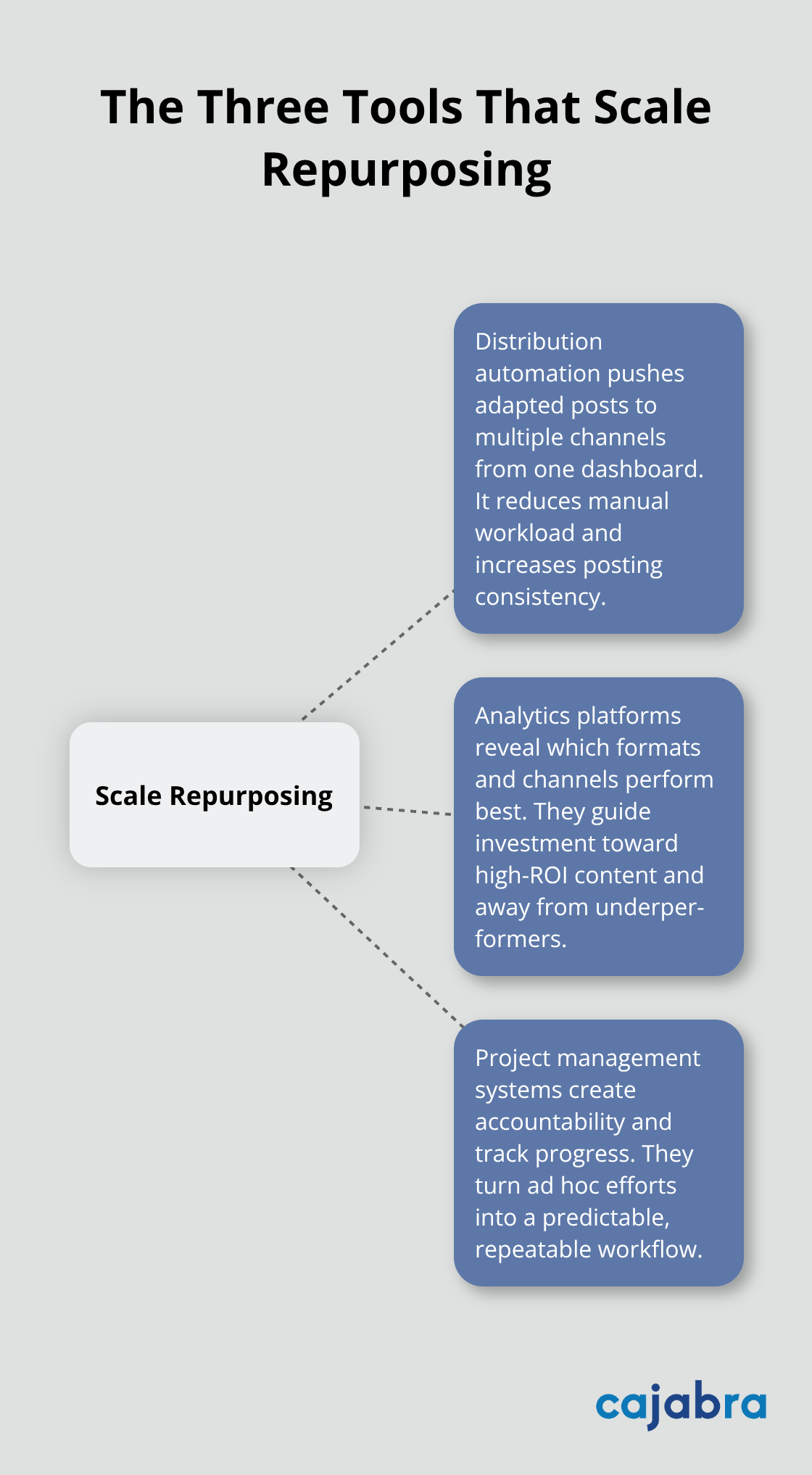

This gap is where good intentions die. You need three categories of tools working together: distribution automation that pushes content to multiple channels simultaneously, analytics platforms that show which repurposed formats drive actual results, and project management systems that keep repurposing campaigns organized across weeks and months. Without these, repurposing becomes another task piling onto already-stretched teams, and it gets abandoned within weeks.

Distribution Automation Cuts Your Posting Time

Buffer, Later, and Hootsuite let you schedule repurposed content across multiple social platforms from a single dashboard. Instead of logging into LinkedIn, Twitter, Instagram, and Facebook separately, you write once and distribute to all channels on your preferred schedule. Distribution automation cuts your posting time by streamlining workflows across channels. Teams using scheduling tools post more frequently than those managing channels manually, which directly correlates with higher reach and engagement. This multiplication effect compounds over months as your content frequency increases without proportional increases in labor costs.

Analytics Platforms Reveal Which Formats Actually Win

Google Analytics, platform-native dashboards, and tools like Semrush reveal which repurposed formats drive actual results. You need to know whether your Instagram carousel slides generate more engagement than your LinkedIn posts about the same topic, or whether email segments outperform social snippets. Without this visibility, you repurpose blindly and waste effort on underperforming formats. Analytics platforms reveal which repurposed formats actually drive traffic by tracking key performance indicators across channels. A quarterly audit of your top 10 repurposed pieces shows which formats deserve more investment and which ones you should abandon or redesign.

Project Management Tools Create Accountability

Monday.com, Asana, or Notion create accountability and visibility across your repurposing workflow. Map out your repurposing plan before starting: identify your source content, assign team members to specific format conversions, set deadlines, and track progress. A simple project template prevents repurposing work from getting lost in daily chaos. When your team knows exactly which blog post converts into what formats (and by whom and when), execution becomes predictable and repeatable rather than sporadic.

The Three-Tool System Compounds Your ROI

The combination of these three tool categories transforms repurposing from occasional effort into a repeatable system that compounds your content ROI over time. Distribution automation handles the logistics, analytics reveal what works, and project management keeps teams aligned. Together, they eliminate the friction that kills most repurposing initiatives before they gain momentum.

Final Thoughts

The numbers tell a clear story: companies that systematically repurpose content generate 40% more leads than those creating entirely new assets, while expanding reach by 400% across platforms without proportional budget increases. This isn't theoretical-it's measurable performance that directly impacts your bottom line. Analytics platforms reveal exactly which formats drive traffic, which ones convert, and which ones deserve more investment.

Start your content repurposing strategy with your existing winners: blog posts with 1,000+ monthly visits or 5% engagement rates that already demonstrate audience demand. A single high-performing piece yields five to ten LinkedIn posts, six to eight Instagram carousel slides, and multiple email segments, each tailored to its platform. This approach minimizes risk because you build on proven assets rather than experiment with untested material.

Distribution tools automate posting across channels, analytics reveal which formats perform best, and project management systems keep campaigns organized (without these three elements working together, repurposing becomes another abandoned task). We at Cajabra, LLC help accounting firms maximize their marketing impact through strategic systems that work smarter, not harder by securing retainer-based clients through effective positioning and lead generation. Your content library already contains the seeds of your next growth phase-content repurposing simply helps them flourish across every channel where your audience lives.

Your accounting firm's website needs to work flawlessly on phones and tablets. Over 60% of web traffic now comes from mobile devices, and Google ranks mobile-friendly sites higher in search results.

At Cajabra, LLC, we've seen firsthand how poor mobile optimization drives potential clients away. The good news is that fixing this problem delivers measurable results for your firm's growth.

How Mobile Traffic Shapes Accounting Firm Success in 2026

Mobile devices now account for 63.31% of global web traffic as of March 2025, meaning more than six out of every ten visitors to your accounting firm's website arrive on a phone or tablet. This shift isn't gradual-it's the dominant reality.

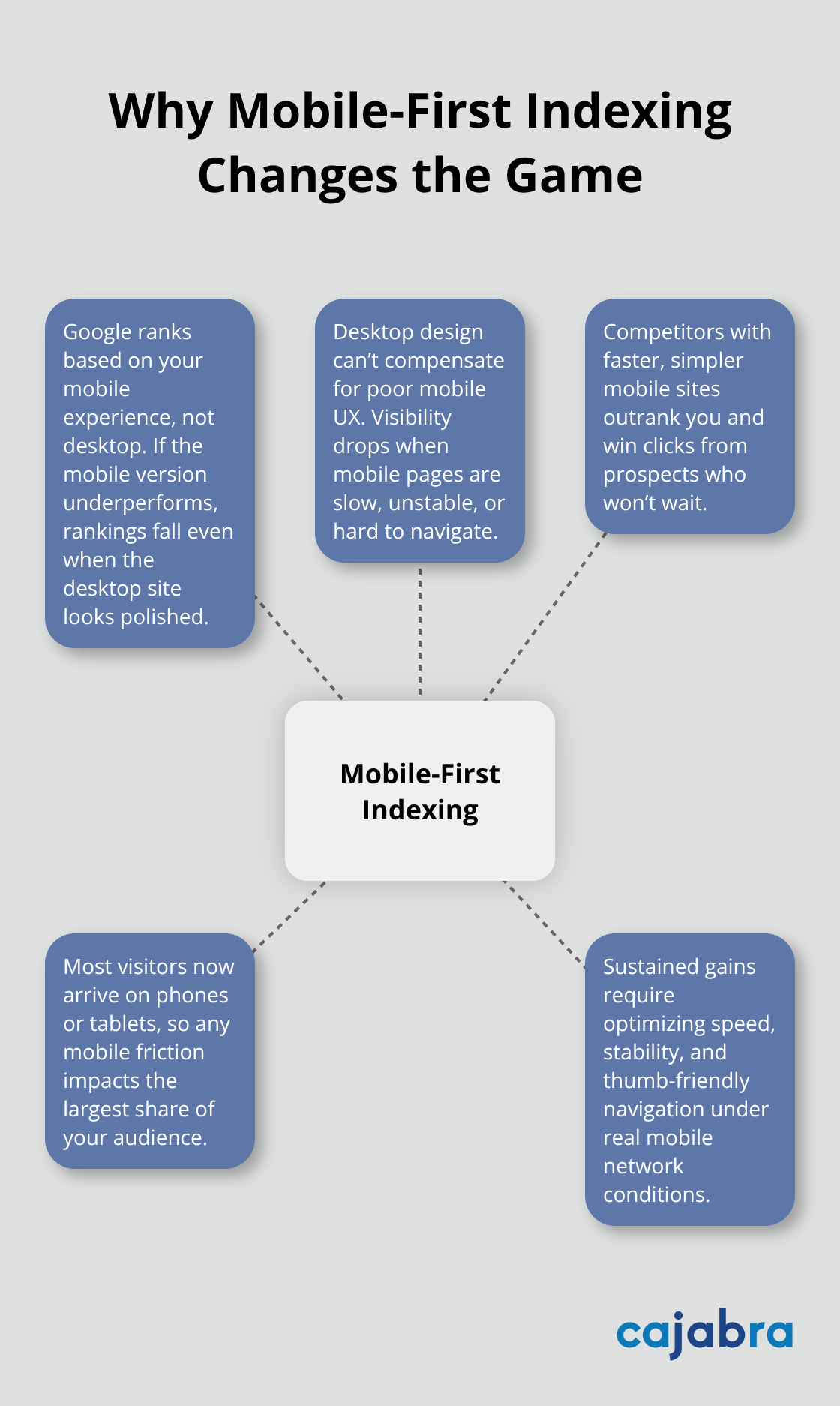

Google responded by making mobile-first indexing the standard for all sites, meaning the search engine crawls and ranks your site based on how it performs on mobile, not desktop. If your mobile experience lags, your visibility in search results drops regardless of how polished your desktop version looks. Accounting firms that ignore mobile optimization lose visibility to competitors who don't, and potential clients simply move on to firms with faster, easier-to-navigate mobile experiences.

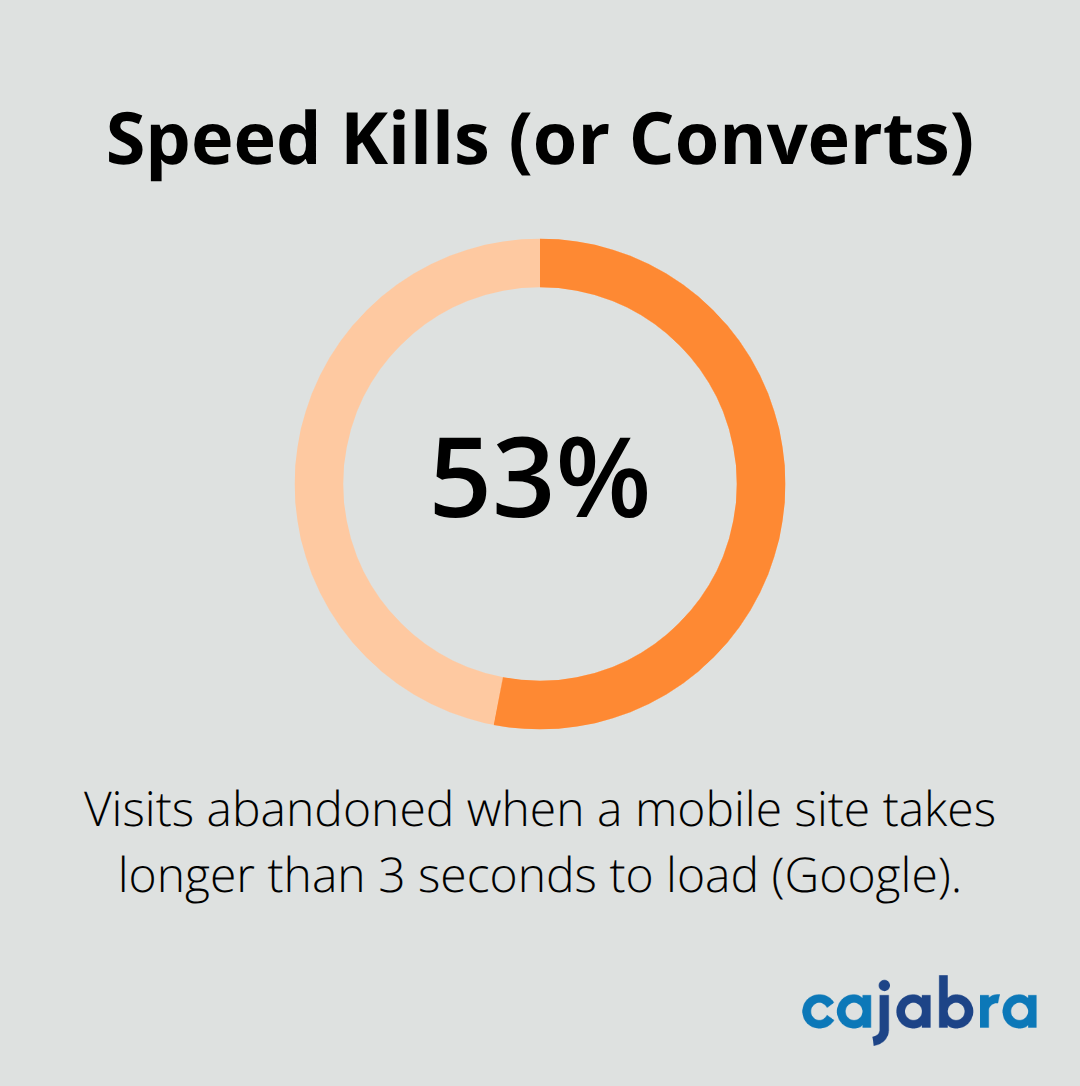

The Real Cost of Slow Mobile Pages

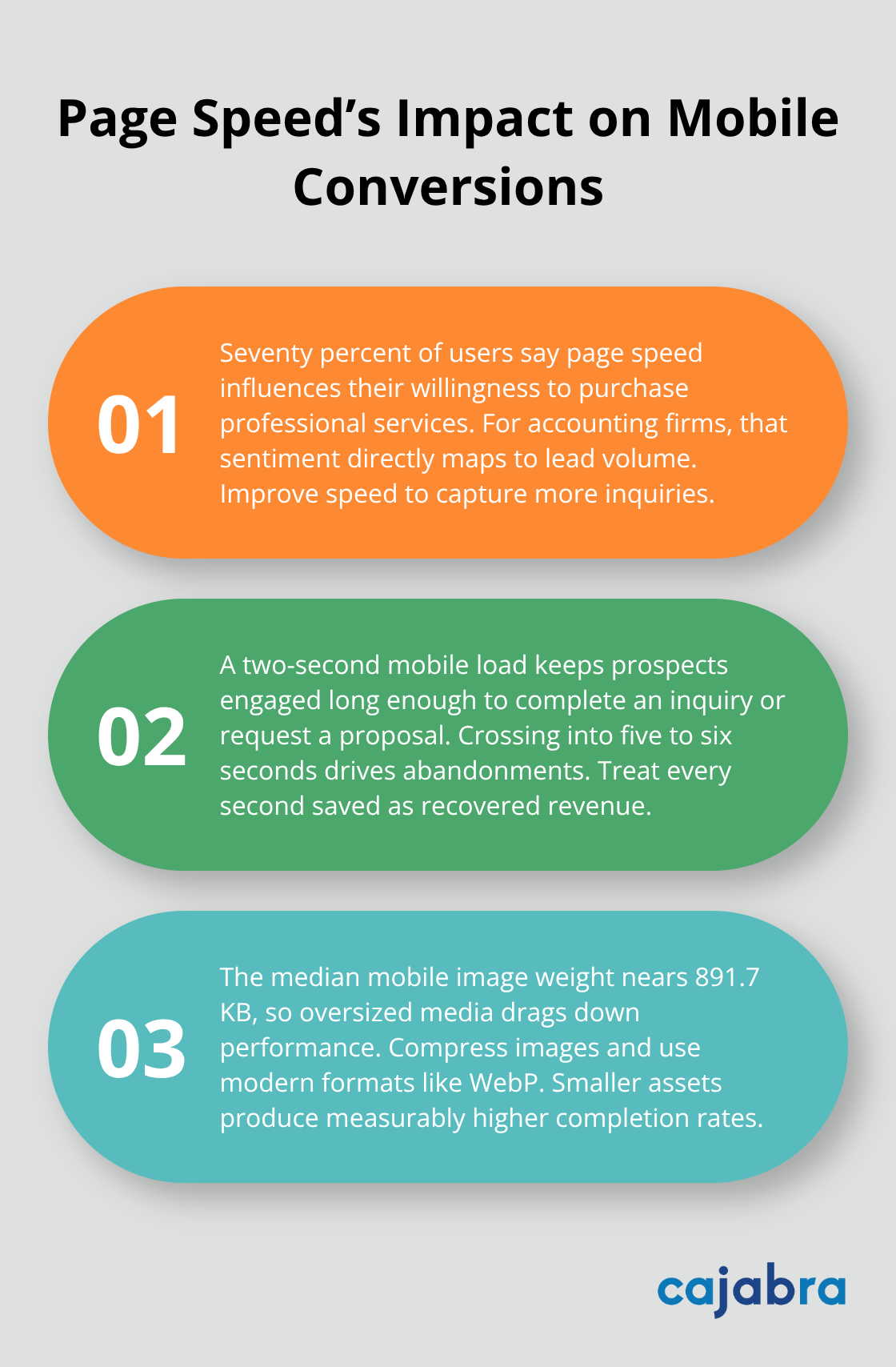

More than 40% of users won't wait longer than two seconds for a page to load, according to the State of Mobile 2024 data. For accounting firms, this matters because initial consultations and engagement often happen on mobile. A prospect searching for tax advice or audit services on their phone expects instant results. If your site takes five or six seconds to load on a mobile network, they've already clicked to a competitor. Google's Core Web Vitals now directly affect rankings, with emphasis on LCP, CLS, and INP on real mobile networks. These aren't theoretical benchmarks-they're the performance standards Google uses to rank sites. Heavy third-party tools like CRM widgets, chat systems, and calendars add input lag on mobile devices, so you need to optimize these integrations aggressively.

Mobile Conversion Patterns in Professional Services

GA4 data reveals that most new users arrive on mobile, and high-value events like inquiry submissions and initial consultations often start there. However, friction on mobile leads to faster drop-offs than on desktop. A cumbersome contact form, slow page loads, or confusing navigation on a phone causes prospects to abandon their search before completing an inquiry. For accounting firms, mobile optimization directly impacts lead generation. Responsive design that scales content intelligently for smaller screens keeps navigation simple and readable, reducing the friction that causes mobile visitors to leave.

Performance Standards That Drive Rankings and Conversions

Your site's mobile performance now determines both search visibility and conversion potential. The stakes are high: prospects expect content to appear instantly, interactions to feel fluid, and navigation to stay within thumb's reach. When your site meets these expectations, visitors stay longer and complete actions like scheduling consultations or requesting proposals. When it doesn't, they leave. Third-party integrations (CRMs, chat widgets, calendars, maps, personalization layers) can slow mobile performance significantly, so audit which tools you actually need and remove those that add unnecessary weight. Image optimization matters too-compress images aggressively to support faster loads on slower mobile networks.

What Comes Next for Your Firm's Mobile Strategy

The path forward requires more than a responsive template. Your accounting firm needs a mobile experience that supports how prospects actually make decisions today: on their phones, during lunch breaks, or while commuting. This means fast pages, stable layouts, lightweight scripts, and predictable interactions under real-world conditions. The next section covers the specific strategies that move your firm from a mobile-friendly website to a mobile-optimized conversion machine.

How Mobile-Friendliness Drives Accounting Firm Growth

Google's ranking algorithm now prioritizes mobile performance as the primary factor determining search visibility. When a prospect searches for accounting services in your area, the firms appearing at the top of mobile search results are those with optimized mobile experiences. Mobile devices account for over 60% of global web traffic, which means mobile optimization directly affects both organic and paid search performance. If your site loads slowly on mobile or forces visitors to pinch and zoom to read content, Google pushes your firm lower in rankings while competitors with faster, cleaner mobile experiences climb higher. Mobile performance now determines whether prospects find your firm first or scroll past to competitors.

Why Mobile Friction Kills Client Inquiries

Accounting firms lose potential clients at the moment of decision when mobile experiences are poor. A prospect researching tax strategies or audit services on their phone expects to complete an inquiry form, schedule a consultation, or navigate to your contact information without frustration. Most new users arrive on mobile, and high-value events like inquiry submissions often begin there-but friction on mobile causes faster drop-offs than desktop. Forms that require excessive scrolling, fields that don't auto-format phone numbers correctly, or navigation menus that cover half the screen force mobile visitors to abandon their search. Accounting firms with cluttered mobile navigation experience significantly higher bounce rates than those with streamlined, thumb-friendly layouts. Every second a prospect spends struggling with your mobile site is a second they could spend contacting a competitor instead.

Converting Mobile Visitors into Retained Clients

Mobile optimization directly affects whether prospects take action or leave. 70% of users say page speed influences their willingness to purchase professional services. For accounting firms, this translates to conversion rates. A site that loads in two seconds on mobile networks keeps prospects engaged long enough to complete an inquiry or request a proposal.

A site that takes six seconds loses them. The median mobile image size sits around 891.7 KB, so aggressive image compression matters-oversized hero images and unoptimized graphics tank page speed on slower mobile networks. Reducing unnecessary third-party tools and simplifying contact forms removes barriers between prospect interest and action. Accounting firms that treat mobile optimization as a conversion tool rather than a design afterthought see measurable increases in client inquiries and consultation bookings.

The Speed-to-Conversion Connection

Page speed directly correlates with whether prospects complete actions on your site. Mobile visitors expect content to appear instantly and interactions to feel fluid-anything less causes them to leave. Heavy third-party integrations (CRMs, chat widgets, calendars, maps) add input lag on mobile devices, so audit which tools you actually need and remove those that add unnecessary weight. Image optimization matters equally; compress images aggressively to support faster loads on slower mobile networks. Prospects who experience fast, stable pages stay longer and complete actions like scheduling consultations or requesting proposals. Those who encounter delays abandon their search and contact competitors instead.

What Your Firm's Mobile Strategy Requires

The path forward requires more than a responsive template. Your accounting firm needs a mobile experience that supports how prospects actually make decisions today: on their phones, during lunch breaks, or while commuting. This means fast pages, stable layouts, lightweight scripts, and predictable interactions under real-world conditions. Clear navigation and logical information architecture transform a fast, mobile-friendly site into one that converts prospects into clients. The next section covers the specific strategies that move your firm from a mobile-friendly website to a mobile-optimized conversion machine.

How to Build a Mobile Experience That Converts

Responsive design is non-negotiable, but it's also table stakes-the bare minimum that separates professional firms from those stuck in 2015. A responsive site that scales content intelligently for mobile screens matters, but what actually drives conversions is aggressive optimization of the three factors that kill mobile performance: oversized images, unnecessary third-party tools, and bloated forms.

Compress Images to Eliminate Load Time Waste

Start with image optimization. The median mobile image size runs around 898.8 KB, but accounting firm websites often load hero images and graphics that exceed 1.5 MB per image. Replace these with compressed versions under 800 KB, use modern formats like WebP for faster delivery, and lazy-load images below the fold so they don't slow initial page load. Test your compression with tools like Google PageSpeed Insights, which shows exactly how much load time you're wasting on oversized assets. Every megabyte you cut from your images translates directly to faster page loads on slower mobile networks.

Remove Third-Party Tools That Add Input Lag

Next, audit every third-party integration on your mobile site. CRM widgets, chat systems, calendars, maps, and personalization layers add input lag that makes interactions feel sluggish on real mobile networks. Most accounting firms load far more tools than they actually use. Remove chat widgets that get ignored, disable auto-loading calendars, and replace map embeds with simple address text and a link to Google Maps. Each tool you remove directly improves the speed prospects experience when they interact with your contact form or navigate your pages.

Simplify Forms to Remove Conversion Barriers

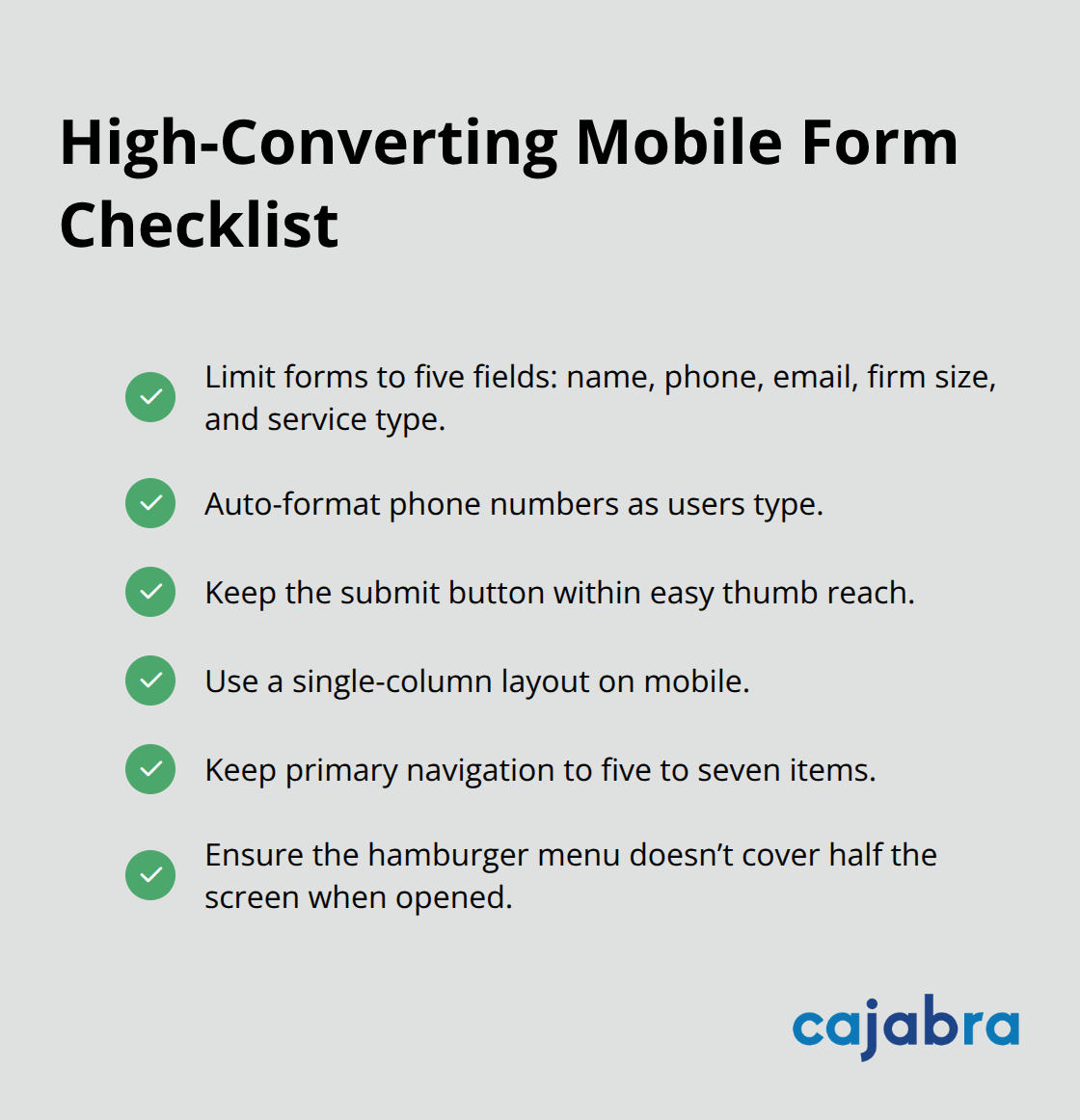

Forms present the biggest conversion killer on mobile. Accounting firms typically ask for too many fields, don't auto-format phone numbers, and force visitors to scroll endlessly through required information. Simplify your inquiry form to five fields maximum: name, phone, email, firm size, and service type. Auto-format phone numbers so visitors don't need to add dashes or parentheses. Place the submit button where visitors can reach it without scrolling. Use a single-column layout on mobile instead of multi-column designs that force pinching and zooming.

Navigation should occupy no more than five to seven primary items, with a clearly visible hamburger menu that doesn't cover half the screen when opened.

Test Performance on Real Mobile Networks

Test your mobile experience on real devices using Chrome's mobile emulator or tools like LambdaTest Real Device Cloud, not just your desktop browser. Load time on a real 4G mobile network differs dramatically from what you see on your office WiFi. Try for Core Web Vitals targets of LCP under 2.5 seconds, CLS under 0.1, and INP under 200 milliseconds on real mobile networks. These aren't arbitrary numbers-Google uses these exact metrics to rank sites and determine whether prospects stay or leave. Accounting firms that treat these optimizations as conversion priorities rather than design afterthoughts see measurable increases in inquiry submissions and consultation bookings.

Final Thoughts

Mobile-friendliness stopped being optional for accounting firms years ago. It now determines whether prospects find your firm, stay on your site, and take action. The data confirms this reality: 63.31% of web traffic comes from mobile devices, Google ranks mobile-optimized sites higher, and prospects abandon sites that load slowly or force awkward navigation on phones. Your competitors understand this shift, and the firms winning new clients treat mobile optimization as a conversion tool, not a design afterthought.

The real business impact shows up in your inquiry submissions and consultation bookings. When you compress oversized images, remove unnecessary third-party tools, and simplify your contact forms, prospects complete actions instead of leaving. A two-second page load keeps them engaged; a six-second load sends them to competitors. Every optimization you make directly affects whether your accounting firm captures leads or loses them to firms that prioritize mobile performance.

Start by testing your site on real mobile devices and checking your Core Web Vitals on actual 4G networks, not your office WiFi. Identify which third-party integrations drive value and which ones add unnecessary weight. Compress your images aggressively and simplify your forms to five fields maximum. If you want professional guidance on modernizing your website and optimizing your digital presence, Cajabra helps accounting firms build lead-generating websites that position your firm as an industry leader.

Accounting firms live or die by client trust, and nothing builds that faster than a polished, professional appearance. Your visual branding-from your logo to your website design-tells clients whether you're serious about their finances before they even read your first email.

At Cajabra, LLC, we've seen firms with identical service offerings win different clients based purely on visual identity. The firms that invest in cohesive, intentional branding consistently outpace their competitors in client acquisition and retention.

Why Visual Branding Actually Matters

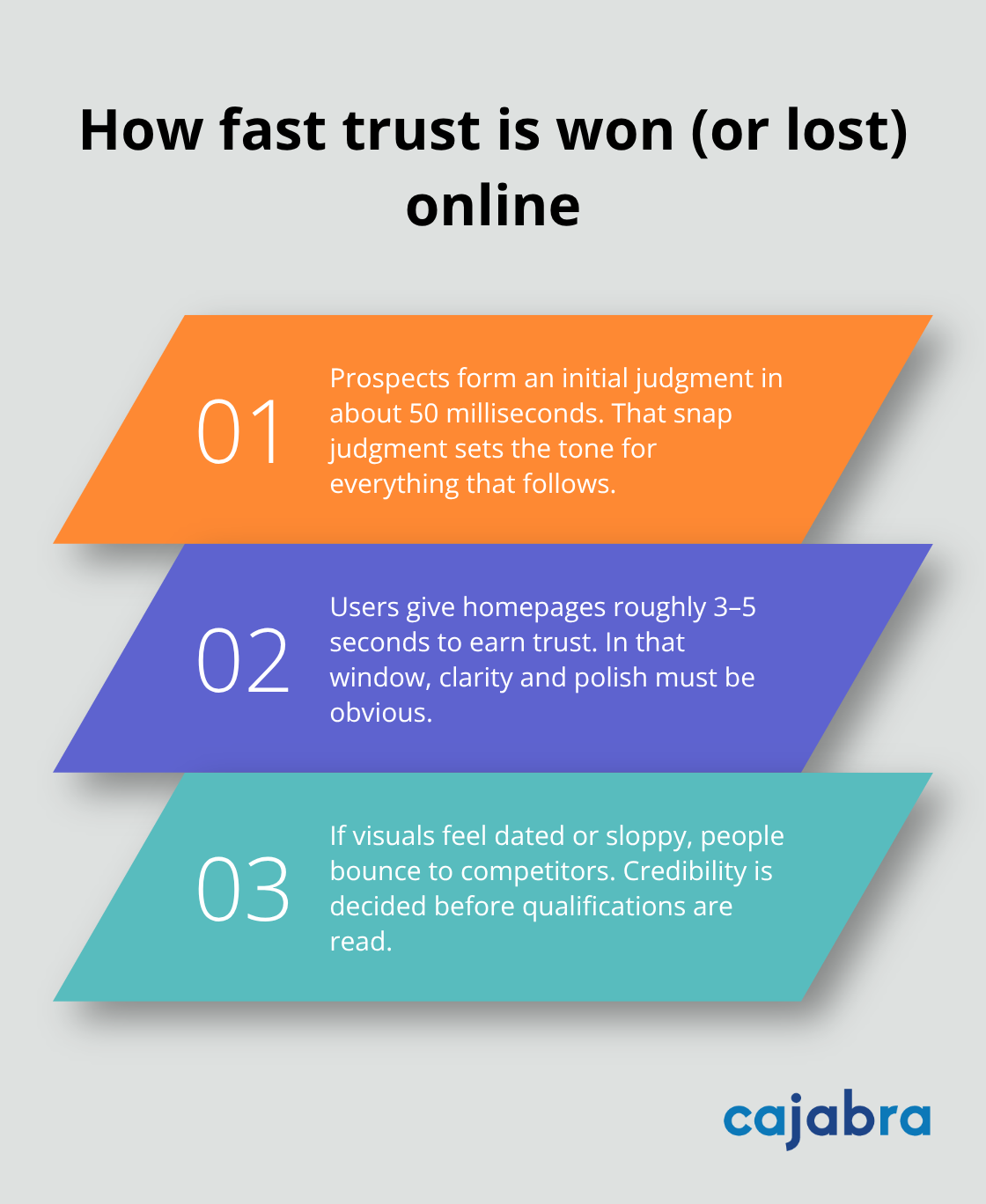

A potential client lands on your website or opens your proposal and forms an opinion about your firm in roughly 50 milliseconds. First impressions may form in milliseconds, but users typically give your homepage 3 to 5 seconds to earn their trust. Instead, they evaluate your visual presentation, and if it looks dated or unprofessional, they move to your competitors.

This isn't subjective preference-it's how human psychology works. Visual credibility influences whether prospects perceive you as competent enough to handle their finances. A polished logo, consistent color scheme, and professional typography signal that you operate with precision and attention to detail, qualities clients desperately need in an accountant.

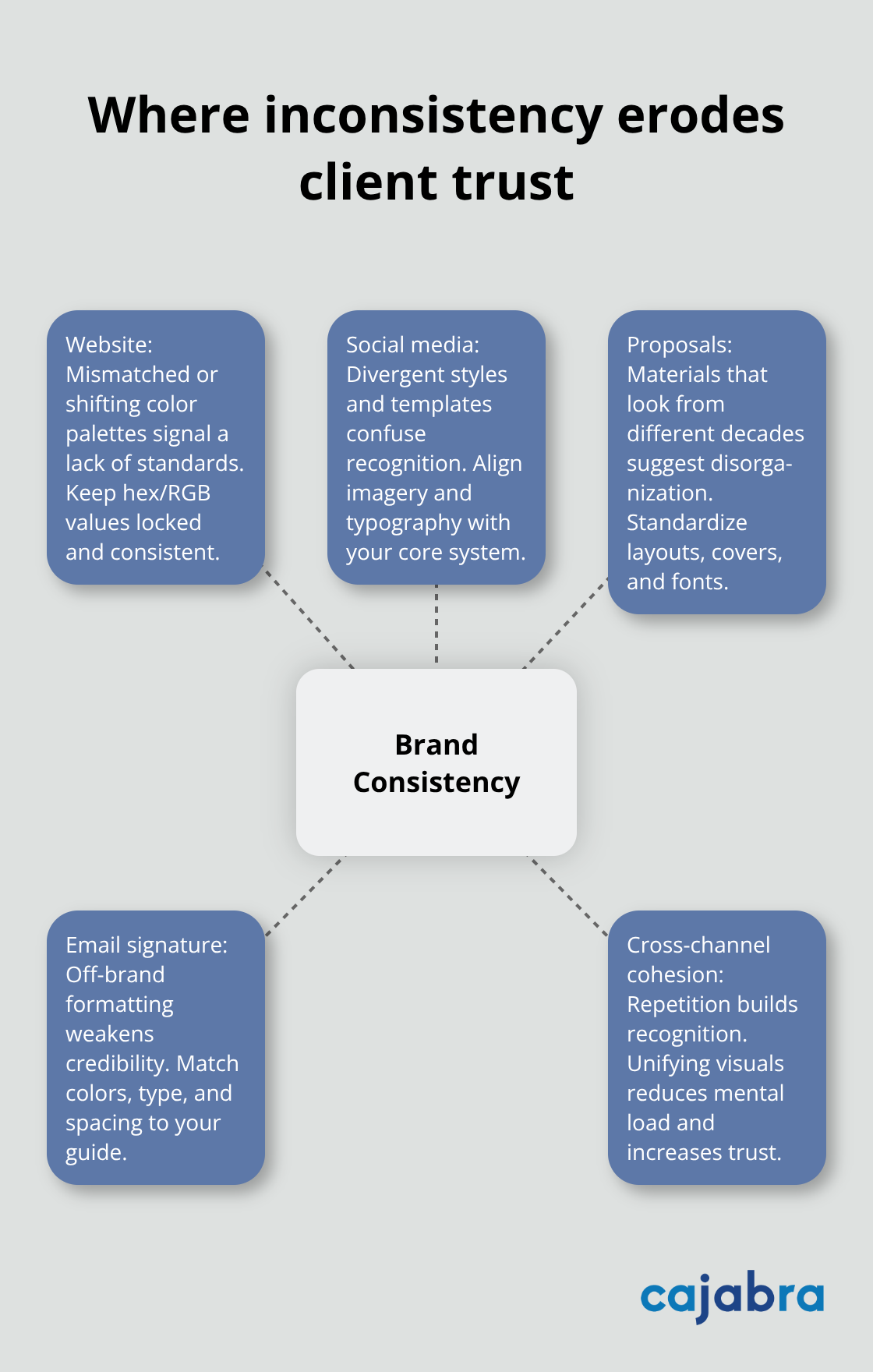

The Real Cost of Inconsistent Branding

Most accounting firms lose money through visual inconsistency without realizing it. Your website uses one color palette, your social media uses another, your proposals look like they came from different decades, and your email signature doesn't match anything else. Each inconsistency creates friction that chips away at client confidence. When a firm's visual identity scatters across channels, prospects unconsciously interpret it as disorganization.

They wonder if your accounting is as messy as your branding. The firms winning market share look intentional-a single logo, a carefully chosen color system (typically blues and greens that signal trust and growth), matching typography across all touchpoints. This consistency doesn't just look better; it actually reduces the mental effort clients need to process who you are, making them more likely to trust you and move forward with an engagement.

Differentiation When Every Firm Offers Similar Services

The accounting services landscape is commoditized. Most firms offer tax preparation, bookkeeping, payroll, and audit services. Your service menu probably looks identical to three other firms in your market. Because the actual work is so similar, perception and experience become the deciding factors. A firm with mediocre services but exceptional visual branding will consistently win against a firm with excellent services but generic branding. This is harsh but true. Your competitors aren't just other accountants-they're the polished, visually cohesive firms that prospects encounter on LinkedIn, Google Business profiles, and websites. If your visual identity doesn't stand out, you compete on price alone, and that's a race you'll lose. The firms that invest in intentional visual branding position themselves as premium options, justify higher fees, and attract clients who value quality over cost.

How Visual Identity Shapes Client Perception

Prospects don't separate your visual branding from your professional competence. They link them together. A firm with a sharp logo, cohesive color palette, and polished website materials appears more organized, more trustworthy, and more capable than a competitor with scattered visuals (even if the competitor's actual accounting work is superior). This perception gap matters because clients make decisions based on what they see and feel, not on technical superiority they can't evaluate. Your visual identity communicates your firm's values, attention to detail, and commitment to professionalism before you ever speak to a prospect. The firms that recognize this advantage invest in visual branding as a strategic asset, not as an afterthought. They understand that strong visual identity directly influences client acquisition, retention, and the fees they can command.

Building the Visual Foundation That Wins Clients

Your logo, colors, and typography form the backbone of how prospects perceive your firm's competence and trustworthiness. These elements work together to create instant recognition and communicate professionalism before a single word is read. The accounting firms that dominate their markets treat visual identity as a strategic business tool that directly impacts revenue.

Design a Logo That Works Everywhere

Start with your logo because it anchors everything else. Your logo must work at 16 pixels on a mobile phone and at billboard size without losing clarity or impact. Complex logos with gradients, shadows, or trendy effects date quickly and fail at small sizes. The most effective accounting firm logos use simple geometry and clean lines-Deloitte, PwC, and EY all employ straightforward mark-based designs that function across every medium. Avoid accounting clichés like calculators, coins, or scales unless you execute them with genuine originality. Focus instead on creating something that feels intentional and premium. If your current logo looks like it was designed in 2008, replace it. A professional designer typically charges between $1,500 and $5,000 for a proper logo redesign that includes multiple concepts and refinements.

Choose Colors That Signal Trust and Stability

Color psychology in purchasing decisions shapes how clients perceive your firm. Blue dominates accounting and financial services because it signals trust, stability, and professionalism-exactly what clients need to feel when entrusting you with their finances. Navy blue, slate blue, and corporate blue work safely across industries. Green functions well as a secondary color because it represents growth and financial health. Avoid bright, trendy colors that make your firm look like a tech startup or creative agency. Red and orange signal urgency or energy, which doesn't match the careful, methodical work accountants perform. Select three to four colors maximum (typically a primary color, a secondary color, and two neutral grays or whites). These colors must appear consistently across your website, proposals, social media, email signatures, and printed materials. Inconsistent colors across channels actively damage your credibility.

Typography That Communicates Precision

Font selection shapes how clients perceive your firm's personality. Serif fonts like Georgia or Garamond feel traditional and established, while sans-serif fonts like Helvetica or Open Sans feel modern and clean. Most successful accounting firms use sans-serif fonts for digital and web because they offer superior legibility on screens. Choose one primary font for headings and one for body text, then apply those two consistently across all materials. Avoid decorative or script fonts in professional materials-they undermine professionalism and hurt readability. Your typography should feel intentional, not trendy. A font that looks cutting-edge today will look dated in two years. Select typefaces that have existed for at least five years and show no signs of disappearing. When you apply these fonts, maintain consistent sizing and spacing. Headlines should be noticeably larger than body text, and body text should be at least 14 to 16 pixels on websites for comfortable reading. Poor typography creates friction that forces prospects to work harder to understand your message, and harder work means lower trust.

Unify Your Visual System Across Every Channel

The biggest mistake accounting firms make is treating their website, social media, proposals, and printed materials as separate projects instead of unified expressions of a single brand. Your LinkedIn profile should match your website, which should match your email templates, which should match your proposal covers. This consistency builds recognition and trust through repetition. When prospects see your color palette and logo repeatedly across different channels, they unconsciously associate those visuals with competence and professionalism. Create a brand style guide that documents your logo usage, color codes (both hex and RGB), font specifications, spacing rules, and imagery guidelines. This guide keeps everyone-whether internal or external designers-aligned on how to represent your firm. Without this guide, your website designer makes one choice, your social media manager makes another, and your printer makes a third, resulting in scattered visual identity that undermines everything else you're doing to build trust.

The visual foundation you establish now determines how prospects perceive your firm for years to come. Once your logo, colors, and typography work together seamlessly, you're ready to apply these elements strategically across the specific channels where your ideal clients spend their time.

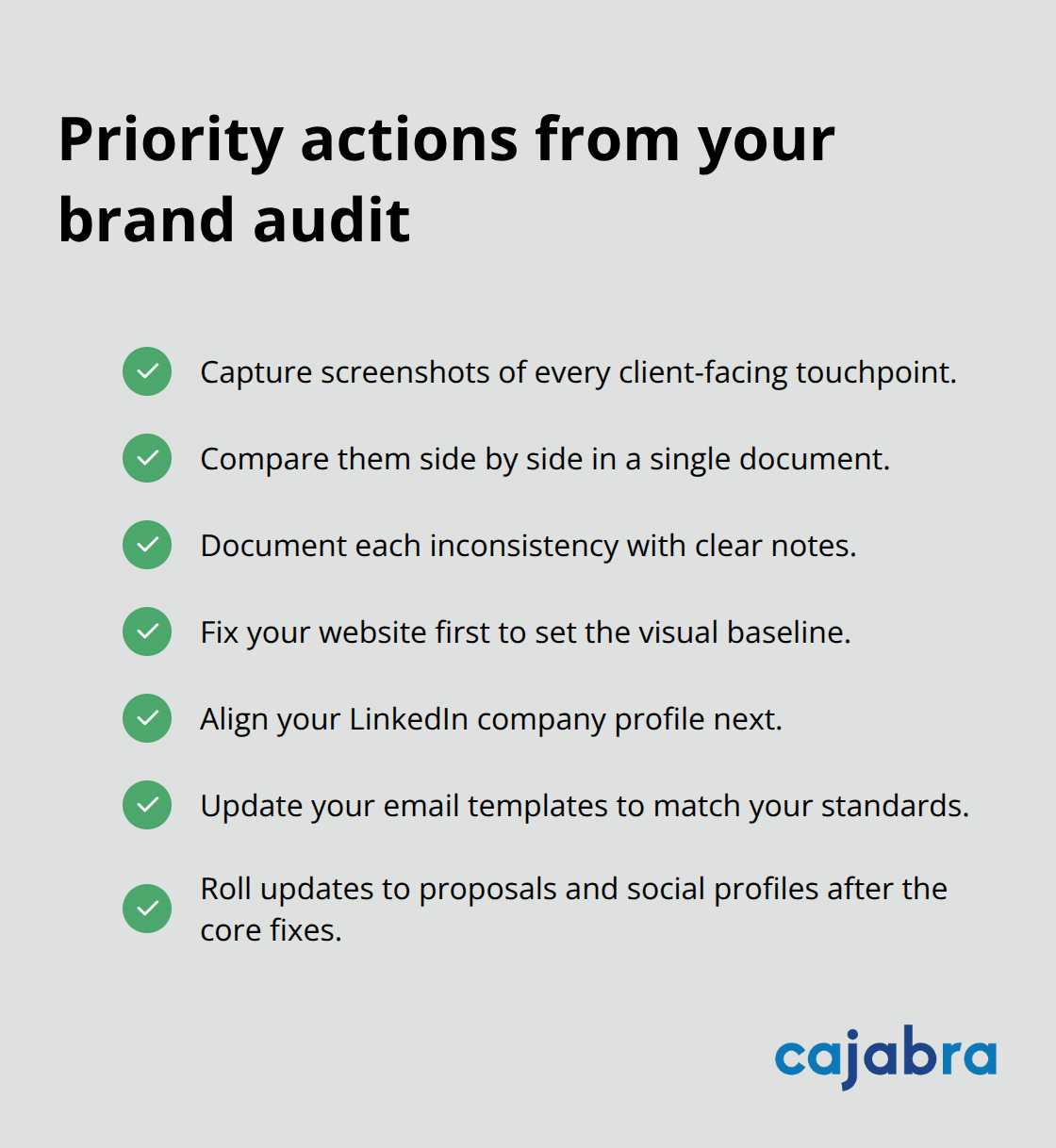

How to Audit and Rebuild Your Visual Branding

Most accounting firms have never conducted a systematic audit of their visual presence across all channels, which means they don't realize how fractured their brand identity has become. Take screenshots of your website homepage, your Google Business profile, your LinkedIn company page, your email signature, your proposal templates, your social media covers, and any printed materials you distribute. Open them all in a single document and compare them side by side. What you'll likely see is jarring inconsistency: colors that shift slightly across platforms, logos sized differently, fonts that don't match, and overall aesthetics that feel disconnected.

This visual chaos actively damages your credibility. Prospects unconsciously interpret this scatter as disorganization, which directly impacts whether they trust you with their finances. The firms that win market share treat this audit seriously and recognize that fixing these gaps is non-negotiable. Document every inconsistency you find, then prioritize fixing the highest-impact channels first: your website, your LinkedIn profile, and your email templates.

These three touchpoints reach prospects most frequently and shape perception most powerfully.

Create a Brand Style Guide That Locks In Your Standards

Once you've identified gaps, develop a brand style guide that prevents inconsistency from happening again. This guide should specify your logo in every format (horizontal, vertical, icon-only, minimum size), your exact color codes in both hex and RGB formats, your primary and secondary fonts with specific sizes for headings and body text, spacing rules between elements, and guidelines for photography and imagery style. This isn't theoretical work-it's the operating manual that prevents future chaos. Without it, your website designer makes one choice, your social media manager makes another, and your printer makes a third.

Create this guide in a shared document or tool like Figma that team members and external vendors can access. Store it somewhere your entire team references regularly. The guide transforms from a static document into a living resource that shapes every visual decision your firm makes.

Apply Your Brand Standards Across Every Channel

Systematically apply these standards across every channel where prospects encounter your firm. Your website should reflect your colors, fonts, and logo usage exactly. Your email signature should match your website. Your LinkedIn background image should use your color palette and typography. Your proposal covers should feature your logo and color scheme. Your social media profile images should use your brand colors.

This consistency compounds over time-prospects see your visual identity repeatedly across different channels, which builds recognition and trust through simple repetition. The firms that execute this flawlessly consistently outpace competitors in client perception and conversion rates, regardless of whether their actual accounting services are superior. Each touchpoint reinforces the same visual message, making your firm feel established and trustworthy.

Maintain Consistency as Your Firm Evolves

Your brand style guide isn't a one-time project-it requires regular review and updates as your firm grows. When you hire new team members, train them on your brand standards before they create any client-facing materials. When you redesign your website or refresh your logo, update your guide immediately so everyone works from the current version. Outdated guides create confusion and lead to inconsistency.

Assign one person responsibility for brand consistency across channels. This person reviews new materials before they launch, catches deviations from your style guide, and communicates standards to external vendors. This single point of accountability prevents the visual chaos that most firms experience. The investment in this role pays for itself through improved client perception and higher conversion rates.

Final Thoughts

Visual branding separates firms that command premium fees from those that compete on price alone. The firms dominating their markets invested in cohesive logos, intentional color palettes, and consistent typography across every channel, creating an unfair advantage that compounds over time. Prospects repeatedly encounter your polished brand across their website, LinkedIn, email, and proposals, building recognition and trust through simple repetition that scattered competitors cannot match.

The financial impact proves measurable across three to five years. Firms with strong visual branding convert prospects faster because consistent visuals reduce friction and build confidence, retain clients longer because the professional experience reinforces their decision, and command higher fees because clients perceive them as more trustworthy and capable. One firm grows steadily with premium clients while the other struggles to fill capacity at lower rates.

Start by auditing your current visual presence across every channel-compare your website, LinkedIn profile, email signature, proposals, and social media side by side to identify inconsistencies. Create a brand style guide that locks in your standards, assign one person responsibility for maintaining consistency, and apply these standards systematically across every touchpoint. We at Cajabra, LLC help accounting firms build strong visual branding strategies that position your firm as an industry leader and attract ideal clients through a polished, professional presence.

Creating great content is only half the battle. The real challenge is getting that content in front of the right people at the right time.

At Cajabra, LLC, we've seen firsthand how strategic content distribution transforms reach and engagement. The channels you choose, when you publish, and how you measure results determine whether your content thrives or gets lost in the noise.

Content Distribution Channels That Drive Real Results

Social Media Platforms Require Strategic Focus

Social media dominates content distribution strategy, with 84% of B2B marketers using paid channels to distribute content, and among those, 73% use social media advertising. However, raw social presence means nothing without audience alignment. Instagram works differently than LinkedIn, which works differently than X, and posting identical content across all platforms dilutes your message. The platforms where your actual buyers spend time are the only ones that matter. LinkedIn tends to drive better results for B2B content because professionals actively seek industry insights there, while Instagram demands visual storytelling and trending audio. Test each platform with your core content, measure which ones drive actual traffic and leads rather than vanity metrics, and then focus on the two or three that perform best. Social sharing alone rarely converts, so treat social as a top-of-funnel awareness tool that funnels people toward owned channels where real engagement happens.

Email Remains Your Most Valuable Asset

Email newsletters beat social platforms for direct audience engagement because you own the relationship. A targeted email list of 40 engaged subscribers who signed up because they genuinely wanted your insights will outperform blasting 5,000 disinterested followers. Segment your email list by buyer stage and send content that matches where people sit in their decision journey. A prospect in early research needs educational content about industry challenges, while someone further along needs comparison guides and case studies. Personalization matters too: reference past interactions or company details when possible.

Paid Advertising Accelerates Distribution When Organic Reach Plateaus

Paid advertising amplifies distribution when organic reach plateaus. Google Ads and LinkedIn ads target people actively searching for solutions, while retargeting ads remind website visitors who didn't convert the first time. The #1 organic search result captures roughly 27.6% of clicks versus 2.6% for the tenth result, so paid ads help your content compete when SEO rankings take time to build. Start with small budgets on your top-performing content pieces, track which ads drive leads versus just impressions, and scale only what converts. Diversify your distribution channels across owned, earned, and paid media to maximize reach-the channels you select and how you allocate resources across them set the foundation for everything that follows, which is why timing your distribution matters just as much as choosing the right platforms.

Timing and Frequency Strategies for Content Sharing

Publish When Your Audience Actually Listens

The time you publish determines whether your content reaches your audience or vanishes into the feed. LinkedIn engagement peaks on Tuesday through Thursday between 7 AM and 9 AM, when professionals check their feeds before starting work. Twitter moves faster, with engagement concentrated around lunch hours and early evening when people take breaks. Facebook sees steady engagement throughout the day but spikes on weekends. Your specific audience, however, may follow different patterns. A B2B software company selling to finance teams needs different timing than a consumer brand targeting students. Test your content across three different time slots over two weeks, track which times generate the most clicks and comments, then commit to that window.

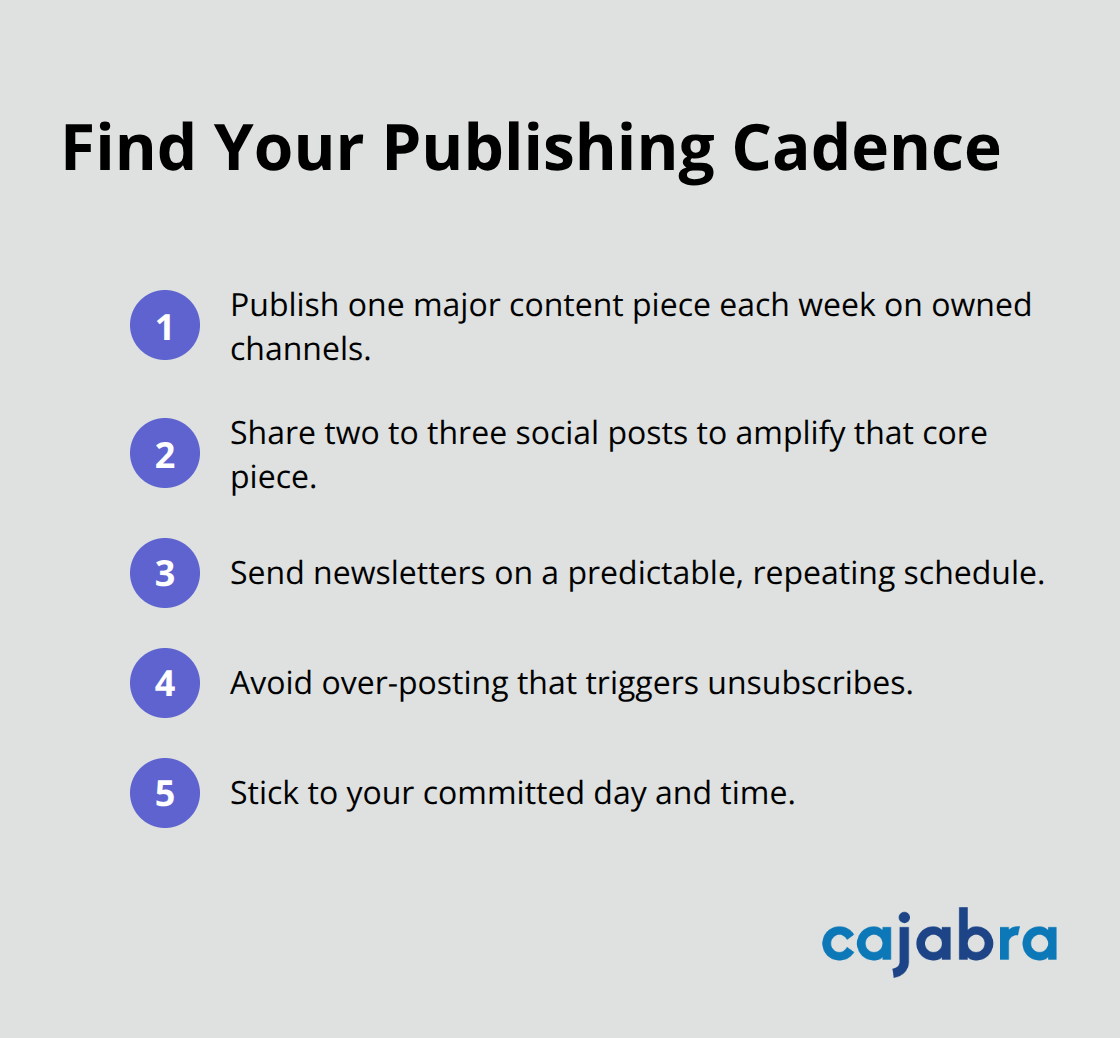

Find Your Publishing Cadence

Posting too frequently exhausts your audience and triggers unsubscribes. Consistency matters more than volume-brands publishing once or twice weekly maintain stronger engagement than those flooding feeds daily. Most successful publishers follow a cadence of one major content piece per week across owned channels, with social amplification spread across two to three posts that week. Email newsletters work best when sent on a predictable schedule that your subscribers expect. If you commit to Thursday mornings, stick with Thursday mornings.

Subscribers who anticipate your message open it at higher rates than those surprised by random sends.

Capitalize on Seasonal Moments and Trending Topics

Seasonal timing and trending topics demand flexibility within your core schedule. Industry conferences, budget cycles, and holiday seasons create windows where your audience actively searches for solutions. Accounting firms see increased demand for tax strategy content in Q1 and Q4. SaaS companies notice budget planning peaks in September and October. News and trending topics offer quick distribution wins if you respond within hours rather than days. A brand that publishes thoughtful commentary on industry news within four hours of the story breaks captures more attention than one that publishes a week later.

Balance Trend Responsiveness With Strategic Focus

Chasing every trend exhausts your team and dilutes focus. Instead, identify three to five predictable seasonal moments relevant to your industry and plan content months in advance. Repurpose evergreen content during slow periods, then shift to trend-responsive content during high-demand seasons. Track which seasonal angles drive the most leads and revenue, then double down on those specific windows next year. The brands that win at distribution publish strategically at moments when their audience actively listens-not the ones publishing constantly. This strategic approach to timing sets the stage for measuring whether your distribution efforts actually move the needle, which brings us to tracking performance across your channels.

Measuring and Optimizing Your Distribution Performance

Track metrics that connect directly to revenue, not vanity numbers that make dashboards look impressive. Click-through rates and impressions mean nothing if they don't convert to leads or clients. Focus on metrics that matter: how many qualified leads each channel produces, what those leads cost, and whether they actually become paying clients. Email open rates tell you your subject line works, but click-through rates show whether your content resonates enough to drive action. Social media follower counts are meaningless; referral traffic from social to your website reveals which platforms actually move people toward conversion.

Set Up Tracking From Day One

Add UTM parameters to every link you distribute so you know exactly which channel, campaign, and content piece drove each visitor. Google Analytics 4 lets you track user journeys across devices and platforms without extra work. Establish a baseline for each channel during your first month, then measure improvements against that baseline rather than against industry averages that may not apply to your specific audience. This foundation prevents wasted effort on channels that look good in reports but produce no actual results.

Measure Different Channels Against Their Purpose

Different distribution channels require different measurement approaches because they serve different purposes in your funnel. Email produces the highest conversion rates because you reach people who already know you, so track email click-through rates and conversion rates separately from social media, which functions primarily as awareness. LinkedIn ads targeting B2B decision-makers should be measured on cost-per-lead and lead quality, not impressions. Organic search traffic matters less for volume and more for intent; someone landing on your website from a search query about your specific solution converts at higher rates than someone who clicked a random social post.

Set specific conversion goals for each channel based on what success looks like: email might target a 3 percent click-through rate, while organic search targets a 15 percent conversion rate from visitor to lead. Test different messaging, content formats, and distribution timing on smaller segments first, then measure which variations outperform before scaling to larger audiences.

Run Controlled Experiments to Identify Winners

Stop guessing and start testing methodically. Change one variable at a time so you know what actually drove results. Send the same email to two segments with different subject lines, track which one produces more clicks, then use the winning subject line for future sends. Test publishing your blog post at different times to see which generates more traffic in the first 24 hours, then lock in that timing. Run controlled experiments with different headlines and landing pages simultaneously, allocate equal budget to each, and measure which combination produces the lowest cost-per-lead.

Most distribution improvements come from small, incremental wins rather than dramatic overhauls. A 10 percent improvement in email open rates from better subject lines, combined with a 15 percent improvement in social click-through rates from better visuals, compounds into significant revenue growth over quarters. Document every test, including what you tested, what won, and why, so you build institutional knowledge rather than repeating failed experiments.

Scale What Works and Cut What Doesn't

The brands winning at distribution treat it as an ongoing optimization process where data informs decisions, not assumptions. Once you identify which channels, timing windows, and content formats produce the best results, allocate more budget and effort to those winners. Reduce or eliminate spending on channels that consistently underperform, even if they seem like they should work. Your audience's actual behavior matters far more than industry best practices or what competitors claim to do. Redirect resources from low-performing channels toward the two or three channels that consistently produce qualified leads at acceptable costs.

Final Thoughts

Content distribution works best when you treat it as an ongoing system rather than a one-time project. Start by auditing which channels produce qualified leads at acceptable costs, then cut the underperformers immediately and reallocate that effort toward your top two or three channels. Most teams waste resources spreading themselves thin across platforms that don't move the needle, so this ruthless focus separates winners from the rest.

Build a sustainable system by establishing clear responsibilities and schedules for your distribution efforts. Assign someone to manage email sends on your committed day and time, designate a person to monitor social platforms during peak engagement windows, and create a simple spreadsheet tracking which content pieces perform best on which channels. Small improvements compound over time-a 10 percent boost in email click-through rates paired with a 15 percent improvement in social referral traffic creates meaningful revenue growth.

For accounting firms, Cajabra helps move accountants from overlooked to overbooked through strategic marketing systems that secure retainer-based clients. Identify your single best-performing distribution channel this month and commit to doubling your effort there next month, then measure the results and repeat with your second-best channel.

Accountants know that clients don't choose based on marketing claims alone. Trust comes from what other clients say about your work.

Social proof transforms how prospects perceive your firm. At Cajabra, LLC, we've seen firsthand how testimonials, reviews, and certifications shift client decisions in your favor.

Why Prospects Trust Other Clients More Than Your Claims

Word of mouth dominates how accounting firms win new clients. Research from the American Institute of CPAs shows that referrals and client recommendations remain the strongest driver of new business, outpacing digital advertising and cold outreach by a significant margin. This isn't coincidence. When a prospect hears directly from another business owner that your firm saved them thousands in taxes or streamlined their bookkeeping, that carries infinitely more weight than anything you say about yourself on your website. Prospects assume you'll highlight your strengths in your marketing, so they discount those claims naturally. They don't assume other clients would lie about their experience, which makes third-party validation extraordinarily powerful. The psychology is straightforward: people believe peers more than institutions because peers have no financial incentive to flatter you.

The Numbers Behind Trust

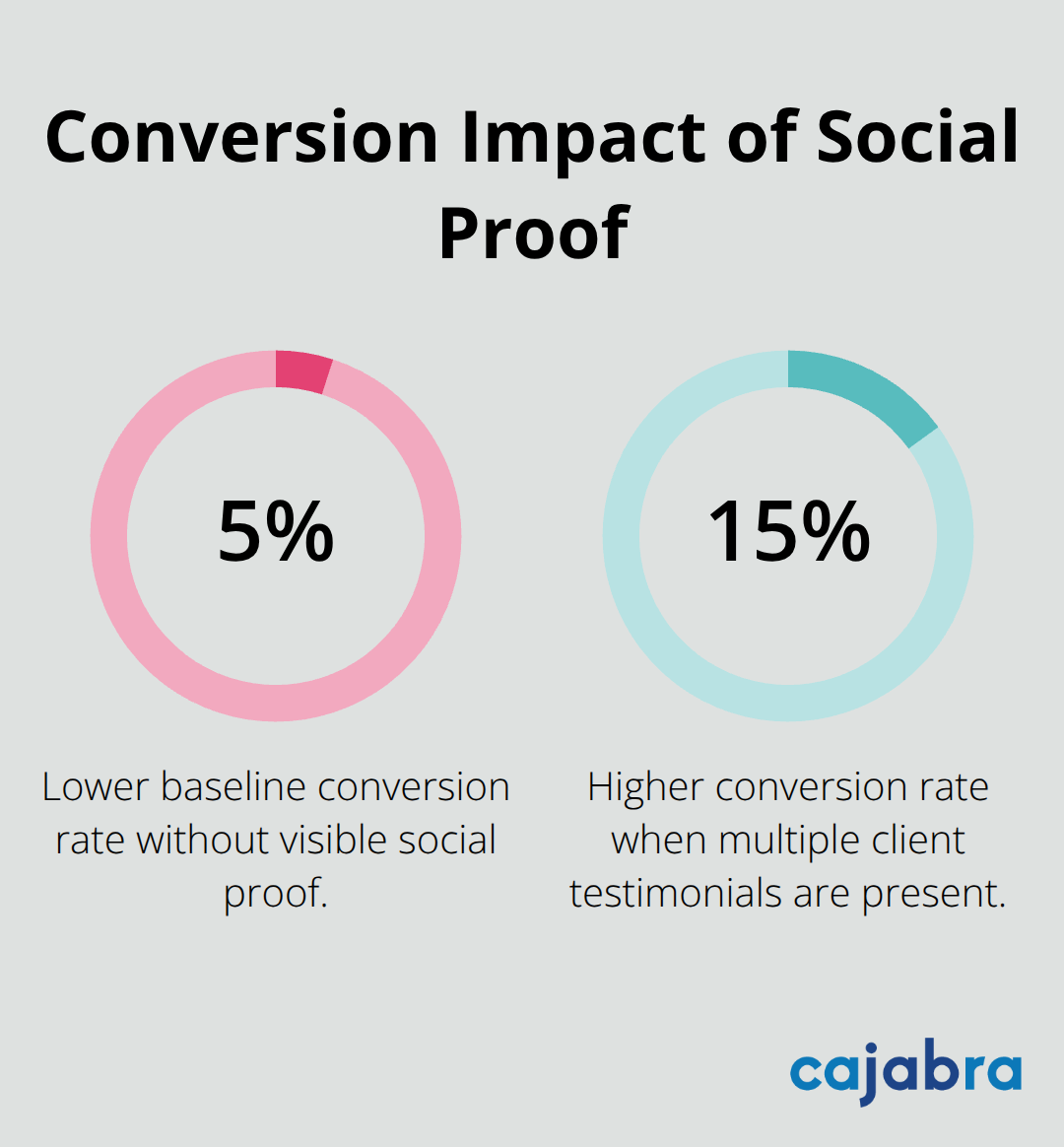

Studies from Nielsen show that people trust recommendations from other people over branded content. For accounting specifically, prospects actively seek out reviews, ask for references, and check what existing clients say before scheduling a consultation. Google Reviews carry particular weight because they require a verified account to post, meaning fabricated testimonials are harder to slip through. Firms with strong review profiles and consistent five-star ratings see higher conversion rates on their websites and attract more qualified leads. LinkedIn recommendations function similarly in the B2B space. When a client publicly endorses your expertise on their profile, other prospects viewing your profile immediately perceive you as credible. Prospects who see three or more client testimonials on your website are significantly more likely to contact you than those landing on pages with no social proof. This isn't marginal improvement. It's the difference between converting five percent of visitors and converting fifteen percent. That compounds quickly when you run consistent traffic to your site.

Building Authority Through Real Results

Certifications and awards matter, but only when paired with client outcomes. An accounting firm can display their CPA credentials all day, yet a single case study showing a manufacturing company reduced their tax liability by thirty-seven thousand dollars speaks louder. The specificity matters enormously. Generic testimonials like "great service, highly recommend" register as noise. Testimonials that mention exact problems solved and measurable results stick in prospects' minds. When you showcase that your firm helped a client identify unclaimed tax credits worth fourteen thousand dollars annually, that prospect reading it immediately thinks about their own tax situation and wonders if you could do the same for them. This transforms social proof from a trust signal into a lead magnet. The most effective approach combines multiple proof types across your marketing channels (LinkedIn, your website, service pages). LinkedIn should feature client recommendations and case study highlights. Your website homepage should display Google Reviews prominently. Your service pages should link to detailed case studies with specific dollar amounts saved. This layered approach means a prospect encounters repeated validation from different sources, each reinforcing the others.

How Specificity Separates You From Competitors

Vague praise accomplishes nothing. A prospect scrolling through your testimonials needs concrete evidence that you solve their specific problems. Instead of "they helped us with our taxes," show that you identified a three-year tax overpayment worth eight thousand dollars or that you restructured a client's entity to save them twelve percent annually on their tax bill. Numbers stick. Percentages stick. Dollar amounts stick. When you present these results alongside the client's industry or business type, prospects in similar situations immediately recognize themselves in your case studies. This recognition is what converts browsers into leads. The prospect doesn't just think you're credible. They think you're credible for them specifically. That distinction matters enormously when prospects evaluate multiple accounting firms. They want proof that you've solved problems for businesses like theirs, not just any business. This is where most accounting firms fail. They collect testimonials but fail to extract the specific outcomes that make those testimonials powerful. The next chapter explores how to systematically collect these testimonials and transform them into case studies that actually move prospects toward a decision.

Which Types of Social Proof Actually Persuade Accounting Prospects

Client Testimonials and Case Studies That Convert

Client testimonials without specifics waste space. The accounting firms winning the most clients pair detailed case studies with quantified outcomes that prospects recognize in their own situations. A case study showing how you helped a construction company recover fourteen thousand dollars in missed tax deductions works because the prospect immediately thinks about their own missed deductions. The industry context matters as much as the dollar amount. When prospects see proof tailored to their sector, conversion rates jump significantly.

The recommendation text matters more than the volume. A recommendation stating you helped a client implement cloud accounting software that reduced their month-end close time from five days to two days creates a mental image of concrete value. Generic praise like "excellent work" and "great communication" registers as background noise that prospects skip over.

Google Reviews and LinkedIn Recommendations

Google Reviews impact both traditional local search rankings and citations in AI Overviews. Firms with forty or more Google Reviews and an average rating above 4.7 stars consistently report higher inquiry volume than competitors with fewer reviews. LinkedIn recommendations function differently but equally powerfully in the B2B space. When a prospect lands on your profile and sees three or more recommendations mentioning specific expertise areas like tax strategy or bookkeeping automation, they perceive you as established and trusted by peers.

Certifications and Awards as Proof Points

Certifications and awards matter only when paired with client outcomes. Your CPA license establishes baseline credibility, but it doesn't differentiate you from the thousands of other CPAs in your market. Industry awards, however, can signal specialization. If you've won recognition for tax strategy or bookkeeping for specific industries, that becomes a proof point worth highlighting. Most accounting firms display credentials without context. Instead, position them alongside client results. For example, mention your CPA designation and then immediately reference a specific case showing how that expertise delivered measurable value.

Systematic Collection Transforms Proof Quality

The collection process determines proof quality. Systematically request testimonials after successful engagements and you'll yield dramatically better results than sporadic requests. Send a simple email within two weeks of completing a significant project, asking the client to describe the specific problem you solved and the measurable outcome. Prompt them for numbers: tax savings, time saved, cash flow improvements, error reductions. Most clients will provide these details if you ask directly.

Transform their response into a short case study with a headline, problem statement, your solution, and quantified results. Publish these case studies on your service pages and LinkedIn. For Google Reviews, send a direct link after positive engagements and you'll make the process friction-free. Firms that email a direct Google Review link to clients see review submission rates five to ten times higher than firms that expect clients to find and navigate Google's review interface independently.

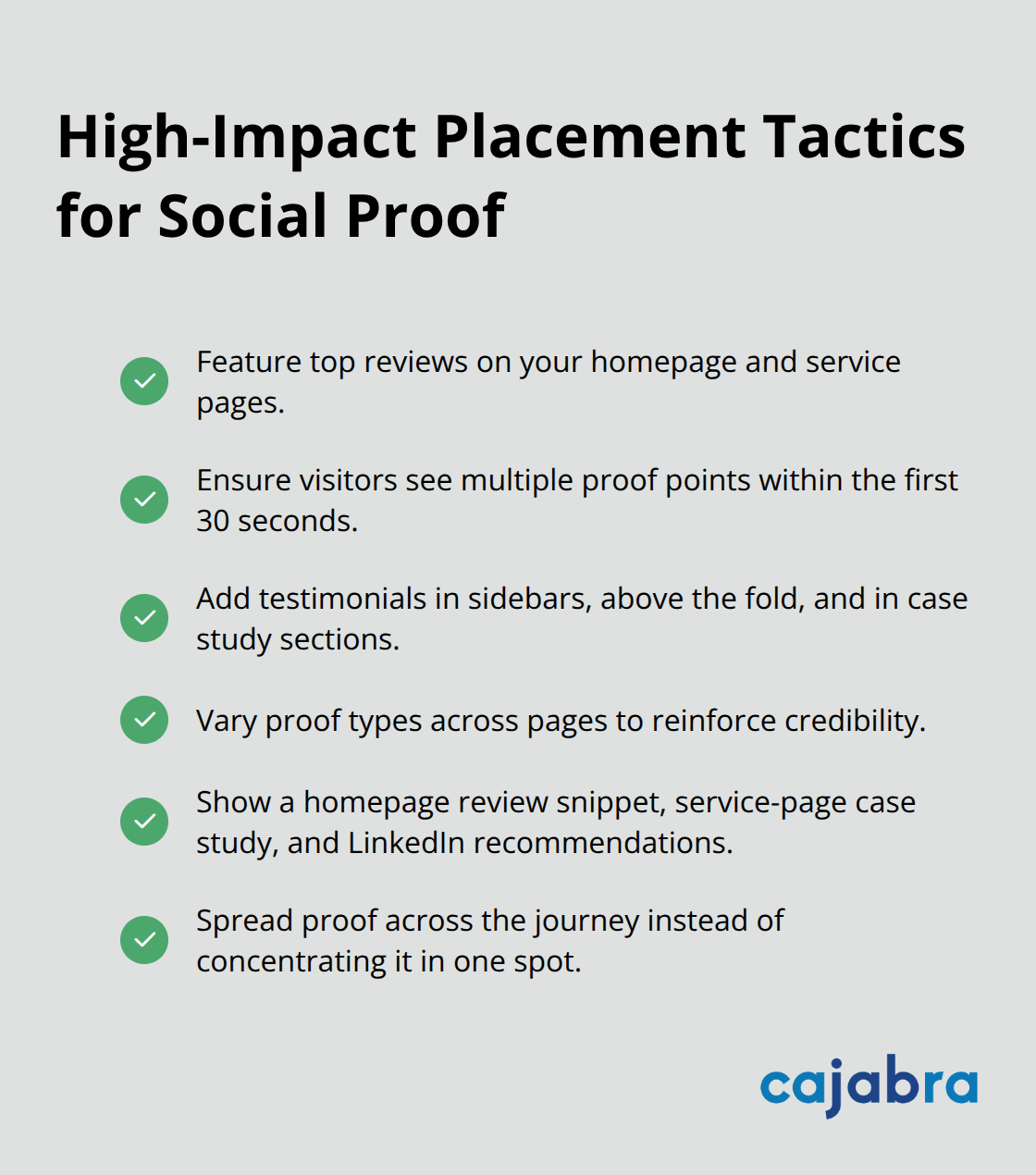

Strategic Placement Multiplies Impact

Display your best reviews prominently on your homepage and service pages. Prospects scrolling through your site should encounter multiple proof points within the first thirty seconds. Place testimonials in sidebars, above the fold on service pages, and within case study sections. Vary the proof types you display.

A prospect might see a Google Review snippet on your homepage, a detailed case study on your tax strategy page, and LinkedIn recommendations on your profile. This repetition from different sources compounds credibility far more effectively than concentrating all proof in one location.

Track which proof types generate the most leads by using unique landing pages for different case studies and monitoring which drive the highest conversion rates. Over time, this data reveals whether video testimonials, written case studies, or review aggregations perform best for your specific audience. The proof types that resonate most with your prospects should inform how you allocate your collection efforts going forward.

How to Systematically Build and Showcase Social Proof

Request Reviews at the Right Moment

Collecting reviews and testimonials works only if you build it into your regular business process. Most accounting firms wait for clients to volunteer feedback, which almost never happens. Instead, send a structured email request within two weeks of completing a significant engagement. The timing matters because the client's satisfaction remains fresh and they haven't yet moved on to their next priority. Keep the request simple: ask them to describe the specific problem you solved and the measurable outcome. Prompt directly for numbers.

Most clients will provide tax savings, time saved, cash flow improvements, or error reductions if you ask explicitly. For Google Reviews, send a direct review link in your email rather than expecting clients to search for your business page and navigate Google's interface independently. Firms that email direct Google Review links see higher submission rates than those requesting reviews without a link. This single change transforms review collection from sporadic to systematic.

Set a calendar reminder to request reviews after every completed project and assign someone on your team ownership of this process. Within six months of consistent requests, you'll accumulate thirty to fifty reviews. At forty or more reviews with a 4.7-star average, your visibility in local search results and AI-generated search summaries increases substantially. LinkedIn recommendations follow a similar pattern. After delivering strong results, send the client a message asking them to endorse your specific expertise on LinkedIn. Make it easy by suggesting exact language they could use. Most professionals will spend two minutes writing a recommendation if you remove friction from the request.

Transform Feedback Into Case Studies That Convert

A case study differs fundamentally from a testimonial. A testimonial consists of one or two sentences of praise. A case study presents a structured narrative that shows a prospect their own situation reflected back at them. Start with a headline that names the client's industry and the specific outcome. Then describe the problem they faced before working with you. Next, explain your solution in plain language without jargon. Finally, quantify the results with specific numbers.

For example: Manufacturing company struggled with entity structure tax inefficiency. You restructured their business entity and identified overlooked tax credits. Result: annual tax liability reduced by twelve percent, saving them eighteen thousand dollars yearly. Notice the specificity. A prospect running a manufacturing business reads this and immediately thinks about their own tax situation. They see themselves in the case study. This recognition drives conversion far more effectively than generic praise.

Publish these case studies on your service pages where prospects evaluating that specific service will encounter them. A prospect researching tax strategy should see case studies demonstrating tax savings on that page. Create short versions for LinkedIn, sharing the industry context and outcome in a post with a link to the full case study on your website. Track which case studies generate the most leads (by monitoring which ones drive traffic and conversions to your website). Over time, this data reveals whether prospects respond more strongly to tax savings stories, time-savings stories, or cash-flow improvements. Allocate your case study creation efforts toward the proof types that resonate most with your target clients.

Leverage Video Testimonials for Maximum Impact

Video testimonials dramatically outperform written testimonials in conversion rates because they feel authentic in ways text cannot replicate. Record a short video of a satisfied client describing the problem you solved and the specific outcome. Keep videos under ninety seconds. Authenticity matters more than production quality. A client speaking directly to the camera about their experience generates far more credibility than a polished corporate video.

Publish these videos on your homepage, service pages, and LinkedIn. Prospects who watch even thirty seconds of a client testimonial video are significantly more likely to schedule a consultation than those who only read text. The combination of seeing a real person, hearing their voice, and hearing them describe concrete results creates trust that written testimonials struggle to match.

Final Thoughts

Social proof shifts how prospects evaluate your firm fundamentally. When a prospect sees that you saved other accounting clients thousands in taxes or streamlined their operations, they stop viewing you as one option among many and instead see you as the firm that solves problems like theirs. This perception change happens because prospects trust outcomes from real clients far more than marketing claims, and the firms winning the most accounting clients understand this reality completely.

Building social proof requires consistency rather than complexity. Request reviews after every completed engagement, transform client feedback into case studies that show industry context and measurable results, and publish these across your service pages and LinkedIn where prospects actively search for proof that you deliver. Within six months of systematic collection, you'll accumulate enough proof to shift how prospects perceive your firm, and prospects will contact you because they've seen evidence that you solve problems for businesses like theirs.