Accountants who ignore SEO for accountants are leaving money on the table. Most potential clients search online when they need accounting services, and if your firm isn't visible in those results, competitors are capturing your leads.

At Cajabra, LLC, we've seen firsthand how the right SEO strategy transforms client acquisition for accounting practices. This guide walks you through the specific tactics that work.

Why Search Visibility Actually Matters for Your Accounting Firm

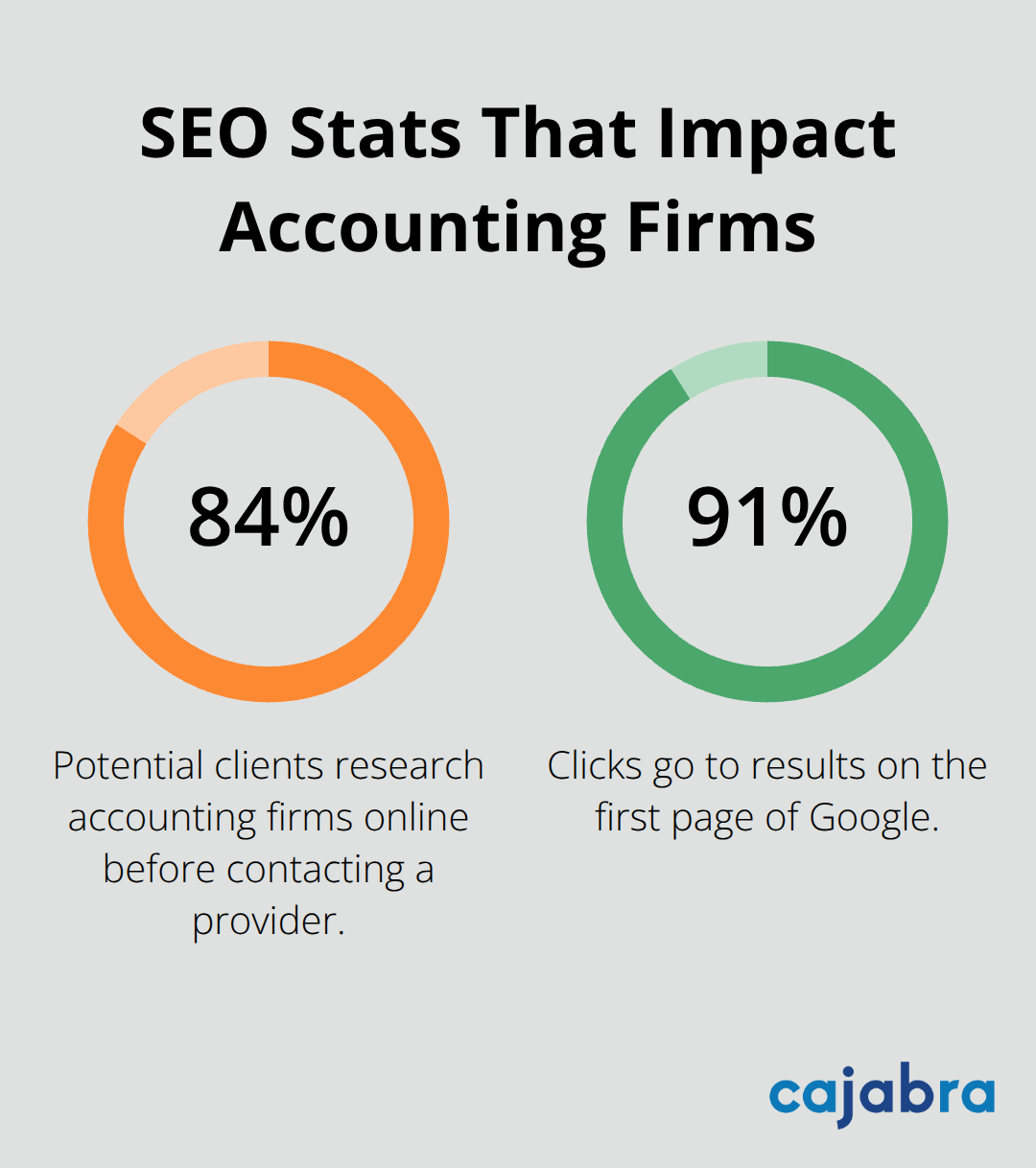

The numbers are impossible to ignore. 84% of potential clients research accounting firms online before making contact. That means the vast majority of people who need your services are already on Google, searching for help. If your firm doesn't appear in those results, you're not just missing visibility-you're actively losing revenue to competitors who do show up. Google processes over 8.5 billion searches daily, and accounting-related queries represent a significant portion of local business searches. When someone types "accountant near me" or "tax preparation services," they're ready to hire. They're not browsing casually. They need help now.

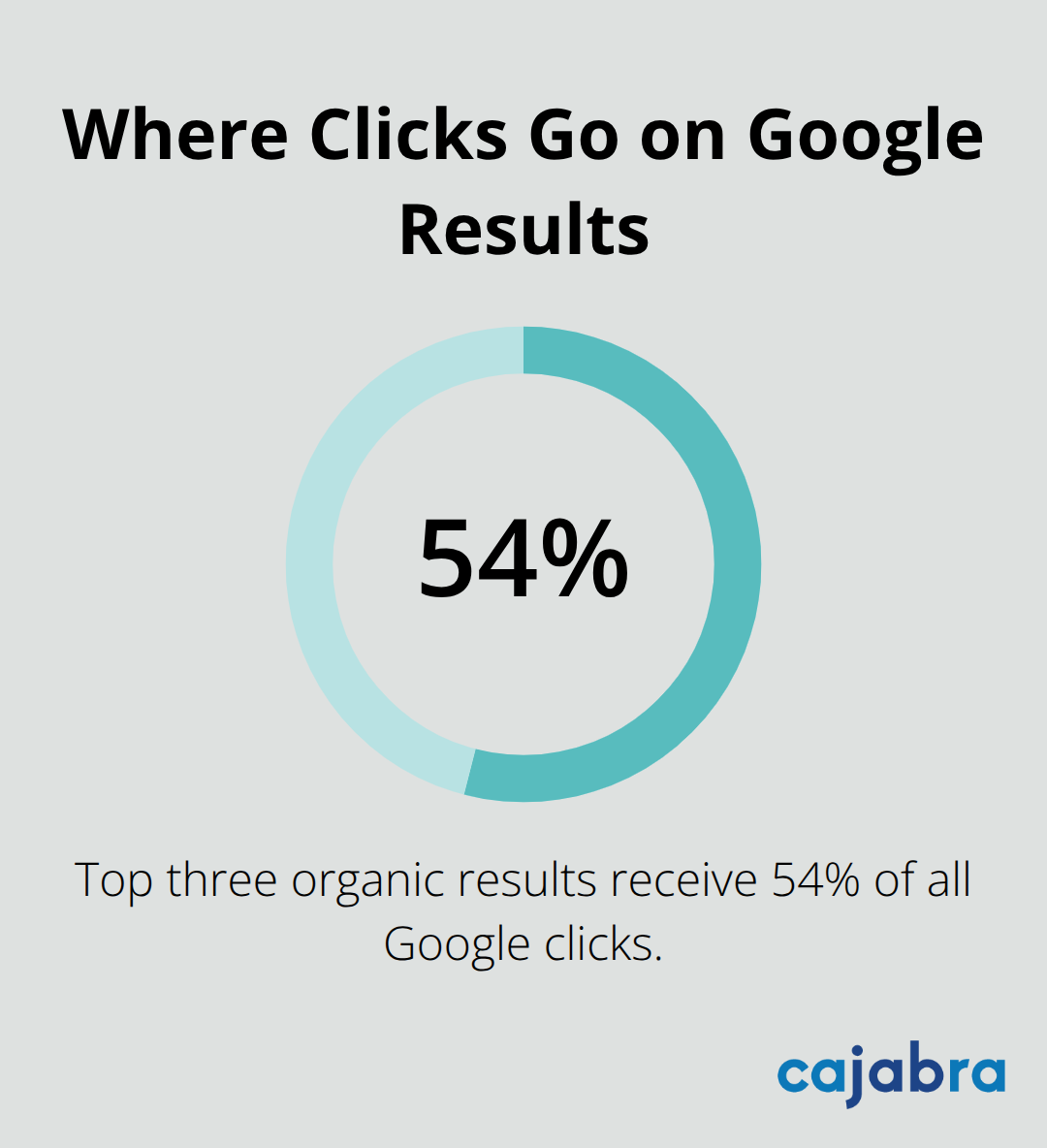

The problem is stark: 91% of all clicks go to results on the first page of Google. Ranking on page one is the difference between attracting clients and being invisible. Most accounting firms either ignore SEO entirely or treat it as an afterthought, which creates an opportunity for firms willing to invest in it properly.

How Rankings Drive Client Acquisition

Your ranking position directly determines how many potential clients find you. A firm ranking fifth for "CPA in Dallas" captures dramatically fewer leads than one ranking second. The difference between position one and position five on Google translates to thousands of lost inquiries annually for most accounting practices. This isn't theoretical-it's how Google's algorithm works. The platform prioritizes certain websites based on technical quality, content relevance, and authority signals. When you optimize for these factors, you move up. When you don't, competitors do.

Local SEO proves particularly powerful for accounting firms because most clients prefer working with someone nearby. They search with geographic intent, which means targeting location-based keywords like "bookkeeping services in [city]" or "small business accountant near me" puts you directly in front of your ideal market. Unlike paid advertising (which stops producing leads the moment you stop paying), organic search traffic compounds over time. A blog post you publish today that ranks in six months will continue bringing clients for years.

What Qualified Leads Actually Look Like

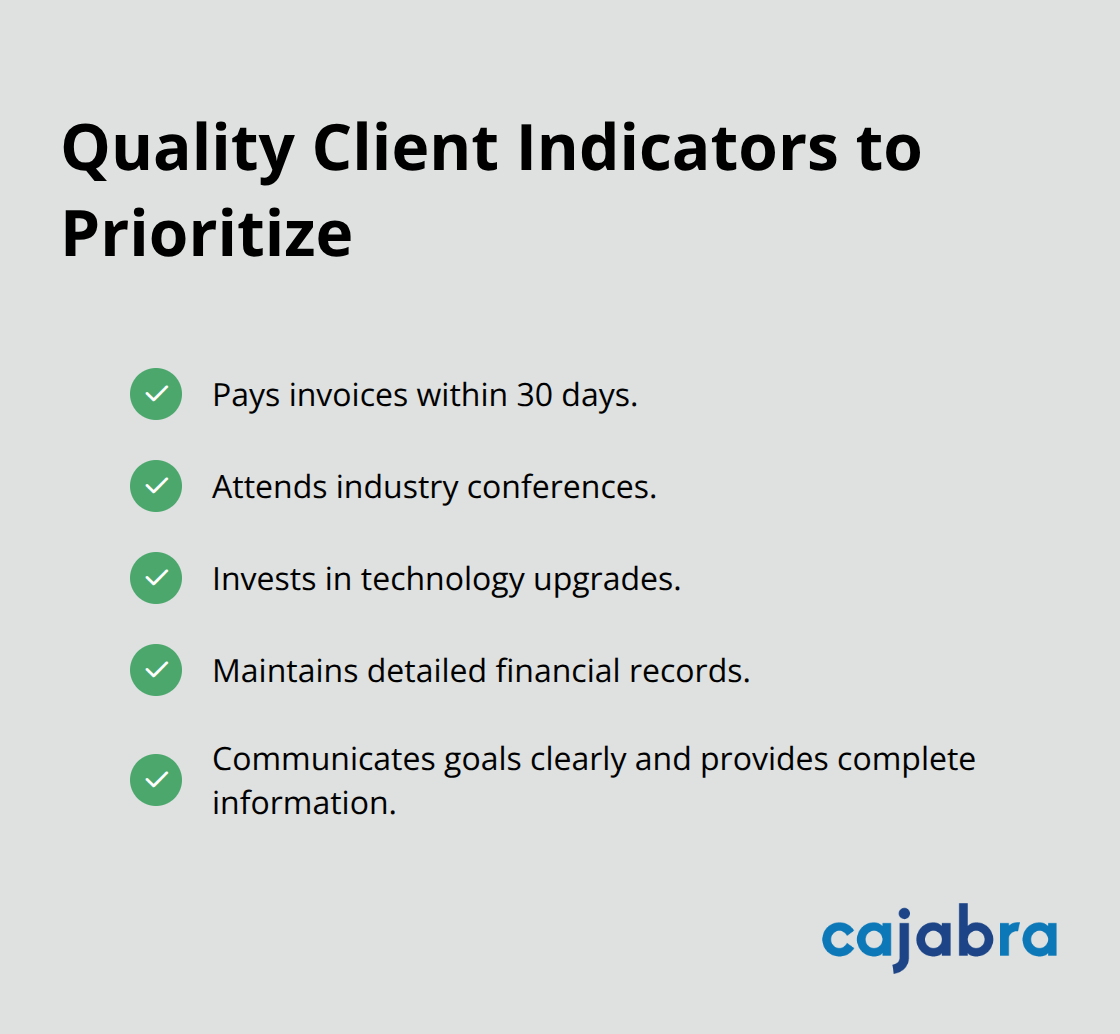

Not all website traffic matters equally. A visitor who searches for "how to become a CPA" is not a prospect. A visitor who searches for "tax preparation for LLC owners" or "payroll services for small businesses" actively looks for what you offer. This distinction separates effective SEO from wasted effort.

When you target high-intent keywords-phrases that indicate someone is ready to buy-your website attracts serious prospects instead of tire-kickers. These visitors convert at much higher rates because they're already sold on needing your service. They just need to find the right firm. This is why keyword research matters. Tools like Google Keyword Planner and Ahrefs help you identify what your actual prospects search for, not what sounds impressive.

The most effective accounting firms target niche, specific keywords rather than broad terms. "Tax deductions for real estate investors" attracts more qualified leads than just "tax deductions" because it speaks directly to a specific client segment. These qualified leads require less sales effort to convert into retainer clients because they've already self-selected as a match for your services. Once you understand what your prospects search for, you can build the technical foundation and content strategy that positions your firm in front of them.

Building the Technical Foundation That Makes Rankings Possible

Your website's technical health determines whether Google can even index your pages, let alone rank them. Most accounting firm websites fail on basics before they ever reach content strategy.

Page Speed and Image Optimization

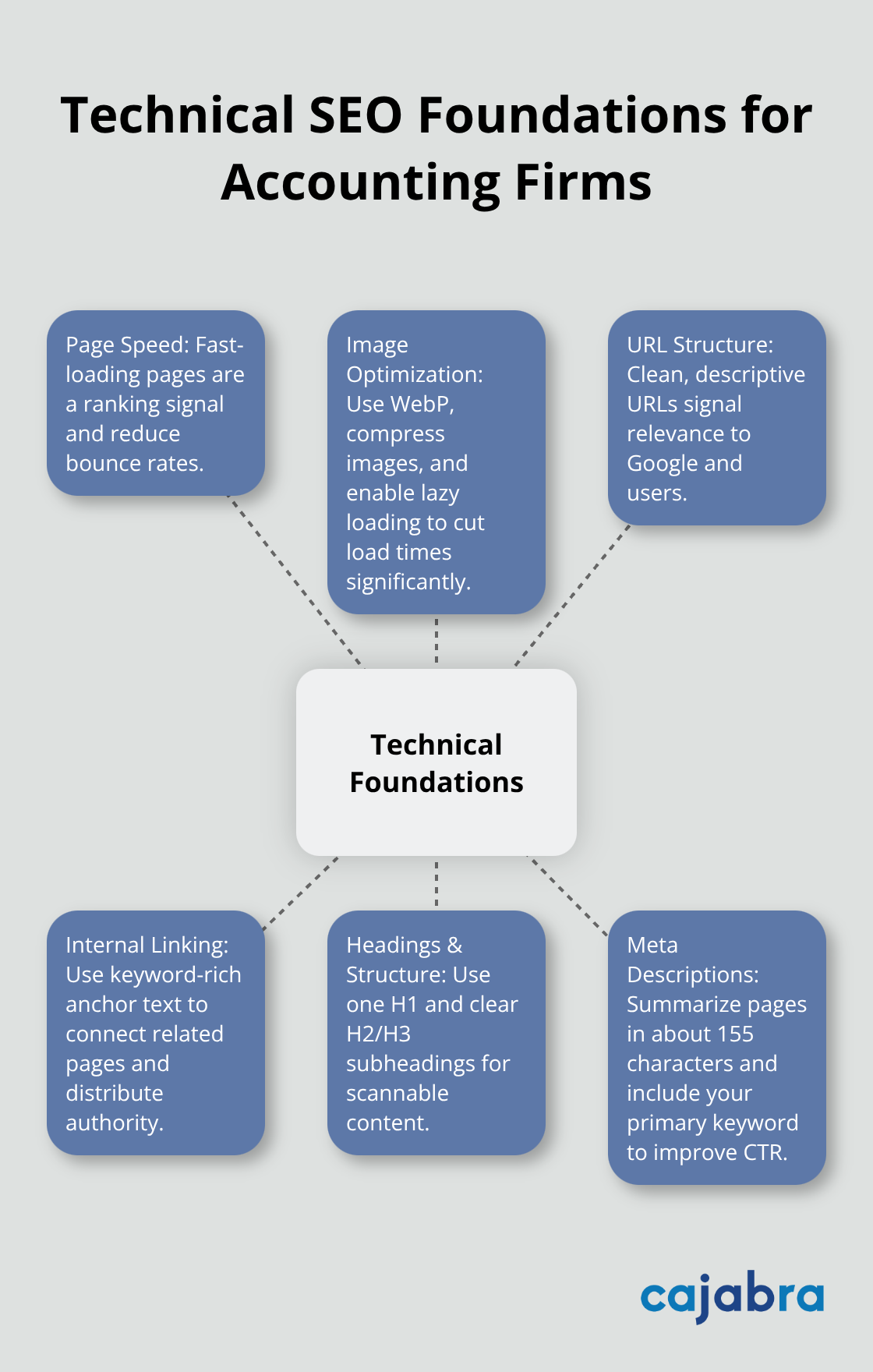

Page speed matters enormously because Google uses it as a ranking signal. Test your current speed with Google PageSpeed Insights right now. If your site takes six seconds to load, you've already lost potential clients to competitors.

Image optimization alone typically cuts load time in half for accounting websites because most firms upload uncompressed photos directly onto their sites. Use WebP format instead of JPEG or PNG, compress ruthlessly with tools like TinyPNG, and enable lazy loading so images load only when visitors scroll to them. These changes cost nothing and take hours, not days.

URL Structure and Internal Linking Strategy

Your URL structure matters more than it appears. Clean, descriptive URLs like yourfirm.com/tax-preparation-for-llcs outperform cryptic ones like yourfirm.com/?p=12847. Google reads URLs as ranking signals, and so do potential clients when they see the link in search results.

Descriptive URLs also help with internal linking strategy, which helps search engines understand your site structure, distribute authority across pages, and improve indexing speed. When you write a blog post about quarterly tax planning for realtors, link to it from your realtor tax services page using anchor text that includes your target keyword. This internal linking tells Google which pages matter most and distributes ranking authority throughout your site strategically.

Targeting High-Intent Keywords With Strategic Content

Content that ranks solves specific problems your prospects actually search for. High-intent keywords like tax preparation for S-corp owners or bookkeeping services for contractors pull in visitors ready to hire, while generic content about accounting basics attracts browsers who disappear without converting.

Use Google Keyword Planner to find monthly search volumes for specific keywords in your area, then try those with 500 plus monthly searches and medium difficulty ratings. A post targeting tax deductions for real estate investors might capture 200 to 400 qualified leads annually if it ranks on page one, compared to maybe 20 leads from a generic post about tax deductions.

Structuring Content for Both Search Engines and Humans

Write content that directly answers the questions your prospects type into Google. If people search for how to file back taxes as an LLC, that exact question should appear in your first paragraph, not buried three sections deep. Structure matters for both Google and humans. Use one clear H1 heading per page that includes your primary keyword, then H2 and H3 subheadings that break content into scannable sections. Accounting content especially benefits from this structure because clients skim before reading deeply.

Meta descriptions should summarize your page in 155 characters and include your target keyword naturally, because this text appears in search results and influences click-through rates directly. These technical foundations work together to signal to Google that your site deserves ranking authority, but they only matter if your content actually speaks to what your prospects need. The next section shows you how to identify those prospects and build a local SEO strategy that puts your firm directly in front of them.

Local SEO Strategies for Accounting Firms

Optimize Your Google Business Profile Completely

Google Business Profile optimization is non-negotiable if you want local clients to find you. Claim your profile immediately if you haven't already, then complete every single field available. Most accounting firms skip this step or fill it out halfway, which tanks their visibility in local search results and Google Maps. Your profile should include your full service list, hours of operation, phone number, website URL, and a professional photo of your office or team. Google treats a fully completed profile as a trust signal, and incomplete profiles rank significantly lower for local queries.

Once your profile is live, upload photos regularly. Firms that post new images at least monthly see higher engagement and click-through rates from local search results than those that don't update their profiles. Add images of your team, office space, and client testimonials to humanize your firm and build confidence in potential clients searching for an accountant in their area.

Build Citations Across Accounting and Local Directories

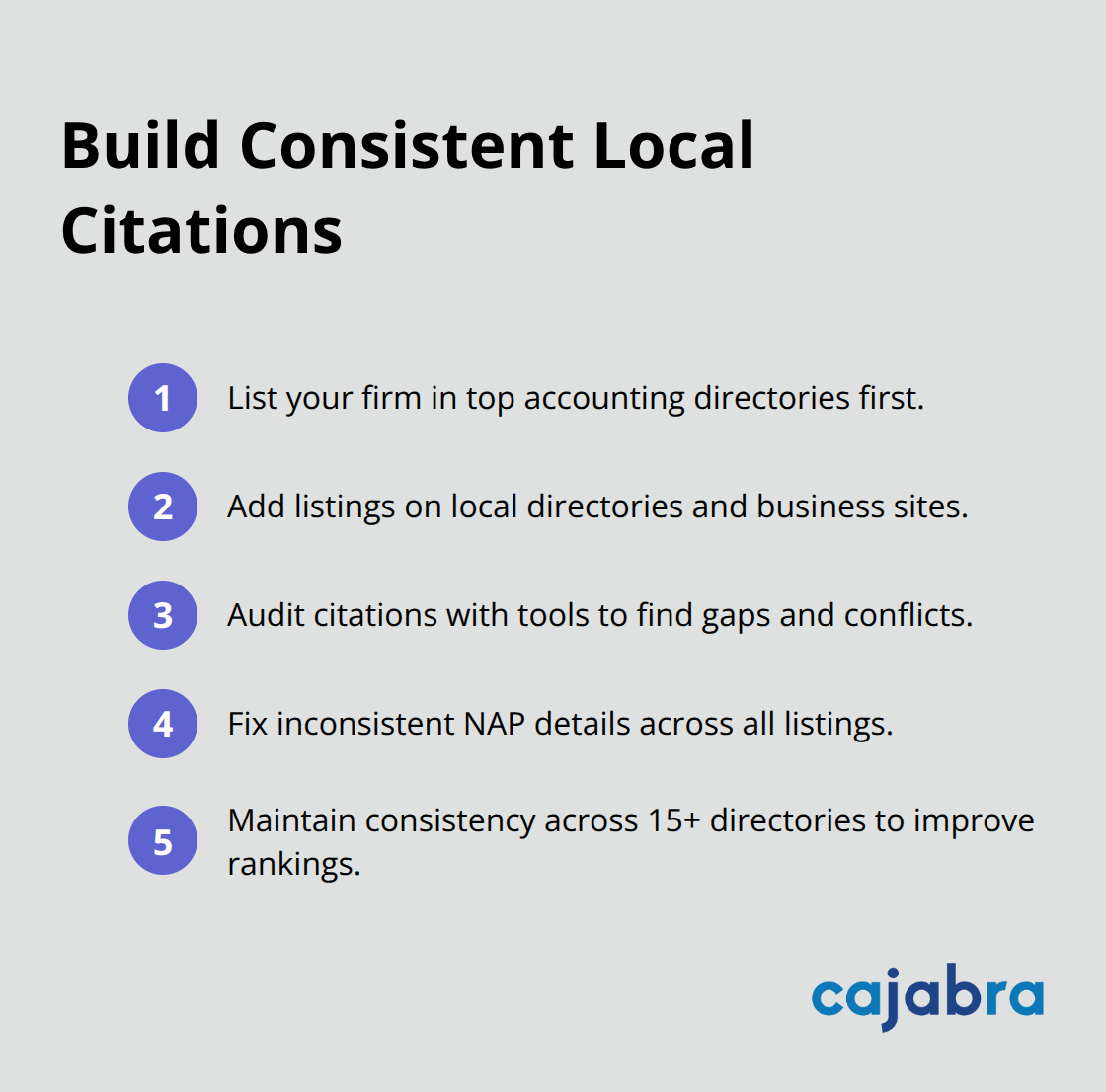

Citations matter far more than most accounting firms realize. A citation is simply your business name, address, and phone number listed on directories and websites around the web. Google uses citations to verify your business legitimacy and location, so consistency across directories directly impacts your local ranking position. Inconsistent information across directories actually damages your local SEO performance because Google sees conflicting data and downgrades your trustworthiness.

Start with high-authority accounting directories like the American Institute of Certified Public Accountants directory and state CPA association listings. Then add your firm to local directories like Chamber of Commerce websites, Yelp, and Better Business Bureau. Tools like Semrush Local Business Data or Bright Local can audit your current citations and identify where your information is missing or contradictory.

Fix these inconsistencies immediately because they directly suppress your local rankings. Firms that maintain consistent NAP information across 15 plus directories typically outrank competitors for local search terms.

Collect and Respond to Google Reviews Strategically

Google uses reviews as a trust signal. A steady stream of real reviews helps your profile stand out in local search results and builds confidence with potential clients before they contact you.

Request reviews actively from clients after you complete their work. Send a follow-up email with a direct link to your Google review page rather than asking clients to search for your firm and find the review section themselves. The easier you make the process, the more reviews you'll receive. Respond to every review, both positive and negative. Responding to negative reviews shows prospective clients that you care about feedback and take client concerns seriously. A thoughtful response to a critical review often converts that negative review into a trust-building opportunity rather than a liability.

Final Thoughts

SEO for accountants transforms how firms acquire clients, and the accounting practices winning right now execute consistently on the basics rather than chase complex tactics. A single blog post targeting high-intent keywords like tax deductions for real estate investors generates 200 to 400 qualified leads annually once it ranks, while your fully optimized Google Business Profile directly influences whether local prospects contact you or your competitor. Reviews compound your credibility with every new client who leaves feedback, and these foundational elements cost almost nothing to implement.

Start with one high-intent keyword in your niche, write a thorough post answering the exact question prospects search for, optimize it technically, and observe the results. Then repeat this process consistently, building a steady stream of inbound leads that require far less sales effort than cold outreach. The firms that commit to SEO for accountants stop chasing leads and start selecting which clients to accept.

Your firm can implement these exact strategies and watch your client acquisition transform. Pick one keyword this week, publish one post next week, and let the compounding effect of consistent effort build your visibility over the next three to six months.

Most accounting firms are stuck in a cycle of feast or famine, struggling to attract consistent high-value clients while drowning in administrative work. The gap between having expertise and actually getting noticed by prospects who need it is wider than ever.

At Cajabra, LLC, we've seen firsthand how marketing for accounting firms fails when it's treated as an afterthought. This guide cuts through the noise and shows you exactly what works to fill your pipeline with retainer clients who stick around.

Why Traditional Marketing Fails Accounting Firms

Time Scarcity Creates a Marketing Handicap

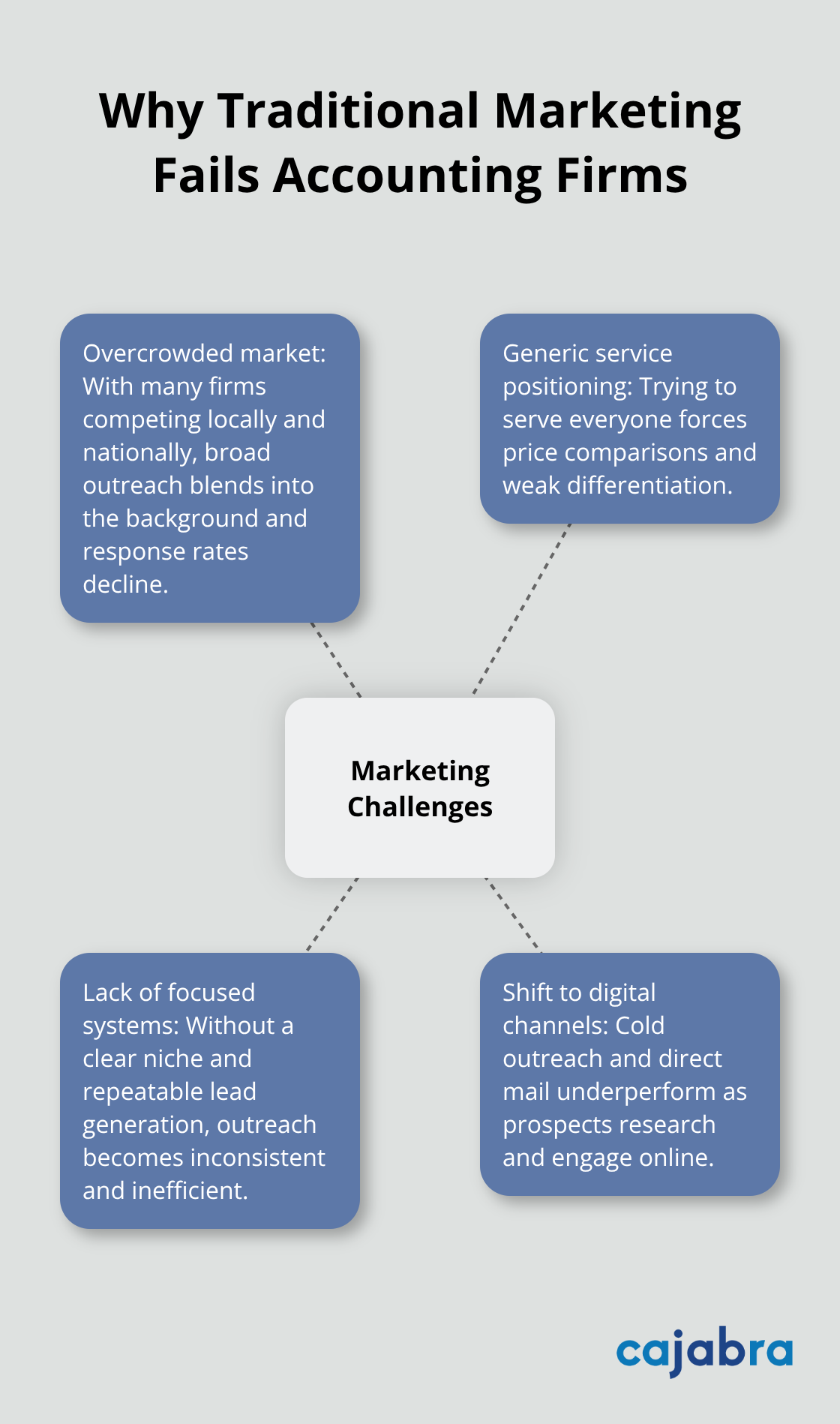

Most accounting firms operate with a marketing handicap that competitors don't talk about: time scarcity. According to the Hinge 2025 High Growth Study, firms allocate over 12% of revenue to marketing when they're serious about growth, yet many accounting practices spend closer to 1% because partners are consumed by client work and compliance deadlines. This creates a vicious cycle where the firm needs more clients to justify hiring marketing staff, but can't attract those clients without marketing. The result is sporadic networking events, outdated websites that haven't been refreshed in five years, and social media accounts that go silent for months.

Why Traditional Tactics No Longer Work

Traditional tactics like cold calling and direct mail have become increasingly ineffective, with response rates dropping as prospects shift to digital channels. IBISWorld reports over 85,000 accounting firms competing in the US market, which means generic approaches no longer work. Firms that try to be everything to everyone-tax prep, bookkeeping, payroll, advisory-get lost in the noise and compete on price rather than value. The firms winning right now are those with a clear niche, a professional digital presence, and systems that generate leads consistently without requiring a partner to personally chase every prospect.

The Real Problem: Invisibility in a Crowded Market

The real problem isn't that accounting firms lack expertise or client service skills. The problem is that high-value retainer clients never find them. A prospect searching for a CPA near me encounters dozens of firms with similar credentials, similar service menus, and similar websites. Without a strong online reputation, client testimonials, and thought leadership content that demonstrates real expertise, firms look interchangeable. Local SEO matters significantly for accounting practices, yet most firms treat these as optional.

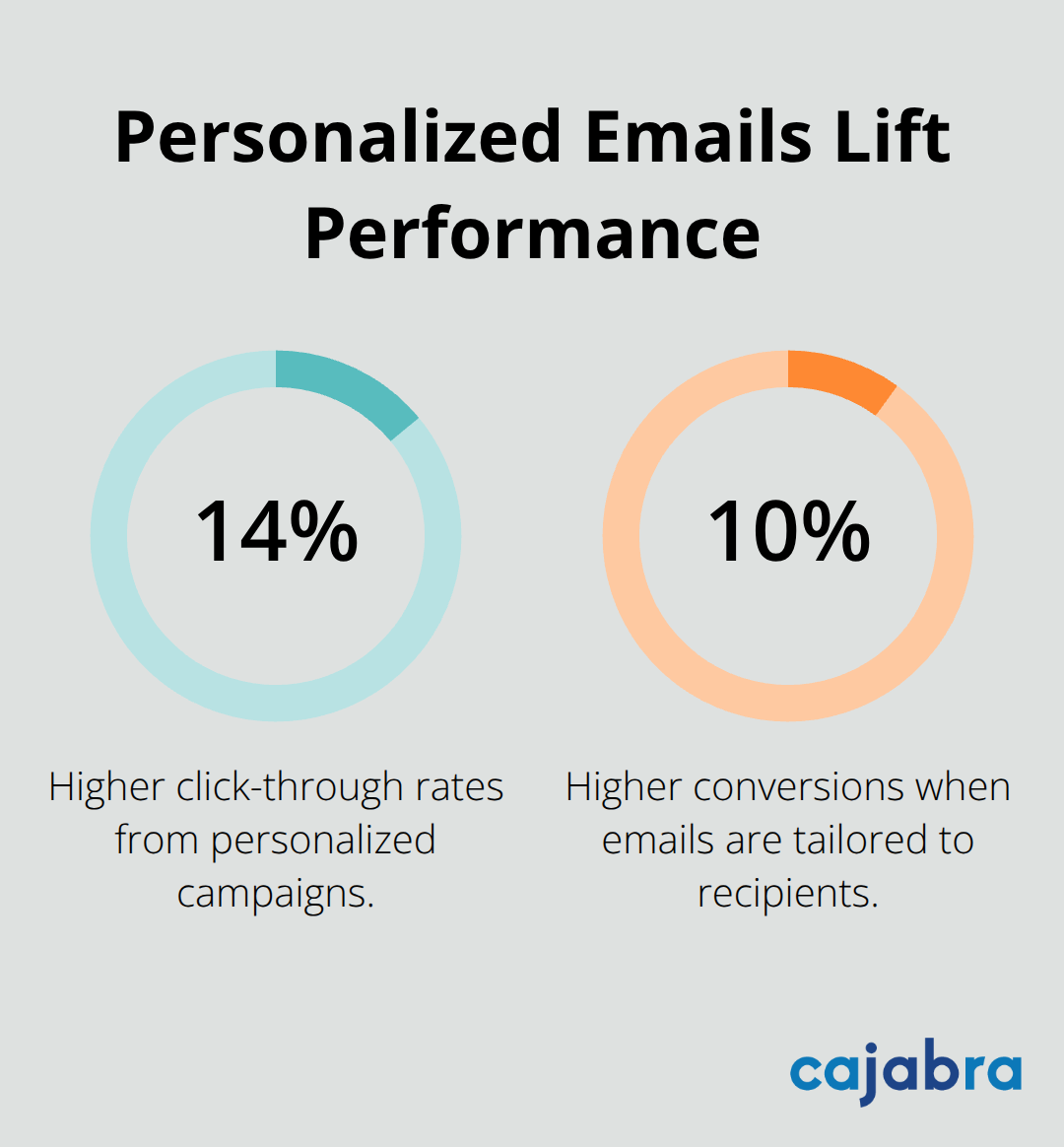

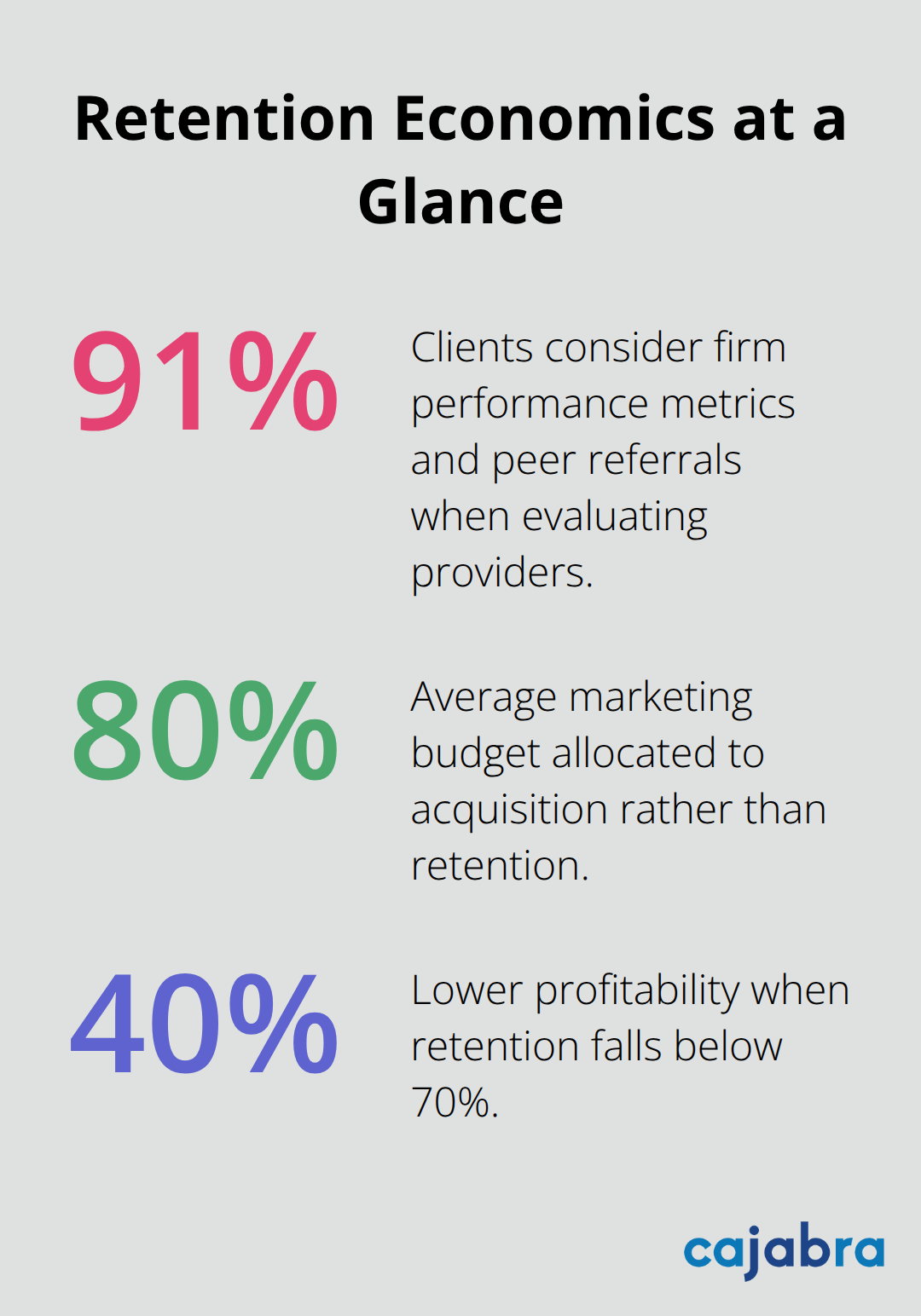

The Hidden Cost of No Email Strategy

Email marketing generates between $36 and $40 for every dollar spent according to industry benchmarks, but many firms have no email strategy at all. The gap between knowing what works and actually implementing it is where accounting firms get stuck. Firms need systems that work without constant attention, websites that convert visitors into qualified leads, and a content strategy that builds authority in their target market (which we'll explore in the next section). This requires moving beyond the feast-or-famine mentality and treating marketing as a predictable business function, not a random activity squeezed in between client calls.

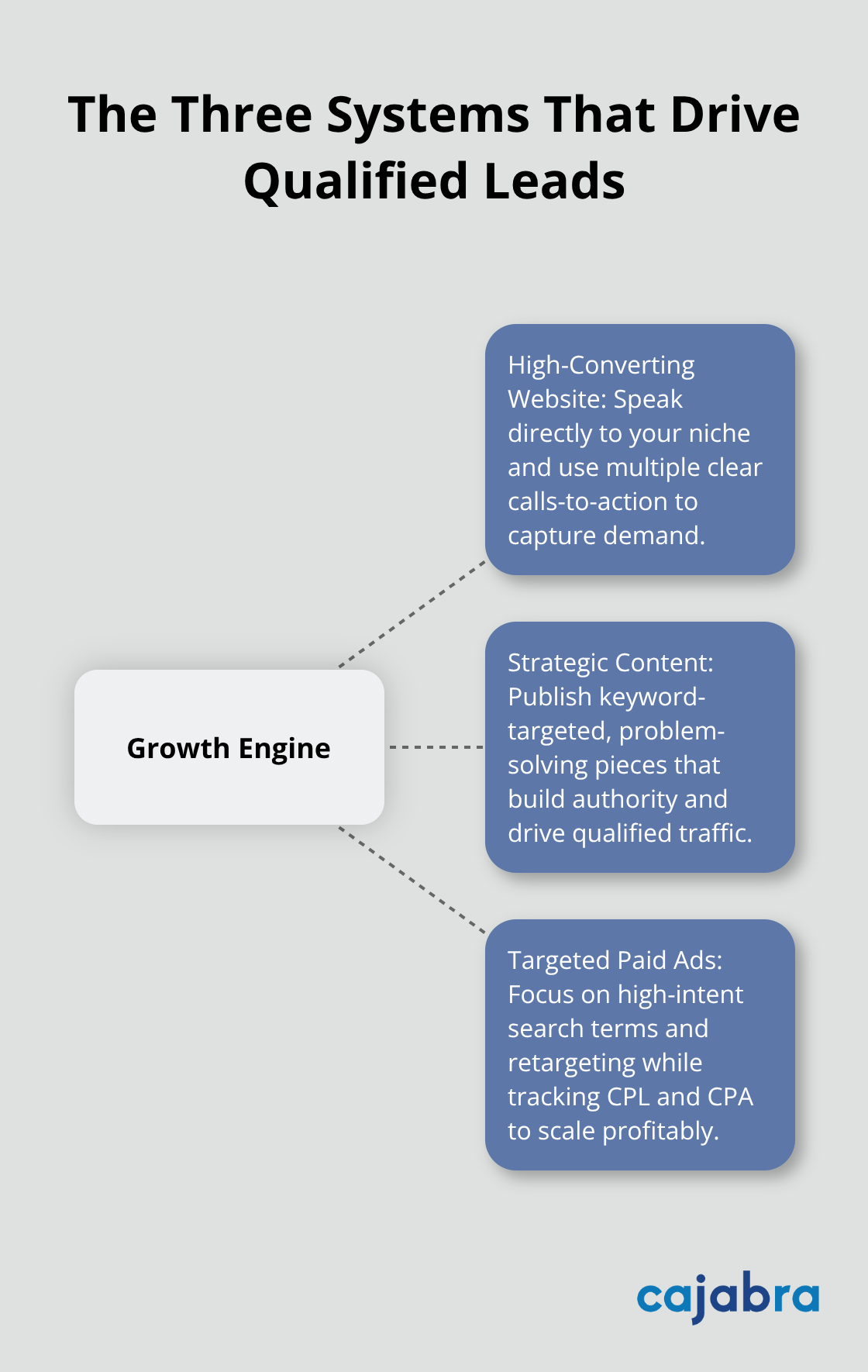

The Three Digital Systems That Fill Your Pipeline

Your Website Converts Visitors Into Leads

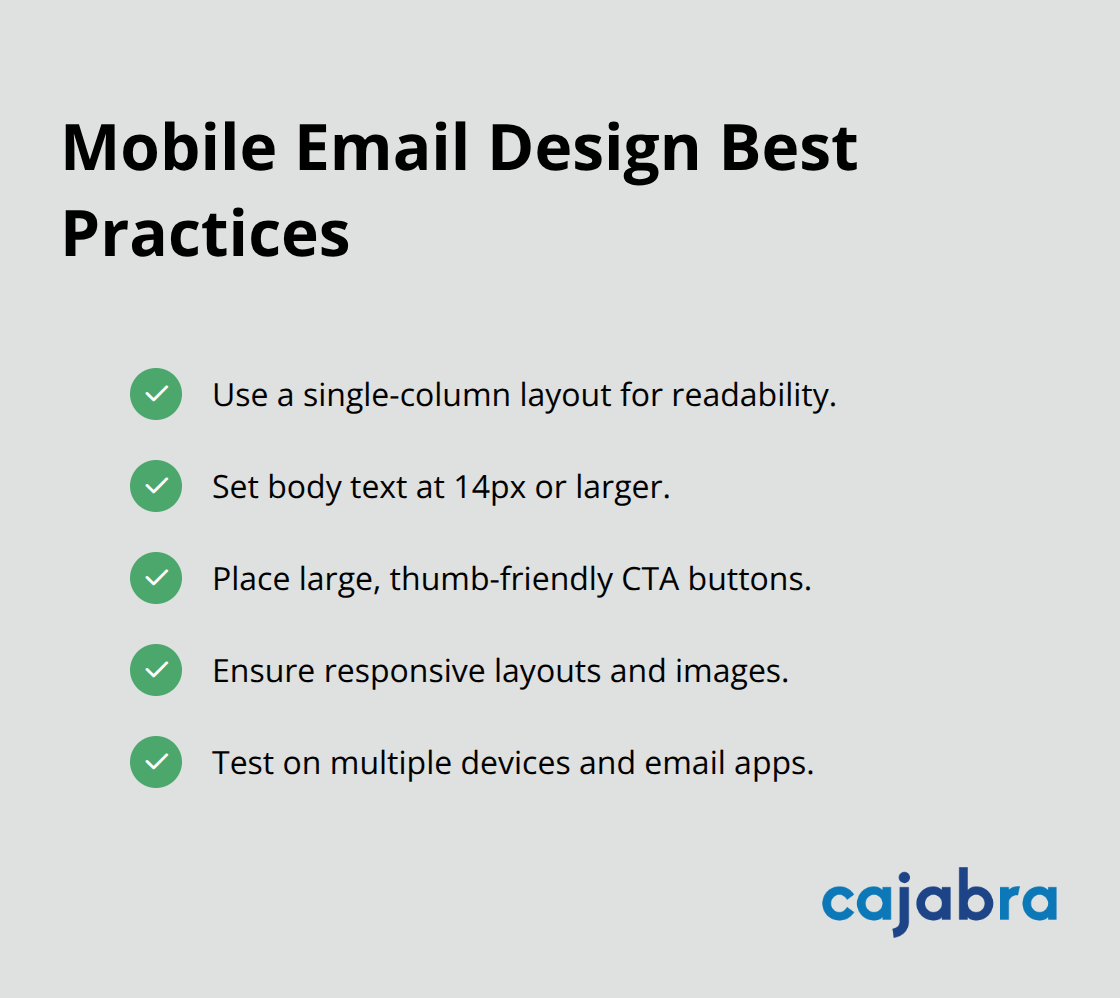

Your website is where prospects form their first impression, and most accounting firm websites fail at the most basic task: converting a visitor into a lead. A functional website isn't enough anymore. Your site needs to load in under three seconds on mobile, clearly explain what problems you solve for specific client types (not generic tax services), include recent client testimonials that highlight real outcomes, and make it simple for prospects to book a consultation.

Local SEO matters significantly for accounting practices. Optimize your Google Business Profile with accurate hours, service categories, and photos. Create location-specific service pages if you serve multiple markets. Encourage satisfied clients to leave reviews on Google and industry directories. Firms that actively manage their online reputation see higher inquiry rates from local searches.

Content Marketing Attracts High-Value Clients

Content marketing separates firms that attract high-value clients from those that compete on price. The firms winning in 2025 publish consistent, specific content that addresses real client pain points: tax planning strategies for real estate investors, year-end tax optimization for professional services firms, or quarterly bookkeeping tips for e-commerce businesses. This isn't about generic blog posts. It's about demonstrating expertise in a specific niche.

One accounting firm publishing twelve targeted articles per year about healthcare practice tax strategies will outrank competitors publishing generic tax tips. Your content reaches prospects across your website, LinkedIn, and email to existing clients. LinkedIn specifically works for accounting firms because decision-makers and CFOs use the platform to find professional services. Post insights about tax law changes, share client success stories anonymously, and engage in industry discussions.

Targeted Advertising Accelerates Your Results

Targeted advertising accelerates results when your website conversion optimization for accounting firms are already in place. Google Ads and LinkedIn advertising allow you to reach prospects actively searching for accounting services in your niche or geographic area. A properly structured Google Ads account focuses on high-intent keywords like "accountant for startups" or "tax planning for real estate" with conversion-optimized landing pages.

Budget matters less than strategy. A firm spending $500 monthly on precisely targeted campaigns will generate better returns than one spending $3,000 on broad, generic keywords. Track your cost per qualified lead, conversion rate from lead to client, and lifetime value of clients acquired through each channel. This data guides your next budget decision and reveals which systems actually produce retainer clients worth your time.

How to Build Systems That Generate Leads Without Constant Effort

Email Sequences Convert Cold Prospects Into Qualified Leads

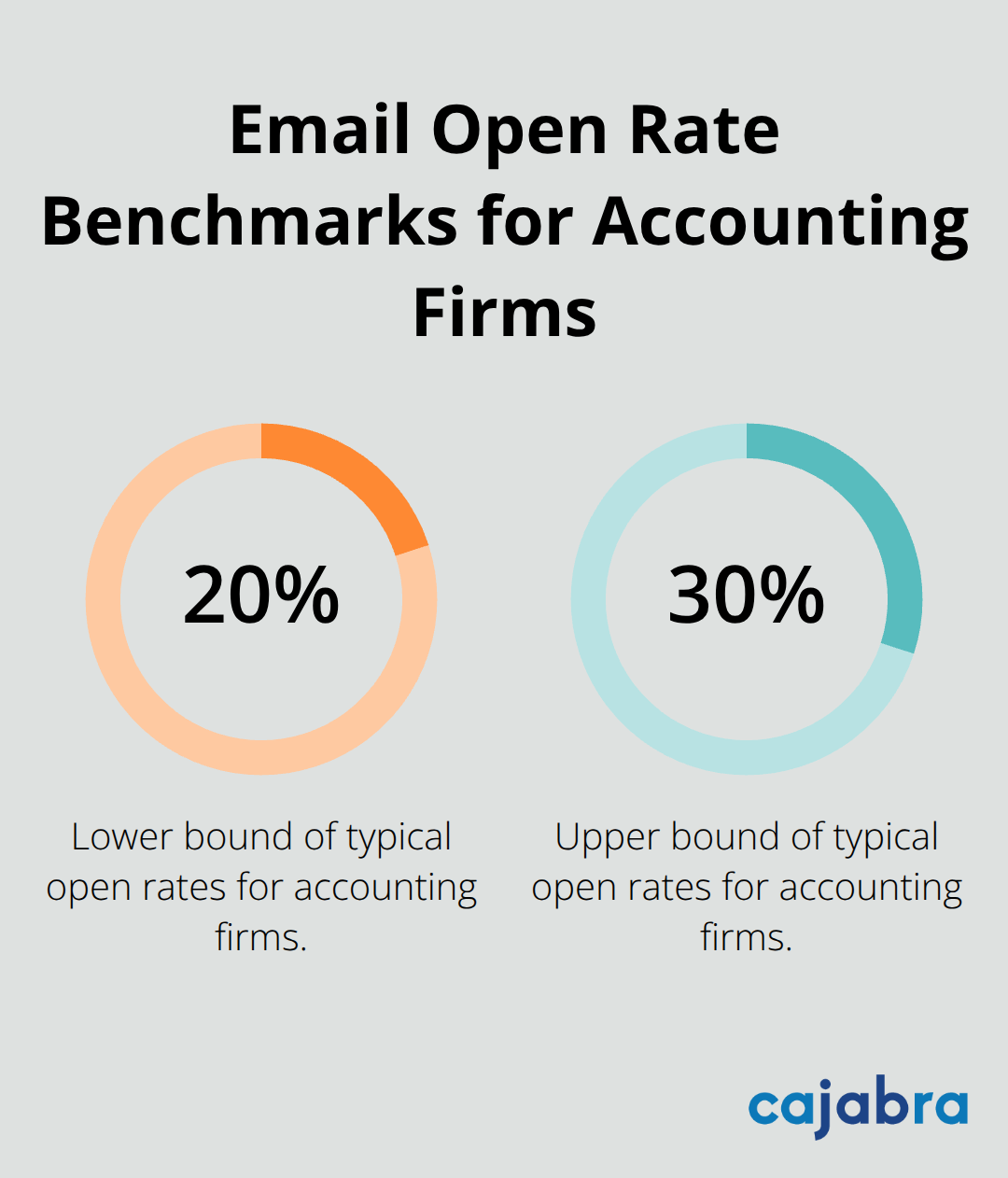

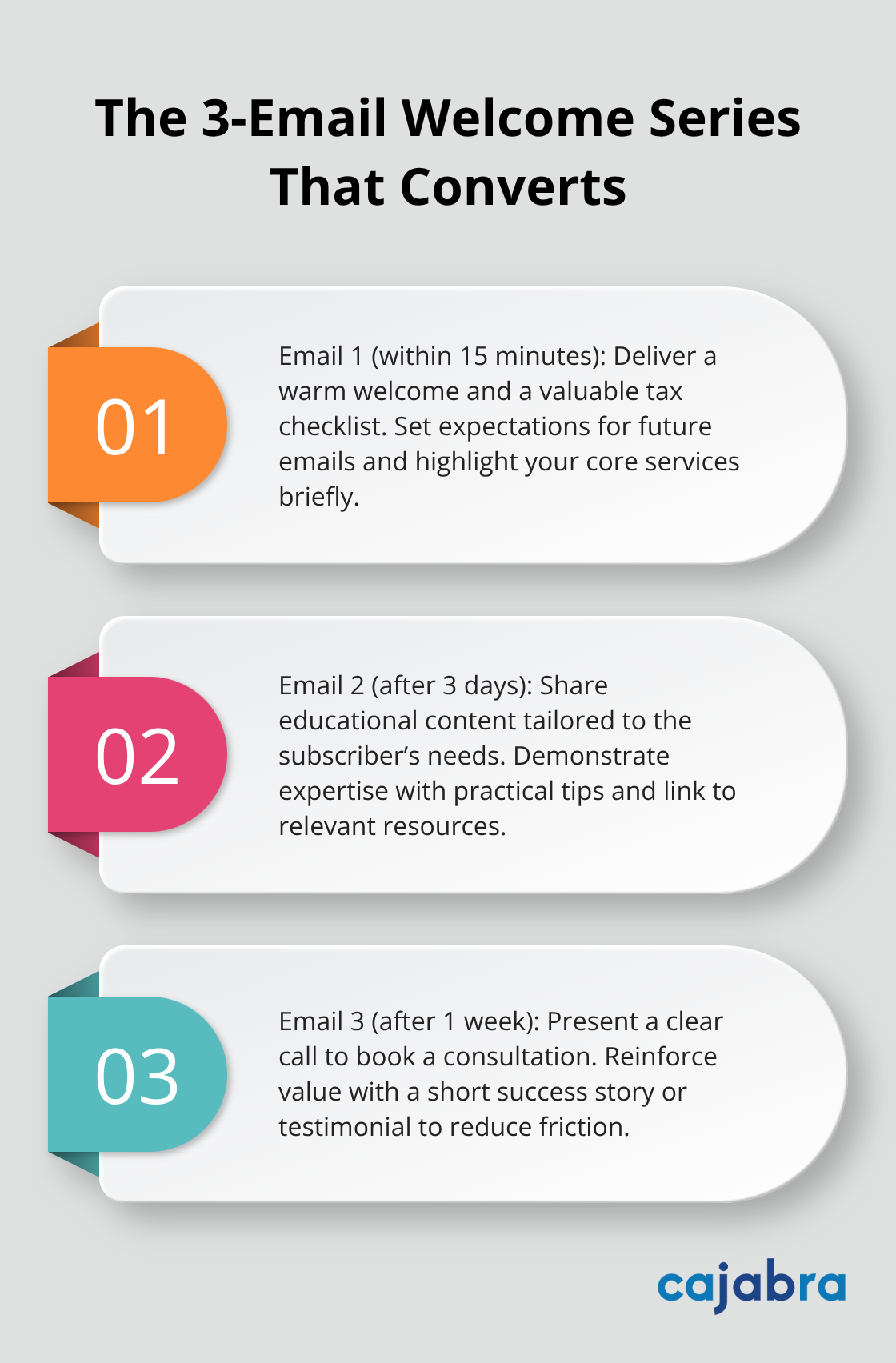

Most accounting firms treat lead generation like a part-time job for a partner who already works sixty hours a week. The result is inconsistent pipeline, months of feast followed by months of famine, and constant stress about where the next client comes from. Firms that escape this trap implement email nurture sequences that work automatically. Capture every prospect who visits your website, downloads a resource, or requests a consultation, then send them a sequence of three to five emails over two weeks that positions your firm as the expert. One accounting firm sends a welcome email with their year-end tax planning guide, a second email three days later highlighting a specific tax strategy relevant to their niche, and a third email after one week offering a fifteen-minute consultation. This sequence converts cold prospects into qualified leads without a single phone call. Track your email open rates (industry average sits around 20% to 30% for accounting firms) and adjust subject lines and send times based on what your audience actually opens.

Retargeting Ads Keep Your Firm Visible to Warm Prospects

Implement a retargeting system that keeps your firm visible to prospects who visited your website but did not convert. Google and Facebook retargeting ads cost significantly less than acquiring new traffic and remind prospects about your services when they research accounting solutions elsewhere online. A prospect who visited your website three weeks ago might see your ad about tax planning for real estate investors and finally book that consultation. Set a monthly retargeting budget of two hundred to five hundred dollars and monitor which ads produce the lowest cost per lead. This approach works because prospects often need multiple exposures to a message before they take action.

Client Retention Expands Revenue From Existing Relationships

Develop a client retention and upsell strategy that treats your current clients as your highest-priority growth channel. The Hinge 2025 High Growth Study found that high-growth accounting firms focus heavily on expanding relationships with existing clients rather than only chasing new business. Schedule quarterly business reviews with clients to discuss their evolving needs, introduce new services they might benefit from, and ask for referrals to similar businesses. One firm increased revenue per client by 35% over eighteen months simply by documenting what each client needed and proactively presenting relevant services. Create a simple tracking system showing which clients are candidates for bookkeeping upgrades, payroll services, or advisory work. This approach produces revenue from people who already trust you, which costs far less than acquiring brand-new clients.

Four Metrics Reveal Which Marketing Activities Actually Work

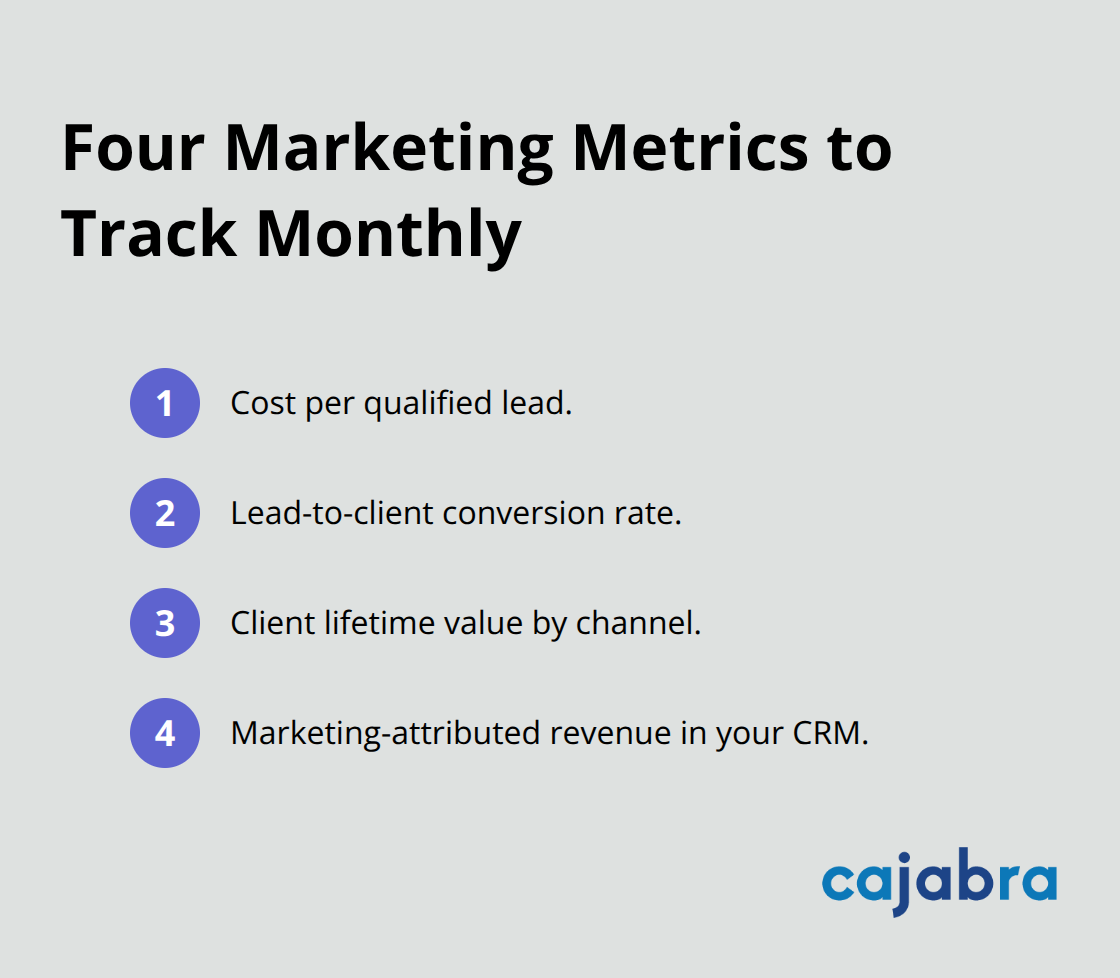

Measuring what actually works separates firms that grow from those that spin their wheels. Most accounting firms have no idea which marketing activities produce clients and which waste time. Start tracking four specific metrics immediately. First, measure your cost per qualified lead by dividing total marketing spend by the number of leads generated. Second, track your lead-to-client conversion rate by monitoring how many leads become paying clients and how long the sales cycle takes. A firm converting 20% of leads into clients performs well; if you fall below 10%, your sales process or lead quality needs work. Third, calculate the lifetime value of clients acquired through each channel so you know which marketing investments actually produce profitable relationships.

A client acquired through Google Ads might cost four hundred dollars but stay for five years and generate fifteen thousand dollars in revenue, while a referral might cost nothing but disappear after one year. Fourth, monitor your marketing-attributed revenue by using your CRM to track which clients came from which source. This requires discipline but reveals exactly which systems deserve more budget. Use a simple spreadsheet or CRM tool like HubSpot or Pipedrive to track these numbers monthly. Most accounting firms spend money on marketing without ever knowing whether it worked, which is precisely why so many firms feel like marketing is a waste. When you measure and adjust based on real data, your marketing becomes predictable and scalable.

Final Thoughts

The accounting firms winning right now built systems that produce consistent, qualified leads instead of treating marketing as an afterthought. Marketing for accounting firms works when you focus on three core elements: a website that converts visitors into leads, content that demonstrates expertise in your niche, and measurement systems that reveal which activities actually produce retainer clients. The gap between struggling firms and thriving ones isn't talent or credentials-it's execution and the willingness to track what actually works.

You now understand why traditional tactics fail, which digital systems generate real results, and exactly how to measure whether your marketing produces clients worth your time. Start with one system this month rather than attempting everything at once. If you optimize your website and Google Business Profile completely before adding email sequences, or commit to publishing one piece of targeted content weekly for three months, consistency beats perfection every single time.

At Cajabra, LLC, we work with accounting firms to handle marketing so you can focus on serving clients and building expertise. Explore how Cajabra transforms your firm's growth and move from overlooked to overbooked through tailored lead-generating websites and effective sales funnels. The firms that thrive implement these systems today and measure results tomorrow.

Most accounting firms rely on outdated marketing tactics that simply don't work anymore. Your competitors are capturing high-value clients with modern accounting marketing strategies while you're stuck with inconsistent leads and limited visibility.

At Cajabra, LLC, we've seen firsthand how the right approach transforms accounting practices. This guide shows you exactly which strategies separate thriving firms from those struggling to grow.

Why Traditional Marketing Fails Accounting Firms

Most accounting firms remain invisible online. According to data from firms analyzed in the 2025 AAM High Growth Study, accounting practices that don't invest in modern marketing strategies watch their client acquisition costs rise while their pipeline stays thin. Firms that rely solely on referrals and networking miss the 54% of search traffic that flows to the top three Google results. When a prospect searches for tax strategies, accounting services, or financial guidance, your firm doesn't appear. This visibility gap means high-value retainer clients-the ones that generate consistent revenue-find your competitors instead. The problem isn't that these clients don't exist; it's that your marketing channels don't reach them.

A 75% credibility gap exists between firms with professional, modern websites and those clinging to outdated designs. Prospects judge your firm's legitimacy in seconds based on your online presence, and if your website looks like it was built in 2015, they move to the next option.

The Referral Dependency Problem

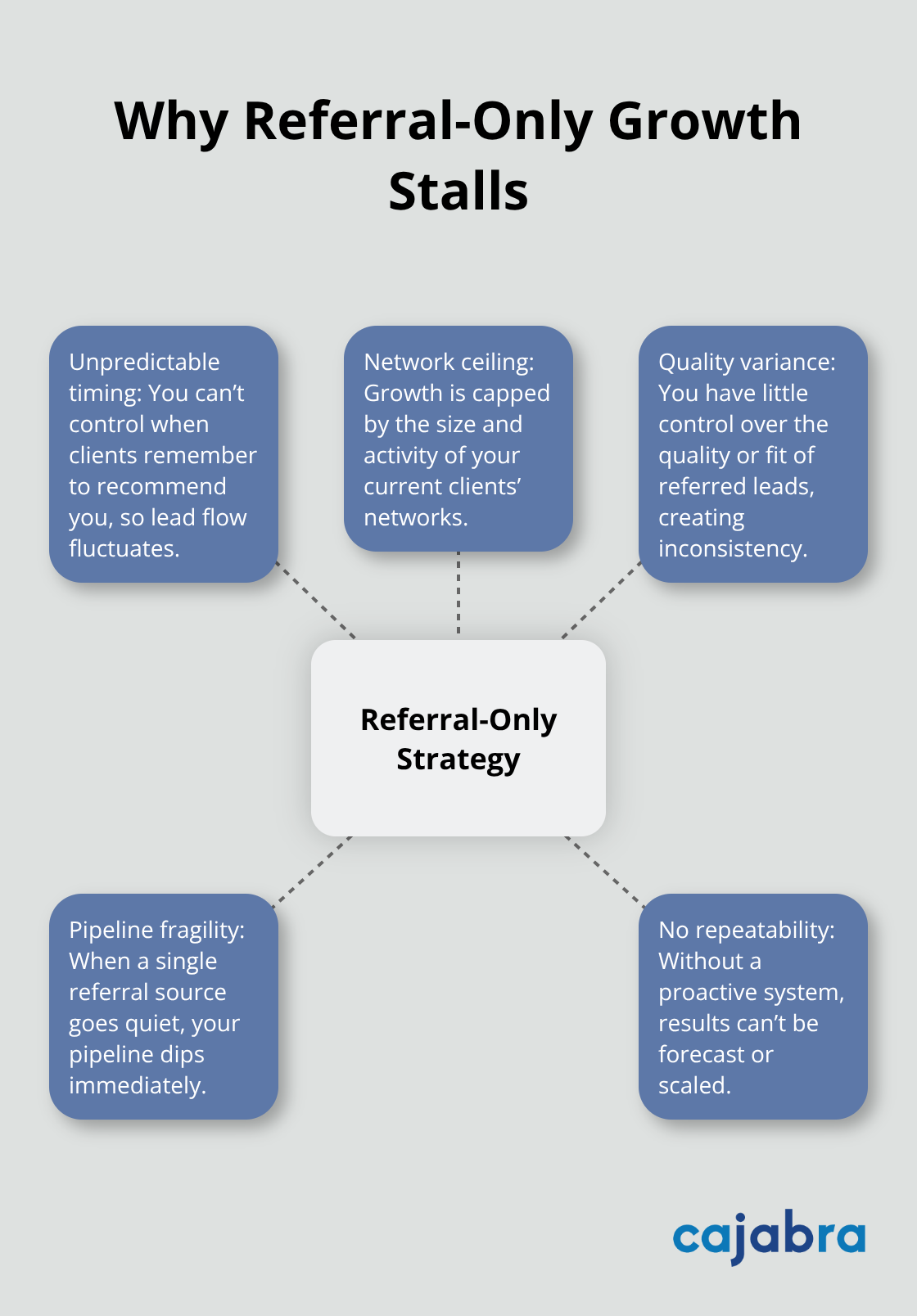

Traditional marketing creates feast-or-famine cycles. Accounting firms that depend on referrals face unpredictable income swings because they lack a systematic way to produce leads consistently. One month you're busy; the next month your pipeline empties. This unpredictability makes it impossible to plan hiring, invest in staff development, or forecast revenue growth. Worse, referral-based practices attract clients similar to your existing ones-often smaller accounts that pay less. Retainer clients who produce recurring revenue require intentional marketing systems that attract them, not hope they'll be referred to you.

How High-Growth Firms Compete Differently

Automated lead-generation systems, SEO-optimized content, and strategic positioning create predictable client flow. Without these systems, you compete on price and relationship history instead of expertise and value. The firms that grow fastest-those in the high-growth category with 38.5% average revenue growth according to the 2025 AAM study-allocate 2.1% of revenue to marketing and build scalable acquisition channels. They don't wait for referrals; they attract clients actively searching for specialized expertise in their niche. These firms understand that modern prospects expect to find you online before they ever consider working with you.

This gap between traditional and modern approaches explains why so many accounting firms plateau. The firms that break through this ceiling recognize that marketing isn't optional-it's the engine that powers sustainable growth. Understanding what separates these high-growth firms from the rest requires examining the specific strategies they implement.

Attracting High-Value Clients Through Strategic Positioning

The accounting firms winning market share right now aren't the oldest or the cheapest-they're the ones prospects find first when searching for specialized expertise. Your positioning determines whether you attract price-sensitive commodity clients or high-value retainer accounts willing to pay for strategic guidance. This starts with a clear, defensible market position that separates you from generic tax preparation shops. Instead of positioning yourself as a general accountant serving everyone, identify a specific industry vertical where you genuinely excel-healthcare practices, real estate investors, e-commerce founders, or professional service firms. This specificity matters because prospects in these niches search for accountants who understand their unique tax challenges and business models. A dental practice owner searching for tax write-offs specific to their industry will convert faster and pay higher retainer fees than someone vaguely looking for accounting help. Your website, content, and messaging must reinforce this positioning consistently across every touchpoint. This means your homepage should immediately communicate who you serve and what problems you solve for them, not generic statements about being a trusted accounting partner. High-growth firms allocate 29.6% of their marketing budget to conferences and events according to the 2025 AAM study, because in-person relationship building in your target market accelerates trust and attracts qualified leads who already operate in your chosen niche.

Your Website Converts Prospects Into Leads

Most accounting firm websites fail because they focus on credentials instead of client outcomes. Prospects don't care about your certifications or how long you've been in business-they care whether you can solve their specific problems. Your homepage needs a clear call-to-action above the fold, typically a button to schedule a consultation or download a valuable resource like a tax strategy guide specific to your target industry. Website design directly impacts credibility, as design quality, mobile responsiveness, and loading speed influence how prospects perceive your firm. If your site takes more than three seconds to load or requires horizontal scrolling on mobile devices, prospects leave and contact a competitor instead. Beyond aesthetics, your website must function as a lead-generation machine with strategic funnels that capture email addresses. Lead magnets like industry-specific tax guides, retirement planning checklists, or accounting process templates convert around 10% of website visitors into leads when the offer aligns with visitor intent. These captured emails feed into automated nurture sequences that keep prospects engaged until they're ready to hire. SEO-optimized landing pages for specific services-such as S-corp tax strategies for freelancers or accounting for medical practices-rank on Google and attract organic traffic continuously without ongoing ad spend. This systematic approach to website design and optimization separates firms that produce consistent leads from those dependent on referrals and networking alone.

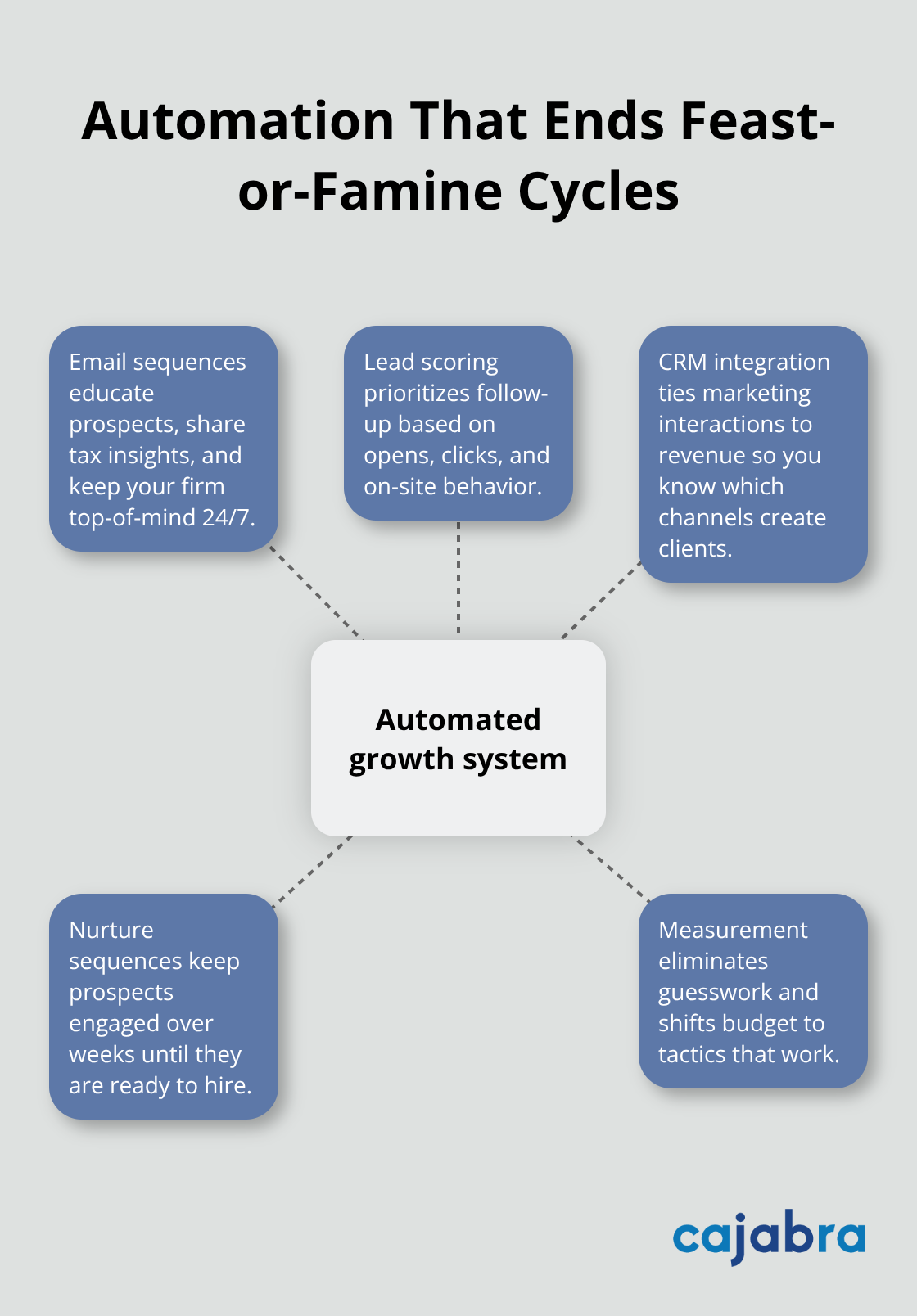

Automation Eliminates Feast-or-Famine Revenue Cycles

Accounting firms that scale fastest implement marketing automation that requires minimal daily attention once configured. Email sequences educate prospects about your services, share valuable tax insights, and remind them of your availability-all working 24/7 without manual effort. A prospect who downloads your tax guide automatically receives a welcome email, then receives helpful content over the following weeks, keeping your firm top-of-mind when they're ready to hire. This automation directly addresses the feast-or-famine problem because prospects flow through your nurture sequences consistently regardless of referral volume. Lead scoring systems identify which prospects show genuine interest through email opens, link clicks, and website behavior, so your team focuses follow-up energy on warm leads instead of cold outreach. CRM integration ties marketing activities directly to revenue, showing exactly which channels, content pieces, and campaigns produce paying clients. This measurement eliminates guesswork about marketing effectiveness and directs budget toward tactics that work. Firms using these systems report more predictable pipelines and higher close rates because prospects are educated and warm before your team ever contacts them.

These systems form the foundation for sustainable growth, but they only work when paired with the right content strategy that attracts your ideal clients in the first place.

How to Scale Without Abandoning Your Core Business

The firms that grow fastest concentrate on maximizing existing client relationships while systematically attracting new ones through channels that don't require constant manual effort. This dual approach separates sustainable growth from chaotic scaling that burns out your team.

Expand Revenue From Your Current Client Base

Your existing clients represent your fastest path to higher revenue. High-growth accounting firms understand that expanding relationships with current clients costs far less than acquiring entirely new ones. A client paying $3,000 annually for tax preparation can become a $15,000 retainer client through strategic advisory positioning. This expansion happens when you identify unmet needs within your existing base-retirement planning gaps, entity structure optimization, quarterly tax planning they're not currently receiving.

Implement a quarterly business review process where you sit down with top clients and discuss their upcoming goals, tax implications, and potential strategies. Document these conversations in your CRM so your team sees expansion opportunities. Firms using this approach report higher revenue per existing client.

Email marketing to current clients costs nearly nothing but drives consistent cross-sell revenue. Send monthly tax tips relevant to their industry, quarterly tax planning summaries, or annual strategy guides. This keeps your firm visible and reminds clients of services they're not yet using.

Implement AI-Powered Systems to Handle Repetitive Tasks

AI-powered systems with features like chatbots, predictive analytics, and AI-integrated CRMs answer common questions about service pricing, intake requirements, and tax deadlines-qualifying leads automatically while your team focuses on high-value conversations. Email sequences powered by AI personalization adjust messaging based on prospect behavior, dramatically improving open rates and conversions compared to generic broadcasts.

Content generation tools accelerate your blogging output; you spend 20 minutes reviewing and refining AI-drafted posts instead of 2 hours writing from scratch. This efficiency multiplier means you can publish more content without expanding your marketing team. These systems (when configured properly) run continuously without daily oversight, freeing your staff to focus on client service and strategic work.

Measure Which Channels Produce Retainer Clients

Track which marketing channels produce retainer clients specifically-not just leads or website visits. A channel driving 50 leads means nothing if none convert to retainers. Use your CRM to tag leads by source, then measure which sources generate the highest-value clients.

High-growth firms allocate marketing budgets across diverse channels, but they ruthlessly cut underperformers. If LinkedIn generates tire-kickers while your industry-specific blog attracts retainer-quality prospects, shift budget toward the blog. This data-driven approach (supported by your CRM and analytics tools) ensures every marketing dollar produces measurable returns.

Build Systems That Scale Without Your Direct Effort

Sustainable growth requires systems that run on their own, not heroic effort from your team. When you construct lead-generation channels that produce consistent prospects, automated nurture sequences that educate them, and processes that maximize existing client value, your firm scales without the chaos that typically accompanies growth. These interconnected systems create a self-reinforcing cycle where new clients flow in predictably while existing clients expand their service usage and referral activity.

Final Thoughts

The accounting firms winning today abandoned outdated marketing approaches and built systems that attract high-value retainer clients consistently. The gap between firms that plateau and those that scale comes down to intentional, data-driven accounting marketing that reaches prospects actively searching for specialized expertise. Your firm has three choices: continue relying on referrals and accept an unpredictable pipeline, compete on price and watch margins shrink, or implement the strategies outlined in this guide and position yourself as the obvious choice for clients in your target market.

The firms growing fastest allocate meaningful budget to marketing, optimize their websites for conversions, create content that ranks on Google, and automate their lead nurture sequences. They measure results by revenue impact, not vanity metrics. They expand existing client relationships while systematically attracting new ones. This combination produces sustainable growth without burning out your team.

Start with one channel that addresses your biggest gap. If your website needs modernization, fix that first. If your content strategy doesn't exist, publish industry-specific blog posts. If your lead nurture sequences are missing, build them. Small improvements compound into significant visibility and revenue gains over time. At Cajabra, LLC, we help accounting firms move from overlooked to overbooked through systems that secure retainer-based clients in 90 days.

Most accounting firms are stuck with marketing strategies that stopped working years ago. Traditional approaches drain your budget while your pipeline stays thin, and you're left juggling client work with the impossible task of finding new business.

At Cajabra, LLC, we've seen this pattern repeat across hundreds of firms. CPA marketing doesn't have to be this painful-the firms winning right now use a completely different playbook.

Why Your Current Marketing Approach Is Costing You Clients

Referral-based marketing worked when clients had limited choices and limited access to information. Today, 54% of all clicks on Google go to the top three organic results, which means if you're not ranking for the services your ideal clients actively search for, they find your competitors instead. Most accounting firms still operate as though word-of-mouth and occasional networking events will fill their pipeline, but this approach leaves massive gaps.

You compete against firms that show up in local search results, maintain active social media presence, and publish content that answers the exact questions your prospects ask. The firms winning in 2025 stopped waiting for referrals to arrive and started building systems that attract clients on demand.

The Real Problem With DIY Marketing Efforts

Accountants train to solve complex tax problems and manage client finances, not to run paid search campaigns or optimize landing pages for conversion. When firms handle marketing internally, they pull billable hours away from client work to post on LinkedIn or update their website. This creates a false choice between growth and revenue. A partner at a mid-sized firm spends five hours per week on marketing tasks that generate zero qualified leads, while their highest-value clients receive less attention. The math doesn't work.

Additionally, DIY marketing lacks consistency. You post for two weeks, then tax season arrives and you disappear for three months. Your website hasn't been updated in two years. Your Google Business Profile contains outdated hours and no recent photos. Prospects judge your credibility heavily on website design and responsiveness. When your digital presence reflects neglect, it signals that your firm might not handle their finances with the same care.

Why Generic Agencies Miss the Mark

Accountants need specialized marketing support that understands their business model, their service complexity, and their ideal client profile. Generic marketing agencies waste your budget on tactics that don't convert prospects into retainer clients. They apply one-size-fits-all strategies that work for e-commerce or SaaS but fail for professional services. Your firm operates on retainer relationships and long sales cycles, not impulse purchases. Standard agencies don't grasp this difference, so they measure success by vanity metrics (social media followers, website traffic) rather than actual client acquisition and revenue growth.

The accounting firms that win in 2025 partner with specialists who understand their market and can build systems that work within their constraints.

What Actually Works in CPA Marketing Right Now

Your Website Converts or It Fails

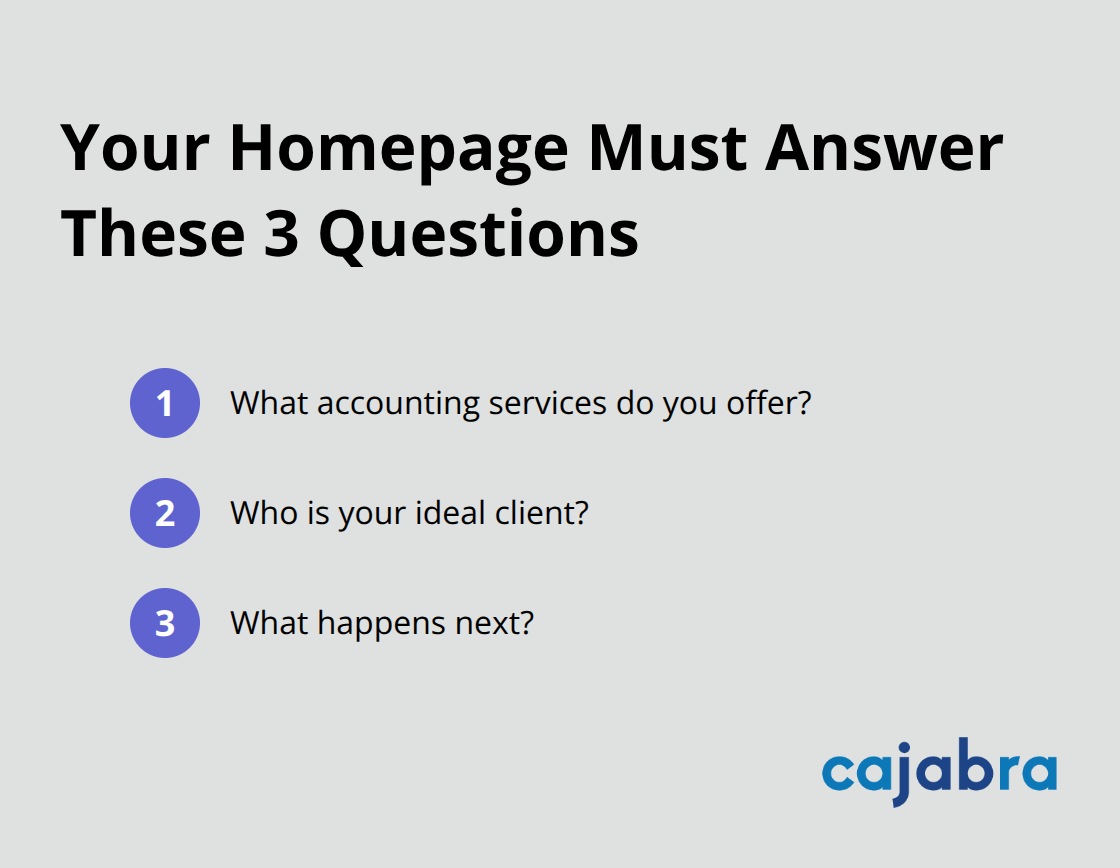

Your website is either your best client acquisition tool or your biggest liability. Firms that convert prospects into retainer clients build websites around one principle: make it obvious what you do and who you serve. Your homepage must answer three questions in the first ten seconds. What accounting services do you offer? Who is your ideal client? What happens next?

A vague homepage that lists fifteen services appeals to no one. Specificity attracts.

If you target real estate investors, your site should feature case studies showing how you reduced their tax burden, not generic language about tax preparation. As of Q1 2025, 62.73% of all web traffic was accessed through mobile phones. That's not opinion-it's how buying decisions start. Your site needs fast load times, clear navigation, and a visible call to action on every page. Most accounting firm websites fail here. They're cluttered with jargon, outdated photos, and buried contact information.

Local SEO Puts You Where Prospects Search

The firms winning in 2025 have websites that funnel prospects toward a specific action: scheduling a consultation, downloading a resource guide, or requesting a proposal. Pair this with local SEO optimization so when prospects search for an accountant in your area, your firm appears in the top three results where 56% of business owners manage their local presence. Update your Google Business Profile with current hours, recent photos, and client reviews. This single step costs nothing and dramatically improves your visibility.

Automation Scales Your Pipeline Without Scaling Your Team

Automation separates firms that scale from firms that stay stuck. When you manually manage client intake, follow-ups, and nurture campaigns, you sacrifice consistency and time. The accounting firms with the healthiest pipelines automate repetitive tasks so partners focus on closing business and serving clients.

Set up automated email sequences that deliver value to prospects before they ever talk to you. If someone downloads your tax planning guide, they should receive a sequence of emails with additional insights, regulatory updates, and a clear path to a conversation. Use tools that integrate your website forms, email platform, and calendar so leads move through your funnel without manual intervention. This creates predictable lead flow instead of feast-or-famine cycles.

Retainer-based service models demand consistency, and consistency requires systems. When you nurture fifty prospects simultaneously through automated sequences while your team focuses on high-value conversations, your conversion rate climbs. The math is simple: more touches, more conversions, more retainer clients. Firms that resist automation because they prefer personal relationships make a false choice. Automation handles the repetitive work so you have more time for genuine relationships with qualified prospects.

The next section reveals how to position your firm as the obvious choice in your market-not through flashy branding, but through systems that demonstrate real expertise and deliver measurable results.

How Accounting Firms Actually Build Industry Leadership

Your brand identity doesn't emerge from design work done in a vacuum. It emerges from solving specific problems better than anyone else in your market. The accounting firms that stand out in 2025 don't compete on price or size. They win by becoming the obvious choice for a narrow group of clients. If you serve real estate investors, every part of your marketing should reflect deep expertise in real estate tax strategy, not generic accounting language. Your website content, email sequences, and social media should answer questions only real estate investors ask. This specificity makes you memorable and trustworthy to the exact people who will pay retainer fees.

Your Website Credibility Determines Your Pipeline

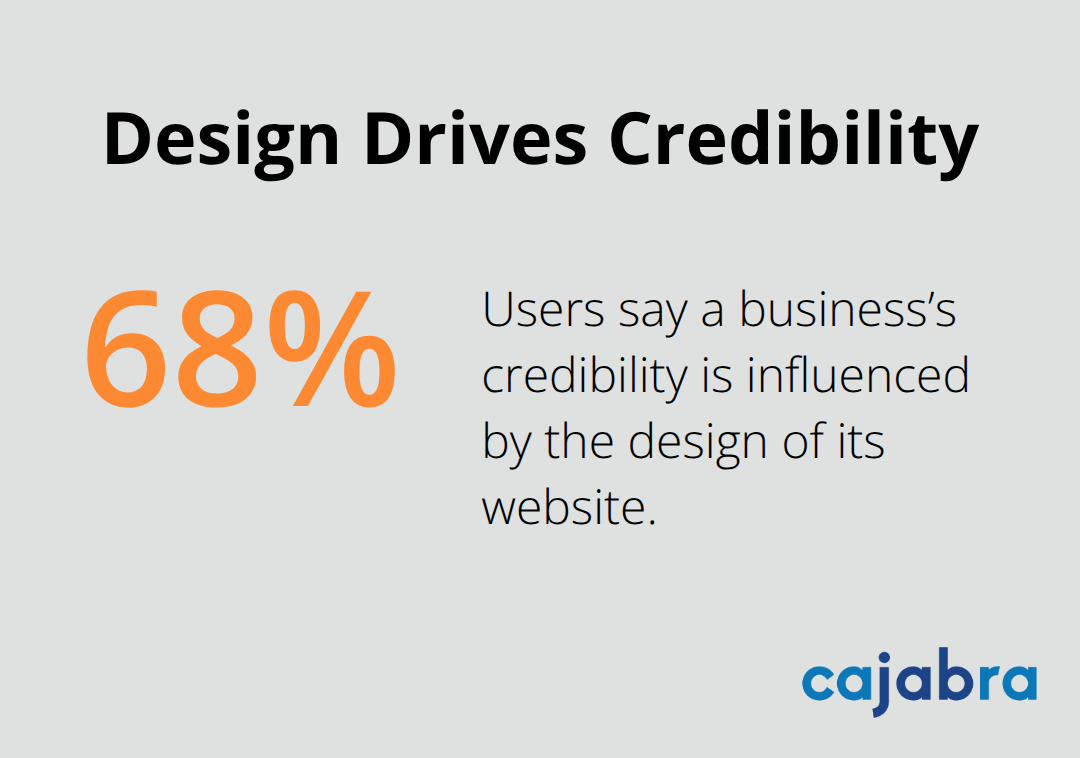

Your online reputation directly influences whether prospects hire you. According to Stanford Web Credibility Research, 68% of users say a business's credibility is influenced by the design of its website. That's before they read a single word about your services.

Your website must load fast on mobile devices, display client testimonials prominently, and make it obvious what your firm does and who you serve best. Include team bios with credentials so prospects connect with actual people, not a faceless corporation. Add an FAQ section that answers the exact objections preventing prospects from booking a consultation. When someone lands on your site after searching for tax strategies for their industry, they should find content that speaks directly to their situation within seconds.

Content That Attracts Your Ideal Clients

Content marketing for accounting firms works differently than it does for other industries. Your goal isn't to go viral on social media or rack up website traffic. Your goal is to attract qualified prospects who become retainer clients. That means you must publish content that addresses real problems your ideal clients face. If you work with SaaS founders, publish articles about equity compensation tax planning, R&D tax credits, and venture capital reporting requirements. Each piece of content should answer a specific question your prospects are already searching for. Tools like Ahrefs or Semrush reveal exactly what terms your ideal clients search for, what questions they ask, and how much monthly search volume exists for those topics.

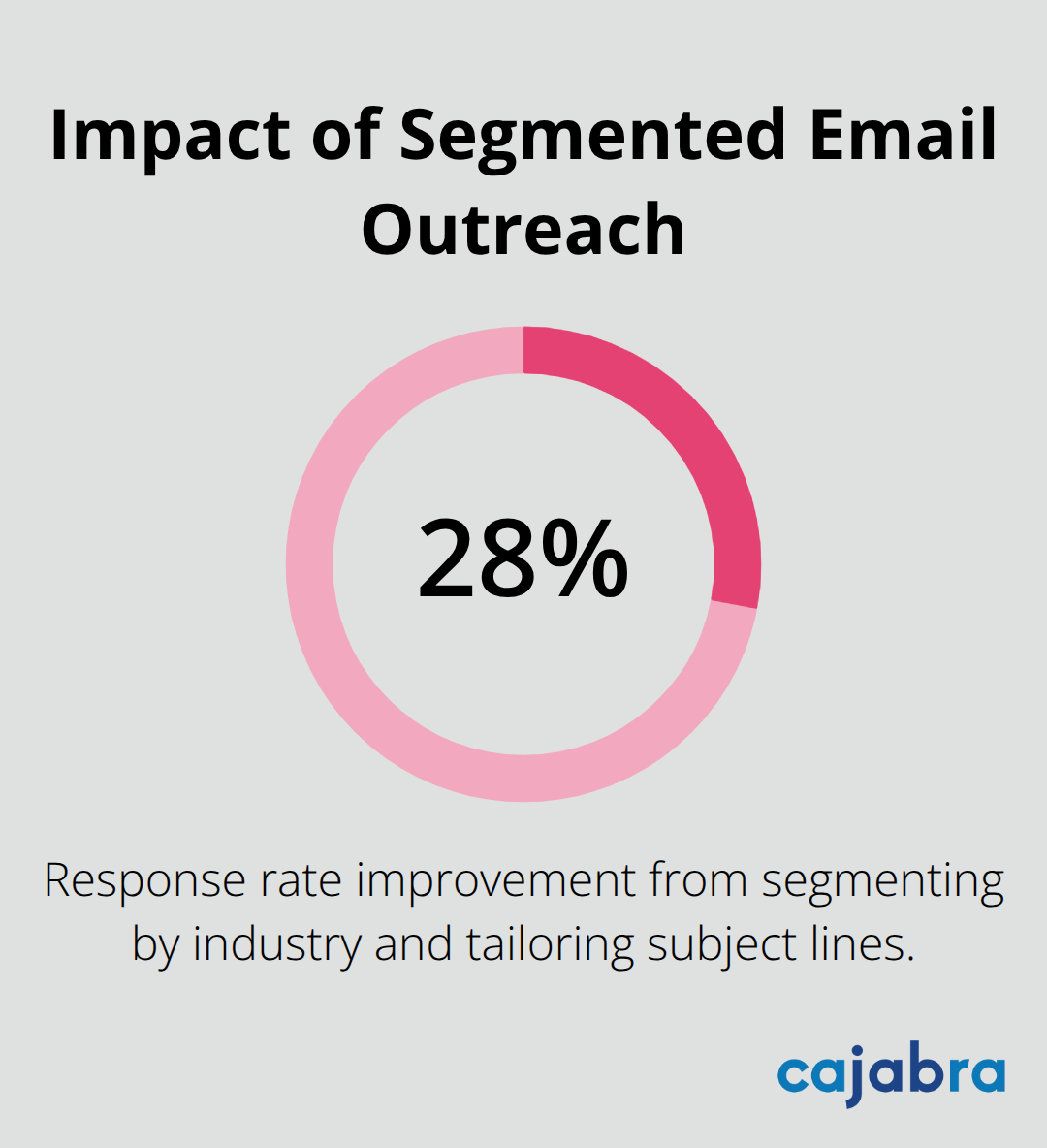

Consistency matters more than frequency. One high-quality article per week that ranks in Google search results generates more qualified leads than daily social media posts to an audience that doesn't convert. Focus on platforms where your ideal clients actually spend time. LinkedIn works exceptionally well for accounting firms because business owners and finance leaders use it professionally. Share insights about tax law changes, regulatory updates, and strategic planning. Email newsletters deliver even stronger results because you reach people who've already shown interest in your firm. Segment your email list so real estate investors receive content about property depreciation while tech founders receive content about equity taxation. This targeted approach converts far better than sending the same generic newsletter to everyone.

Sales Funnels That Move Prospects to Retainer Engagements

Your website needs a clear conversion path. Too many accounting firm websites treat every page like a brochure instead of a lead-generation tool. Each page should guide visitors toward a specific action: you want them to download a tax planning guide, schedule a consultation, or request a proposal. When someone downloads your guide, they enter an automated email sequence that delivers additional value and builds trust. After three to five emails, a prospect either schedules a call or moves to the bottom of your funnel for longer nurturing. This system works because it removes the pressure of manually following up with every prospect. Your automation handles the repetitive touches while you focus on conversations with qualified leads.

The firms that generate consistent retainer revenue use sales funnels to attract clients. If you offer tax planning services, your funnel might start with a free tax strategy assessment. A prospect answers questions about their situation, and your system automatically schedules them with a partner. If you offer bookkeeping and advisory services, your funnel might start with a business health check that reveals gaps in their current accounting process. Each funnel should feel natural to your ideal client, not like a generic sales pitch. The goal is to demonstrate expertise before you ask for money. When prospects experience your knowledge and process firsthand, they're far more likely to sign retainer agreements.

Final Thoughts

The accounting firms that transformed their business in 2024 invested in CPA marketing systems that work while they focus on client service. Your website now converts prospects into retainer clients, your content attracts the exact people who need your expertise, and your automation handles follow-ups so qualified leads move through your funnel consistently. These systems represent the baseline for competing in 2025, not optional upgrades.

The real ROI of professional CPA marketing appears in retainer revenue, predictable pipeline growth, and the ability to turn away clients who don't fit your ideal profile. When you build systems that attract qualified prospects automatically, you stop chasing business and start choosing it. Partners reclaim time previously wasted on marketing tasks, and your team focuses on high-value client work instead of administrative overhead.

The firms winning right now started somewhere-they made one change, updated their website, published their first piece of targeted content, or set up their first automated email sequence. Start with your website and make it clear who you serve and what happens next. Add one piece of content that answers a question your ideal clients actually search for, then set up one automated email sequence that delivers value before you ask for anything. Explore how Cajabra can transform your firm and move from overlooked to overbooked through systems that work while you sleep.

Most accounting firms rely on outdated marketing tactics that don't work anymore. Your competitors are invisible online, and so are you-which means you're all fighting for the same handful of clients.

At Cajabra, LLC, we've seen firsthand how digital marketing for accountants transforms firms from struggling to thriving. The strategies in this post aren't theoretical-they're proven methods that attract qualified leads and convert them into long-term clients.

Why Your Current Marketing Approach Keeps You Invisible

The accounting industry has a marketing problem that most firms refuse to acknowledge. According to Ahrefs research, 96.55% of pages get no organic traffic, and for accounting firms using generic tactics, this number is probably worse. You post on LinkedIn and receive three likes. You run Facebook ads that convert at 0.5%. You write blog posts about topics nobody searches for.

Meanwhile, your competitors do the exact same things, which means you're all equally invisible. The global accounting market will reach $735.94 billion in 2025, yet most firms fight over the same local referral pool instead of capturing the massive online demand that exists right now. Gartner research shows that most buyers prefer to carry out independent research through digital channels before purchasing, which means potential clients are already searching for accounting services-they're just not finding you because your website looks outdated, your content doesn't answer their actual questions, and you have zero brand presence beyond your local network.

The Differentiation Problem Accountants Face

Most accounting firms are indistinguishable from each other. Your website offers tax preparation, bookkeeping, and consulting-exactly like the five other firms in your area. You post generic tax tips on LinkedIn that apply to everyone and nobody. Your brand identity is whatever your cousin designed in Canva five years ago. Potential clients can't tell why they should hire you instead of the firm down the street, so they choose based on price or a friend's recommendation. The firms that win right now have built a clear brand around a specific niche or service. They own keywords like "accounting for tech startups" or "bookkeeping for e-commerce" instead of competing on "accounting near me." This positioning attracts higher-quality leads who already pay premium fees because they know exactly what they're getting. Without a defined brand and a clear message about who you serve and why you're different, you remain invisible in search results and forgettable on social media.

Why Generic Marketing Drains Your Budget

You probably pay for ads, hire freelance writers, or manage social media yourself without seeing real results. Generic tactics don't work because they're designed for nobody, which means they resonate with nobody. A tax tip that applies to small business owners, real estate investors, and W-2 employees simultaneously helps none of them. A Facebook ad targeting accountants within 50 miles of your office reaches people who already have accountants. A blog post about "5 Tax Deductions You Didn't Know About" ranks nowhere because thousands of firms have written the exact same thing. Organic search delivers strong ROI for most businesses, yet most keywords have limited monthly search volume, which means you need a long-tail, targeted approach instead of chasing broad terms. Firms that shift their budget toward targeted strategies-SEO for specific niches, email nurturing of qualified prospects, and conversion-focused websites-see immediate improvements in lead quality and cost per acquisition.

How Niche Positioning Changes Everything

The firms that dominate their markets have stopped trying to serve everyone. They've chosen a specific industry (real estate agents, e-commerce owners, medical practices) and built their entire marketing around that niche. This approach works because it allows you to speak directly to your ideal client's pain points. Your website copy addresses their specific tax challenges. Your blog posts answer the questions they actually search for. Your ads reach people who are actively looking for an accountant who understands their business. When you position yourself as the accounting expert for a particular niche, you attract clients who value specialization and pay higher fees. You also reduce your marketing costs because you're not wasting money reaching people who will never hire you. The firms that remain invisible are the ones still trying to be the best accountant for everyone in a 50-mile radius.

The Three Systems That Drive Qualified Leads

Your website either attracts the right clients or it costs you money. Most accounting firm websites fail because they prioritize looking professional over converting visitors into leads.

According to HubSpot research, 84% of consumers say authentic content from brands builds trust, yet most accounting sites feature generic stock photos, vague service descriptions, and no clear call-to-action telling visitors what to do next.

Build a High-Converting Website for Your Niche

A high-converting website starts with a homepage that speaks directly to your niche. If you serve e-commerce businesses, your headline should state that explicitly. Your navigation should answer the specific questions those owners search for: tax strategies for sellers, quarterly bookkeeping requirements, sales tax compliance across marketplaces. Your homepage needs multiple clear conversion points-a button to schedule a consultation, a lead magnet like a tax checklist or pricing guide, a contact form.

Research from HubSpot shows that lead magnets convert visitors into email subscribers when positioned correctly. A website attracting even 200 visitors monthly can generate qualified leads through a single resource. Beyond the homepage, your site needs a blog section optimized for keywords your ideal clients actually search for.

Most accountants write about topics nobody searches for. Use keyword research tools like Ubersuggest to validate that people search for your topics with meaningful monthly volume and reasonable competition. A guide titled "Pricing Accounting Services for E-Commerce Stores" ranks better and attracts hotter leads than "The Importance of Bookkeeping." Content that solves a specific problem your niche faces ranks faster and converts higher because the visitor already looks for exactly what you offer.

Establish Authority Through Strategic Content

Content marketing works when you stop writing generic tax tips and start answering the exact questions your niche searches for. LinkedIn dominates B2B content marketing, with 96% of B2B content marketers using it as their primary platform, yet most accountants post surface-level advice that generates no engagement. Instead, post long-form content around 500 words directly addressing your niche's pain points.

If you serve medical practices, write about tax deductions specific to healthcare providers, strategies to reduce self-employment taxes on practice income, or how to structure partnerships to minimize liability. This approach positions you as the expert who understands their business, not a generalist accountant. Pair your LinkedIn posts with a marketing strategy that targets the same topics.

Blogging correlates with 434% more indexed pages and roughly 55% more traffic than sites without consistent blog activity, according to HubSpot. Publish one post every two weeks addressing keywords your ideal clients search for. Update older posts quarterly to maintain relevance and SEO strength.

Email marketing delivers exceptional returns-approximately $36 earned per $1 spent according to HubSpot data. Capture emails through your lead magnets and send a weekly or biweekly newsletter featuring your best content, client wins, and timely tax tips. Segment your email list by client type so medical practice owners receive content relevant to their situation, not generic advice.

Target High-Intent Prospects With Paid Ads

Paid ads work for accountants only when you target with precision and maintain a clear sales process to convert leads. Most accounting firms run broad Facebook ads targeting everyone within 50 miles, which wastes money reaching people who already have accountants. Instead, run Google Ads targeting high-intent keywords specific to your niche: tax planning for LLC owners, bookkeeping services for Shopify stores, or quarterly tax strategies for real estate investors.

Google Ads lets you target by search intent, meaning people actively look for your services right now. Set a daily budget of $15–25 to test campaigns before scaling. Track your cost per lead and cost per client acquisition. If you spend $200 to acquire a $3,000 annual client, that's profitable. If you spend $500, your ads need optimization or your niche selection needs adjustment.

Facebook and Instagram ads work differently-they reach people based on interests and demographics rather than search intent. Use these platforms for brand awareness and retargeting, not as your primary lead source. Around 65% of SMBs allocate resources to paid search campaigns, yet most don't measure results properly.

Use Google Analytics and conversion tracking through Google Ads or Facebook Pixel to monitor which campaigns generate actual clients, not just clicks or form submissions. Paid ads should complement your organic strategy, not replace it. The firms winning in 2025 combine SEO, content marketing, and targeted ads to own their niche across multiple channels. Once you attract qualified leads through these three systems, converting them into long-term retainer clients requires a sales funnel designed specifically for how accountants sell.

Converting Visibility Into Retainer Clients

Attracting leads means nothing if your sales process loses them. Most accounting firms generate traffic and leads but never convert them into retainer clients because they lack a clear system to move prospects from awareness to signed engagement letters. Your website visitor reads a blog post, downloads your tax checklist, and joins your email list-then what? Without a clear follow-up sequence and sales process, that prospect vanishes. You need a sales funnel designed specifically for how accountants sell, which differs fundamentally from other service businesses.

Design a Sales Funnel That Qualifies Prospects

Accountants sell based on trust, expertise, and understanding of the prospect's specific situation. Your funnel must demonstrate all three before asking for the sale. Start by mapping your ideal prospect's journey from first touchpoint to signed retainer agreement. A prospect searching for tax strategies for e-commerce sellers finds your blog post, downloads your free guide on sales tax compliance across marketplaces, and receives an automated email sequence introducing your firm and offering a 30-minute strategy call.

This call is where you qualify the prospect, understand their pain points, and determine if they fit your services. Most accounting firms skip this step and immediately pitch their services, which kills deals. Instead, use the discovery call to ask questions about their current accounting situation, their biggest tax challenges, and what they've tried before. Take notes. Show genuine interest in solving their specific problem, not just landing another client. After the call, send a customized proposal addressing the exact issues they mentioned during your conversation.

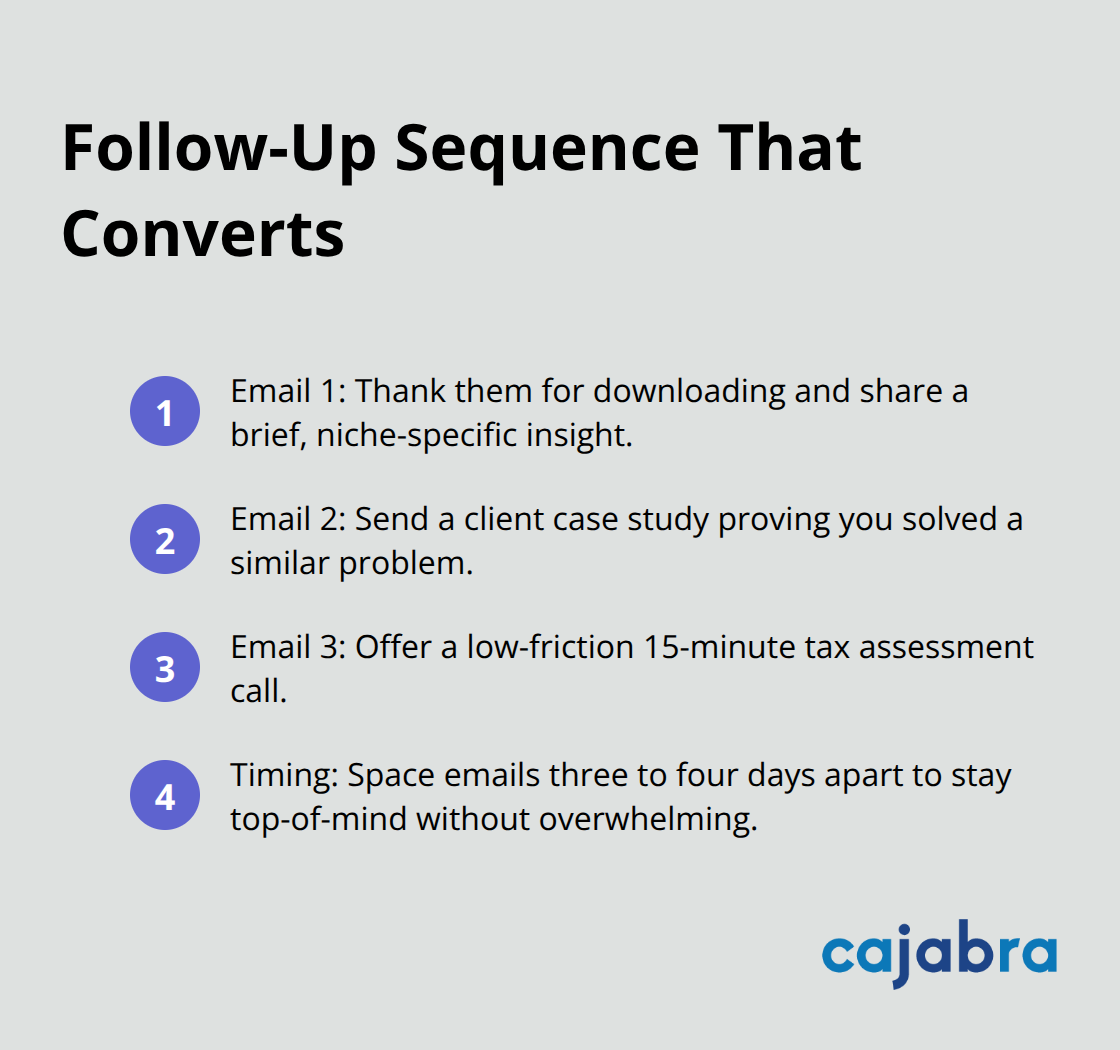

Execute a Follow-Up Sequence That Converts

Email marketing delivers strong returns when executed strategically, yet most accountants treat email as an afterthought rather than a core revenue channel. Your follow-up sequence should include three to five emails over two weeks if the prospect doesn't book a call after downloading your lead magnet. The first email thanks them for downloading and offers a brief insight related to their industry. The second email shares a client case study or success story showing how you solved a similar problem. The third email presents a low-friction offer like a free 15-minute tax assessment call, removing the barrier to engagement.

Space these emails three to four days apart to maintain presence without overwhelming the prospect.

Transition Prospects to Retainer Relationships

Retainer-based pricing flips the dynamic that most accounting firms operate within. You charge a fixed monthly fee for ongoing services, which creates predictable revenue for your firm and positions you as an ongoing advisor rather than a vendor. The prospect who downloads your lead magnet, receives your email sequence, and books a call should hear about retainer pricing during that initial conversation. Present your pricing as monthly retainers ranging from $300 to $1,500 depending on service scope, business complexity, and industry. Transparency about pricing during the sales call eliminates tire-kickers and attracts serious prospects willing to invest in quality advisory services.

Deepen Client Relationships Through Ongoing Reviews

After you close a new retainer client, your relationship doesn't end-it deepens. Schedule quarterly business reviews with each client to discuss their financial performance, upcoming tax planning opportunities, and how your services can evolve as their business grows. These reviews uncover upsell opportunities and strengthen the relationship, making the client less likely to shop around. Firms that implement structured sales funnels with clear follow-up sequences and retainer-based pricing models see dramatically higher close rates and client lifetime value compared to those relying on ad-hoc outreach and project-based pricing.

Final Thoughts

Digital marketing for accountants transforms firms from invisible to booked solid, yet most still rely on referrals and local networking while their ideal clients search online for solutions. The accounting market reaches $735.94 billion in 2025, and the firms winning right now attract qualified leads consistently through strategy, not hope. They build clear brands around specific niches, create websites that convert visitors into leads, and implement sales funnels that turn prospects into retainer clients.

Success requires you to combine SEO-optimized content targeting your niche's actual search behavior, a high-converting website with clear calls-to-action, targeted paid advertising reaching high-intent prospects, and a structured follow-up sequence that moves prospects toward signed agreements. When you execute these systems together, you stop competing on price and start attracting clients who value your expertise. Your marketing becomes predictable, your lead quality improves, and your cost per acquisition drops.

We at Cajabra, LLC built the JAB System to move accountants from overlooked to overbooked by securing retainer-based clients in 90 days. The firms that implement these strategies see immediate results, and we handle the digital marketing strategy, website optimization, and sales funnel design so you can focus on serving your clients.

Most accountants rely on referrals and hope for the best. This approach leaves money on the table and makes growth unpredictable.

Lead generation for accountants works differently when you have a system. At Cajabra, LLC, we've seen firms double their client base by moving away from random tactics and building a strategic approach instead.

Why Your Current Approach to Getting Clients Isn't Working

Referrals feel safe. An existing client calls a friend and mentions your name, and suddenly you have a warm lead. This works until it doesn't. The problem is that referrals are unpredictable and depend entirely on your clients remembering to recommend you at exactly the right moment.

Most accountants sit back and hope referrals arrive, which means their growth flatlines when referrals dry up. A study from the American Institute of CPAs found that firms relying primarily on referrals experience growth rates that vary significantly, with some reporting median increases of 6.7% in total net client fees. The real issue is that referrals alone create a ceiling on your practice size because they're limited by the network effect of your existing clients. You also lack control over the quality or consistency of incoming leads. When one referral source stops sending work, your pipeline suffers immediately.

The Marketing Message That Misses the Mark

Generic accounting marketing fails because business owners don't care about your credentials or how long you've been in business. They care about their specific problems: rising tax bills, cash flow confusion, payroll headaches, or audit anxiety. When you market yourself as just another accountant who handles bookkeeping and tax returns, you sound identical to every other firm. Business owners tune you out because you haven't shown them why you're different or why you matter to their situation. The accounting firms winning new clients are the ones who speak directly to the pain points of their ideal client, whether that's eCommerce businesses struggling with sales tax complexity or nonprofits drowning in compliance requirements. Vague messaging like "we handle all accounting services" doesn't convert prospects into clients. Specific, problem-focused messaging does. This means your website, your social media content, and your outreach need to address the exact challenges your target clients face through a strong brand messaging strategy, not generic industry language.

The Cost of Operating Without a System

Accountants without a lead generation system waste time and money on tactics that don't work together. One month you try LinkedIn, the next month you cold call, the month after that you hope someone finds you through Google. This scattered approach means you never give any single strategy enough time or effort to actually work. Lead generation requires consistency, which only happens when you have a documented process and metrics tracking. Without a system, your lead pipeline looks like a series of random spikes followed by dry periods, making it impossible to forecast growth or plan hiring. You also pay for tools and services that don't integrate with each other, creating friction and wasting resources. The accounting firms that scale fast have replaced this chaos with a clear process: they know exactly where their leads come from, how they move those leads through a sales funnel, and what conversion rates they hit at each stage. They track metrics weekly and adjust based on data, not gut feel. Building a system takes work upfront, but it's the only way to move from hoping for growth to engineering it.

What Separates Firms That Grow From Those That Stagnate

The difference between a stagnant practice and a growing one isn't talent or credentials. It's structure. Firms that scale have replaced hope with a repeatable process. They've identified their ideal client profile, crafted messaging that resonates with that specific audience, and built channels (website, content, outreach) that consistently attract qualified prospects. They measure what works and what doesn't, then double down on what produces results. This systematic approach transforms lead generation from a frustrating guessing game into a predictable engine that feeds your sales pipeline month after month. The firms stuck at the same revenue level year after year are the ones still waiting for referrals or running random marketing experiments without tracking results. The path forward requires you to stop treating lead generation as something you do occasionally and start treating it as a core business function that demands attention, measurement, and refinement through proven strategies for client engagement and satisfaction.

How to Build a Lead Generation Engine That Actually Works

Target Your Audience With Specific Content

Educational content fails when accounting firms publish generic tax tips or year-end checklists that apply to everyone. The firms winning clients publish content that addresses the specific pain points of their target audience. If you serve eCommerce businesses, your content should tackle sales tax nexus issues, quarterly estimated payments, and inventory accounting. If you serve nonprofits, your content should address grant accounting, Form 990 complexity, and restricted fund management. Target Your Audience With Specific Content by publishing 6-8 posts per month if your blog is less than a year old. Consistency and specificity matter far more than volume alone.

Craft a Website That Converts Prospects

Your website needs a clear value proposition in the headline that speaks directly to your ideal client's problem, not your credentials. Instead of "Full-Service Accounting Firm," try "Tax Strategy for eCommerce Sellers" or "Nonprofit Accounting and Grant Compliance." This specificity signals immediately that you understand their world. Your website should also feature case studies with concrete numbers-how much you saved a client in taxes or how many hours you freed up in their month. Generic testimonials like "Great service" don't convert; specific outcomes do.

Google My Business profiles for local accounting firms matter more than most accountants realize. Firms with optimized profiles that accumulate multiple five-star reviews appear higher in local search results. You should respond to every review, positive or negative, because engagement builds trust with potential clients.

Build a Sales Funnel That Moves Prospects Forward

Your sales funnel separates firms that convert prospects into clients from those that lose them to competitors. The funnel starts with attracting qualified traffic through content and positioning, then captures their contact information through a lead magnet. A lead magnet for accountants might be a tax planning calendar, industry-specific checklist, or ROI calculator gated behind an email signup form. The form should ask for only essential information-name, email, and company type-because longer forms kill conversion rates.

Once you capture their contact, you move them into an automated email sequence that provides value before asking for anything. This sequence should include case studies, insights about their industry, and answers to common objections. The conversion happens when you identify high-intent leads and reach out with a personalized message referencing something specific about their business. Cold email and LinkedIn outreach both work, but the message must address their actual situation, not your services.

Track Metrics at Every Stage

Research shows that consistent multi-channel outreach through LinkedIn, email, and direct calls generates higher-quality discovery calls than relying on referrals alone. You need to track your conversion rates at each stage: how many website visitors become leads, how many leads open your emails, how many respond to outreach, and how many meetings convert to clients. This data reveals where your funnel leaks. Most accounting firms lose prospects in the nurture phase because they disappear after the first email. A systematic follow-up sequence over 4-6 touchpoints with case studies and insights significantly improves conversion.

The firms scaling fastest have replaced hope with measurement. They know exactly which channels produce qualified leads, which messages resonate with their audience, and which follow-up sequences move prospects toward a decision. This data-driven approach transforms lead generation from guesswork into a predictable process that you can refine and improve month after month. With these fundamentals in place, you're ready to implement the tools and systems that turn this strategy into consistent client acquisition.

Build Your System Before You Scale

Start With Positioning, Not Tools

The biggest mistake accounting firms make is buying tools before they know what they're trying to accomplish. You'll see firms subscribe to six different software platforms, hire a marketing person, and launch campaigns that go nowhere because they never defined their positioning or messaging first. Stop that. Start with positioning and messaging, then layer in tools and automation only after you know exactly what message you're sending and to whom.

Your positioning answers one question: what specific problem do you solve for which specific type of business? Not accounting problems in general. Specific problems. If you serve eCommerce sellers, your positioning might be: we eliminate sales tax complexity and recover unclaimed refunds for online retailers doing $1M+ in annual revenue. That's concrete. That's ownable. That's different from every other accounting firm in your market.

Align Your Message Across Every Channel

Once you have positioning, your messaging flows from it. Every piece of content, every cold email, every website headline should reflect this positioning. This is where most accountants fail. They create a website, send cold emails, and post on LinkedIn without a coherent message tying it together. The prospect sees conflicting signals and assumes you're just another generalist.

Spend two weeks on positioning and messaging before you touch a single tool. Interview your best clients and ask what problem you solved that made the biggest difference. Ask why they chose you over competitors. Document the patterns. That becomes your positioning. Then write it down in one sentence. Repeat it obsessively across every channel.

Automate the Repetitive Work

Once positioning is locked, implement tools that automate the repetitive parts of your lead generation process. Most accounting firms waste 10+ hours per week on manual tasks that software can handle. Use a CRM like HubSpot or Pipedrive to centralize all prospect information, track where each lead came from, and automate follow-up sequences.

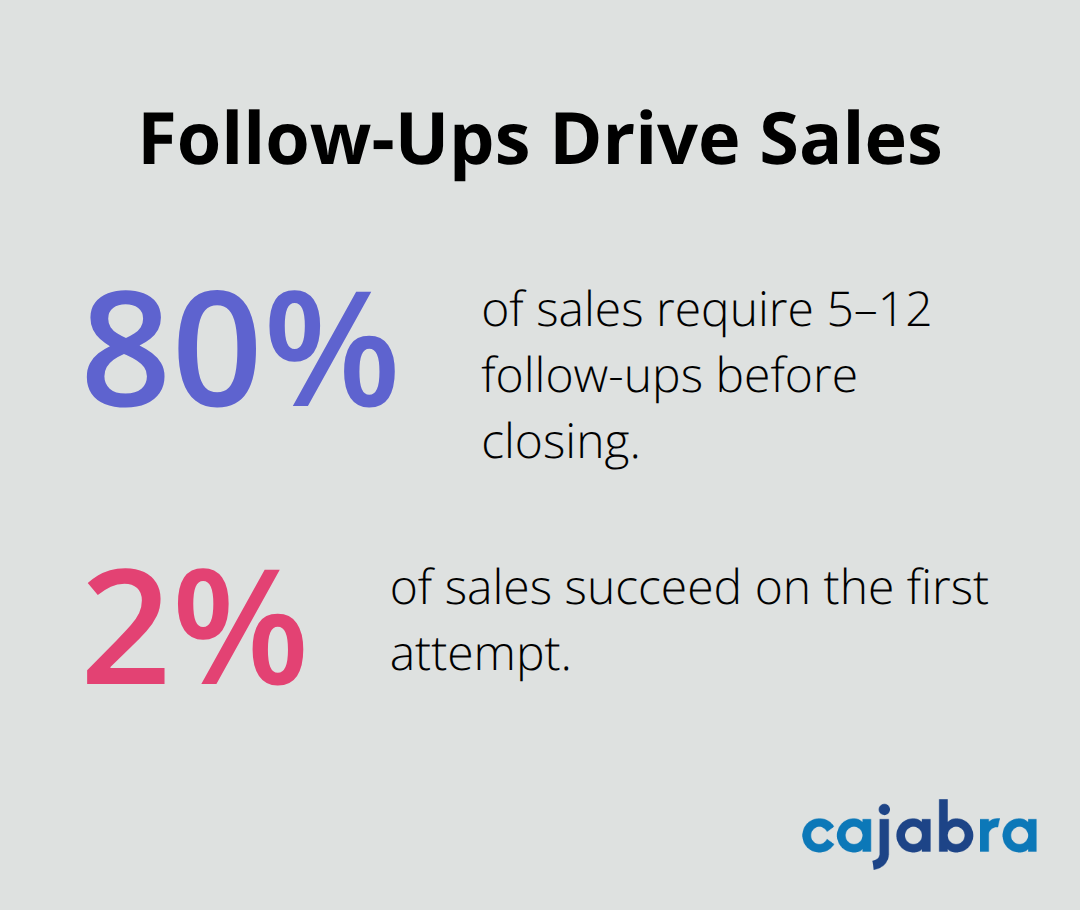

Set up email automation so that when someone downloads your lead magnet, they immediately receive a welcome email, followed by a second email three days later with a case study, and a third email a week after that asking for a call. This consistency matters far more than perfect messaging. Studies reveal that 80% of sales require 5–12 follow-ups, yet only 2% succeed on the first attempt.

Most accounting firms give up after the first email. Automation removes that temptation.

Systematize Your Outreach

Use LinkedIn automation tools like Sales Navigator to identify prospects matching your ideal client profile, then set up a system where you send 20-30 personalized connection requests per week. Once connected, you can send a follow-up message referencing something specific about their business. This requires less time than you think and generates measurable results.

Track exactly how many messages you send, how many responses you get, and what percentage convert to calls. If you're sending 100 messages per month and getting two calls, your conversion rate is 2 percent. That's actionable data. Now test a different message, send another 100, and see if your conversion rate improves. This is how you refine your system. Most firms never track these metrics, so they never know what's actually working.

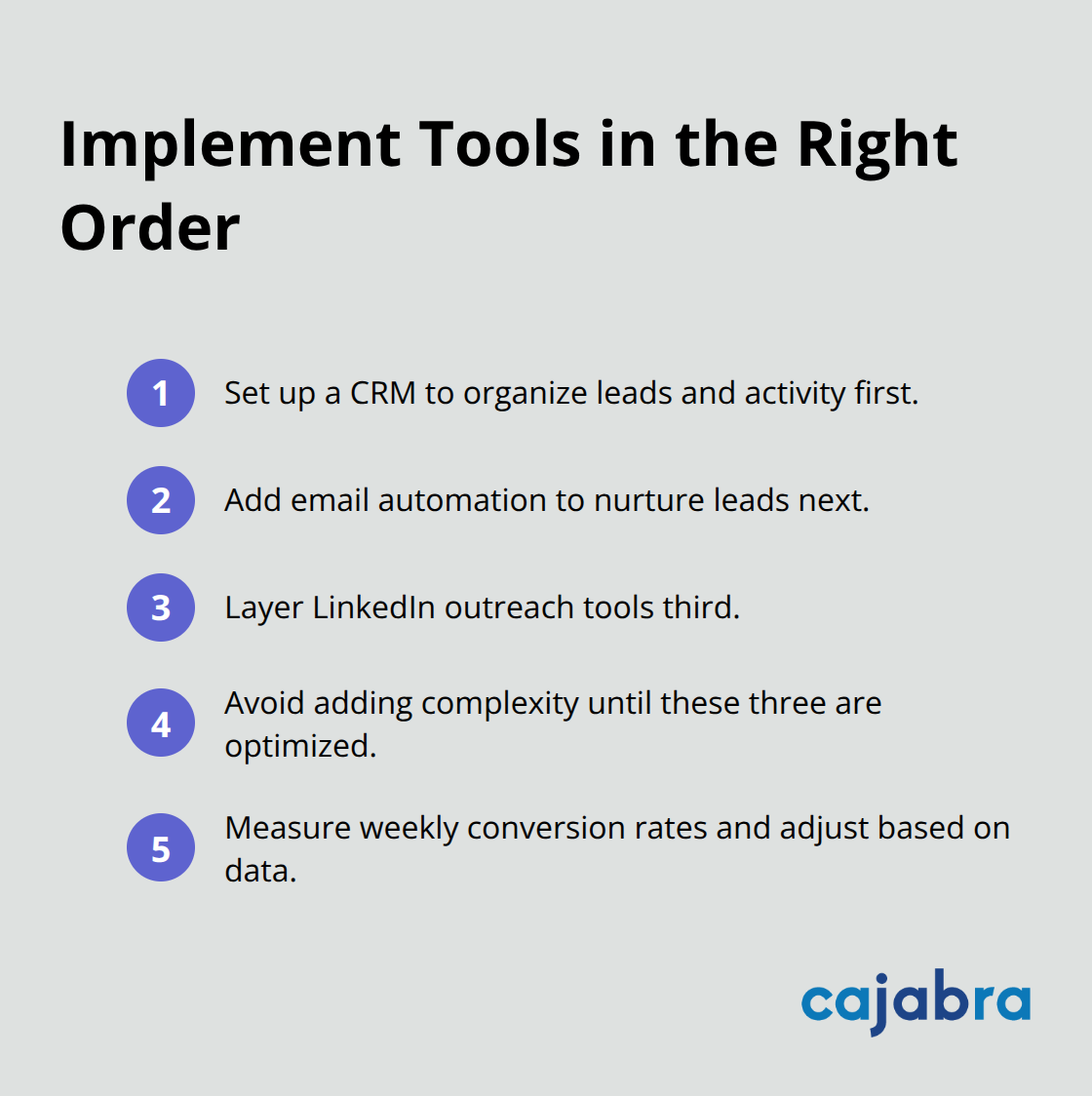

Implement Tools in the Right Order

Implement your tools in this order: first a CRM to organize everything, then email automation to nurture leads, then LinkedIn tools to systematize outreach. Don't add more complexity until you've optimized these three.

Measure your conversion rate at each stage weekly and adjust based on what the data shows, not what feels right. The firms scaling fastest have replaced hope with measurement. They know exactly which channels produce qualified leads, which messages resonate with their audience, and which follow-up sequences move prospects toward a decision. This data-driven approach transforms lead generation from guesswork into a predictable process that you can refine and improve month after month.

Final Thoughts

Lead generation for accountants transforms from painful to predictable the moment you stop treating it as a side project and start treating it as a core business function. The firms winning right now have systems in place, not hope. You now understand that positioning comes first, messaging flows from positioning, and tools only matter after you answer the fundamental question of who you serve and what problem you solve for them. The accounting firms gaining ground move fast-they implement positioning this week, launch email automation next week, and track metrics the week after.

Implementation separates the firms that scale from those that stagnate. Most accountants read content like this, feel motivated, and return to their daily work without changing anything. You can break that pattern by picking one channel, one message, and one metric to track (your response rate, conversion rate, or call volume). This data becomes your roadmap for what to do next, and you refine your approach based on what actually works, not what feels right.