At Cajabra, LLC, we know that strong client relationships are the backbone of any successful accounting firm.

Client engagement activities are key to building and maintaining these relationships. They help you stay connected with your clients, understand their needs, and provide value beyond basic accounting services.

In this post, we'll explore effective strategies to boost client engagement and strengthen your firm's client relationships.

Client engagement refers to the ongoing interaction between an accounting firm and its clients. It involves building strong, lasting relationships that transcend transactional services. Effective client engagement includes regular communication, proactive problem-solving, and delivering value that surpasses expectations.

For accounting firms, client engagement is essential for long-term success. Engaged clients tend to:

A new report by Bain & Company reveals that, for the first time ever, marketing to existing customers is exceeding that to new ones. This finding underscores the significant impact of client engagement on an accounting firm's bottom line.

To improve client engagement, you must measure it. Here are some key metrics to track:

NPS measures the likelihood of clients recommending your firm to others. This simple yet powerful indicator reflects client satisfaction and loyalty. A high NPS often correlates with strong client engagement.

This metric shows the percentage of clients who continue to use your services over time. A high retention rate indicates that clients find ongoing value in your relationship. PwC reports that 73% of people consider customer experience a crucial factor in their purchasing decisions.

Monitor how often you communicate with clients outside of regular service delivery. More frequent, meaningful interactions often signal higher engagement levels. However, quality trumps quantity-ensure each interaction adds value to the client relationship.

As you focus on these metrics, you can gauge the effectiveness of your client engagement efforts and identify areas for improvement. Client engagement requires consistent effort and refinement.

The next section will explore effective activities that can significantly boost your client engagement. These strategies will help you transform your client relationships and position your firm as a trusted partner in your clients' financial success.

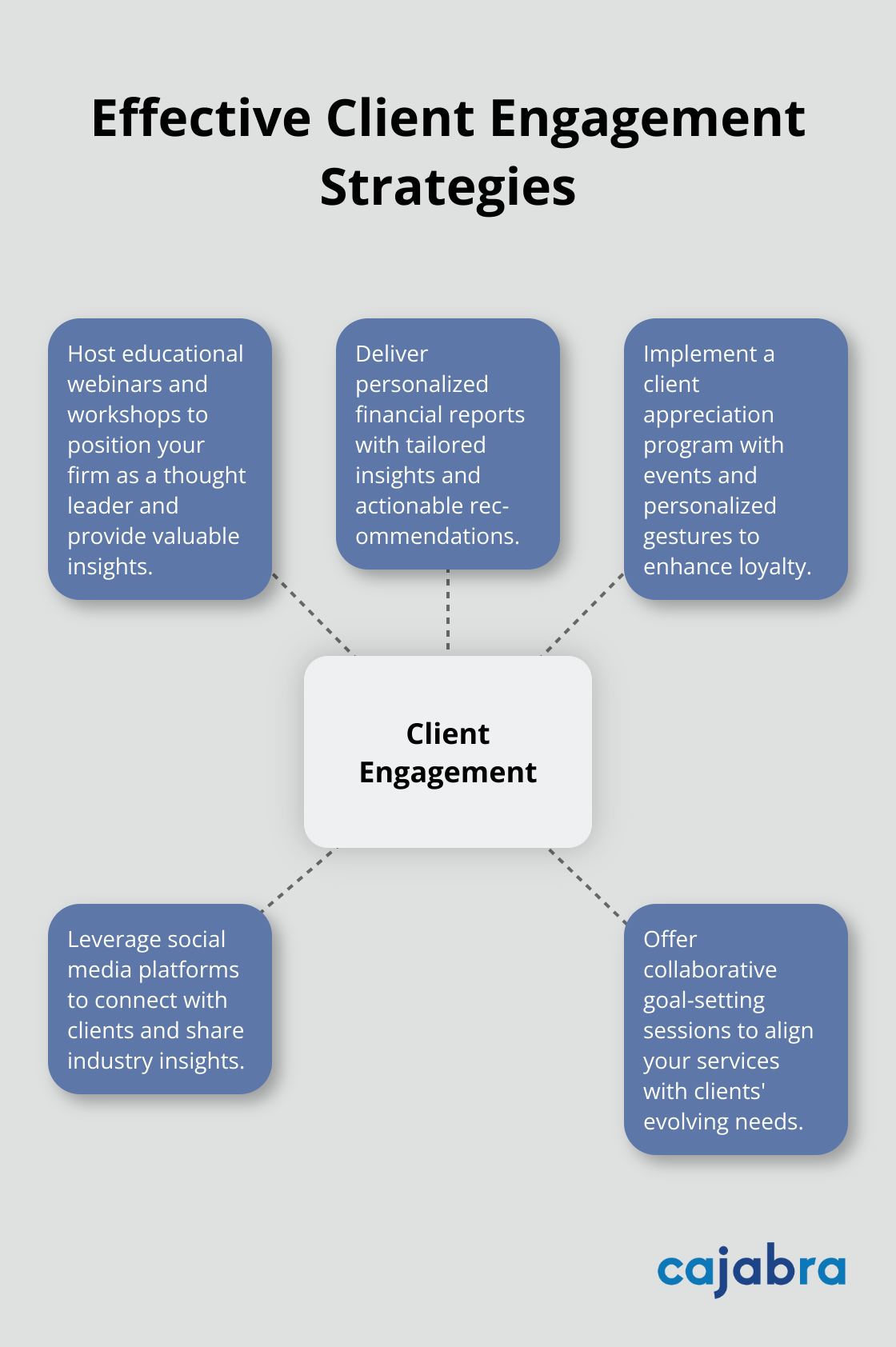

Organizing educational webinars and workshops positions your firm as a thought leader while providing valuable insights to clients. They offer a number of benefits, such as increased visibility and customer engagement, and the ability to stay up to date on relevant news. We recommend monthly webinars on topics like tax law changes, financial planning strategies, or industry-specific accounting challenges. These events educate clients, showcase your expertise, and create opportunities for deeper engagement.

Generic reports no longer suffice in today's data-driven world. Clients expect tailored insights that directly impact their business. Implement a system to provide quarterly personalized financial reports that highlight key performance indicators, industry benchmarks, and actionable recommendations. By tracking client development KPIs, your firm can get a better understanding of how to maximize client intake and ensure excellent client service. Customized insights demonstrate a deep understanding of each client's unique financial situation and goals.

Showing gratitude to your clients can significantly enhance engagement and loyalty. A study by the Wharton School of Business found that customers who feel appreciated are 33% more likely to spend more. Consider an annual client appreciation event, such as a golf tournament or a wine tasting evening. These events provide an excellent opportunity for networking and strengthening relationships in a relaxed setting. Additionally, send personalized thank-you notes or small gifts on client milestones or anniversaries to make a lasting impression.

Social media platforms offer unique opportunities to connect with clients on a more personal level. Share industry insights, company updates, and behind-the-scenes glimpses of your firm's culture. Respond promptly to comments and messages to foster a sense of community. According to Sprout Social, 64% of consumers want brands to connect with them on social media. This engagement can humanize your firm and build stronger relationships with clients. For accountants looking to get started, it's essential to develop a content strategy that resonates with your target audience.

Schedule annual or bi-annual goal-setting sessions with clients to align your services with their evolving needs. These sessions allow you to understand their long-term objectives, anticipate future challenges, and tailor your services accordingly. This proactive approach demonstrates your commitment to their success and positions your firm as a strategic partner rather than just a service provider.

The next section will explore how technology can further enhance these engagement efforts, providing seamless and efficient ways to connect with clients in the digital age.

Technology transforms client engagement for accounting firms. We at Cajabra have witnessed how the right tech tools revolutionize client relationships and streamline communication. Let's explore some game-changing technologies that will elevate your client engagement strategy.

Client portals have become essential for modern accounting firms. These secure online platforms allow clients to access their financial information, documents, and reports at any time. A recent survey by Accounting Today reveals that 72% of clients prefer firms that offer digital access to their financial data.

When you implement a client portal, prioritize user-friendliness and security. Make sure the portal is intuitive and mobile-responsive. Update your security protocols regularly to protect sensitive financial data. Many firms report a 30% reduction in client inquiries after implementing a well-designed portal (freeing up time for more value-added services).

Automated reminders and notifications are powerful tools for consistent client communication. These can include tax deadline reminders, upcoming meeting notifications, or alerts about important financial events.

A study by Constant Contact found that personalized, timely notifications can increase client engagement by up to 50%. When you set up your notification system, segment your client base to ensure relevance. For example, send quarterly tax reminders to small business owners and annual reminders to individual tax clients.

Interactive financial dashboards provide clients with a real-time, visual representation of their financial status. These tools can significantly enhance client understanding and engagement with their financial data.

When you design your dashboards, focus on key metrics that matter most to your clients. Include features like drill-down capabilities and customizable views to cater to different client needs.

The pandemic accelerated the adoption of virtual meeting platforms, and they're here to stay. These tools allow for face-to-face interactions regardless of geographical constraints. A survey by Zoom found that 67% of clients prefer video meetings over phone calls for complex financial discussions.

To maximize the effectiveness of virtual meetings, invest in high-quality audio and video equipment. Create a professional background and ensure a stable internet connection. Consider offering a mix of virtual and in-person meetings to cater to different client preferences.

AI-powered chatbots provide instant support to clients, answering common questions and guiding them through basic processes. This technology can help improve accuracy and efficiency, reduce costs, and provide valuable insights and predictions for decision-making.

When implementing chatbots, start with a focused scope of common client queries. Continuously refine and expand the chatbot's knowledge base based on client interactions. Implementing a chatbot on your website can increase lead generation by up to 45%. It engages potential clients outside of business hours and provides immediate assistance.

Client engagement activities form the foundation of lasting relationships in the accounting industry. Accounting firms can enhance their client relationships through educational events, personalized insights, and collaborative goal-setting sessions. These strategies, combined with technology like client portals and AI-powered chatbots, create a comprehensive approach to client engagement.

Engaged clients remain loyal, recommend services, and stay open to additional offerings. This leads to increased revenue, reduced client churn, and a stronger industry reputation. Firms should assess their current engagement levels using metrics like Net Promoter Score and client retention rate, then prioritize strategies that align with their strengths and client needs.

At Cajabra, we understand the challenges accounting firms face in today's competitive landscape. Our specialized marketing services for accountants can help you implement these client engagement strategies effectively. With our JAB System™, we can help move your firm from overlooked to overbooked in just 90 days (securing retainer-based clients and enhancing your online presence).