Client engagement metrics are the lifeblood of accounting firms. They reveal how well we're connecting with our clients and meeting their needs.

At Cajabra, LLC, we've seen firsthand how tracking these metrics can transform client relationships and boost business growth.

This post will guide you through key engagement metrics and show you practical ways to improve them, helping you build stronger, more profitable client partnerships.

Client engagement metrics form the foundation of successful accounting firms. These indicators offer valuable insights into client relationship health and overall firm performance. Let's explore the key metrics that can revolutionize your understanding and improvement of client engagement.

Client retention rate measures the percentage of clients who continue to use your services over a specific period. A high retention rate signals strong client satisfaction and loyalty. Research shows that among small, mid-size, and large accounting firms in the U.S., retention rates tend to increase with firm size. To calculate this rate, divide the number of clients at the end of a period by the number at the start (subtract any new clients acquired during that time).

CSAT measures immediate satisfaction after an interaction. This metric provides a snapshot of client sentiment and helps identify areas for improvement. Implement regular surveys to track CSAT and pinpoint specific aspects of your service that resonate with clients or need enhancement.

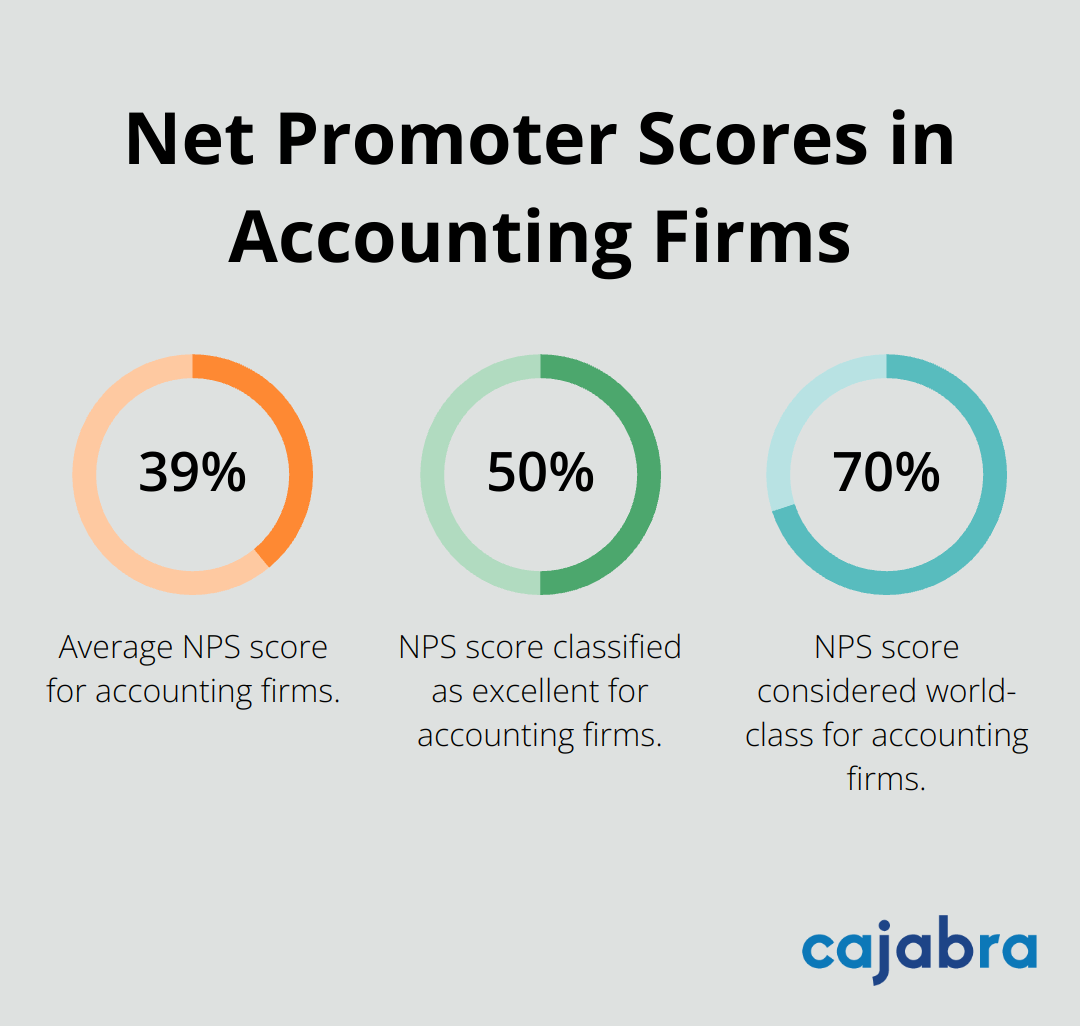

NPS gauges long-term loyalty and the likelihood of referrals. A recent study found that the average NPS score for accounting firms is 39%, with 50% classified as excellent and 70% as world-class. This metric helps you understand how likely your clients are to recommend your firm to others, providing insight into overall satisfaction and loyalty.

CLV predicts the total revenue a client will generate over their entire relationship with your firm. This metric helps prioritize client relationships and allocate resources effectively. To calculate CLV, multiply the average annual revenue per client by the average client lifespan, then subtract the cost of acquiring and serving the client. Firms that focus on increasing CLV often see a significant boost in overall profitability.

This metric helps you understand the financial impact of each client on your firm. Calculate it by dividing your total revenue by the number of clients. Tracking this metric over time can reveal trends in client value and help you identify opportunities for upselling or cross-selling services.

These metrics provide a comprehensive view of client engagement, allowing for targeted improvements in service delivery, communication strategies, and overall client experience. The next section will explore practical strategies to enhance these metrics and strengthen client relationships.

At Cajabra, LLC, we understand the power of effective client engagement strategies in transforming accounting firms. This chapter explores proven tactics to enhance your client relationships and drive business growth.

A structured communication schedule forms the cornerstone of client engagement. We recommend quarterly review meetings with each client. These sessions provide opportunities to discuss financial health, address concerns, and identify new opportunities. Regular check-ins should typically last no longer than an hour, and it's important to set up next steps and schedule the next meeting before concluding.

Expanding your service offerings can significantly boost engagement. Consider introducing financial planning, business advisory, or technology consulting services. A recent survey by Accounting Today reveals that firms offering value-added services see an average revenue increase of 18% per client.

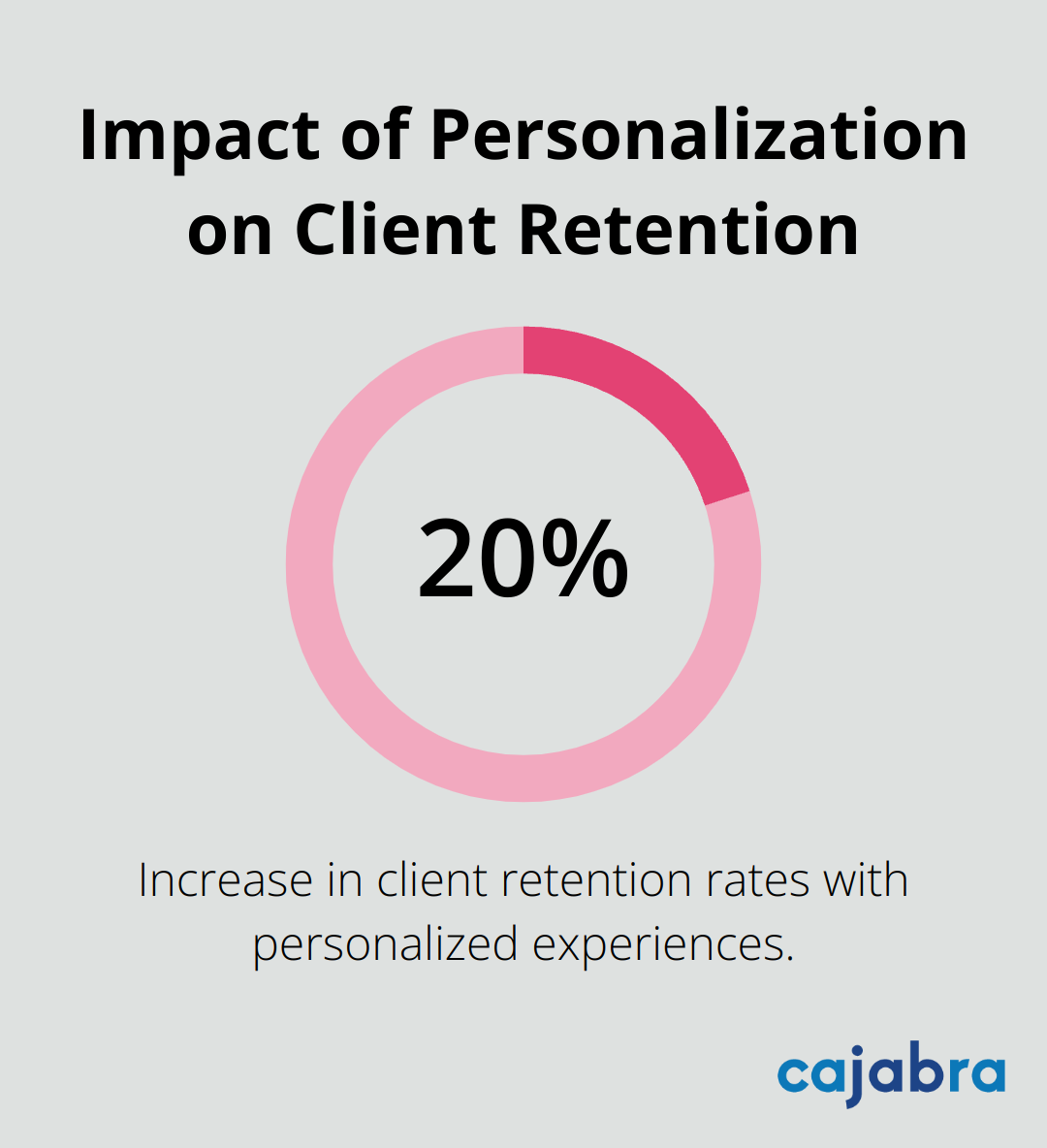

Accounting is not a one-size-fits-all industry. Use your CRM data to segment clients based on industry, size, and needs. Then, customize your communications and service offerings accordingly. A Deloitte report indicates that personalized client experiences can lead to a 20% increase in client retention rates.

The right tools can significantly enhance client engagement. Implement secure client portals for document sharing and real-time collaboration. Cloud-based accounting software provides clients with up-to-date financial information. The 2024 Accounting Firm Operations and Technology Survey shows that firms using collaborative technologies experience a 25% increase in client satisfaction scores.

Providing valuable educational content positions your firm as a trusted advisor. Host webinars on tax planning strategies or create a monthly newsletter with financial tips. The American Institute of CPAs reports that firms offering educational resources see a 15% increase in client loyalty metrics.

Improving client engagement requires continuous effort and adaptation. The next chapter will explore the tools and technologies that can help you measure and track these engagement efforts effectively, ensuring you stay ahead in this competitive landscape.

In today's digital landscape, the right technology transforms client relationships and drives business growth. Let's explore essential technologies that can help your accounting firm stay ahead of the curve.

Customer Relationship Management (CRM) systems are essential for tracking client interactions and engagement. A robust CRM (like Salesforce or HubSpot) centralizes client data, tracks communication history, and provides insights into client behavior. A study by Nucleus Research found that CRMs increase sales by up to 29% and productivity by up to 34%. When selecting a CRM, prioritize features such as customizable dashboards, integration with your accounting software, and mobile accessibility.

Client feedback platforms (e.g., SurveyMonkey or Typeform) allow you to collect direct input from your clients. These tools help you conduct satisfaction surveys, collect Net Promoter Scores, and gather qualitative feedback. A PwC report revealed that 73% of people consider customer experience an important factor in their purchasing decisions. Regular surveys identify areas for improvement and demonstrate to clients that you value their opinions.

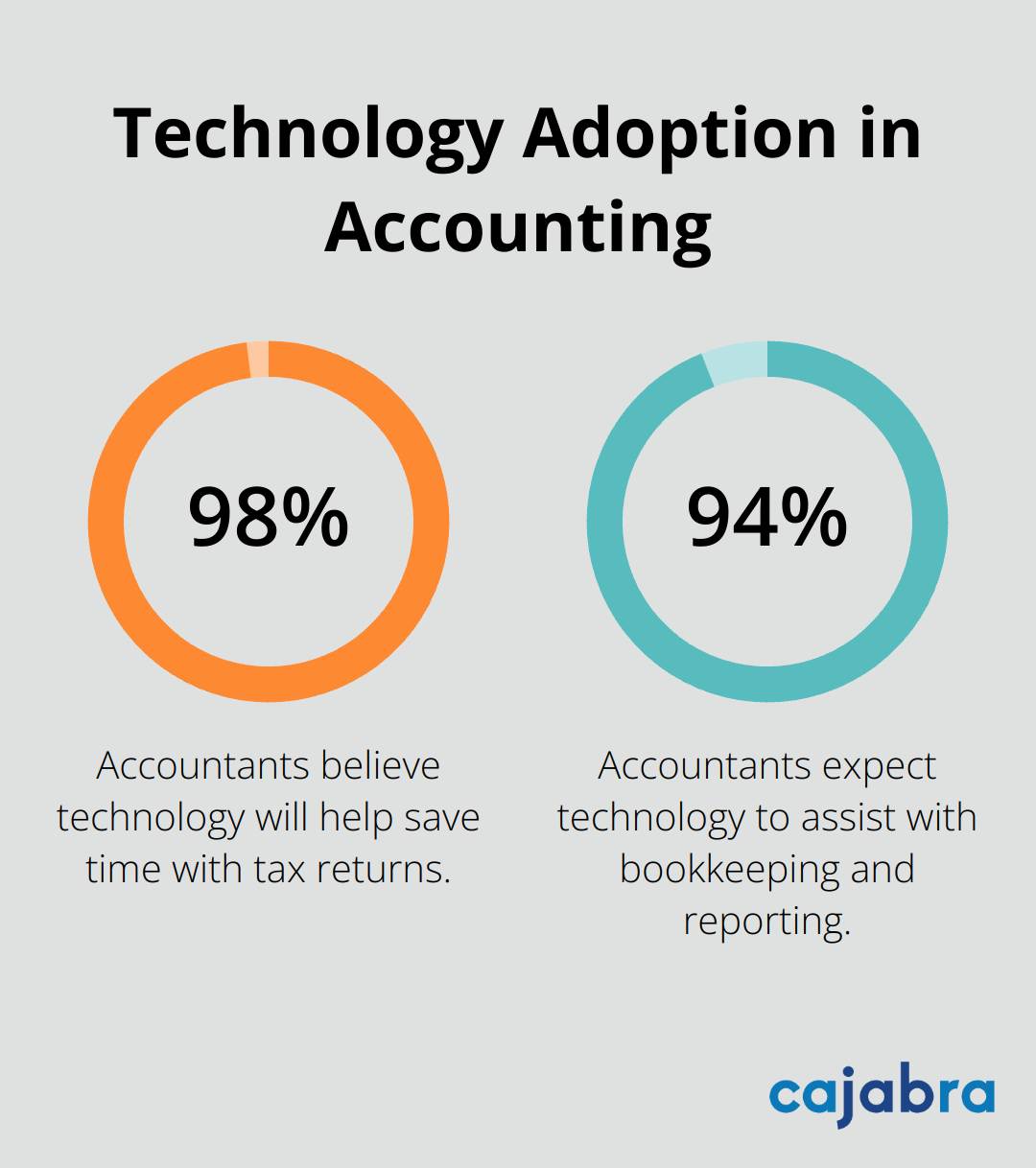

Analytics tools offer deep insights into client behavior and engagement patterns. Google Analytics tracks how clients interact with your website, while specialized accounting practice management software monitors client portal usage and document access. According to the 2024 Accountant Tech Survey, 98% of respondents believe technology will help save time with preparation and filing of tax returns, while 94% expect it to assist with bookkeeping and financial reporting.

Email marketing platforms (such as Mailchimp or Constant Contact) enable you to create targeted campaigns and track engagement metrics. These tools provide valuable data on open rates, click-through rates, and conversion rates. Try to segment your email lists based on client characteristics to deliver more personalized content.

Social media management tools streamline your firm's social media efforts. These platforms allow you to schedule posts, monitor mentions, and analyze engagement across multiple social networks. A strong social media presence helps you stay connected with clients and attract potential leads.

Client engagement metrics provide a comprehensive view of client relationships, enabling accounting firms to make data-driven decisions. Firms can improve these metrics through regular check-ins, value-added services, personalized experiences, technology integration, and educational resources. The right tools (such as CRM systems, feedback platforms, and analytics software) offer valuable insights and streamline communication processes.

At Cajabra, LLC, we understand the challenges accounting firms face in measuring and improving client engagement metrics. Our specialized marketing services help accountants secure retainer-based clients and maximize revenue from existing relationships. We handle all aspects of marketing, allowing you to focus on your expertise and client service.

Client engagement requires continuous measurement, analysis, and adaptation for long-term success. You will build lasting relationships that drive your firm's growth and success when you stay attuned to your clients' needs and consistently refine your engagement strategies. The path to enhanced client engagement starts with the right metrics and tools.