Most accounting firms struggle to attract new clients because they lack a structured approach to marketing. Without a clear marketing plan for accounting firm growth, practices often waste money on ineffective tactics.

We at Cajabra, LLC have seen firms transform their client acquisition by following proven marketing frameworks. This guide walks you through building a comprehensive plan that generates consistent leads and grows your practice.

Who Is Your Ideal Accounting Client

Finding Your Profitable Niche

High-growth accounting firms understand the power of targeting specific client segments, with marketing budgets varying significantly across different firm sizes and growth stages. Firms that specialize in niches like startups, nonprofits, or restaurants generate higher profit margins than generalist practices through focused expertise and premium positioning.

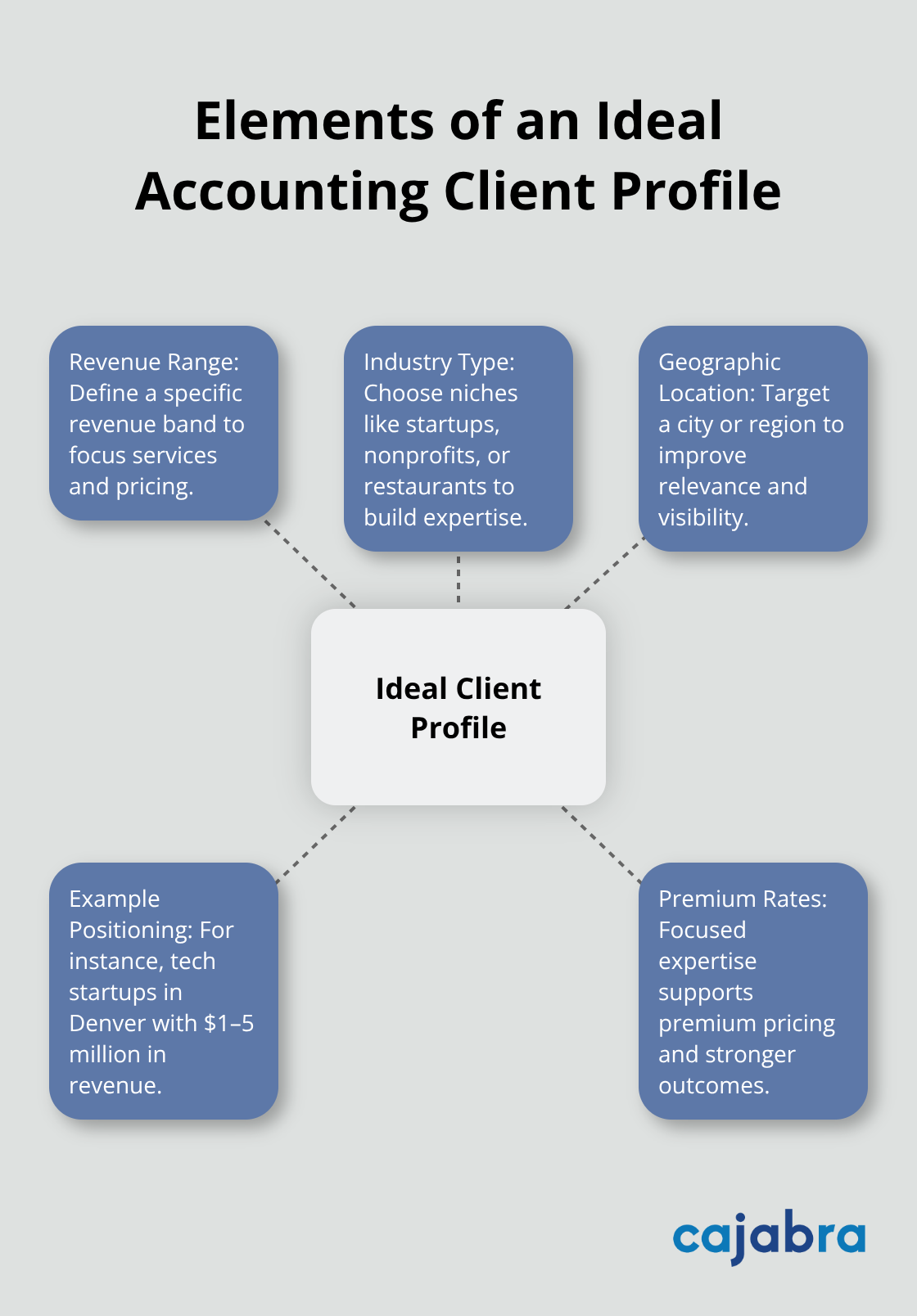

Your ideal client profile should include specific revenue ranges, industry types, and geographic locations. A tax firm in Denver that targets tech startups with $1-5 million revenue will outperform a general practice that tries to serve everyone. This focused approach allows you to develop deep expertise and command premium rates.

Analyzing Your Local Market Position

Research from the Association for Accounting Marketing provides insights into how accounting firms of all sizes structure their marketing approaches and understand marketplace dynamics. Study your competitors' websites, pricing structures, and service offerings to identify gaps in the market.

If three firms in your area focus on individual tax returns but none specializes in small business advisory services, that represents a significant opportunity. Document which firms charge premium rates and examine why their positioning allows higher pricing (often through specialized expertise or proven results).

Building Your Competitive Advantage

Your value proposition must address specific client pain points rather than generic accounting services. Firms that position themselves as industry experts command higher fees than generalists through specialized knowledge and proven track records.

Instead of offering basic bookkeeping, focus on outcomes like helping restaurants reduce food costs or helping contractors improve cash flow timing. This messaging differentiates your practice and attracts clients willing to pay premium rates for specialized expertise.

Defining Your Service Portfolio

Structure your services around client outcomes rather than traditional accounting tasks. High-growth firms package their expertise into advisory services that solve business problems. A construction accounting specialist might offer cash flow optimization, project profitability analysis, and equipment financing guidance.

This approach positions you as a strategic partner rather than a commodity service provider. Clients pay more for solutions that directly impact their bottom line (versus standard compliance work that every firm offers).

With your ideal client profile defined and competitive positioning established, you need to examine the local market landscape to identify specific opportunities for growth.

How Should You Build Your Digital Marketing Foundation

Create a High-Converting Website

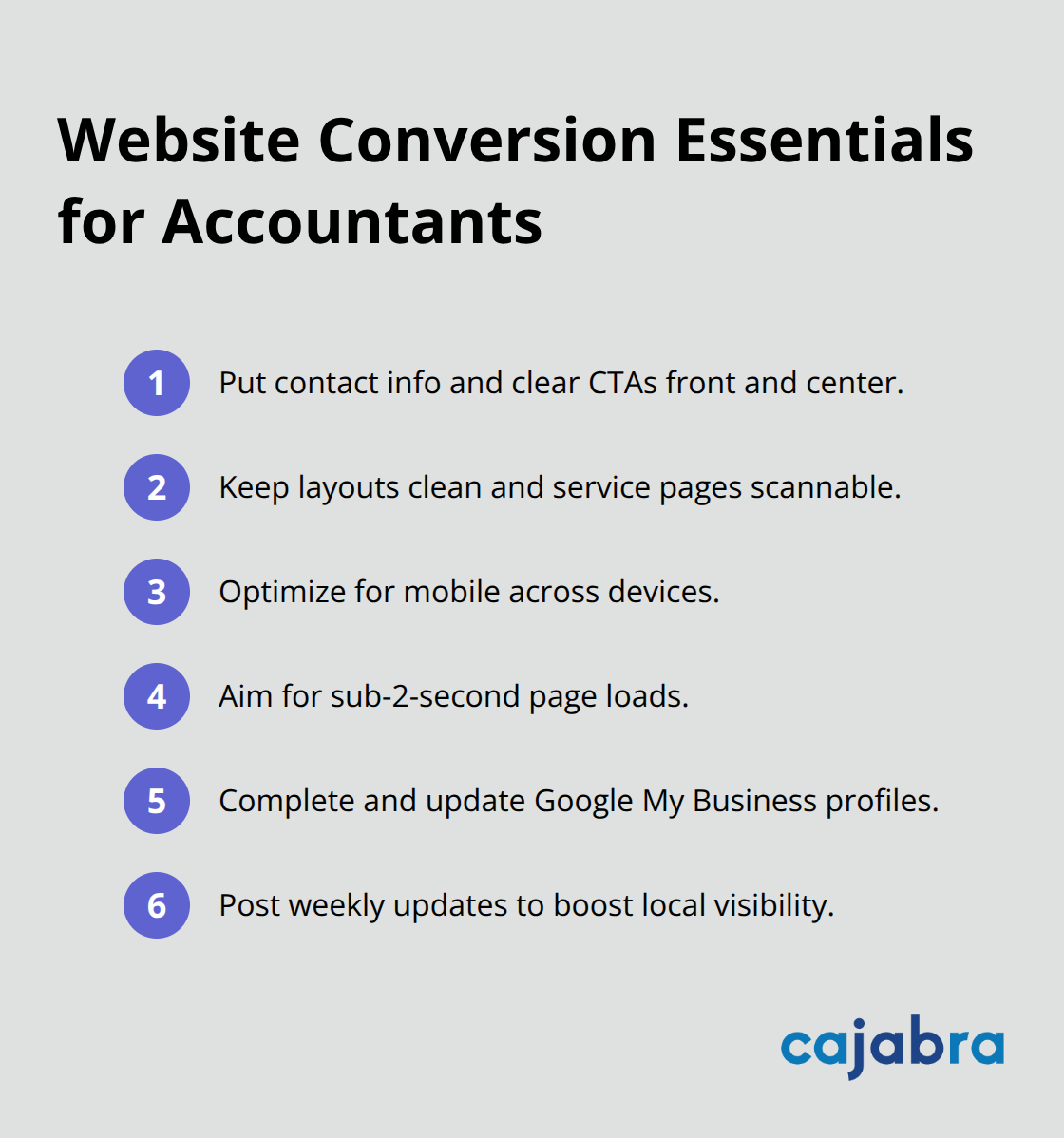

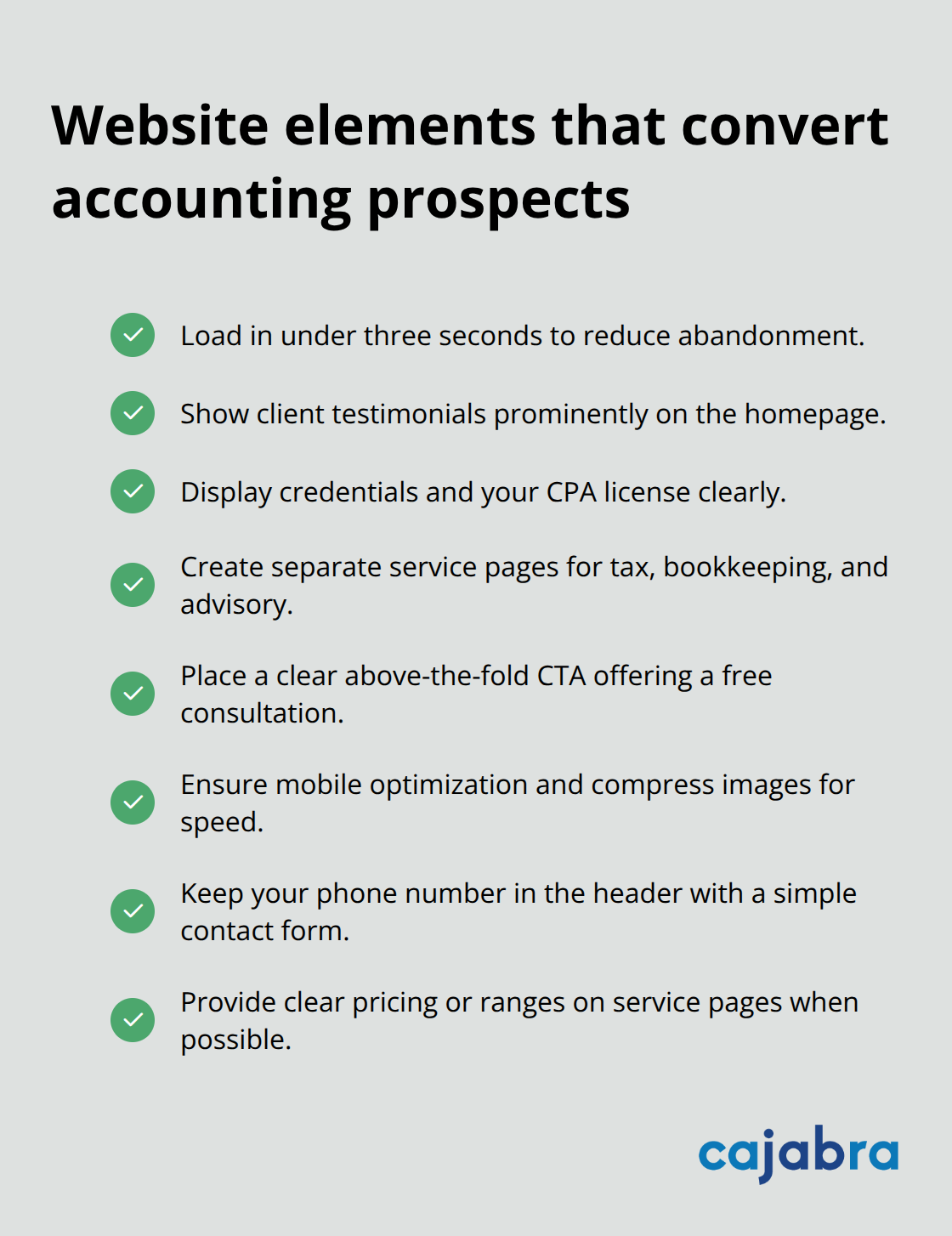

Your website serves as the primary conversion tool for accounting firms, with prospective clients reviewing websites, comparing testimonials and assessing credentials before ever making contact. A professional website must load within three seconds and include specific lead generation elements like consultation booking forms, downloadable tax guides, and client testimonials with measurable results.

High-growth firms invest in responsive designs that work seamlessly across mobile devices, since 60% of initial website visits now occur on smartphones. Your site needs clear navigation, professional photography, and compelling calls-to-action on every page to convert visitors into leads.

Implement Strategic Content Marketing

Content marketing generates over three times as many leads as outbound marketing and costs 62% less. Create industry-specific blog posts that address client pain points like cash flow management for restaurants or tax planning for contractors.

SEO optimization requires you to target long-tail keywords such as "construction accounting Denver" or "nonprofit tax services Atlanta" rather than generic terms. This focused approach helps you rank higher in search results and attracts qualified prospects who need your specific expertise. Effective content development requires strategic planning to ensure consistent value delivery.

Launch Email and Social Media Campaigns

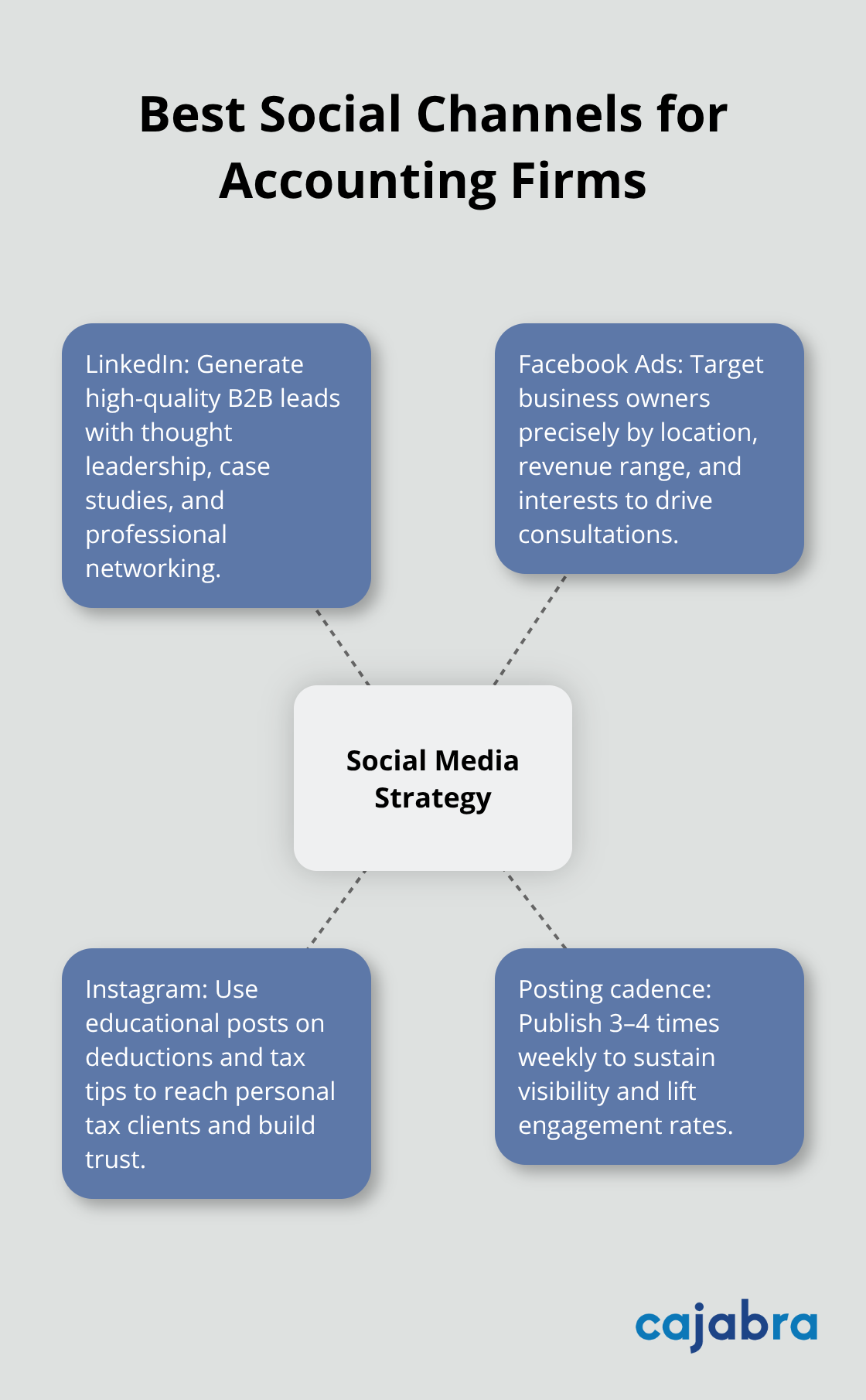

Email campaigns deliver $36 return for every dollar invested, which makes automated sequences essential for lead nurturing. Set up welcome series, tax deadline reminders, and educational newsletters that keep your firm top-of-mind with prospects and existing clients.

LinkedIn generates the highest engagement rates for B2B accounting services, while Facebook advertising works effectively for individual tax clients. Post educational content twice weekly and respond to comments within four hours to build authority and trust with potential clients (consistency matters more than frequency). Client engagement strategies can significantly improve your social media performance.

Your digital foundation requires careful budget allocation across these channels to maximize return on investment and support sustainable growth.

How Do You Budget and Schedule Your Marketing Activities

Set Measurable Performance Targets

High-growth accounting firms allocate 29.6% of their budget to conferences and events compared to slower-growing practices according to Association for Accounting Marketing research. Start with specific targets like acquiring 12 new clients within six months or generating 50 qualified leads monthly through your website. Track cost per acquisition, which should stay below $466.20 for bookkeeping clients and $27.75 for individual tax clients to maintain profitability.

Monitor website conversion rates (try for 3-5% of visitors scheduling consultations), email open rates (target 25% for accounting newsletters), and LinkedIn engagement metrics. These numbers provide clear benchmarks for campaign effectiveness and help you adjust tactics quickly when performance drops below expectations.

Distribute Marketing Investment Strategically

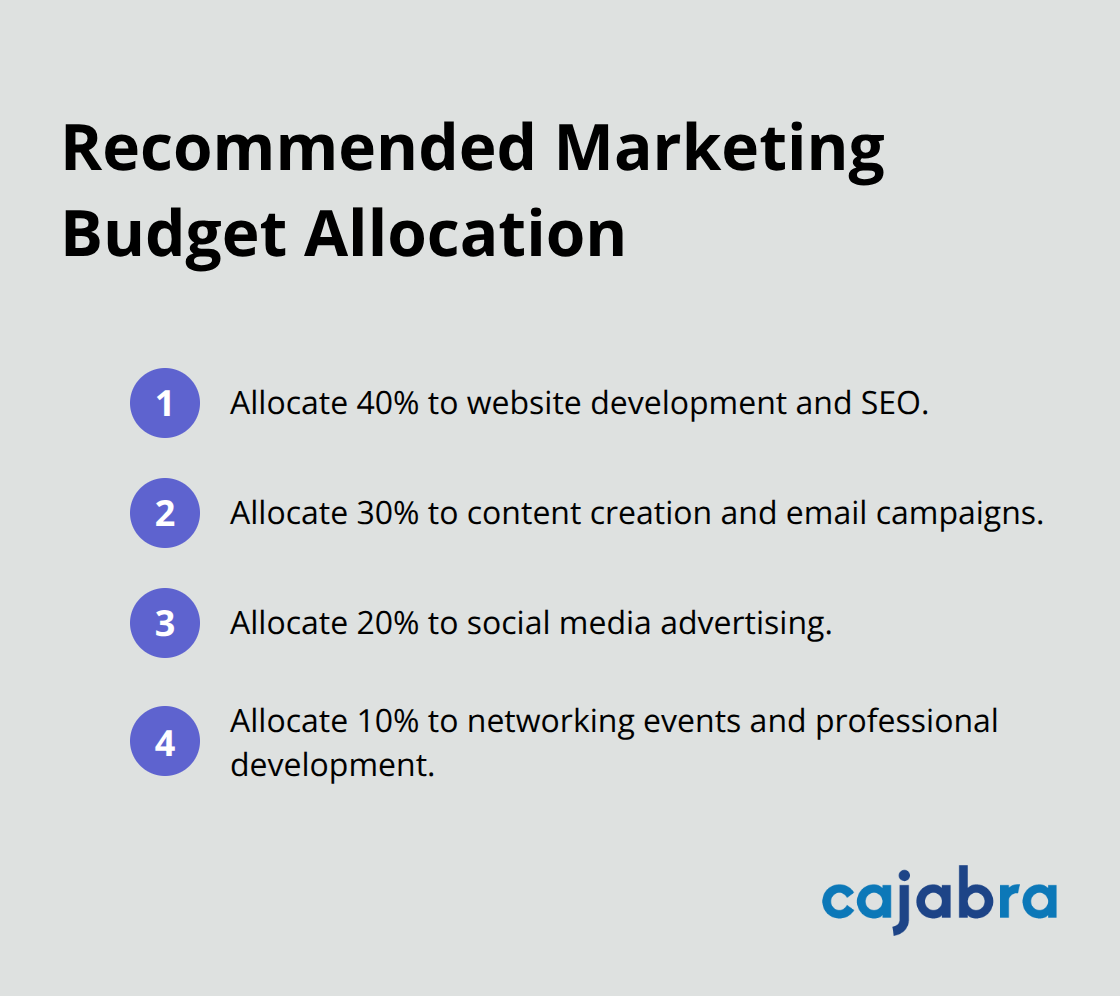

Allocate 40% of your marketing budget to website development and SEO, 30% to content creation and email campaigns, 20% to social media advertising, and 10% to networking events and professional development. A firm with $500,000 annual revenue should invest $10,500 yearly in marketing, with $4,200 for website optimization, $3,150 for content marketing, $2,100 for LinkedIn and Facebook ads, and $1,050 for industry events.

Focus spending on channels that generate qualified leads rather than spreading resources thin across every platform. LinkedIn advertising typically costs $6-12 per click for accounting services but converts better than Facebook for business clients, while Google Ads for tax preparation keywords can cost $15-25 per click during peak season.

Execute Quarterly Marketing Campaigns

Plan marketing activities in 90-day cycles that align with accounting seasonal demands. Launch tax planning content in September, year-end advisory campaigns in November, and business formation services in January when entrepreneurs start new ventures. Schedule weekly blog posts, bi-weekly email newsletters, and monthly webinars to maintain consistent prospect engagement throughout the year.

Track Progress with Monthly Action Plans

Create monthly action plans that specify exact deliverables like publishing four industry-specific articles, sending eight targeted emails, and posting 16 LinkedIn updates. This structured approach prevents marketing gaps during busy seasons and maintains momentum when client work intensifies. Track progress weekly and adjust tactics based on lead generation results rather than waiting for quarterly reviews (consistency beats perfection in marketing execution).

Final Thoughts

A successful marketing plan for accounting firm growth requires three fundamental components: clear target market identification, strategic digital foundation development, and disciplined budget allocation with measurable goals. Firms that implement these elements systematically achieve 20% annual growth rates compared to the 11% median for the accounting industry. Consistent execution matters more than perfect strategy.

High-growth firms maintain regular content publication schedules, track performance metrics monthly, and adjust tactics based on actual lead generation data rather than assumptions. This disciplined approach separates thriving practices from those that struggle with client acquisition. Your next step involves choosing one marketing channel and implementing it completely before you expand to additional tactics (start with website optimization and SEO-focused content creation since these generate the highest return on investment for most accounting practices).

We at Cajabra, LLC specialize in helping accounting firms implement proven marketing systems that generate consistent leads. Our JAB System™ helps accountants move from overlooked to overbooked through strategic marketing approaches and automated lead generation systems. This allows you to focus on client service while we handle the marketing complexities that drive sustainable practice growth.

Getting new accounting clients fast requires the right strategy and consistent execution. Most accounting firms struggle with client acquisition because they rely on outdated methods.

We at Cajabra, LLC have identified proven tactics that help accounting professionals learn how to get accounting clients within weeks, not months. The strategies below focus on building systems that generate qualified leads consistently.

What Gets Accounting Clients Fastest

Harness the Power of Referral Programs

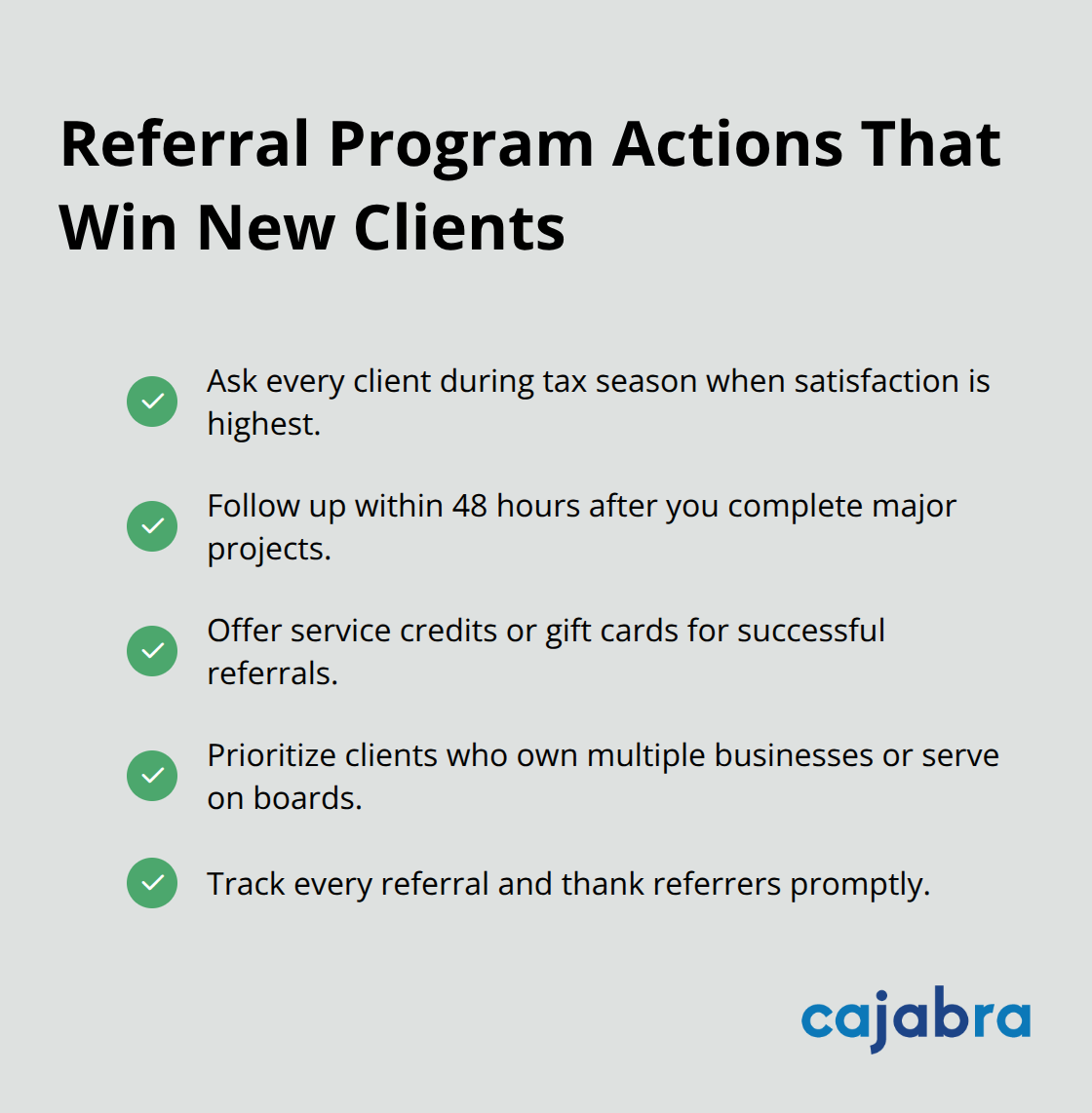

Word-of-mouth referrals are the most powerful client generation method available for accounting firms. Most firms leave this potential untapped because they fail to ask satisfied clients for referrals systematically. You need to create a structured referral program that rewards clients with service credits or gift cards for successful referrals.

Ask every client during tax season when satisfaction peaks, and follow up within 48 hours after you complete major projects. Target clients who own multiple businesses or serve on boards, as they typically know other business owners who need accounting services.

Optimize Local SEO for Maximum Visibility

Local SEO optimization amplifies referral effectiveness when you capture clients who search within your service area. Claim and optimize your Google Business Profile with recent photos, consistent NAP information (name, address, phone), and regular posts about tax deadlines or regulatory changes.

Target location-specific keywords like "accounting services" plus your city name, as local searches drive significant business visits each month according to Google data. This strategy puts your firm in front of prospects at the exact moment they search for accounting help.

Establish Authority Through Content Marketing

Content marketing positions you as the expert clients want to hire while it generates organic leads through search engines. Write weekly blog posts that address specific client pain points like cash flow management, tax planning strategies, or compliance requirements for different industries.

Post practical tips on LinkedIn three times weekly, and focus on actionable advice rather than promotional content. Create industry-specific content for sectors like construction, healthcare, or e-commerce to attract higher-value clients who pay premium rates for specialized knowledge. Host monthly webinars that cover topics like year-end tax planning or new regulations, then repurpose recordings into blog content and social media posts.

This foundation of referrals, local visibility, and thought leadership creates multiple client acquisition channels that work together. The next step involves building systems that automate and scale these efforts for consistent results.

How Do You Build Systems That Generate Clients Consistently

Manual client acquisition methods fail because they depend on your daily availability and energy levels. Successful accounting firms build automated systems that work around the clock and generate qualified leads even when you focus on client work.

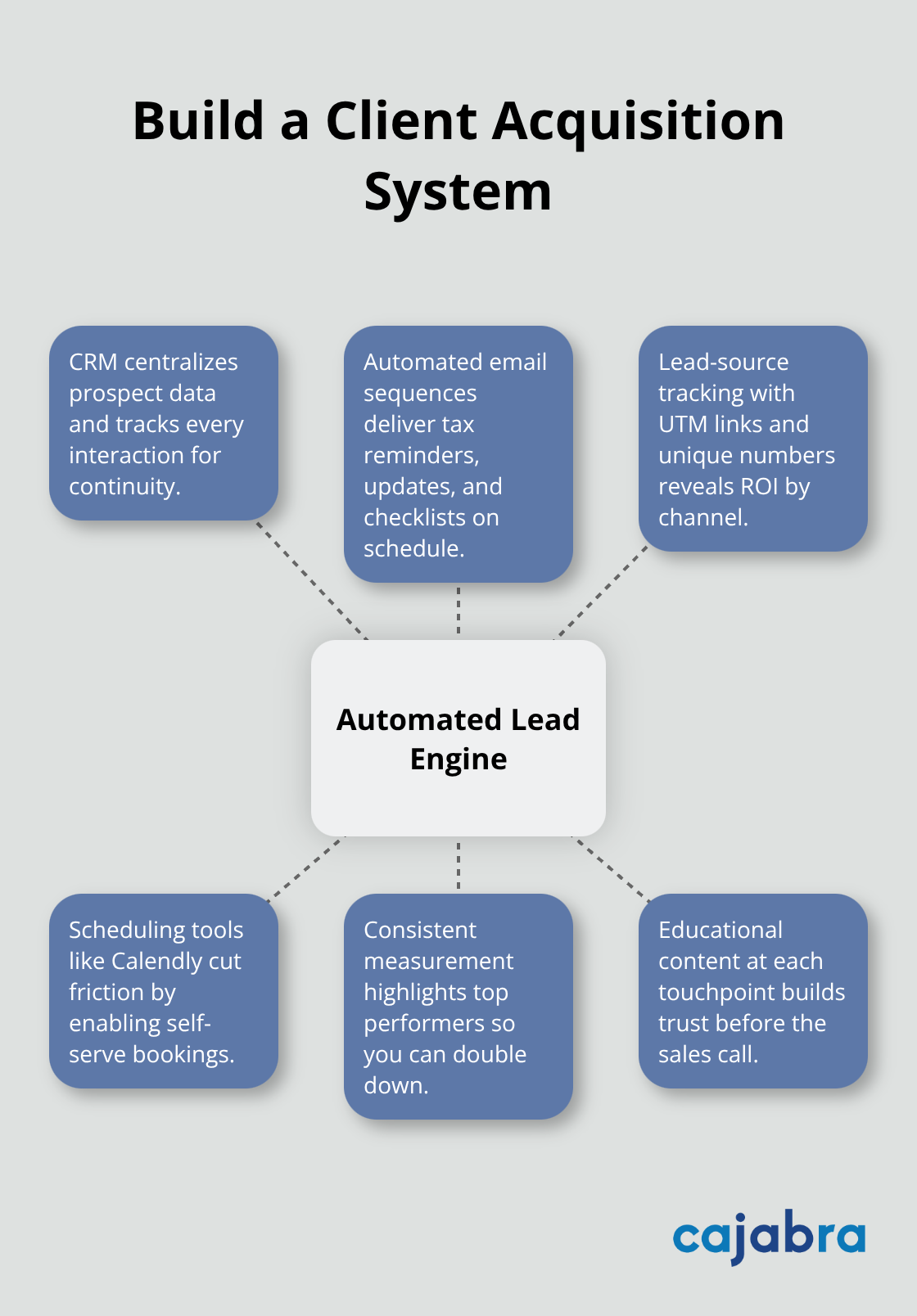

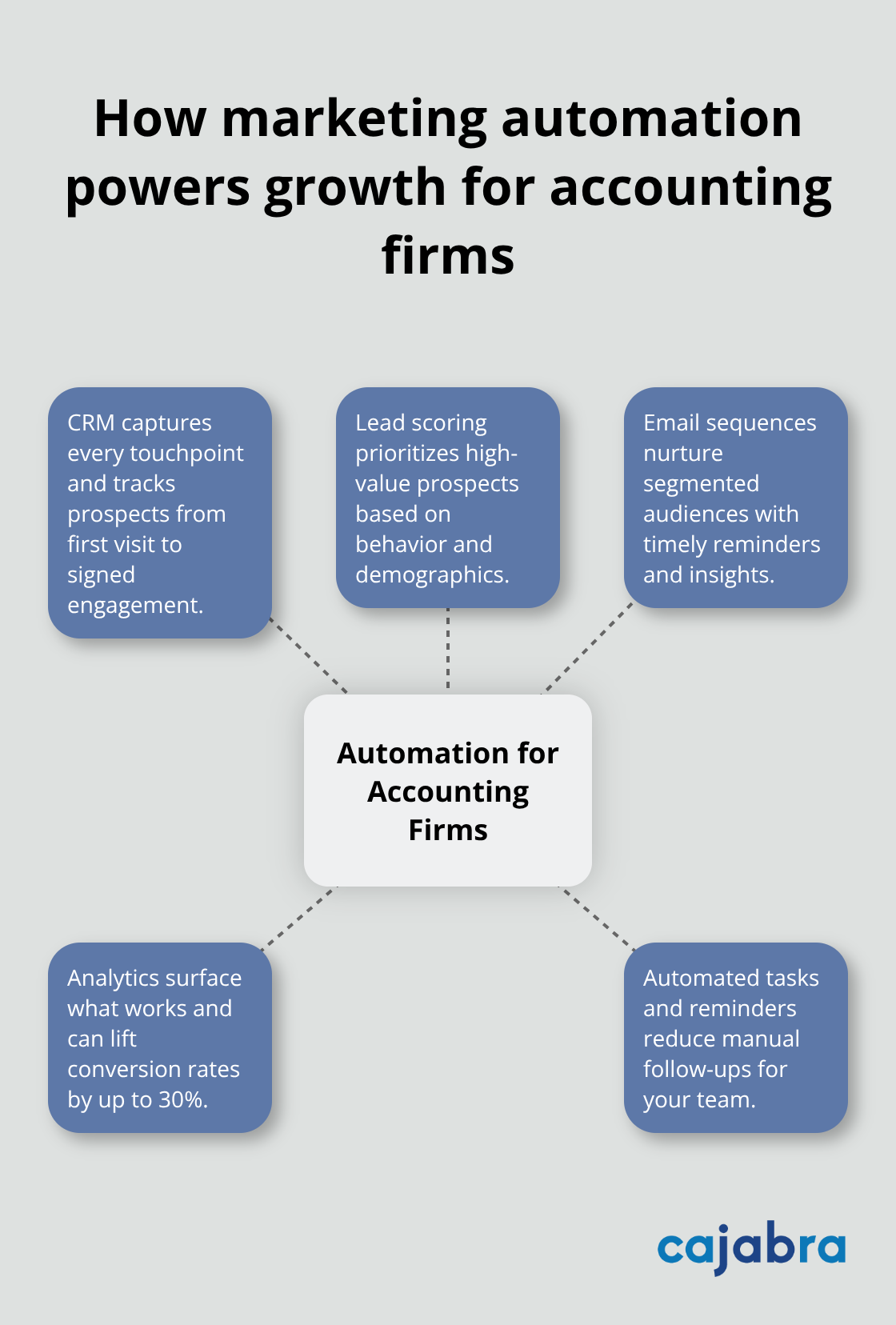

Set Up Your Client Relationship Management Foundation

Start with a simple CRM system like HubSpot or Pipedrive to track every prospect interaction from initial contact through conversion. These platforms capture lead information automatically and organize prospect data in one central location. Set up automated email sequences that nurture leads with valuable content like tax deadline reminders, industry updates, and compliance checklists sent at predetermined intervals.

Track Every Lead Source and Conversion Rate

Most accounting firms waste marketing budgets because they cannot identify which channels produce paying clients. Track lead sources meticulously with UTM codes on website links, unique phone numbers for different marketing campaigns, and referral systems that attribute new clients to specific sources.

Measure conversion rates for each channel monthly, then double down on the highest-performing methods while you eliminate underperforming tactics. LinkedIn typically converts at 2.74% for professional services according to WordStream data, while Google Ads average 3.75% conversion rates when properly targeted.

Automate Follow-Up Communications for Maximum Impact

B2B buyers consume three to seven pieces of content before connecting with a salesperson, yet most accounting firms give up after two attempts. Create automated follow-up sequences that deliver value at each touchpoint through educational content, case studies, and industry insights.

Send welcome emails immediately after lead capture, followed by weekly educational content for four weeks, then monthly newsletters to maintain top-of-mind awareness. Use scheduling tools like Calendly to eliminate phone tag and allow prospects to book consultations directly (this reduces friction in your sales process while it maintains professional boundaries).

These automated systems create the foundation for consistent lead generation, but advanced marketing tactics can accelerate your client acquisition even further.

How Do Advanced Marketing Tactics Accelerate Client Acquisition

Strategic partnerships with complementary service providers create the fastest path to qualified accounting clients because they tap into existing trust relationships. These professionals encounter business owners who need accounting services regularly, and their referrals convert at higher rates because trust transfers from the referring professional.

Build Strategic Partnerships That Generate Qualified Referrals

Target partners who serve the same client base but offer different services. Commercial lenders need accountants to review financial statements before loan approvals, while business consultants require accounting expertise for client engagements. Partner with attorneys who specialize in business law, commercial real estate agents, business insurance brokers, and financial advisors who serve your ideal client profile.

Attend local Chamber of Commerce meetings and industry association events to identify potential partners. Propose specific collaboration opportunities like joint client presentations or shared educational content. Structure formal referral agreements that specify lead sharing procedures, compensation terms, and communication protocols to maximize partnership effectiveness.

Host Educational Events That Convert Prospects

Educational workshops and webinars position you as the expert while they create direct sales opportunities with pre-qualified prospects. Host quarterly tax planning workshops for local business owners, and focus on specific strategies like Section 199A deductions or cost segregation opportunities that demonstrate tangible value.

Webinars typically generate 20-40% more leads than static content according to GoToWebinar data. Attendees convert to clients at rates three times higher than cold prospects because they invest time to learn from you before they make purchasing decisions. Track referral sources meticulously and reciprocate with high-quality leads to maintain strong partnership relationships that generate consistent client flow.

Leverage Social Media for Direct Client Connections

LinkedIn outperforms all other social platforms for B2B client acquisition. Professional services firms report 277% higher lead generation rates compared to Facebook or Twitter according to HubSpot research. Post industry-specific content three times weekly that addresses real problems your prospects face (like cash flow management during seasonal fluctuations or compliance requirements for government contractors).

Engage directly with comments and messages within four hours to maintain momentum. Use LinkedIn Sales Navigator to identify and connect with decision-makers at target companies who match your ideal client profile. This direct approach eliminates intermediaries and creates personal connections that convert to long-term client relationships. These digital marketing fundamentals create the foundation for more advanced client acquisition strategies that focus on strategic market positioning.

Final Thoughts

Fast client acquisition requires consistent execution of proven strategies rather than hope for overnight success. The most effective approach combines referral programs with local SEO optimization and content marketing to create multiple lead generation channels that work simultaneously. The biggest mistake firms make involves jumping between tactics without measurement of results.

Track every lead source meticulously and focus your efforts on channels that produce qualified prospects who convert to paying clients. Avoid the temptation to chase every new marketing trend without establishment of solid fundamentals first. Most accounting professionals who learn how to get accounting clients successfully stick to proven methods that generate predictable results.

Start implementation of these strategies with setup of your Google Business Profile this week, then create a simple referral program for existing clients. Build automated follow-up sequences that nurture prospects with valuable content while you develop strategic partnerships with complementary service providers. We at Cajabra, LLC help accounting firms implement these client acquisition systems through our JAB System™ that moves accountants from overlooked to overbooked (our specialized marketing service handles all aspects of lead generation while you focus on client service and practice growth).

Accounting practice growth requires more than just acquiring new clients. The most successful firms build sustainable systems that support long-term expansion while maintaining service quality.

We at Cajabra, LLC have identified three core areas that drive lasting growth: operational efficiency, strategic marketing, and client value maximization. These pillars work together to create a foundation for consistent revenue increases and market expansion.

Building a Strong Foundation for Growth

Establishing Clear Business Goals and Metrics

Strong growth starts with measurable targets that connect daily operations to revenue outcomes. Accounting firms that track specific metrics like client acquisition cost, average client value, and monthly recurring revenue see stronger growth than those that rely on general financial statements.

Set quarterly revenue targets, monthly new client goals, and weekly pipeline metrics. Track your average project completion time and client satisfaction scores through Net Promoter Score surveys. These numbers become your navigation system for growth decisions and help you identify which strategies deliver the best returns.

Developing Efficient Operational Systems

Efficient systems separate firms that grow from those that stagnate. Implement practice management software that automates client onboarding, project tracking, and billing processes.

Accounting firms with above-average revenue use productivity tools 61% more than other firms.

Standardize your client communication workflows with templates for initial consultations, progress updates, and project completion reports. Create checklists for tax preparation, bookkeeping reviews, and advisory consultations. Document every process step so team members can replicate quality service regardless of workload fluctuations.

Creating Standardized Service Offerings

Standardized service packages eliminate pricing confusion and increase profit margins. Develop three-tier service levels: basic compliance, enhanced advisory, and comprehensive business partnership. Price each tier based on value delivered rather than hours worked.

Firms with standardized offerings report higher profit margins compared to custom-pricing models. Create clear service descriptions, deliverable timelines, and communication schedules for each package. This approach allows faster client onboarding and reduces scope creep that damages profitability.

Technology Integration for Scalable Growth

Modern accounting practices require technology that supports expansion without proportional staff increases. Cloud-based accounting platforms enable remote work capabilities and real-time client collaboration (essential for today's business environment). Automated data entry tools reduce manual work significantly, freeing staff for higher-value advisory services.

Invest in client portal systems that allow secure document sharing and progress tracking. These platforms improve client satisfaction while reducing administrative overhead. Technology investments pay for themselves through improved efficiency and enhanced service delivery capabilities.

With these foundational elements in place, your practice becomes ready to attract and convert prospects through strategic marketing initiatives that build long-term client relationships.

Marketing Strategies That Drive Sustainable Growth

Effective marketing for accounting practices requires a focused approach that builds authority and generates predictable leads. Strategic SEO implementation helps accounting firms improve lead quality, while successful practices concentrate on three specific areas: content creation that establishes professional authority, systematic referral programs, and digital presence optimization for local search.

Strategic Content Creation That Builds Authority

Weekly articles on tax planning, business advisory topics, and industry-specific insights position your firm as the expert in your market. Focus content on specific client problems rather than general accounting topics. Write about quarterly tax strategies for restaurants, cash flow management for construction companies, or succession planning for family businesses. This targeted approach attracts higher-value prospects who need specialized expertise.

Share these articles across LinkedIn, email newsletters, and industry forums where your ideal clients spend time. Content marketing generates three times more leads per dollar spent compared to traditional advertising methods. Consistent publication schedules build trust with prospects who see your expertise demonstrated regularly.

High-Converting Referral Systems

Referral programs produce the highest quality leads because 91% of customers trust recommendations from people they know. Create a formal referral system that rewards existing clients with service credits or gift cards for successful introductions.

Send quarterly referral reminder emails with specific examples of ideal client types you serve best.

Partner with complementary professionals like attorneys, bankers, and business consultants who serve similar client bases. These partnerships often generate consistent monthly referrals when properly maintained through regular communication and mutual client introductions. Track referral sources to identify which relationships produce the most valuable clients.

Digital Presence Optimization for Local Discovery

Strategic SEO implementation helps accounting firms improve lead quality and drive more targeted website traffic. Optimize your Google Business Profile with current photos, service descriptions, and weekly posts about tax deadlines or business tips. Respond to all reviews within 24 hours and request reviews from satisfied clients immediately after project completion.

Target location-specific keywords through website content and blog posts. Pay-per-click advertising works effectively for accounting firms when targeting specific services and geographic areas (typically generating leads at 15-20% lower cost than broader campaigns). Focus ad spend on high-intent keywords that indicate immediate need for accounting services.

These marketing strategies create a steady pipeline of qualified prospects, but converting them into long-term clients requires strategic approaches to service delivery and relationship management.

Client Retention and Value Maximization

Expanding Beyond Compliance Into High-Value Advisory Services

Advisory services generate profit margins 40-60% higher than traditional compliance work, yet most accounting firms leave this revenue on the table. Start with cash flow forecasting, business succession planning, and strategic tax planning during regular client meetings. These services command premium pricing because they directly impact client profitability rather than just meet regulatory requirements.

Transform quarterly business reviews into strategic planning sessions where you analyze financial trends, identify growth opportunities, and recommend specific actions. Clients pay substantially more for forward-looking advice than backward-looking compliance reports. Firms that focus on advisory services consistently outperform compliance-only competitors in both revenue growth and client retention rates.

Systematic Client Communication That Drives Revenue Growth

Monthly check-ins with your top 20% of clients prevent revenue loss and identify expansion opportunities before competitors do. Schedule these conversations as formal business reviews, not casual phone calls. Prepare specific talking points about their industry trends, tax law changes, and growth strategies that apply to their situation. This proactive approach positions your firm as an essential business partner rather than a seasonal service provider.

Track client engagement through Net Promoter Score surveys after each major project completion. Send quarterly newsletters with industry-specific insights, regulatory updates, and case studies that show how similar businesses solved common problems. Regular communication creates multiple touchpoints that strengthen relationships and generate additional service requests throughout the year.

Value-Based Pricing That Maximizes Long-Term Profitability

Hourly billing caps your revenue potential and encourages clients to minimize contact with your firm. Switch to value-based pricing for advisory services and monthly retainer agreements for ongoing support. Price services based on client revenue size, complexity of their operations, and value of outcomes you deliver. A manufacturing company with $5 million revenue pays more for cash flow management than a $500,000 retail business because the stakes and complexity differ significantly.

Implement subscription pricing for bookkeeping, payroll processing, and monthly financial reporting. Predictable monthly revenue improves cash flow management and allows better resource planning. Clients prefer fixed monthly costs over unpredictable hourly bills, which makes them more likely to engage your services regularly rather than delay necessary work due to cost concerns.

Final Thoughts

Sustainable accounting practice growth demands systematic execution across three fundamental areas: operational efficiency, strategic marketing, and client value maximization. Start with standardized service packages and practice management software to create scalable systems. Then implement content marketing and referral programs to generate consistent leads, followed by advisory services with value-based pricing to maximize client relationships.

Begin implementation with operational systems during your next slow season (typically January through March). Launch marketing initiatives in month two, focus on SEO optimization and weekly content creation. Introduce advisory services to existing clients in month four after systems stabilize to prevent overwhelming your team while momentum builds.

Track monthly recurring revenue, client acquisition costs, and Net Promoter Scores to measure progress. Adjust strategies quarterly based on these metrics rather than gut feelings. We at Cajabra, LLC help accounting firms implement these growth strategies through our JAB System™, which moves practices from overlooked to overbooked.

Most accounting firms struggle to stand out in an increasingly competitive market where services appear identical to potential clients.

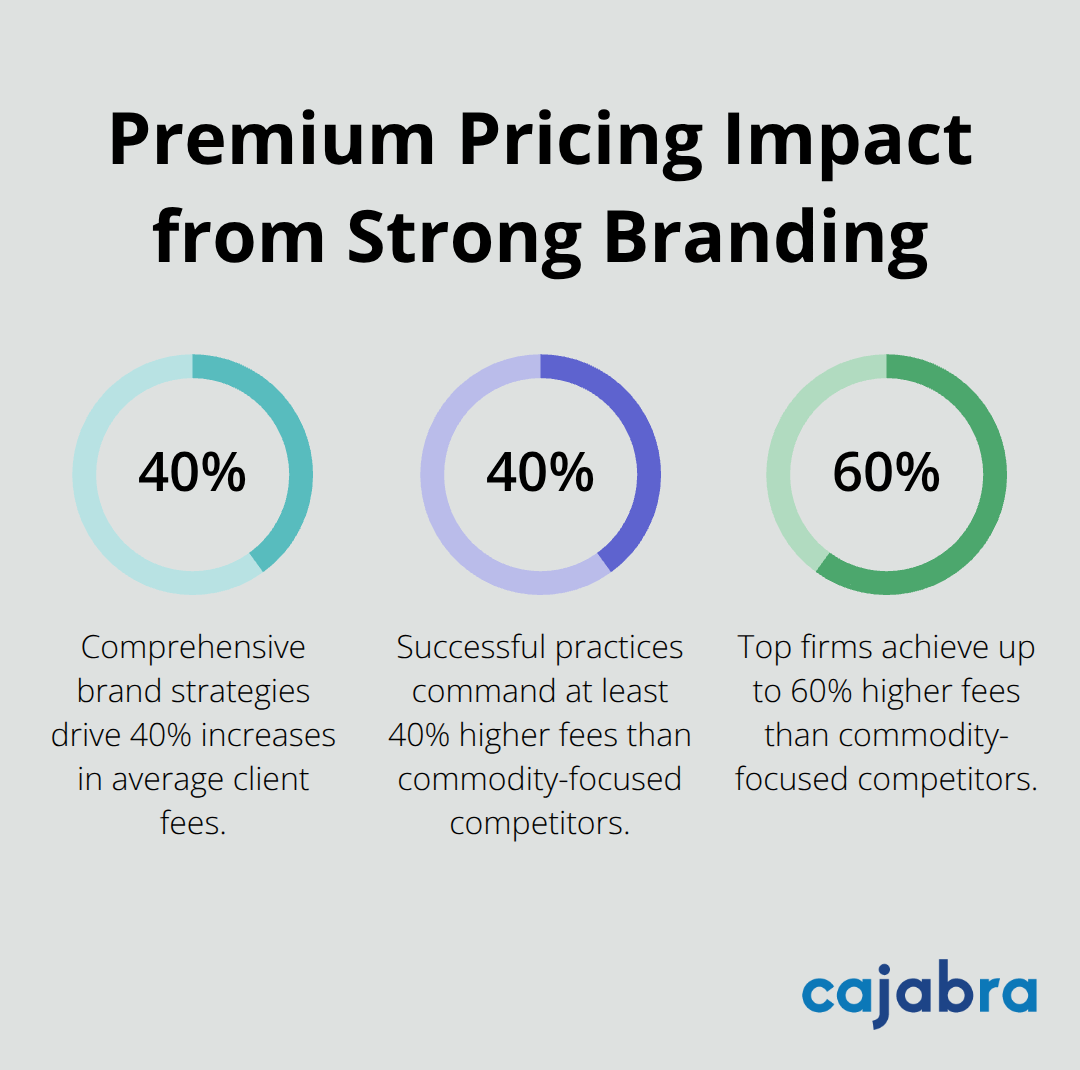

Effective branding for accounting firms transforms how prospects perceive your expertise and value. We at Cajabra, LLC have seen firms increase their average client fees by 40% through strategic brand positioning.

This guide reveals the specific branding strategies that separate thriving practices from struggling ones.

Why Strong Branding Matters for Accounting Firms

The accounting industry generates over $180 billion annually in the United States alone, yet most firms compete solely on price because clients perceive their services as identical commodities. This race to the bottom destroys profit margins and forces firms into unsustainable business models. High-growth accounting firms invest significantly more in marketing compared to average performers, creating substantial competitive advantages.

Differentiation in a Commoditized Market

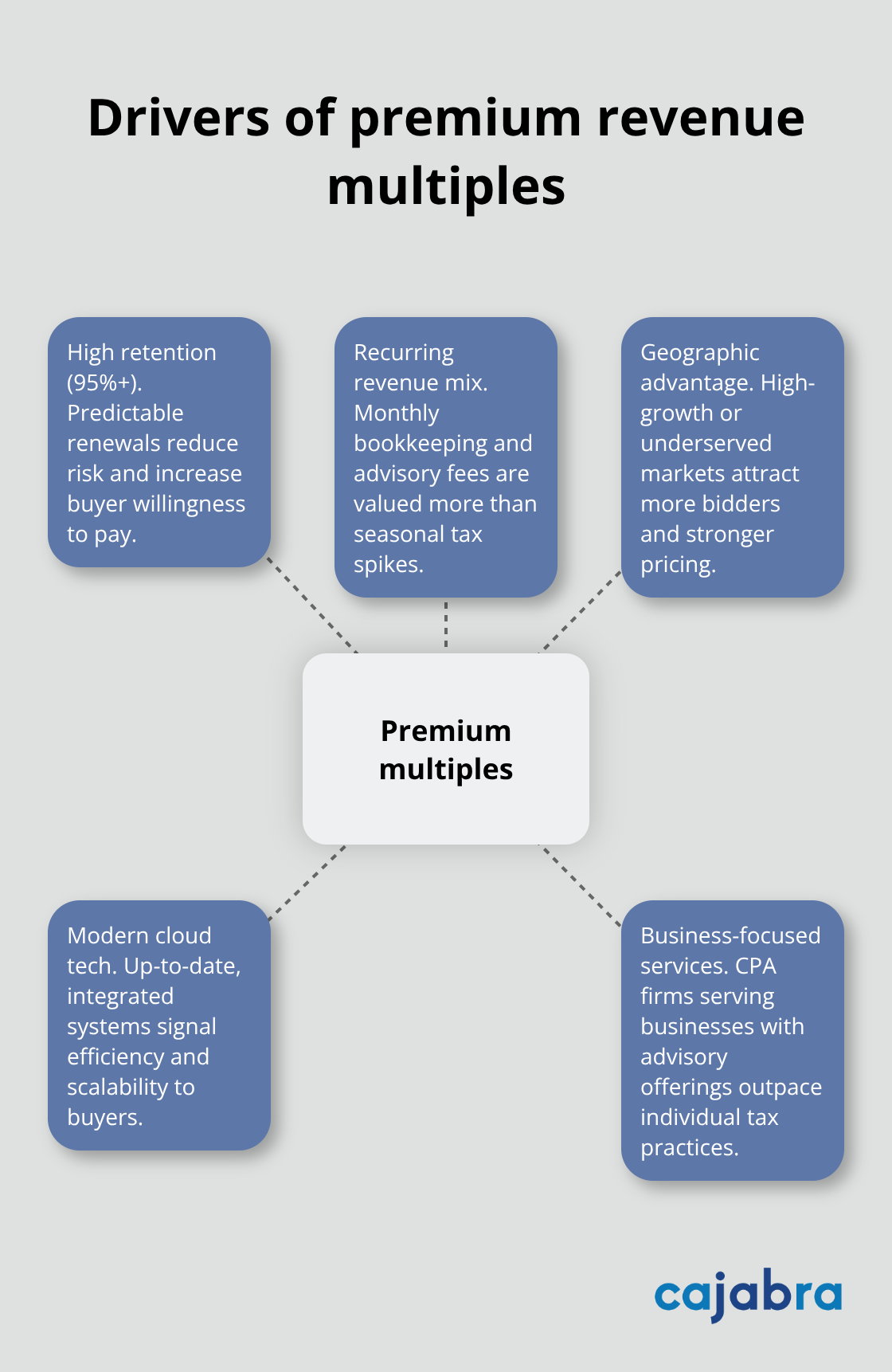

Strategic brand positioning enables firms to charge premium rates through expertise rather than price competition. Mid-size accounting firms report significant increases in client referrals after brand alignment workshops, while repositioning from compliance-focused to strategic advisory services doubles average engagement sizes. Firms with compelling brand identities win more RFPs and attract higher-value clients who seek emotional connections beyond basic competencies. The most successful practices command 40-60% higher fees than commodity-focused competitors because clients perceive greater value in their specialized approach.

Building Trust and Credibility with Clients

Professional brand identity establishes immediate credibility with affluent individuals and high-growth businesses who increasingly demand sophisticated advisory relationships. Consistent visual identity, clear messaging, and authentic positioning build trust faster than credentials alone. Clients make decisions within seconds of viewing firm materials, making first impressions through brand presentation absolutely critical for client acquisition. Authenticity matters more than polish - firms that mimic larger competitors dilute trust and fail to resonate with their target market.

Commanding Higher Fees and Retainer-Based Services

Strong brand positioning transforms one-time transactions into recurring retainer relationships through strategic partner positioning rather than seasonal service provision. This shift creates predictable revenue streams and reduces client acquisition costs over time while establishing sustainable growth patterns. As the public accounting profession evolves, firms must update their brand and marketing message to differentiate themselves and attract ideal clients. Marketing compliance and regular brand audits maintain transparency while ongoing training helps teams embody brand messages consistently across all client interactions.

The foundation of effective brand positioning starts with the essential visual and messaging elements that communicate your firm's unique value proposition to potential clients.

Essential Elements of Accounting Firm Branding

Professional visual identity serves as the foundation for client perception, with research showing that first impressions significantly affect the effectiveness of initial client encounters. Color psychology plays a vital role in financial services branding, with research indicating that color can increase brand recognition by up to 80%. Modern accounting firms that implement minimalist logo designs with hidden symbols reflecting their values see higher engagement rates than traditional approaches. Typography choices matter significantly - clean, professional fonts increase perceived credibility compared to outdated serif styles that suggest inflexibility.

Professional Visual Identity and Logo Design

Strategic logo development requires careful consideration of industry expectations while maintaining distinctive elements that separate your firm from competitors. Minimalist design trends simplify communication and make logos more memorable across digital platforms and print materials. Hidden meanings or symbols in logos create deeper connections with clientele, reflecting their values and vision through subtle visual cues. Custom logo designs convey professionalism (a factor clients prioritize when choosing financial services), while consistent application across all materials builds brand recognition and customer loyalty.

Clear Value Proposition and Messaging Strategy

Value proposition development requires specific positioning around pain points your firm solves rather than generic service listings. Firms position themselves as strategic partners rather than compliance providers and achieve higher conversion rates from initial consultations. Your messaging strategy should target specific audiences like medical professionals or tech entrepreneurs who value specialized expertise over generalist approaches. Thought leadership content that addresses industry-specific challenges generates more qualified leads than broad financial advice. The most successful firms develop unique brand voices that appeal to younger clientele while maintaining professional credibility through consistent communication frameworks.

Consistent Brand Voice Across All Communications

Brand voice implementation requires detailed guidelines that specify tone, vocabulary, and messaging hierarchy for every client interaction. Staff training programs that emphasize brand embodiment result in higher client satisfaction scores according to recent industry studies. Digital presence optimization through cohesive visual elements, messaging consistency, and strategic content distribution creates seamless client experiences that reinforce brand positioning. CRM systems should track brand message adherence across all communications to maintain professional standards while personalizing client relationships through authentic engagement strategies (particularly important for retainer-based service models).

These foundational brand elements must translate into practical implementation strategies that maximize your firm's digital presence and client acquisition potential.

Implementing Your Brand Strategy Effectively

Modern accounting firms require sophisticated digital infrastructure that converts visitors into high-value clients through strategic website optimization. Your website must load within three seconds or you lose 40% of potential clients according to Google's research. Mobile-responsive design generates more leads than desktop-only sites, while client testimonials and case studies boost conversion rates when you display them prominently. Search engine optimization that focuses on industry-specific keywords like forensic accounting or estate planning drives more qualified traffic than generic terms.

Website Design and Digital Presence Optimization

Professional photography and clean layouts increase perceived firm value. Chatbots and contact forms that you place strategically throughout site pages capture leads that would otherwise leave without contact. Site architecture must prioritize service pages that address specific client pain points rather than generic service descriptions that blend into competitor messages.

Analytics systems track which content generates the highest-value prospects and enable data-driven optimization of your marketing spend. Landing pages optimized for Google Ads and LinkedIn campaigns should feature clear value propositions and single call-to-action buttons that eliminate decision paralysis.

Content Marketing and Thought Leadership

Thought leadership content that addresses industry-specific challenges generates more qualified leads than broad financial advice according to recent marketing studies. Weekly blog posts that target niche audiences like medical professionals or technology entrepreneurs establish expertise while they improve search rankings for specialized terms.

Webinars and educational events showcase competency while they generate contact information from engaged prospects who attend sessions. Email campaigns that nurture prospects through educational content achieve higher open rates than promotional messages (automated follow-up sequences convert more leads into initial consultations).

Client Experience and Service Delivery Alignment

Service delivery must align with brand position through consistent communication protocols, regular client check-ins, and proactive advisory recommendations. These practices reinforce strategic partner relationships rather than transactional interactions that commoditize your services.

Client onboarding processes should reflect your brand values through professional documentation, clear communication timelines, and systematic follow-up procedures. Regular client satisfaction surveys help you identify gaps between brand promise and actual service delivery (this feedback loop strengthens both client retention and referral generation).

Final Thoughts

Strategic branding for accounting firms transforms commodity services into premium advisory relationships that command higher fees and generate predictable revenue streams. Firms that implement comprehensive brand strategies report 40% increases in average client fees while they build sustainable competitive advantages through differentiated market positions. The most successful practices combine professional visual identity with clear value propositions that address specific client pain points rather than generic service offerings.

Consistent brand voice across all communications reinforces strategic partner relationships while thought leadership content establishes expertise that attracts high-value prospects. Digital presence optimization through modern websites, targeted content marketing, and systematic client experience alignment creates seamless brand interactions that convert visitors into retainer-based clients. These integrated approaches generate measurable results through improved client acquisition rates and enhanced revenue growth patterns.

Implementation requires systematic execution across visual identity development, messaging strategy refinement, and digital infrastructure optimization (each element must work together to create cohesive brand experiences). We at Cajabra, LLC help accounting firms move from overlooked to overbooked through strategic brand development that secures retainer-based clients within 90 days. Your brand investment directly impacts long-term profitability through premium pricing power and reduced client acquisition costs that create sustainable growth trajectories for forward-thinking accounting practices.

Accounting firms face intense competition in today's market. Traditional referral methods alone won't sustain growth anymore.

Online marketing for accounting firms has become essential for attracting new clients and building lasting relationships. We at Cajabra, LLC see firms that embrace digital strategies consistently outperform those that don't.

Which Digital Marketing Strategies Actually Generate Clients

Search Engine Optimization That Converts

Search engine optimization forms the foundation for accounting firm visibility, yet most firms approach it incorrectly. Generic accounting keywords like "accounting services" create massive competition with conversion rates below 2%. Smart firms target specific phrases like "small business tax planning Chicago" or "QuickBooks setup for restaurants." Local searches drive significant traffic, with 88% of people who conduct a local search on their smartphone visiting a related store within a week. Professional service SEO requires technical content that demonstrates expertise while remaining accessible to business owners who need help but lack financial knowledge.

Content Marketing That Builds Authority

Content marketing builds authority faster than any other strategy when firms execute it correctly. Tax deadline reminders, quarterly business tips, and industry-specific guides generate 3x more leads than generic blog posts (according to HubSpot research). Video content performs exceptionally well, with accounting explainer videos receiving 1200% more shares than text-based content. Firms that create valuable content establish themselves as trusted advisors before prospects even contact them.

Social Media Strategies for Professional Services

Social media amplifies content reach significantly across multiple platforms. LinkedIn generates the highest quality leads for B2B accounting services, while Facebook advertising allows precise targeting of business owners within specific revenue ranges. Instagram works surprisingly well for personal tax services through educational posts about deductions and tax strategies. Consistent posting schedules matter more than perfect content-firms that post 3-4 times weekly see 67% higher engagement rates than sporadic posters.

Email Marketing Automation Systems

Email marketing automation captures leads from content downloads and nurtures them through tax season cycles. Email marketing delivers $36 to $42 for every dollar spent, making it the highest-ROI marketing channel for accounting firms. Automated sequences can guide prospects from initial interest to consultation booking without manual intervention.

Your digital marketing foundation sets the stage for success, but converting online visitors into paying clients requires a strategic approach to your web presence and user experience.

How Do You Transform Website Visitors Into Paying Clients

Your website serves as your firm's digital storefront, yet nearly 40% of consumers abandon over $100 per cart due to poor website experiences. Professional accounting websites require clean layouts that prioritize contact information, service descriptions, and clear next steps rather than flashy graphics. Mobile optimization becomes non-negotiable since business owners research accounting services on smartphones during evenings and weekends.

Page speed directly impacts conversions - sites that load within 2 seconds achieve higher conversion rates than slower competitors. Google My Business optimization drives local visibility with searches that seek local information. Complete profiles with accurate hours, services, and regular posts increase visibility compared to basic listings.

Local Search Dominance Through Strategic Optimization

Local SEO generates qualified leads more effectively than broad national campaigns for accounting firms. Geographic keywords like "CPA near me" or "tax preparation downtown Denver" convert at higher rates than generic terms. Weekly Google My Business posts about tax deadlines, business tips, or regulatory changes signal activity to search algorithms and improve local rankings.

Schema markup for professional services helps search engines understand your expertise areas, which leads to featured snippets for tax and accounting queries. Professional photos, service categories, and consistent NAP (Name, Address, Phone) information across all directories build search engine trust.

Client Review Systems That Build Trust

Online reviews are an indispensable tool for accounting firms looking to build trust, improve visibility, and attract new clients. Automated review request systems sent 48 hours after service completion generate more responses than manual requests. Teams that respond to all reviews - positive and negative - within 24 hours demonstrate professionalism and client care.

Review management platforms help monitor mentions across Google, Yelp, and industry-specific sites while they streamline response workflows for busy accounting teams. These systems transform satisfied clients into powerful advocates who attract similar prospects to your practice.

Once you establish trust through reviews and local presence, the next step focuses on converting that trust into actual client relationships through strategic lead generation and follow-up systems.

How Do You Convert Visitors into Loyal Clients

Website conversion requires strategic placement of lead magnets that address specific accounting pain points. Tax planning checklists, QuickBooks setup guides, and year-end preparation templates capture contact information from visitors who need immediate solutions. Simple forms requesting only basic contact information perform significantly better than complex questionnaires, as marketers report that average landing page conversion rates remain below 10%. Pop-up timing matters significantly - visitors who spend adequate time on service pages show genuine interest and higher conversion potential when presented with relevant downloads.

Strategic Lead Capture Through Value-First Content

Free consultation offers work when you position them correctly after educational content consumption. Visitors who download multiple resources demonstrate serious intent and schedule consultations at rates 5x higher than cold traffic. Email sequences that deliver promised content while they introduce firm capabilities convert leads into clients within 6-8 touchpoints. Automated workflows segment prospects by business size, industry, and service needs to deliver personalized follow-up messages. CRM integration tracks engagement levels to identify hot prospects ready for direct outreach.

Email Automation That Nurtures Prospects

Automated email sequences move prospects through the decision process without manual intervention. Welcome emails that arrive within 5 minutes of form submission achieve 91% higher open rates than delayed responses. Drip campaigns that share case studies, client testimonials, and service explanations build trust over time.

Behavioral triggers send targeted messages when prospects visit pricing pages or download multiple resources (indicating serious consideration).

Client Retention Through Systematic Onboarding

New client onboarding determines long-term retention rates more than service quality alone. Structured welcome sequences that outline expectations, introduce team members, and provide account access reduce first-year churn by 23%. Quarterly check-in calls proactively address concerns before clients consider other firms. Client portals with document sharing, project status updates, and direct messaging capabilities increase satisfaction scores while they reduce administrative overhead.

Advanced Conversion Optimization Techniques

A/B testing of landing pages reveals which headlines, images, and call-to-action buttons generate the highest conversion rates. Heat mapping tools show where visitors focus their attention and where they abandon forms. Exit-intent popups capture departing visitors with last-chance offers or valuable resources. Live chat features answer questions immediately and guide prospects toward consultation bookings during business hours. Designing websites that convert requires careful attention to user experience and strategic placement of conversion elements.

Final Thoughts

Online marketing for accounting firms demands systematic implementation rather than random efforts. Firms that commit to SEO optimization, content creation, and lead nurture systems see measurable results within 90 days. Start with website optimization and Google My Business setup during month one, then add content marketing and email automation in month two, and launch social media campaigns plus review management systems by month three.

Long-term success depends on consistent execution across all channels. Firms that maintain regular blog posts, social media engagement, and email campaigns build compound growth over time. Analytics tracking reveals which strategies generate the highest-quality leads (allowing you to double down on effective tactics while you eliminate wasteful spending).

We at Cajabra, LLC understand the complexity of marketing implementation for busy accounting professionals. Our JAB System™ moves accountants from overlooked to overbooked in 90 days through specialized marketing services designed specifically for accounting firms. Digital marketing transforms accounting practices when you implement it strategically and consistently over time.

Accounting firms face intense competition in today's market, making effective marketing more important than ever. The best marketing strategies for accounting firms combine digital presence with strategic client positioning.

We at Cajabra, LLC have identified proven approaches that generate measurable results. This guide covers practical tactics that accounting professionals can implement immediately to grow their practice.

Digital Marketing Fundamentals for Accounting Firms

Your website serves as the foundation for all digital marketing efforts, and accounting firms need specific elements to convert visitors into clients. A professional website must load within three seconds to avoid losing over half of users (according to Google research). Include client testimonials prominently on your homepage, display your credentials clearly, and create separate service pages for tax preparation, bookkeeping, and business advisory services.

Add a clear call-to-action above the fold that offers a free consultation or tax assessment. Most accounting websites fail because they focus on features rather than client benefits. Your homepage should immediately communicate how you solve client problems, not just list your services.

Professional Websites That Convert Prospects

Modern accounting websites require specific design elements that build trust and drive action. Place your phone number in the header of every page and include a contact form that captures essential client information. Create dedicated landing pages for each service you offer, with clear pricing information when possible.

Mobile optimization remains non-negotiable since over 50% of web traffic comes from mobile devices. Test your website speed regularly and optimize images to maintain fast load times. Include your CPA license number and professional certifications prominently to establish credibility immediately.

Local SEO Drives Quality Leads

Local search engine optimization generates the highest-quality leads for accounting firms because people search for accountants near them. Set up your Google Business Profile completely with current hours, services, and regular posts about tax deadlines or financial tips. Collect client reviews consistently since 87% of consumers read online reviews.

Target location-specific keywords like "tax accountant in [city name]" and "CPA near me" in your website content. Create location pages for each city you serve and include your address on every page. Local SEO requires patience but delivers predictable results within six months of consistent effort.

Content Marketing That Showcases Expertise

Educational content positions your firm as the go-to expert in your market and builds trust with potential clients. Write blog posts that answer common client questions about tax deductions, business expenses, and financial planning. Companies with blogs generate significantly more leads than those without blogs.

Create content around tax season topics like "Business Deductions Most Entrepreneurs Miss" or "Quarterly Tax Planning for Small Businesses." Video content performs exceptionally well and will account for the majority of internet traffic. Record short videos that explain complex tax concepts in simple terms and post them on YouTube and LinkedIn.

These digital marketing fundamentals create the foundation for more advanced client acquisition strategies that focus on strategic market positioning.

Client Acquisition Through Strategic Positioning

Developing a Niche-Based Marketing Approach

Strategic positioning transforms accounting firms from commodity services into specialized experts that command premium fees. Niche specialization generates higher conversion rates because potential clients prefer accountants who understand their specific industry challenges. Restaurant owners seek CPAs familiar with food service margins and labor costs, while medical practices need accountants versed in healthcare regulations and insurance reimbursements.

This targeted approach allows firms to charge premium fees compared to generalists while reducing marketing costs through focused messaging. Specialized firms attract clients who value expertise over price, creating sustainable competitive advantages in crowded markets.

Creating Retainer-Based Service Packages

Retainer-based service packages provide predictable monthly revenue and deeper client relationships compared to traditional hourly billing. Structure packages around monthly bookkeeping, quarterly tax planning, and annual strategy sessions rather than isolated transactions. Professional services firms benefit significantly from retainer models, though many freelancers underprice retainers by substantial margins compared to project equivalent rates.

Monthly retainers create cash flow predictability that allows firms to invest in growth initiatives and hire quality staff. Clients prefer fixed monthly fees because they eliminate billing surprises and create budget certainty for their businesses.

Leveraging Referral Programs and Professional Networks

Referral programs amplify growth when existing clients become active advocates for your specialized services. Implement systematic referral requests during positive client interactions and offer meaningful incentives like service credits or charitable donations. Professional networks within your chosen niche multiply referral opportunities exponentially when you consistently demonstrate expertise at industry events and online communities.

Active participation in trade associations and professional groups positions your firm as the preferred accounting partner within specific industries. These relationships generate higher-quality referrals because they come with built-in trust and credibility.

The foundation of strategic positioning requires sophisticated automation and technology systems that streamline client acquisition and retention processes. Effective marketing transforms industry insights into client-attracting content that builds authority and generates consistent revenue growth.

Automation and Technology in Accounting Marketing

Marketing automation solutions eliminate manual tasks that consume valuable time while they generate consistent client acquisition results. Customer relationship management platforms track every prospect interaction from initial website visit through final contract signature. These systems provide data-driven insights that improve conversion rates by up to 30%. Modern CRM systems like HubSpot or Salesforce automatically score leads based on engagement levels, website behavior, and demographic information. This automation allows accounting firms to prioritize high-value prospects immediately.

CRM Systems Transform Lead Management

Professional CRM platforms integrate seamlessly with email marketing tools and social media schedulers. They create comprehensive automation workflows that nurture leads without constant manual intervention. These systems capture prospect information automatically when visitors download resources or schedule consultations. The software tracks communication history and sets automatic follow-up reminders for sales teams. Advanced CRM features include lead scoring algorithms that identify prospects most likely to convert into paying clients.

Email Campaigns Generate Consistent Revenue

Email marketing delivers strong returns on investment, making it a highly effective digital channel for accounting firms. Automated email sequences should target specific client segments with relevant content like quarterly tax reminders for business owners or year-end planning tips for high-net-worth individuals. Schedule welcome series for new subscribers, monthly newsletters with tax updates, and seasonal campaigns around major deadlines.

Personalization increases open rates significantly, so segment your email list by client type, service needs, and engagement history. Track metrics like open rates above 20% and click-through rates above 3% to optimize campaign performance continuously.

Social Media Automation Maximizes Reach

Social media management tools like Buffer or Hootsuite allow accounting firms to maintain consistent online presence without daily time investment. Schedule educational content across LinkedIn, Facebook, and Instagram during peak engagement hours when your target audience stays most active. LinkedIn performs best for B2B accounting services and generates three times more leads than other platforms for professional services firms.

Post industry insights, tax tips, and client success stories consistently while you engage with comments and messages promptly. Automation tools provide analytics that identify top-performing content types, optimal posting times, and audience demographics that inform future content strategies.

Final Thoughts

The best marketing strategies for accounting firms combine digital fundamentals with strategic positioning and automation technology. Professional websites that convert prospects, local SEO optimization, and educational content marketing create the foundation for sustainable growth. Niche specialization allows firms to command premium fees while retainer-based packages generate predictable monthly revenue streams.

Implementation requires a phased approach over 6-12 months. Start with website optimization and Google Business Profile setup in month one (budget of $3,000-$5,000). Add content marketing and email automation in months 2-3 with ongoing costs of $500-$1,000 monthly. Social media management and CRM systems follow in months 4-6.

Success depends on consistent execution rather than perfect timing. Firms that implement these strategies systematically see measurable results within 90 days. We at Cajabra, LLC help accounting firms implement the JAB System™ that moves practices from overlooked to overbooked through retainer-based client acquisition and automated marketing systems.

Most accounting firms still treat social media marketing for accountants as an afterthought. This approach costs them valuable client opportunities every single day.

We at Cajabra, LLC have seen how strategic social media presence transforms accounting practices. The right platform strategy connects you with decision-makers actively seeking financial expertise.

Why Social Media Marketing Transforms Accounting Practices

Social media marketing creates measurable business results for accounting firms. With 5.66 billion social media users worldwide, the opportunity to connect with potential clients has never been larger. The average internet user spends over six hours daily online, which makes digital presence non-negotiable for modern accounting practices. Firms that maintain active social profiles generate 40% more leads than those that rely solely on traditional marketing methods.

Trust Development Through Consistent Expert Content

Regular social media activity positions your firm as a trusted advisor before clients need services. When you share tax strategies, financial insights, and regulatory updates, potential clients see your expertise firsthand. Research from Edelman and LinkedIn shows that B2B buyers trust recommendations from industry professionals they follow online. This trust translates into higher conversion rates when prospects contact your firm. Tax season posts that explain complex regulations demonstrate competence while they build confidence in your abilities.

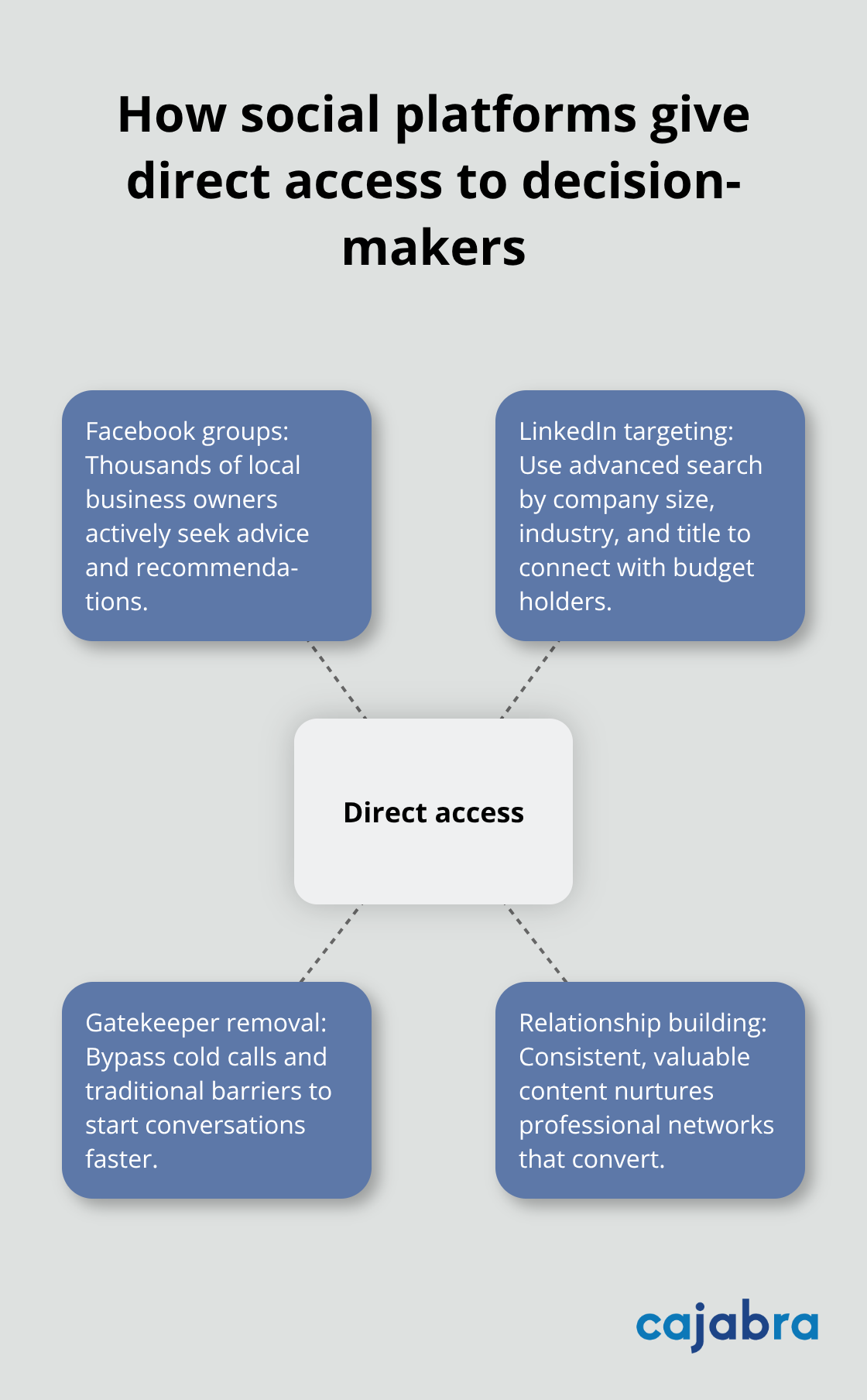

Direct Access to Business Decision Makers

Social platforms provide direct communication channels with company owners and financial decision makers. Facebook groups dedicated to small business owners contain thousands of potential clients who actively seek advice. LinkedIn allows you to connect with CFOs, business owners, and entrepreneurs who make decisions. These platforms eliminate gatekeepers and cold calls that traditionally slow client acquisition. Professional networks develop naturally through valuable content and meaningful engagement with prospects.

Market Differentiation Through Strategic Presence

Most firms post generic content or avoid social media entirely. This creates opportunities for firms that share authentic, valuable content consistently. When competitors remain invisible online, your active presence captures attention and generates inquiries. Client testimonials and behind-the-scenes content humanize your practice while competitors appear faceless. Strategic content creation differentiates your expertise from traditional firms that still use outdated methods.

The foundation for social media success starts with platform selection. Each platform serves different purposes and attracts distinct audiences that require tailored approaches.

Which Platforms Generate the Best Results for Accounting Firms

LinkedIn dominates B2B client acquisition for accounting firms with 900 million professionals who actively network and seek business solutions. The platform is highly effective for B2B lead generation, with 40% of B2B marketers listing LinkedIn as the most effective channel for driving high-quality leads. Professional decision-makers spend 17 minutes daily on LinkedIn, which makes it the prime location for reaching CFOs, business owners, and entrepreneurs who need accounting services.

LinkedIn Connects You with Decision Makers

Post educational content about tax changes, share industry insights, and engage with business groups where your ideal clients gather. LinkedIn's advanced search features allow you to identify prospects by company size, industry, and job title, then connect directly with decision-makers who control budgets. The platform's professional environment creates natural opportunities for meaningful business conversations that convert into client relationships.

Facebook Captures Local Business Owners

Facebook groups contain concentrated pools of local business owners who actively seek professional advice and recommendations. Small business groups generate consistent referrals when you provide valuable insights without aggressive sales tactics. The platform's local advertising capabilities target businesses within specific geographic areas and revenue ranges (making client acquisition cost-effective).

Business owners use Facebook to research service providers, read reviews, and ask for recommendations from peers. Share practical tips during tax season, answer questions in relevant groups, and maintain an active business page with client testimonials and behind-the-scenes content that builds trust.

YouTube Establishes Long-Term Authority

YouTube content creates evergreen marketing assets that attract clients for years after publication. Educational videos about tax strategies, bookkeeping basics, and financial planning rank in search results when prospects research accounting topics. The platform's algorithm favors consistent creators who publish weekly content (building subscriber bases that convert into consulting calls).

Videos that demonstrate software tutorials, explain regulatory changes, and break down complex financial concepts position your firm as the go-to expert. YouTube analytics show exactly which topics generate the most engagement, which allows you to create content that directly addresses client pain points and frequently asked questions.

Each platform requires different content strategies and posting approaches to maximize client acquisition potential.

What Content Converts Prospects Into Paying Clients

Tax season content generates the highest engagement rates for accounting firms because prospects actively search for solutions during peak filing periods. Posts about quarterly estimated payments receive significant engagement as social media has become essential for contemporary businesses. Share specific strategies like Section 179 deductions, home office calculations, and retirement contribution limits with exact dollar amounts and deadlines. January through April posts should focus on immediate tax concerns while May through December content addresses year-end planning and business strategy topics.

Peak Season Content That Drives Inquiries

December posts about year-end tax moves generate consultation requests throughout January. Share actionable advice about equipment purchases before December 31st, retirement account contributions, and charitable giving strategies with specific deadlines and limits. March content should address common filing mistakes, extension procedures, and audit red flags that business owners want to avoid. These posts position your firm as the expert who prevents costly errors and maximizes deductions for clients.

Behind-the-Scenes Content Builds Personal Connections

Team photos during busy season, office setup videos, and day-in-the-life content humanize your practice beyond spreadsheets and tax returns. Show your team as they celebrate client wins, work late during tax season, and participate in continuing education courses. This content generates 40% more comments than purely educational posts because prospects connect with people, not just services. Personal stories about why you became an accountant or challenges you solved for specific industries create emotional connections that convert into client relationships.

Client Success Stories Provide Powerful Social Proof

Share specific results without revealing confidential information: helped a restaurant save $15,000 in taxes, guided a startup through their first audit, or restructured a family business for succession planning. These stories demonstrate your expertise while prospects envision similar outcomes for their businesses.

Video testimonials from satisfied clients generate superior engagement as people retain 95% of information from videos compared to only 10% from text. Client success content should highlight the problem you solved, your approach, and the measurable results you achieved.

Final Thoughts

Social media marketing for accountants transforms overlooked practices into client magnets through strategic platform selection and valuable content creation. Start with LinkedIn for B2B connections, then expand to Facebook groups where local business owners gather. Post tax tips during peak seasons, share behind-the-scenes content that humanizes your firm, and showcase client success stories that demonstrate measurable results.

Choose one platform and post three times weekly with educational content that addresses specific client pain points. Consistency beats perfection when you build your online presence and establish expertise in your market. Active social media profiles generate 40% more leads than competitors who rely solely on traditional marketing methods (making digital presence essential for modern accounting practices).

We at Cajabra, LLC help accounting firms implement comprehensive marketing strategies that move practices from overlooked to overbooked. Our specialized approach includes automated systems, optimized websites, and targeted lead generation that positions your firm as the industry leader prospects choose first. Long-term social media presence generates compound returns through increased visibility, enhanced credibility, and direct access to decision-makers who control budgets.

Selling an accounting practice represents one of the most significant financial decisions in a professional's career. The process requires careful planning, strategic positioning, and expert navigation of complex negotiations.

We at Cajabra, LLC have guided countless practitioners through successful accounting practice sales. This comprehensive guide covers every step from initial valuation to final transition.

How Do You Position Your Practice for Maximum Sale Value

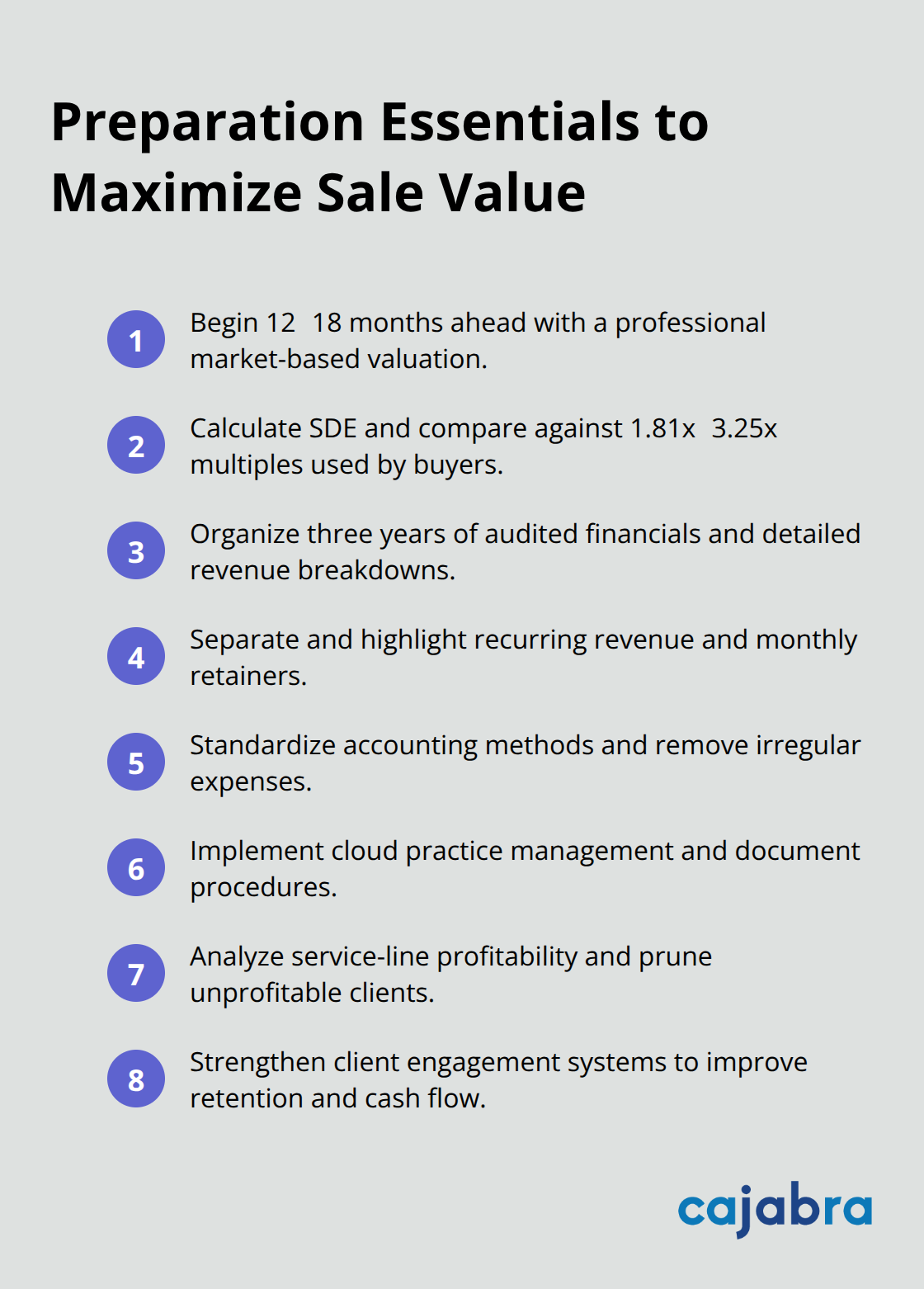

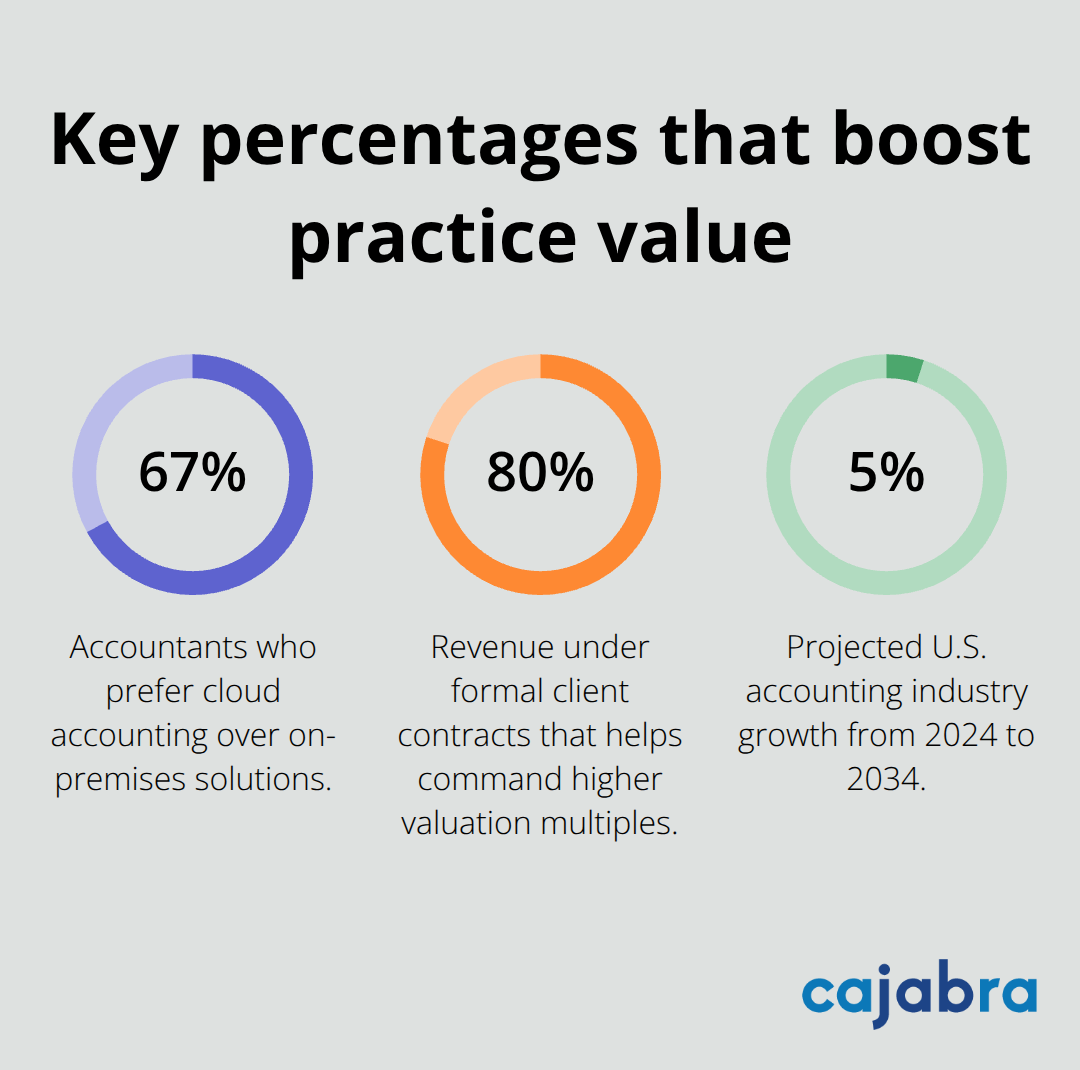

The foundation of a successful accounting practice sale lies in comprehensive preparation that begins 12 to 18 months before you list. Start with a professional business valuation that uses the market approach, which leverages actual transaction data from similar firms. CPA practices typically sell for 0.5 to 1.5 times gross revenue, with the AICPA's 2025 MAP Survey showing median revenue growth of 6.7% across surveyed firms. Calculate your Seller's Discretionary Earnings, as buyers often use SDE multiples that range from 1.81x to 3.25x to determine value.

Financial Documentation Standards

Your financial records must demonstrate consistent profitability and growth patterns. Organize three years of audited financial statements, client retention data that shows rates above 90%, and detailed revenue breakdowns by service line. Document your recurring revenue streams separately, as monthly retainer arrangements significantly boost valuations. Clean up any irregular expenses, standardize your accounting methods, and present monthly financial summaries that highlight your practice's stability and predictable cash flow patterns.

Operational Excellence Improvements

Invest in modern practice management software and cloud accounting systems before you list. Document all operational procedures, create staff training manuals, and establish systems that function independently of your daily involvement. Focus on profit margin improvements through service line analysis and client profitability reviews. Eliminate unprofitable clients and services while you strengthen relationships with high-value accounts. Boost client engagement through improved service delivery and communication systems. These operational improvements can increase your valuation multiple and attract buyers who seek turnkey operations with established systems and processes.

Technology Infrastructure Upgrades

Modern buyers expect firms to operate with current technology stacks that support remote work and client collaboration. Upgrade your accounting software to cloud-based platforms, implement secure client portals, and automate routine processes wherever possible. Document your technology assets and demonstrate how these systems reduce operational costs while improving service delivery. Buyers pay premium prices for practices that require minimal technology investment post-acquisition.

With your practice positioned for maximum value through proper preparation and documentation, the next step involves identifying and attracting qualified buyers who align with your firm's culture and growth objectives.

How Do You Find the Right Buyer

Your network contains the most qualified buyers for your accounting practice. Start with competitors who lack your specialized services or geographic coverage. Reach out to firms within a 50-mile radius that handle similar client sizes but offer complementary services.

Regional firms often seek acquisitions to expand their footprint, and they understand your market dynamics better than distant buyers. Contact former colleagues who started their own practices, as they frequently pursue strategic acquisitions for rapid growth.

Professional Intermediary Selection

Business brokers who specialize in accounting practice sales command higher prices than owner-handled transactions. Experienced brokers maintain databases of pre-qualified buyers and complete sales faster than individual sellers. Expect to pay commissions between 8% to 12% of the sale price, but brokers typically recover these costs through better valuations and terms. Interview at least three brokers before you select one, and choose specialists who complete at least 20 accounting practice sales annually. Verify their track record with recent transactions in your revenue range and geographic area.

Buyer Financial Qualification

Qualified buyers must demonstrate financial capability for your price plus capital requirements. Request proof of funds or pre-approval letters before you share detailed financial information. Evaluate their operational experience with staff management and client relationships, as inexperienced buyers often struggle with retention rates. Review their current client base size and service offerings to assess growth potential and operational synergies.

Cultural Compatibility Assessment

Cultural alignment matters significantly for client satisfaction during transitions and long-term practice success. Meet potential buyers in person to assess their communication style and professional approach. Buyers who understand your service delivery methods and share similar client service philosophies typically achieve smoother transitions. Observe how they interact with your staff during facility tours and client meetings. Test their knowledge of your specialized services and industry focus areas to gauge their commitment to maintaining service quality standards.

Once you identify qualified buyers who align with your practice culture and demonstrate financial capability, the negotiation phase requires strategic planning to structure favorable terms and protect your interests throughout the transaction process.

How Do You Structure a Winning Sale Agreement

Market data shows CPA practices sell for multiples between 0.5 to 1.5 times gross revenue, but your price depends on specific performance metrics and buyer competition. Set your initial price at the higher end of this range if your practice shows consistent revenue growth and maintains strong client retention rates. Practices with recurring revenue streams command premium multiples, often reaching 1.3 to 1.5 times gross revenue. Factor in your geographic location, as urban practices typically sell for higher multiples than rural firms due to larger talent pools and diverse client bases. Research recent sales of comparable practices within 100 miles to establish realistic benchmarks that reflect current market conditions.

Payment Terms That Protect Your Interests

Structure payment terms with 10% to 20% cash at closing, followed by seller financing over five to seven years at market interest rates. Longer payment terms often justify higher sale prices, as buyers can manage cash flow more effectively while you receive premium valuations. Include personal guarantees from buyers and maintain security interests in practice assets until full payment completion.

Negotiate acceleration clauses that trigger full payment if buyers default on operational benchmarks or client retention targets. Establish clear payment priorities that position your seller note ahead of other debts, and require quarterly financial reports to monitor buyer performance throughout the payment period.

Earn-Out Provisions and Performance Metrics

Base earn-out provisions on client retention percentages rather than revenue targets, as retention metrics provide clearer performance measurements. Structure these provisions to pay additional amounts when retention rates exceed 90% annually for three years post-sale. Cap total earn-out payments at 25% of the base purchase price to maintain reasonable risk exposure. Include specific definitions for client retention calculations and establish dispute resolution procedures for performance disagreements. These provisions align buyer incentives with practice preservation while protecting your financial interests.

Due Diligence Documentation Requirements

Prepare comprehensive due diligence packages that include three years of tax returns, client aging reports, staff employment agreements, and technology asset inventories. Organize client contracts by service type and revenue contribution to demonstrate practice stability. Document all recurring revenue arrangements and highlight monthly retainer clients separately. Provide detailed staff compensation records and employment terms to help buyers assess transition costs. Include professional liability insurance policies and claims history to address buyer concerns about potential liabilities.

Legal Framework and Transition Support

Engage attorneys who specialize in accounting practice acquisitions to draft purchase agreements that include non-compete clauses, client retention requirements, and transition support obligations. Include specific transition periods where you remain available for client introductions and operational guidance (typically 90 to 180 days depending on practice complexity). Negotiate professional liability insurance continuation and establish clear boundaries for post-sale client communication responsibilities. Structure non-compete agreements that protect buyer investments while allowing reasonable career flexibility for sellers.

Final Thoughts

Successful accounting practice sales demand strategic preparation that starts 12 to 18 months before you list your firm. You must focus on comprehensive business valuations, clean financial documentation, and operational improvements that show consistent profitability. Modern technology infrastructure and documented procedures boost buyer interest and drive higher final sale prices.